I have been researching the ongoing discussion about value and growth investment strategies. Both approaches have merits, but they differ greatly in philosophy and strategy. Value investors focus on buying companies they believe are undervalued, while growth investors seek out stocks with high potential for future expansion.

Over the past twenty years, growth stocks have outperformed value stocks by a wide margin. My data shows that growth investing yielded a 1,366% return compared to 715% for value investing.

This research contains many charts comparing value and growth stocks to illustrate this difference. This visual representation helps clarify the performance gap between these two investing styles. While past performance doesn’t guarantee future results, it’s clear that growth stocks have had a strong run recently. Investors should consider their own goals and risk tolerance when deciding between these two approaches.

Value vs. Growth Stocks

Tech companies like Apple and Amazon have seen their stock prices soar, driven by strong earnings growth. These growth stocks often have high P/E ratios as investors bet on future potential. Meanwhile, traditional value stocks have struggled to keep pace with the broader market. Some well-known value investors have even lagged behind the S&P 500 by significant margins.

Value vs. Growth Stocks 20-Year Performance

I’ve analyzed the performance of value and growth stocks over the past two decades, and the results are eye-opening. The Nasdaq 100 Index, which is packed with growth stocks, has soared by a whopping 1,366%. This blows away the S&P 500’s still impressive 417% gain.

Berkshire Hathaway, known for its value investing approach, lagged with a 715% increase. Finally, the JP Morgen and Fidelity Value ETFs lagged way behind.

Here’s a breakdown of the 20-year gains:

- Nasdaq 100 Index: +1366%

- S&P 500 Index: +417%

- Berkshire Hathaway: +715%

- Fidelity Bluechip Value ETF: +48%

This data shows that growth stocks have outpaced value stocks by a wide margin. Market conditions have favored companies with high growth potential, often in the tech sector. While value stocks are typically seen as more stable, they’ve struggled to keep up in this bull market.

Value vs. Growth Fund 10-Year Performance

I’ve analyzed the performance of value and growth funds over the past decade, and the results are striking. Growth stocks have significantly outpaced value stocks, with the gap widening considerably.

The data shows a clear trend. Over a 10-year period, the Nasdaq 100 index returned an impressive 266.10%, while value-focused funds lagged far behind. For instance, the Vanguard Value Index Fund ETF Shares (VTV) underperformed the S&P 500 by 70.60%.

Here’s a breakdown of some key fund performances:

| Fund/Index | 10-Year Return vs. S&P 500 |

|---|---|

| Nasdaq 100 (Growth) | +403% |

| Berkshire Hathaway BRK.B (Growth + Value) | +197% |

| S&P 500 (Broad Market) | +188% |

| Fidelity Bluechip Value Fund (FBCV) | +48% |

| JP Morgan International Value (JIVE) | +14% |

This stark contrast is also visible in the chart below:

Interest rates play a role in this performance gap. When rates are low, growth stocks tend to thrive. This has been the case for much of the past decade, helping to fuel their strong returns.

Warren Buffett on Value & Growth Stocks

I’ve found that Warren Buffett, the legendary investor behind Berkshire Hathaway, doesn’t see value and growth stocks as opposite ends of a spectrum. He believes they’re closely linked. Buffett once said, “Growth and value investing are joined at the hip.”

In my view, Buffett’s approach blends both styles. He looks for companies with strong growth potential that are also reasonably priced, which adds a safety net to his investments.

Buffett thinks growth is crucial for a stock’s long-term value. Without it, inflation can eat away at a company’s worth over time. He seeks businesses that can consistently grow their revenue and share value.

I’ve noticed that Buffett’s philosophy allows for flexibility. He’s open to investing in traditional growth companies if they show value characteristics. For example, tech giants like Alphabet and Amazon, known for their growth, also have large cash reserves – a key value trait Buffett looks for.

This approach shows that the line between growth and value isn’t always clear. In Buffett’s eyes, a growth stock can also be a value stock. It’s about finding the right mix of potential and price.

Growth Stocks

I often see them in tech and new industries that are expanding rapidly. When I think of growth stocks, companies like Amazon, Microsoft, and Tesla come to mind. These stocks tend to have high share prices and are known for their potential to grow quickly.

As a growth investor, I focus on a company’s growth rate rather than traditional metrics like revenue or profit. My goal is to buy stocks that I believe will increase in value over time, allowing me to sell them at a higher price later.

Here’s a quick breakdown of growth stock characteristics:

- High potential for rapid growth

- Often in tech or new industries

- May have high share prices

- Focus on growth rate over traditional metrics

It’s important to note that growth stocks can be risky. For example, Tesla is a classic growth stock with a high share price, but it has a history of not making money. This risk is part of what makes growth investing exciting and potentially rewarding.

Value Stocks

Value stocks are the hidden gems of the stock market. I look for companies that I believe are undervalued by the market but have solid potential for growth over time. Unlike growth stocks, value stocks often fly under the radar.

When I’m hunting for value stocks, I pay close attention to:

- Low price-to-earnings ratios

- Strong fundamentals

- Attractive dividend yields

- Robust cash flows

- Intrinsic value higher than current stock price

Value investing is all about finding stocks that are priced below their true worth. I believe these stocks have the potential to increase in value as the market recognizes their true potential.

To illustrate the difference between growth and value stocks, here’s a simple comparison:

| Growth Stocks | Value Stocks |

|---|---|

| High share prices | Lower share prices |

| Rapid growth potential | Steady growth potential |

| Often, in established industries | Often in established industries |

| Focus on future prospects | Focus on current fundamentals |

Both growth and value investing have their merits. The key is to choose a style that fits your investment goals and risk tolerance. I find that a mix of both can help create a well-rounded portfolio.

Dividend vs. Growth Investing

Dividend and growth investing are two different approaches to the stock market. Many investors mix up these strategies, but they have distinct goals and methods.

Dividend investing focuses on stocks that pay regular cash distributions to shareholders. When seeking dividend stocks, I look for companies with steady income and strong cash flows. These firms often have stable business models and a history of increasing payouts over time.

Some key metrics I consider for dividend stocks include:

- Dividend yield

- Payout ratio

- Dividend growth rate

- Company earnings stability

Growth investing, on the other hand, targets stocks of companies expected to grow faster than the overall market. I’m not as concerned with current dividends here. Instead, I’m betting on stock price appreciation as these businesses expand rapidly.

Traits I look for in growth stocks:

- High revenue growth rates

- Expanding market share

- Innovative products or services

- Reinvestment of profits into the business

While these approaches differ, they’re not mutually exclusive. I sometimes find stocks that offer both growth potential and dividends. For example, some tech giants generate huge cash flows that could support future dividend payments.

Value investing shares similarities with dividend investing, as both seek stocks trading below their intrinsic value. Many value stocks pay dividends, providing a steady income stream while I wait for the market to recognize their true worth.

I’ve noticed that even growth-focused investors may hold some dividend stocks to balance their portfolios. Regular payouts can offer a cushion during market downturns or provide income in retirement.

Growth Stock Examples

Nvidia Corporation (NVDA).

The growth of AI has boosted Nvideo into the stratosphere, making it one of the most successful companies in the tech industry.

Nvidia, founded in 1993, started as a graphics chip manufacturer for personal computers. However, with advancements in artificial intelligence and deep learning algorithms, they quickly became a leader in producing powerful GPU chips that could handle complex processing tasks.

Tesla, Inc (TSLA)

Tesla is a great growth stock that has been making headlines recently. Founded by visionary entrepreneur Elon Musk, Tesla is a leading electric vehicle and clean energy company that has been disrupting the automotive industry.

Tesla’s mission is to accelerate the world’s transition to sustainable energy. They have revolutionized the electric vehicle market and are making strides in solar panels, home batteries, and other renewable energy products. This commitment to sustainability sets them apart from traditional car companies and makes them an attractive investment for those looking to support environmentally conscious businesses.

In addition to its innovative technology, Tesla boasts impressive financial growth.

When I look at these examples, I see that growth stocks can offer big gains, but they come with risks. Companies like Amazon, Microsoft, and Alphabet (Google’s parent company) have been successful growth stocks in the tech sector. Meta (Facebook) is another example. Tesla has been a notable growth stock in the electric vehicle space.

I’ve noticed that many top growth stocks are in the technology sector. These companies often reinvest their earnings to grow bigger and more profitable in the long run. This strategy can lead to big price increases, but it also means these stocks might not pay dividends.

It’s key to remember that not all growth stocks succeed. For every Amazon or Microsoft, many don’t make it big. That’s why it’s important to research carefully and maybe consider a mix of different types of stocks in your portfolio.

Growth vs. Value ETFs and Funds

Growth ETFs focus on stocks with potential for high future earnings. These funds aim for bigger long-term gains but can be riskier. I’ve seen growth ETFs do well when interest rates are low.

Value ETFs, on the other hand, look for underpriced stocks. They hope to find hidden gems that will pay off later. Some investors think value ETFs are safer bets.

Here’s a quick comparison:

| Growth ETFs | Value ETFs |

|---|---|

| Higher risk | Lower risk |

| Potential for bigger gains | Steady, modest returns |

| Popular in tech sectors | Often include industrial stocks |

I’ve noticed growth stocks have done better recently. The Vanguard Growth ETF went up 40.22% in 2020 and 27.34% in 2021. But markets change, and past performance doesn’t guarantee future results.

Picking between growth and value comes down to personal choice and market conditions. I recommend looking at your goals and risk tolerance before deciding.

Growth ETFs

Invesco QQQ Trust Series 1 (NASDAQ: QQQ)

I find the Invesco QQQ to be a standout among growth ETFs. It tracks 100 top non-financial stocks on the NASDAQ, including tech giants like Apple, Microsoft, and Amazon.

The QQQ is popular for its focus on major tech stocks. Here’s a quick list of some big names you’ll find in this ETF:

- NVIDIA (NVDA)

- Meta (FB)

- Alphabet (GOOG)

- Tesla (TSLA)

- Amazon (AMZN)

- Microsoft (MSFT)

- Apple (AAPL)

For investors keen on tech exposure, the QQQ is worth a look. According to Invesco, it’s the fifth-largest ETF.

The chart shows the ETF’s performance over time. It’s a useful tool for evaluating the fund’s growth.

Vanguard Growth Index Fund ETF

Next, I want to discuss the Vanguard Growth Index (VUG). This ETF follows the CRSP US Large Cap Growth Index and includes many big growth stocks, not just tech.

Some key stocks in the VUG are:

- Amazon (AMZN)

- Alphabet (GOOG)

- Apple (AAPL)

- Walgreens Boots Alliance (WBA)

- Berkshire Hathaway Inc. Class B (BRK.B)

- JPMorgan Chase & Co. (JPM)

- Home Depot Inc. (HD)

- UnitedHealth Group Incorporated (UNH)

The VUG has a low expense ratio of 0.04%. It pays dividends every three months and has a yield of 1.2%. This ETF gives you a mix of large growth stocks without the need to buy each one separately.

This chart shows how the VUG has performed over two decades. It’s a good way to see the fund’s long-term growth.

Value ETFs

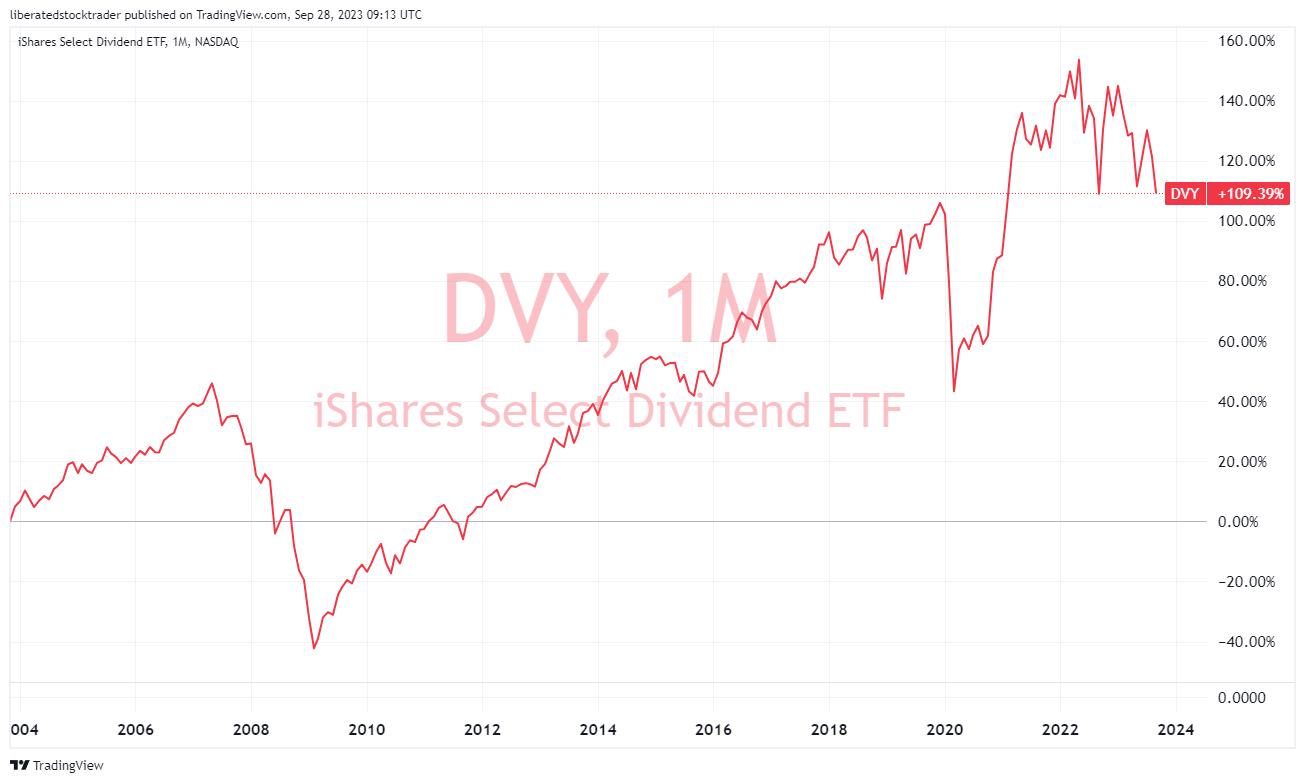

The iShares Select Dividend ETF

I find the iShares Select Dividend ETF (DVY) to be an excellent choice for value investors. It gives exposure to 100 dividend-paying U.S. stocks with a solid 5-year track record. The 0.3% expense ratio is reasonable for the diversification it offers.

DVY’s portfolio includes less-known value investments, which I see as a plus. It blends dividend and value characteristics, potentially offering both income and growth.

Key holdings in DVY are:

- Altria Group (MO)

- Prudential Financial (PRU)

- International Paper (IP)

- Wells Fargo (WFC)

- Marathon Petroleum (MPC)

- Philip Morris International (PM)

- ViacomCBS Class B (VIAC)

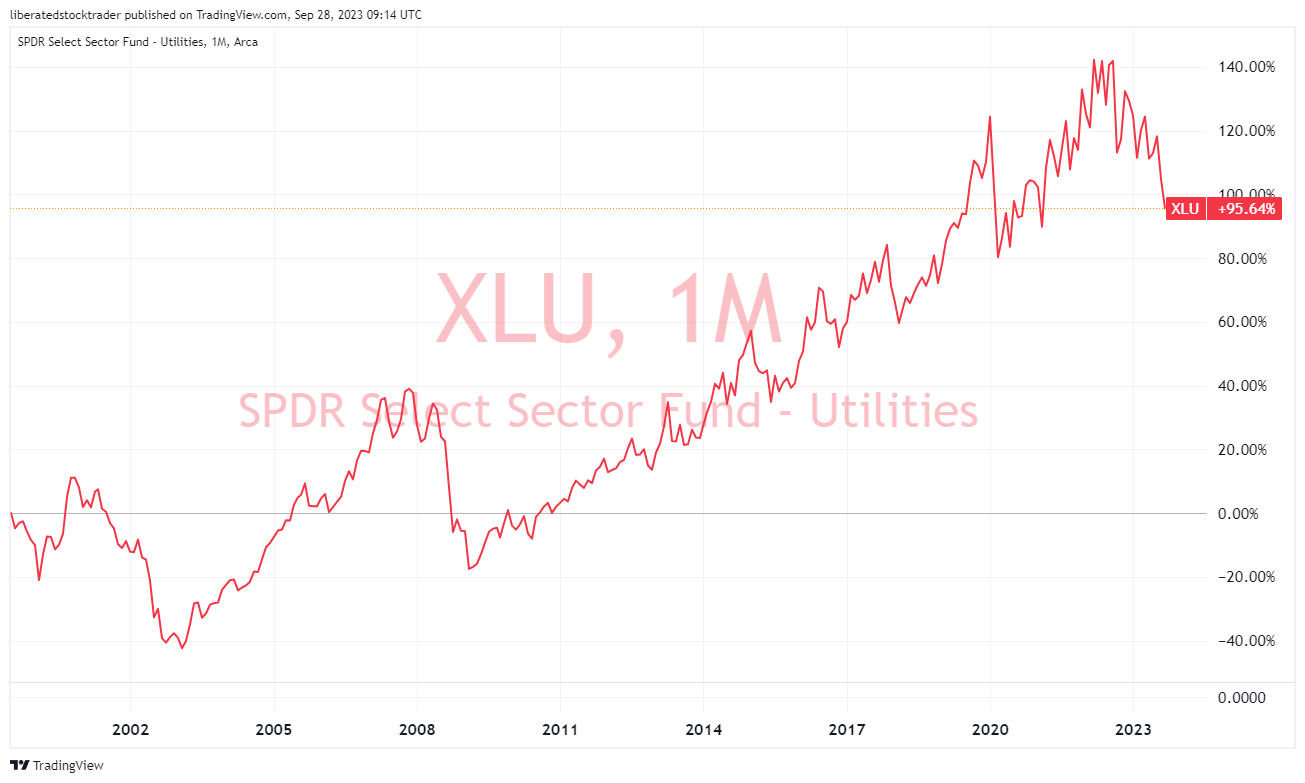

The Utilities Select Sector SPDR Fund

The Utilities Select Sector SPDR Fund (XLU) is another value ETF I recommend. It tracks U.S. energy utilities, offering a defensive play with a steady income and limited risk.

XLU’s top holdings include:

- NextEra Energy Inc. (NEE)

- Duke Energy Corporation (DUK)

- Southern Company (SO)

I like XLU because it focuses on a less glamorous but stable sector. It’s a good fit for investors seeking income with lower volatility.

FAQ

Is it better to invest in value or growth stocks?

Based on my analysis, growth stocks have outperformed value stocks by about 200% in the past decade. However, some studies show that value stocks performed better over 25 years.

What is the main difference between value and growth stocks?

I see the main difference in company performance and investor expectations. Value stocks are seen as undervalued with steady earnings, while growth stocks are expected to have rapid earnings growth.

What are growth stocks?

In my view, growth stocks are shares of companies expected to grow faster than the market average. These companies usually reinvest their earnings instead of paying dividends.

What are value stocks?

I define value stocks as shares of companies that seem undervalued compared to their true worth. They often have low price-to-earnings ratios and may pay dividends.

What is the best platform for value and growth investing?

From my research, Stock Rover stands out as the top stock analysis software for value and growth investing. It offers robust fundamental data, industry rankings, and detailed financial reports.