Stock options are contracts that give investors the right to buy or sell stocks at set prices within specific timeframes. I see them as versatile financial tools that can serve multiple purposes. Some view options as a form of gambling, while others use them for protection or income. The truth is that options can fill all these roles depending on how they’re used.

Options trading involves predicting future stock prices, which carries inherent risks. But it’s not just about luck. With careful analysis and strategy, investors can profit from or potentially protect their portfolios.

It’s important to understand that options are complex instruments that differ from stocks themselves.

Are Stock Options a Gamble?

Stock options can be seen as gambling, but it’s not that simple. It depends on how you use them. Some traders treat options like betting and making risky moves without much research. However, options can also be smart investing tools when used carefully.

Weekly options are riskier. They’re more like gambling because prices change fast, and you can lose money quickly. But longer-term options give you more time to be right about where a stock is going.

Here’s how I think about it:

- Gambling: Making trades based on hunches or excitement

- Investing: Using options as part of a well-planned strategy

- Insurance: Buying options to protect other investments

The key is having a solid plan. I use TrendSpider to help me make smarter choices. Its AI tools spot patterns in stock charts that I might miss, helping me trade options more like an investor and less like a gambler.

Remember, even with good tools, options still have risks. I always suggest learning a lot before trading them. And never bet more than you can afford to lose.

Stock Options: A Gamble?

Stock options are a form of speculation that shares some similarities with gambling. When traders buy options, they’re essentially placing bets on the future price movements of stocks. It’s a high-risk, high-reward game that can be thrilling for those seeking excitement in the financial markets.

Take Apple Inc. as an example. If I believe Apple’s stock will rise 10% in the next year, I might buy 2 call option contracts expiring in 12 months. I’m betting on Apple’s continued growth, but there’s no guarantee. Unlike owning the stock itself, my options could expire worthless if I’m wrong.

This speculative nature is what makes options trading feel like gambling. The odds can be stacked against traders, especially novices. Just like at a casino, it’s possible to lose all your money quickly if you’re not careful.

But options trading isn’t pure chance.

Smart traders do their homework:

- Analyzing company financials

- Studying market trends

- Assessing economic conditions

Even with thorough research, though, it’s still a gamble. I’m making an educated guess, but I can’t predict the future with certainty.

For some, the excitement of potentially big wins is a major draw. The rush of a successful options trade can be addictive. But it’s crucial to approach options with caution and a clear strategy.

Stock Options as a Safety Net

I see stock options as a tool for investors to protect their investments. They’re like an insurance policy for your stocks. Let’s say I own 1,000 shares of Microsoft. I like getting those dividends and watching my investment grow. But I’m worried about a possible recession due to interest rate hikes.

I can use put options to guard against a price drop. If Microsoft’s stock falls, I’ll make money from the puts, which helps offset my losses. Or I could sell call options to earn extra cash if the stock price stays flat.

These strategies let me:

- Set a limit on potential losses

- Make some money even if the market doesn’t move my way

- Sleep better at night knowing I have a safety net

It’s a smart way to manage risk in my portfolio.

Stock Options as a Source of Income

Stock options can generate extra income from existing investments. Let’s say I own 1,000 shares of Microsoft worth $220,000. If I’m bullish on the company’s future, I might sell 10 put option contracts, giving me control over 1,000 shares.

This strategy could net me $22,000 upfront. I’d then wait two months for the contracts to expire. If Microsoft’s stock price stays flat or goes up, those options would expire worthless – leaving me with a nice profit.

But there’s a catch. If the stock price drops significantly below the strike price, I could be forced to buy more shares or pay the difference to the contract holder.

Here are some key points to remember:

- Options can boost returns on existing investments

- Selling puts can generate immediate income

- Risks include potential forced stock purchases

- Time value and strike price are crucial factors

Options aren’t for everyone, but they can be a valuable income tool when used carefully.

Are Binary Options a Form of Gambling?

Binary options have a lot in common with gambling. They involve predicting future outcomes with no guarantees, much like betting on a sports game or roulette spin. Binary options use small amounts of money and expire quickly, similar to placing wagers at a casino. While profits are possible, the risks of big losses are real.

The terms can be tricky to understand. I think it’s essential to know what you’re getting into before trading binary options. Like any form of gambling, you could win big – but the house usually has the edge in the long run.

What are the potential risks of trading binary options?

Binary options trading comes with significant risks. The biggest danger is betting against the market maker, which is like playing in a rigged casino. The short expiration dates mean your investment can quickly turn into a loss if the market moves unexpectedly.

Understanding contract terms is crucial, as they can be complex and unclear. Many traders lose money due to poor decisions or a lack of knowledge about how binary options work.

The potential losses can far exceed your initial investment. While some traders make big profits, most lose money.

Here’s an easy-to-understand summary of the main risks:

- Betting against the house

- Short time frames for trades

- Complex contract terms

- High potential for losses

- Limited understanding of the market

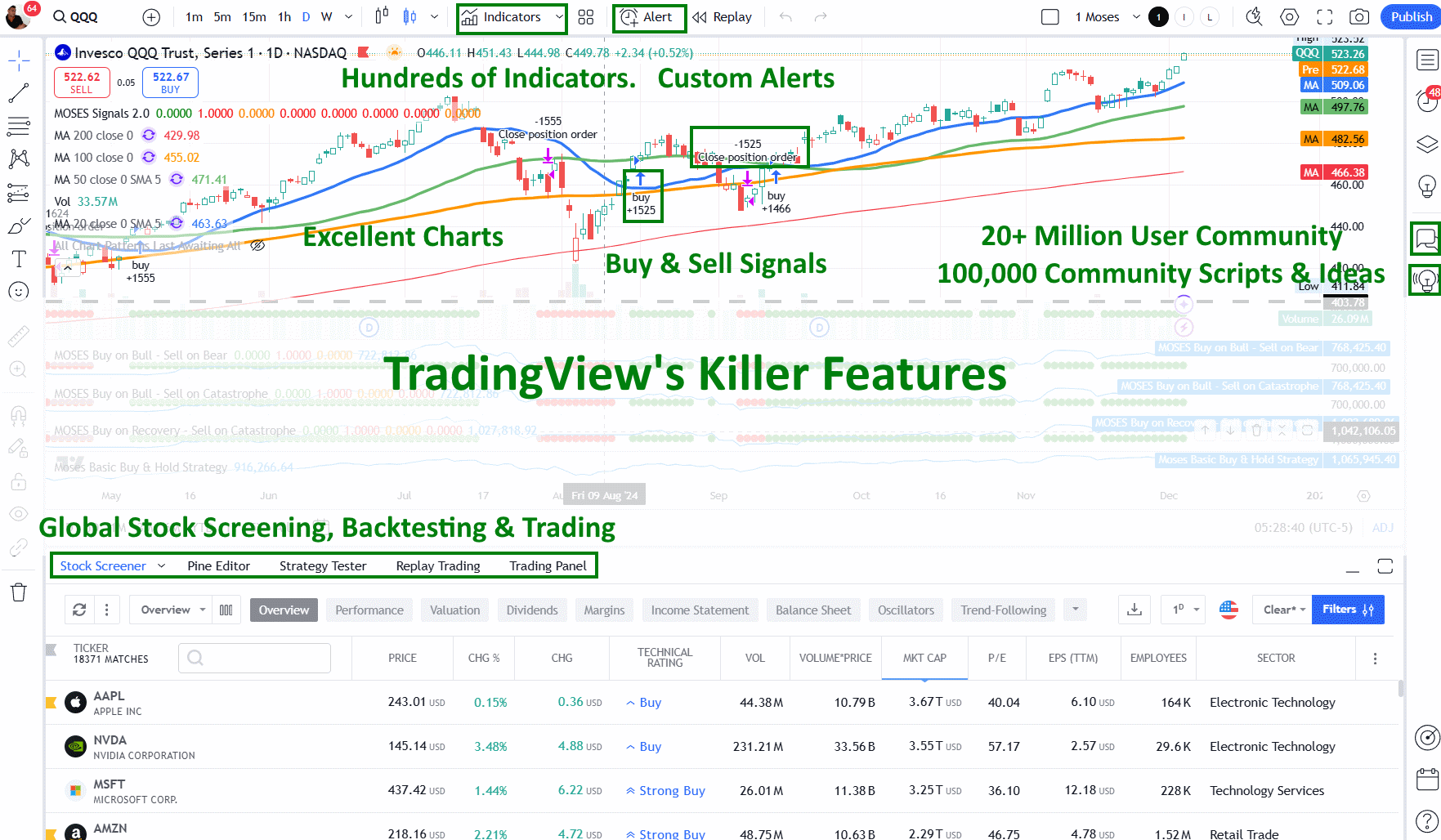

I recommend using tools like TradingView for better market analysis before entering binary options trading. For an in-depth review of TradingView, check out my TradingView review.

TradingView gets my top rating! It’s hands down the best trading software out there, offering built-in broker integration, powerful backtesting tools, advanced scanners, and access to the world’s largest trading community. It’s a game-changer for traders at all levels!

The Hidden Risks of Stock Options

Stock options can be tricky. I’ve seen many people lose money fast when trading them. The prices change quickly, and I can end up with big losses if I’m not careful.

6 Strategies to Mitigate Stock Option Risks

1. Don’t use Sell Contracts

I always recommend buying options contracts instead of selling them. When I buy puts or calls, my potential loss is fixed and clear. Selling contracts can lead to much bigger losses if the stock moves unexpectedly. I leave contract selling to the pros.

2. Avoid Selling Naked Options

Avoid naked options selling like the plague. This is when you sell the option to buy a stock without owning it. It’s super risky—you could lose a ton of money if things go south. I stick to safer options strategies.

3. Leverage Options as a Safety Net

I love using options to protect my investments. If I own a stock and worry it might drop, I buy a put option. It’s like an insurance policy for my portfolio. This is my favorite way to use options – it helps me sleep better at night.

4. Avoid risking it all on a single Options contract

I never put all my eggs in one basket with options. They can be rewarding, but they’re also really risky. I only trade what I can afford to lose. When I use options to bet on a stock’s direction, I keep it small – just a tiny part of my capital.

5. Select your Option’s Expiry Date with Care

Picking the right expiry date is key. If I’m using options as insurance, I choose a date that gives me enough time to make gains. When I’m betting on a stock’s direction, I pick a date that’s not too far off but gives my idea time to play out. I avoid dates that are too close – I don’t want sudden news to mess up my plan.

6. Understanding “In the Money” and “Near the Money”

I always go for options that are “near the money” or “in the money.” This cuts down the risk of my options becoming worthless. These terms refer to the profit I’d make if the option expired at the current price. I find this approach much safer than gambling on far-out options.

By following these steps, I’ve been able to manage my risk better when trading options. Remember, options can be tricky, so understand them well before diving in. Always do your homework and never risk more than you can afford to lose.

Is Options Trading a Form of Gambling?

Options trading can be a form of gambling if you’re simply guessing which way a stock will move. Many traders make risky bets without proper analysis.

But options aren’t always a gamble. When used wisely, they can act like insurance for your investments. Unlike pure chance-based gambling, options allow for strategic approaches. Still, it’s important to understand the risks.

Day trading options require even more caution, as the fast pace can lead to impulsive choices. Smart options traders develop systems and stick to their plans rather than chasing excitement.