Portfolio trackers have become essential for anyone looking to build a balanced stock portfolio. These apps and software help monitor performance, analyze asset allocation, and stay on top of your investments across multiple accounts. I’ve researched and tested many options to find the best portfolio trackers for various investor needs.

My research shows Stock Rover and Portfolio123 offer robust screening, watchlist, and portfolio management capabilities that I find particularly useful. Tickeron provides helpful tools for those focused on building balanced portfolios. Investors seeking low-cost options may want to check out Firstrade for retirement portfolios and commission-free stock trading. The right tracker can make a big difference in staying organized and making informed investment decisions.

Editor’s Top Picks

I’ve thoroughly tested the top stock portfolio trackers, and here are my top picks:

- Stock Rover is the best option for US investors. It offers strong analytics and research tools to help you manage your portfolio effectively.

- For those interested in backtesting strategies, Portfolio123 is unmatched. Its robust system allows you to create and test custom investment strategies.

- Tickeron brings AI to portfolio management. Its machine-learning algorithms provide unique insights for portfolio construction and tracking.

- Firstrade is my choice for a free broker with solid portfolio management features. It’s great for cost-conscious investors who want a full-service platform.

- TC2000 excels in real-time trading and charting. It’s perfect for active traders who need up-to-the-minute data.

What is a Stock Portfolio Tracker?

A stock portfolio tracker is a tool I use to keep tabs on my investments. It helps me manage my stocks, ETFs, and mutual funds in one place. I can see how my portfolio is doing, check asset allocation, and get alerts for price changes. Good trackers also offer research tools and stock screening. They are useful for making investment decisions and staying on top of market news. Some even track cryptocurrencies and commodities. With a portfolio tracker, I can easily see my overall financial picture and adjust my strategy as needed.

1. Stock Rover: The Ultimate Stock Portfolio Tracker

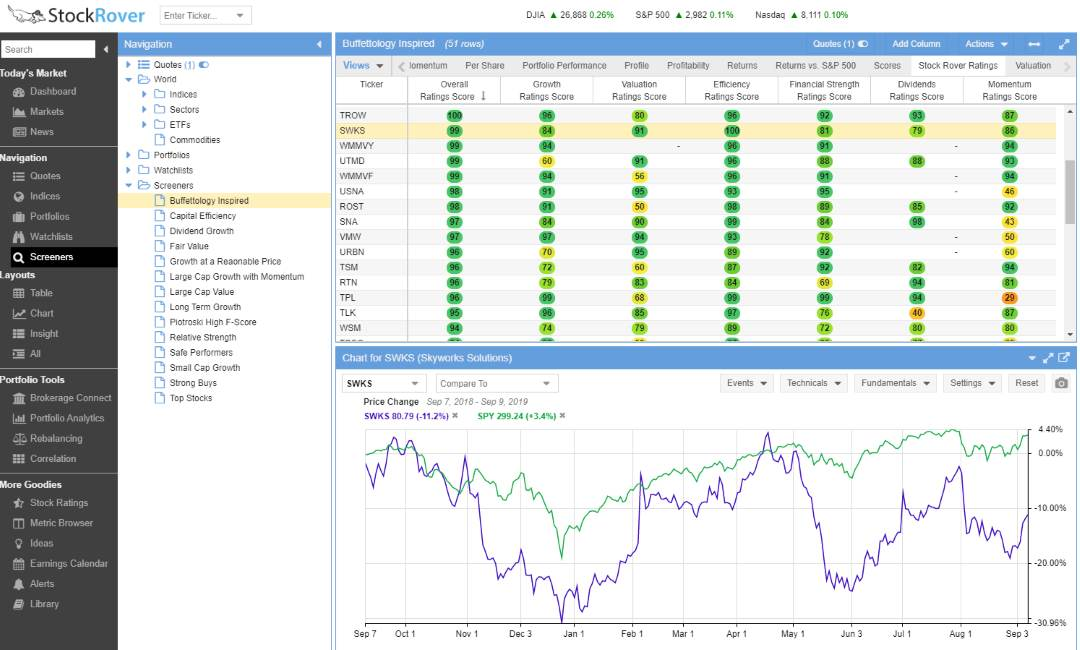

Stock Rover offers incredibly useful portfolio tracking capabilities. It lets me organize my investments using three types of watchlists: screening watchlists for finding potential buys, regular watchlists for tracking stocks I’m interested in, and portfolio watchlists for in-depth analysis of my holdings. The portfolio watchlists can sync with my brokerage account or be updated manually. I appreciate how customizable the column sets are, allowing me to see exactly the data I want for each stock.

Stock Rover Rating: 4.7/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Backtesting: ★★★★✩ |

| Trading: ★★★✩✩ | Pattern Recognition: ★✩✩✩✩ |

| Screening: ★★★★★ | Candlestick Recognition: ★✩✩✩✩ |

| Charts & Analysis: ★★★★✩ | Usability: ★★★★★ |

| Features | Rating ★★★★★ |

|---|---|

| Powerful Value, Growth & Dividend Features | ✅ |

| Broker Integration | ✅ |

| Backtesting | ✅ |

| Portfolio Management | ✅ |

| Financial News | ✅ |

| Markets Covered | USA |

| Assets | Stocks, ETFs |

| Free Trial | ✅ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Discount Available | 25% Off with Annual Plan |

Portfolio Research & News

Stock Rover’s research and screening tools are great. With over 600 data points to filter and scan, I can create highly specific criteria for my stock picks. The rating engine compares stocks to their industry and sector peers, giving me valuable context. The minute-by-minute updates are particularly helpful for staying on top of market movements.

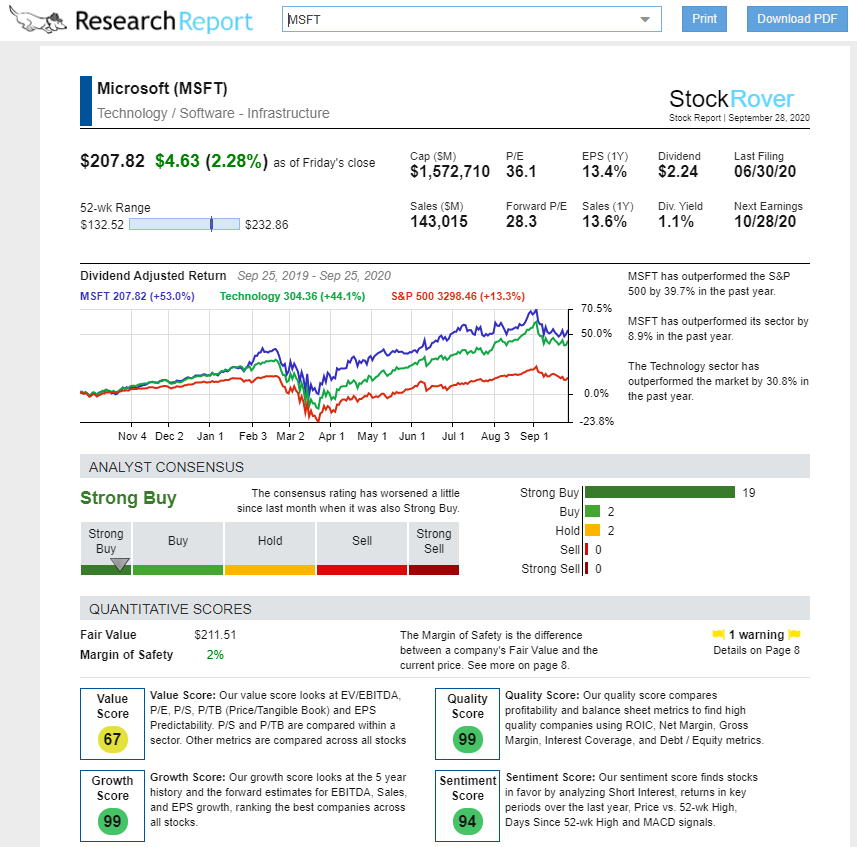

Stock Rover Rates Your Stock Portfolio

Stock Rover’s portfolio rating system rolls up all the analyses into an easy-to-understand ranking, saving me time while providing deep insights. For example, I can quickly see how a portfolio like Warren Buffett’s top 25 holdings stacks up across various metrics. The research reports are another standout feature, offering readable PDFs with comprehensive information on a stock’s performance, competitive position, and potential returns.

Portfolio Performance Reporting

Stock Rover doesn’t skimp on the essentials. Its profit and loss reporting gives a clear picture of my portfolio’s value, percentage changes, annual returns, and dividend income. This data is crucial for tracking my investment success over time.

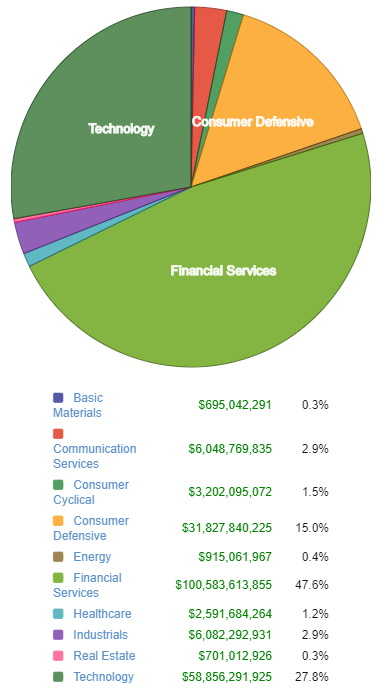

I find Stock Rover’s performance comparison tools invaluable. With a few clicks, I can see how my portfolio stacks up against major indexes like the S&P 500 or NASDAQ 100. This helps me gauge whether I’m beating the market or if I need to adjust my strategy. The depth of reporting is impressive, breaking down my holdings by sector and industry with both percentage and dollar amount allocations.

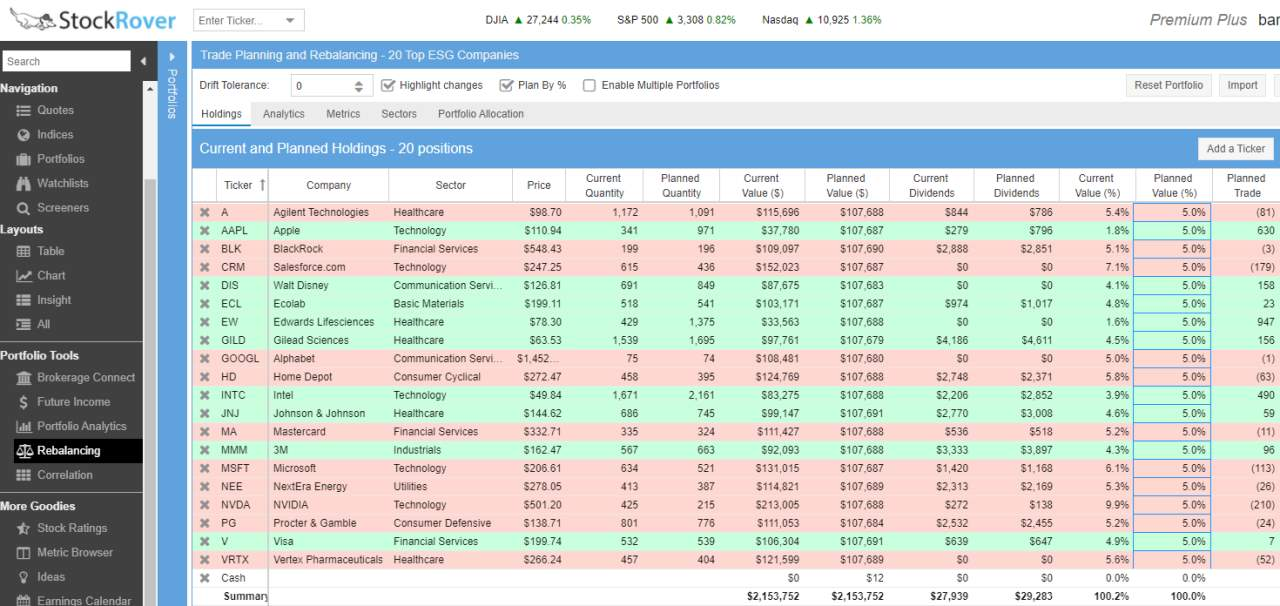

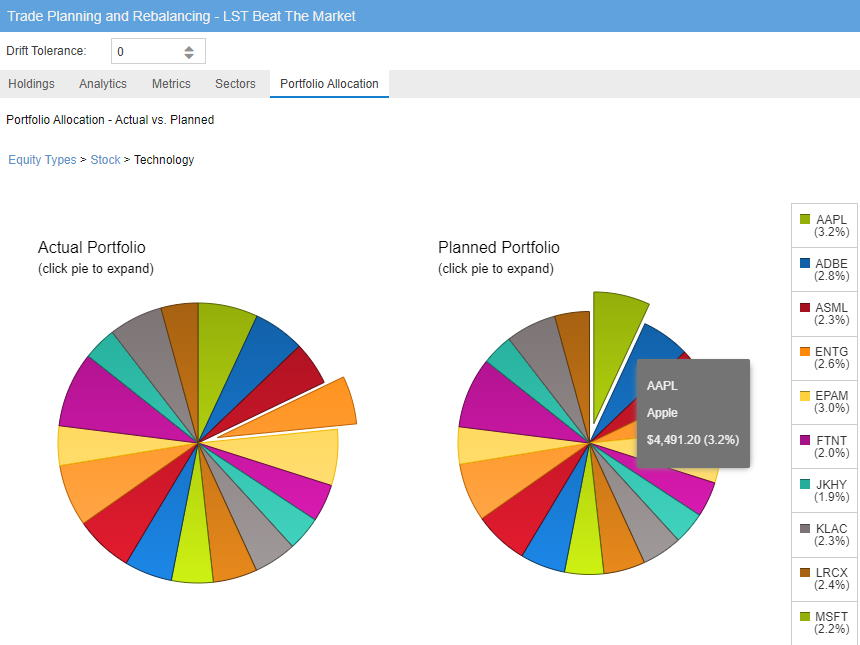

Portfolio Weighting & Rebalancing

Stock Rover’s rebalancing features are a game-changer for maintaining my desired portfolio allocation. If a stock grows to take up more of my portfolio than I’d like, the tool suggests buy and sell actions to get back to my target weights. This automation takes the guesswork out of rebalancing and helps me stick to my investment plan.

Portfolio Asset Allocation

The asset allocation tools in Stock Rover give me a bird’s-eye view of my investments. I can easily see how my money is spread across different sectors and industries. This insight helps me ensure I’m not overly concentrated in any one area and aligns with my diversification goals.

Broker Integration & Reporting

Connecting to my brokerage account automatically keeps my portfolio data up-to-date, saving me time and reducing the chance of errors from manual updates. The seamless integration also makes it easier to act on Stock Rover’s insights directly through my broker.

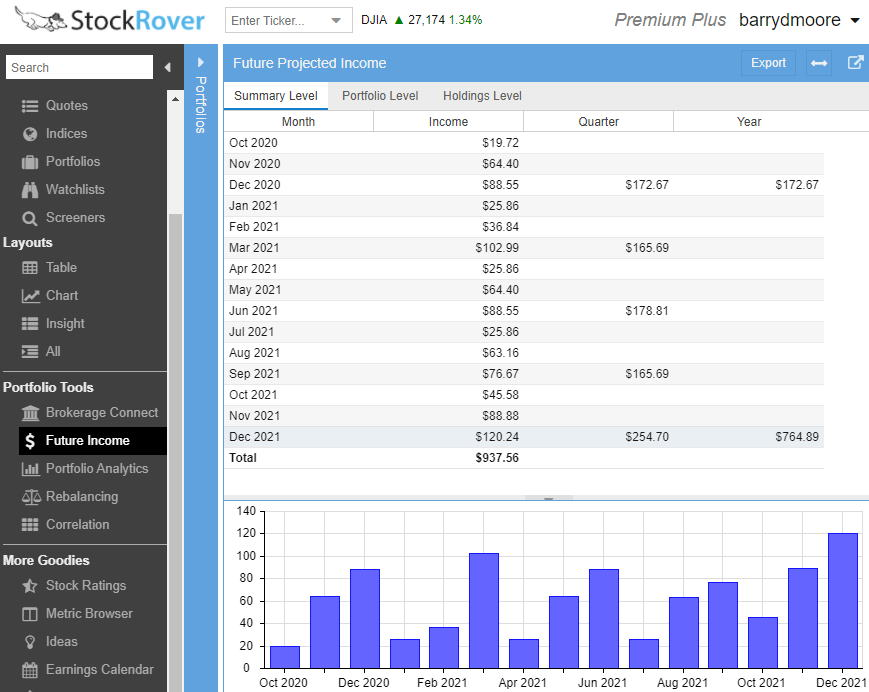

For income-focused investors, Stock Rover’s dividend tracking is a valuable feature. It projects future dividend income based on my current holdings and known dividend schedules. This helps me plan my cash flow and evaluate the income potential of different stocks. The tool also tracks dividend growth over time, which is key for assessing the long-term value of dividend-paying stocks.

2. Tickeron: Top AI-Powered Stock Portfolio Tracker

Tickeron Portfolio Reporting

Tickeron’s portfolio reporting features are great, and their AI-powered portfolio management is incredibly user-friendly. By answering a few simple questions about my goals and risk tolerance, I got a customized portfolio with a strong diversification score.

The platform’s reporting tools are clear and insightful. I can easily track my portfolio’s performance, including:

- Diversification score

- Allocation quality

- Profit and loss

- Performance metrics

Tickeron Rating: 4.4/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Backtesting: ★★★✩✩ |

| Trading: ★★★★✩ | Pattern Recognition: ★★★★✩ |

| Scanning: ★★★★★ | Candlestick Recognition: ★★★★✩ |

| Charts & Analysis: ★★★★✩ | Usability: ★★★★★ |

| Features | Rating ★★★★☆ |

|---|---|

| Buy/Sell Signals | ✅ |

| Automatic Trade Execution | ❌ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ❌ |

| Backtesting | ✅ |

| Code-Free Backtesting | ❌ |

| Markets Covered | USA |

| Assets | Stocks, ETFs, forex, and cryptocurrencies |

| Free Trial | ❌ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Price/Month | $125 |

| Discount Available | Get -50% off annual plans |

What really impressed me was the transparency. Tickeron provides a fully audited track record for every AI-managed stock. Before I commit to a strategy, I can see:

- Performance summaries

- Trade amounts

- Percentage of profitable trades

- Sharpe ratio

- Trade duration

This level of detail helps me make informed decisions about my investments.

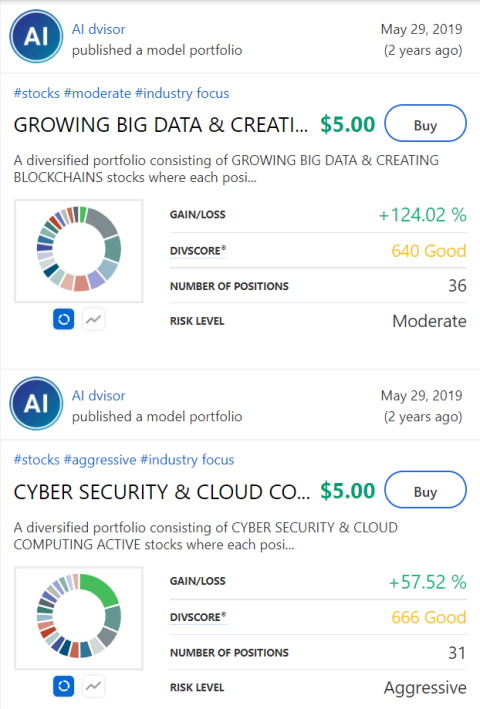

Tickeron AI Portfolios

Tickeron’s AI portfolios are a game-changer. The platform uses artificial intelligence to pick stocks and create balanced portfolios. I can run the AI on specific indexes or my watchlists to find trading opportunities.

Some key features of Tickeron’s AI portfolios include:

- Custom stock picks based on your preferences

- AI-driven portfolio building for diversification and high returns

- Specialized portfolios like “GROWING BIG DATA & CREATING BLOCKCHAINS PASSIVE.”

I tried out their AI stock asset allocation, and I was impressed by how they selected a mix of AI and blockchain companies. The process was smooth, and the results were promising.

Tickeron’s pricing is flexible:

- Free option available

- Paid plans at $250/month or $125/month billed annually

- 50% discount on the annual plan

Tickeron is a professional and sophisticated tool that’s still easy to use. The AI-powered features deliver solid results, making it a strong choice for both new and experienced investors looking to optimize their portfolios. For further information, please visit my Tickeron review.

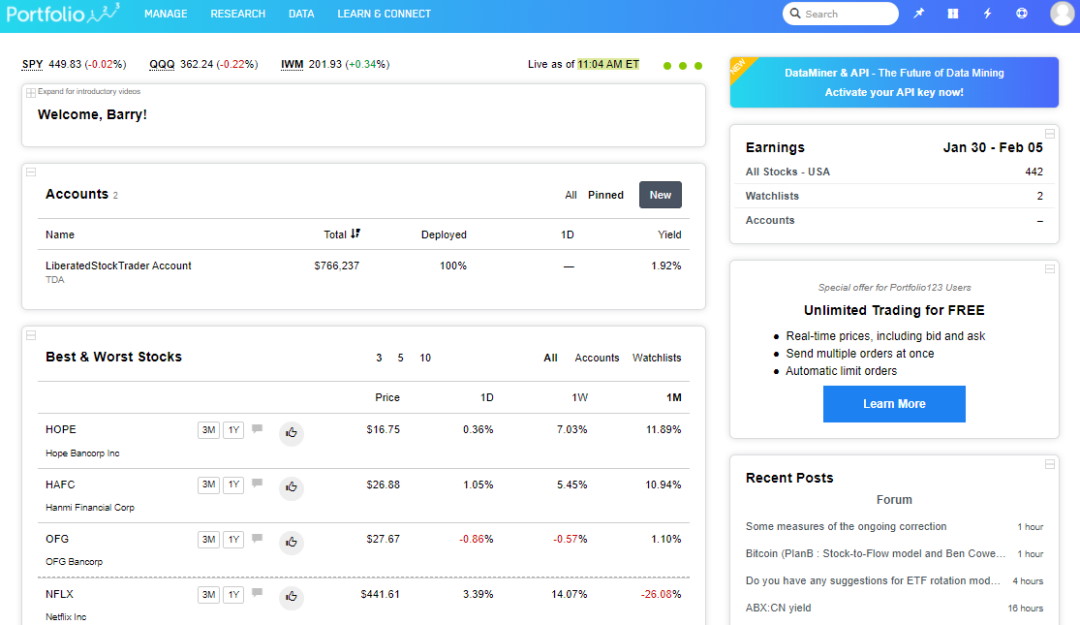

3. Portfolio 123: Advanced Tracking and Backtesting

Portfolio123 is an excellent choice for self-directed investors looking to manage their retirement accounts like IRAs and 401(k)s. This tool combines portfolio tracking with a robust 10-year financial database, making it ideal for backtesting investment strategies. For further information, please visit my Portfolio123 review.

The platform offers a user-friendly dashboard that displays your portfolio’s performance at a glance. I appreciate how it breaks down profit and loss reporting, helping me monitor my investments’ growth over time.

One of Portfolio 123’s standout features is its stock screener. It lets me filter through over 10,000 stocks and 44,000 ETFs using more than 460 criteria, including analyst revisions, estimates, and technical data. I find this incredibly useful for finding investments that match my specific retirement planning goals.

Portfolio 123 Rating: 4.1/5.0

| Pricing: ★★★★★ | News & Social: ★✩✩✩✩ |

| Software: ★★★★★ | Backtesting: ★★★★✩ |

| Trading: ★★★✩✩ | Pattern Recognition: ★✩✩✩✩ |

| Screening: ★★★★★ | Candlestick Recognition: ★✩✩✩✩ |

| Charts & Analysis: ★★★★✩ | Usability: ★★★★✩ |

| Features | Rating ★★★★✩ |

|---|---|

| Value, Growth & Dividend Features | ✅ |

| Broker Integration | ❌ |

| Backtesting | ✅ |

| Portfolio Management | ✅ |

| Financial News | ✅ |

| Markets Covered | USA |

| Assets | Stocks, ETFs |

| Free Trial | ✅ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Discount Available | Free Plan or $25/mo |

The platform integrates with brokers like Tradier and Interactive Brokers. While you can’t place trades directly from charts, automated trading based on rules or bulk trade orders is allowed.

The ranked screening feature is particularly helpful. It lets me rank stocks that best match my criteria, narrowing down hundreds of options to just a few top picks. This is great for fine-tuning my IRA or 401(k) investments.

Portfolio 123 offers different pricing tiers:

| Plan | Price |

|---|---|

| Free | $0/month |

| Screener | $25/month |

| Pro | $83/month (billed annually) |

While the free plan is available, I think the real value lies in the Screener and Pro services. They unlock the platform’s full potential for serious retirement planning.

For those who want to test it out, Portfolio 123 offers a 21-day trial for just $9. This gives you a chance to explore its features and see if it fits your investment style.

The ability to screen stocks based on their performance relative to benchmarks like the S&P 500 is particularly useful. It helps me develop strategies for selecting stocks that have historically outperformed the market.

For self-directed investors managing their retirement accounts, Portfolio 123 provides a solid set of tools to track, analyze, and optimize investment strategies. Its backtesting capabilities are especially valuable for those looking to refine their approach to long-term wealth building.

4. Firstrade: A Good Free Brokerage and Tracking

Firstrade stands out as my top pick for a free broker with excellent portfolio tracking. I’m impressed by their wide range of commission-free ETFs, stocks, and options. They also offer full retirement portfolio support, which is a big plus for long-term investors.

Portfolio Tracking & Reporting

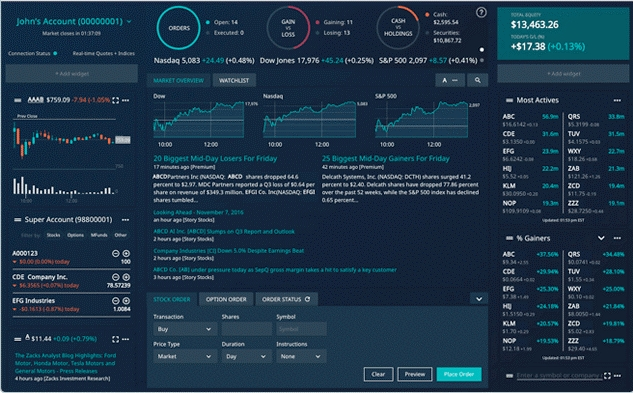

Firstrade’s portfolio tracking tools are robust and user-friendly. Their Firstrade Navigator system gives me quick access to important information about my investments. I can easily customize the dashboard with widgets that show the data I care about most.

Some key features I appreciate:

- Free watchlists

- Detailed performance reporting

- Customizable dashboard

- Stock chart indicators and studies

This screenshot shows the clean layout of Firstrade Navigator. I find it easy to track my portfolio’s performance at a glance.

Firstrade’s fee structure is another standout feature. Here’s a quick comparison with some competitors:

| Broker | Stock Trades | Option Trades | Mutual Fund Trades |

|---|---|---|---|

| Firstrade | $0 | $0 | $0 |

| E*Trade | $0 | $0 + $0.65/contract | $49.99 |

| Schwab | $0 | $0 + $0.65/contract | $49.95 |

| Fidelity | $4.95 | $0 + $0.65/contract | $49.95 |

As you can see, Firstrade offers the best value across the board.

Research & News

I’m pleased with the research tools Firstrade provides. They give free access to:

- Zacks Research

- Morningstar Research & Ratings

- Briefing.com

- Benzinga News

These are solid resources for making informed investment decisions. While it’s not the real-time Benzinga PRO version, it’s still valuable, especially considering the zero-commission trading.

It’s one of the best free stock trackers I’ve used. The mobile app makes it easy to monitor my investments on the go.

One thing to note: Firstrade doesn’t offer automated portfolio management. If you’re looking for a robo-advisor, you’ll need to look elsewhere. Also, their portfolio management tools could use some upgrades. They don’t currently offer features like:

- Portfolio weighting

- Rebalancing

- Future income and dividend reporting

Despite these minor drawbacks, I find Firstrade to be an excellent choice for cost-conscious investors who want a reliable stock trading app with good tracking features. The combination of zero fees and solid research tools makes it a top contender in the free broker category.

5. TC2000: Real-time Stock Portfolio Trading

TC2000 offers competitive pricing in the stock market analysis software arena. I’ve found it to be a leader in this aspect, with only TradingView offering similar rates. For 25 years straight, readers of Technical Analysis of Stocks & Commodities Magazine have voted TC2000 the best software – a testament to its quality and value. For further information, please visit my TC2000 review.

TC2000 Rating: 4.3/5.0

| Pricing ★★★★★ | News & Social ★✩✩✩✩ |

| Software ★★★★★ | Charting★★★★★ |

| Trading ★★★★✩ | Pattern Recognition ★✩✩✩✩ |

| Scanning ★★★★★ | Support ★★★★★ |

| Backtesting ★✩✩✩✩ | Usability ★★★★★ |

| Features | Rating ★★★★✩ |

|---|---|

| Buy/Sell Signals | ❌ |

| Automatic Trade Execution | ❌ |

| Trendline Recognition | ❌ |

| Chart Pattern Recognition | ❌ |

| Candlestick Recognition | ❌ |

| Screening | ✅ |

| Custom Indicators | ✅ |

| Backtesting | ❌ |

| Markets Covered | USA |

| Assets | Stocks, ETFs |

| Free Plan | ✅ |

| Community & Chat | ❌ |

| OS | Windows |

| Discount Available | $25 Discount Available + 30-Day Premium Trial |

You can download TC2000 for free, which is great for those wanting to test the waters. The free version is packed with essential features for tracking your stock portfolio. If you need more, the premium version unlocks additional capabilities at $60 per month or $50 per month if billed annually.

Portfolio Tracking

I’m impressed by TC2000’s watchlists. They’re incredibly powerful and flexible. You can configure hundreds of columns for technical and fundamental financial indicators, covering almost any tracking need you might have.

A standout feature is the integrated market scanning. This lets you sort and list stocks based on specific criteria. For example, if I’m looking for stocks with an EPS increase of over 20%, I can easily set up a scan for that.

Research & News

While TC2000 doesn’t offer integrated research reports like some competitors, it shines in market scanning. I can quickly scan the entire market for core financial data such as P/E ratios, EPS, earnings, employee numbers, or even insider ownership.

This tool is perfect for finding any company’s best fundamental setups in seconds. It’s a powerful ally for investors looking to identify promising stocks based on solid financial criteria.

Portfolio Profit & Loss Reporting

TC2000 allows for profit and loss reporting on individual stocks. I can see key information like purchase date, shares owned, and profit/loss for each holding.

You’ll need to use the TC2000 brokerage for full portfolio profit and loss reporting. This integration provides a more comprehensive view of your overall portfolio performance.

Portfolio Rebalancing & Management

I must note that TC2000 falls short in some portfolio management areas. It lacks functionality for portfolio performance reporting, rebalancing, asset allocation, and future income reporting.

TC2000’s strengths lie in technical analysis, charting, and market scanning. While the stock watchlists are excellent for tracking individual stocks, portfolio-level tracking is limited.

Broker Integration

TC2000 Brokerage is a relatively new offering from Worden Brothers Inc. As a user of their stock market analysis software, I was excited to see them expand into brokerage services.

They’ve done an impressive job. Stock trade commissions are just $1, and options trades are priced at $1 plus $0.65 per contract. These rates are quite competitive in the current market.

What really stands out to me is their margin interest rates. TC2000 Brokerage offers very low rates on margin loans, which is unusual in an industry where brokers often profit heavily from this service.

The ability to trade directly from charts in TC2000 is a game-changer. I can perform real-time fundamental and technical screening of entire stock markets, including ETFs, and easily create indicators based on market conditions. Their options trading platform is arguably one of the best in the industry.

It’s worth noting that TC2000 Brokerage only offers trading in stocks, options, and ETFs.

What is the Best Stock Portfolio Tracker?

I believe Stock Rover is the top choice for stock portfolio tracking. It offers a unique mix of features, such as portfolio correlation, management, and rebalancing. The broker integration and built-in research reports are big pluses. For US investors focused on stocks and mutual funds, it’s hard to beat.

That said, Yahoo Finance is a popular free option. It provides a basic watchlist and portfolio tracking. The premium version adds more reporting, but at $49.99 per month, it’s pricey compared to alternatives.

FAQ

How do I track my stock portfolio?

I recommend using a dedicated tool like Stock Rover for detailed tracking. It offers performance data, balancing recommendations, and dividend forecasting. Your broker’s platform is another option, but it often lacks advanced reporting features.

Is Google Portfolio free?

Yes, Google Finance is free. However, it’s quite basic compared to other options. Yahoo Finance, Stock Rover, TradingView, and Portfolio 123 offer more robust features.

How do I track a stock portfolio in Excel?

You can use a free trade tracking Excel spreadsheet. It lets you log trades and the reasons behind them and calculates profit/loss. While not as advanced as dedicated software, it’s a good DIY option.

How do I track all my investments in one place?

For a comprehensive view, I recommend Stock Rover. It connects to your broker, updates automatically, and provides integrated profit/loss and dividend forecasts.

Are online portfolio trackers safe?

Generally, yes. Most use encryption for secure communication. Remember, safety largely depends on your password strength and online practices.