Financial news can have a big impact on stock prices and market trends. That’s why I decided to test out different news sources to find the best options for traders.

I tested over 25 financial news services for speed, cost, features, and reliability. Benzinga Pro, MetaStock R/T, TrendSpider, and Bloomberg stood out as the top choices. These services offer up-to-the-minute stock market news that traders can trust.

My Research On Stock Market News Services

I’ve found several seriously fast and trustworthy stock market news services:

- Bloomberg’s financial TV channel is widely respected.

- Benzinga Pro offers blisteringly fast real-time news.

- MetaStock R/T delivers global news instantly.

- TrendSpider’s ability to scan and backtest news is revolutionary.

Features Compared

| Features | Benzinga Pro | MetaStock R/T | TrendSpider | Bloomberg |

| Rating | 4.6 | 4.5 | 4.4 | 4.3 |

| Free Version | ✅ | ❌ | ❌ | ❌ |

| Global Market Data | USA | ✅ | USA | ✅ |

| Real-time News | ✅ | ✅ | ❌ | ✅ |

| News Backtesting | ❌ | ❌ | ✅ | ❌ |

| Powerful Charts | ✅ | ✅ | ✅ | ✅ |

| Stocks | ✅ | ✅ | ✅ | ✅ |

| Futures | ✅ | ✅ | ✅ | ✅ |

| Forex | ✅ | ✅ | ✅ | ✅ |

| Cryptocurrency | ✅ | ❌ | ✅ | ✅ |

| Screeners | ✅ | ✅ | ✅ | ✅ |

| Backtesting | ❌ | ✅ | ✅ | ❌ |

| Code-Free Backtesting | ❌ | ❌ | ✅ | ❌ |

| Automated Chart Analysis | ❌ | ❌ | ✅ | ❌ |

1. Benzinga Pro: Real-time Trading News

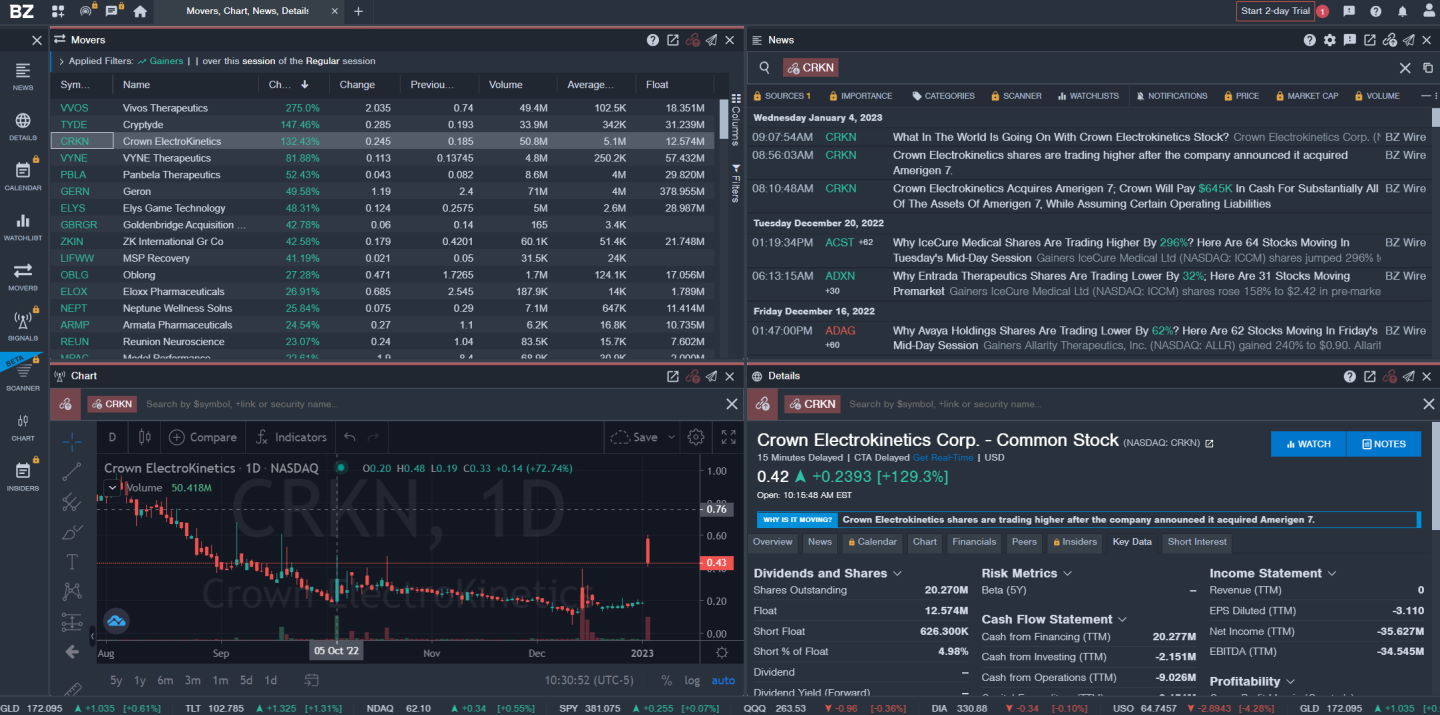

Benzinga Pro stands out as the top choice for traders seeking real-time stock market news. I’ve been using this platform for 4 years, and it consistently delivers actionable insights at a fraction of the cost of a Bloomberg Terminal.

The core of Benzinga Pro is its lightning-fast newsfeed. It updates in real-time, giving me access to critical information like SEC filings and company press releases as they happen. This speed can be great when markets are moving quickly.

The customization options are particularly useful. The newsfeed lets you choose from 20 different news categories, and you can color-code them to suit your preferences. My setup focuses on market-moving exclusives, hot news, market updates, and tech news. This filtering helps me cut through the noise and focus on what matters most to my trading strategy.

Alerts are another key feature I rely on. I’ve set up multiple watchlists and receive notifications for specific stocks or sectors. These alerts come through as emails, desktop pop-ups, or sounds, so I don’t have to watch the feed constantly. It’s a huge time-saver.

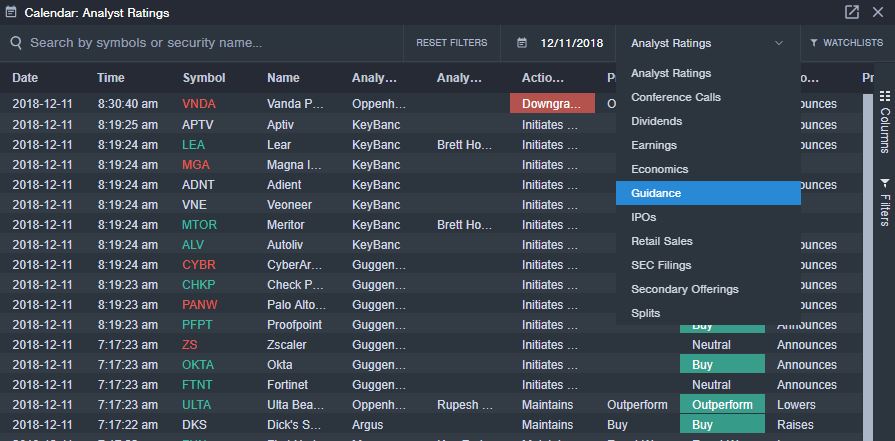

The calendar suite is a tool for staying ahead of market-moving events. It provides real-time updates on analyst upgrades and downgrades, which can significantly impact stock prices. I also use it to track upcoming conference calls, earnings reports, IPOs, and more.

One feature that really impresses me is the “Change Since Publish” function. It shows how a stock’s price has moved since a news item was released. For example, I saw a 21% increase in Cronos Group’s stock over two days following news of a strategic investment. This kind of insight helps me gauge the market impact of news.

The Squawk Box is a standout feature of the Essentials plan. It’s like having a personal news anchor reading out the most important updates. I’ve caught breaking news on FDA approvals and other market-moving events before they hit mainstream sources.

Here’s a quick breakdown of the Benzinga Pro plans:

| Plan | Monthly Cost (Annual Plan) | Key Features |

|---|---|---|

| Basic | $30 | Real-time newsfeed, quotes |

| Essential | $166 | Advanced filtering, Squawk Box, calendars, sentiment indicators |

| Options Mentor | $381 | Trading mentorship, options inner circles |

I recommend the Essential Plan for most traders. It offers the best balance of features and cost.

The sentiment indicators are a unique addition. They use color-coding to show the analyst’s sentiment behind each news item. This quick visual cue helps me gauge the potential market reaction at a glance.

Benzinga Pro’s charts and screeners are solid additions to the package. While they might not replace dedicated charting software for advanced traders, they’re more than adequate for quick analysis alongside breaking news.

The platform’s coverage focuses mainly on North American markets. This concentration allows for depth in U.S. stock, forex, and crypto news, but traders focused on other regions might find the coverage lacking.

One small drawback is the volume of information. Even with filtering, it can be overwhelming at times. It took me a few weeks to fine-tune my settings and get the most out of the platform without information overload.

Benzinga Pro’s real-time updates have given me an edge in reacting to market-moving news. Whether it’s a surprise FDA approval or an unexpected earnings beat, I often find myself aware of significant developments before they’re widely reported.

In my experience, Benzinga Pro is at its best during earnings seasons and big economic events. The combination of real-time news, analyst calls, and sentiment indicators creates a comprehensive picture of market dynamics.

I appreciate how Benzinga Pro continually evolves. They regularly add new features and refine existing ones based on user feedback. This commitment to improvement keeps the platform relevant in the fast-paced world of financial news. Read the full Benzinga review.

2. MetaStock R/T: Global Real-time Stock News

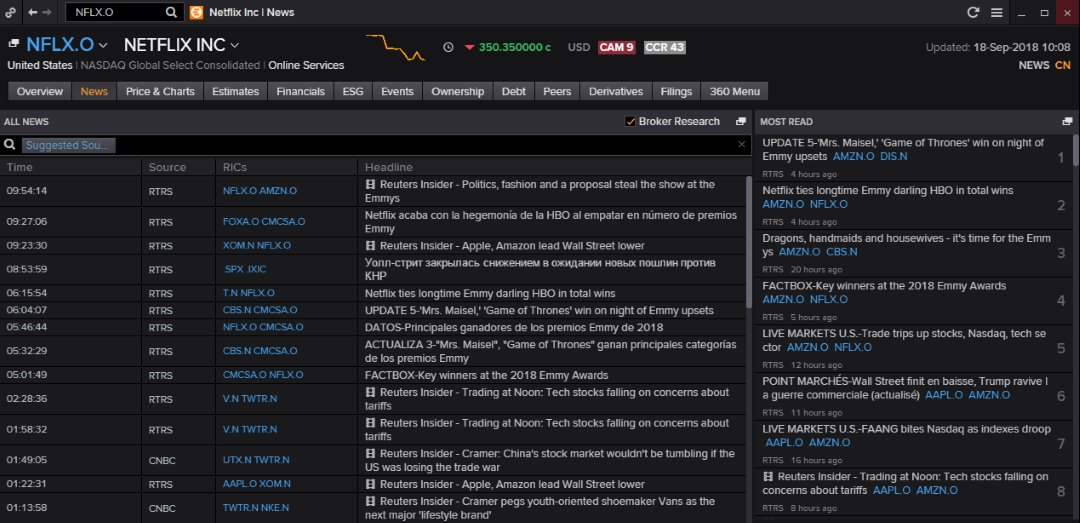

MetaStock R/T Xenith is the top choice for global traders needing real-time financial news. It delivers top-notch data from Refinitiv and offers powerful technical analysis and backtesting tools.

MetaStock R/T stands out for its fast global news service, which includes translations into major languages. TV news coverage is also available through smartphone and smart TV apps, plus insider alerts and expert analysis from the financial network team.

The platform gives you detailed company snapshots. For example, the Refinitiv Xenith Streaming News Screen for Netflix (NFLX) is packed with original news from the Refinitiv Network. You’ll see this news before anyone else.

MetaStock R/T includes:

- Stock quotes

- Charts

- Analyst estimates

- Financial details

- SEC Filings

- Upcoming events listings

- Real-time global news feeds

- News translated into multiple languages

- TV news coverage on various devices

- Insider alerts

- Exclusive content

- Expert analyst research

It covers stocks, options, bonds, futures, FX, and macroeconomic news and data. You can set up multiple workspaces for different monitors and save them for later. The software works on PCs, smartphones, and TVs.

MetaStock R/T with Xenith costs $265 per month. This includes real-time data, news, and fundamentals from Refinitiv, the gold standard for international financial data.

It lets you test your trading ideas against historical data to see how they might perform in real markets. This feature is key for developing and refining trading strategies.

I’ve been using MetaStock for 9 years, and I can appreciate its customer service. If you run into any issues or have questions, their support team is quick to help.

MetaStock R/T is best for stock, forex, and commodity traders who need fast, reliable news and data. While it’s not cheap, the quality and breadth of information you get make it worth the investment for serious traders. Read the in-depth MetaStock review.

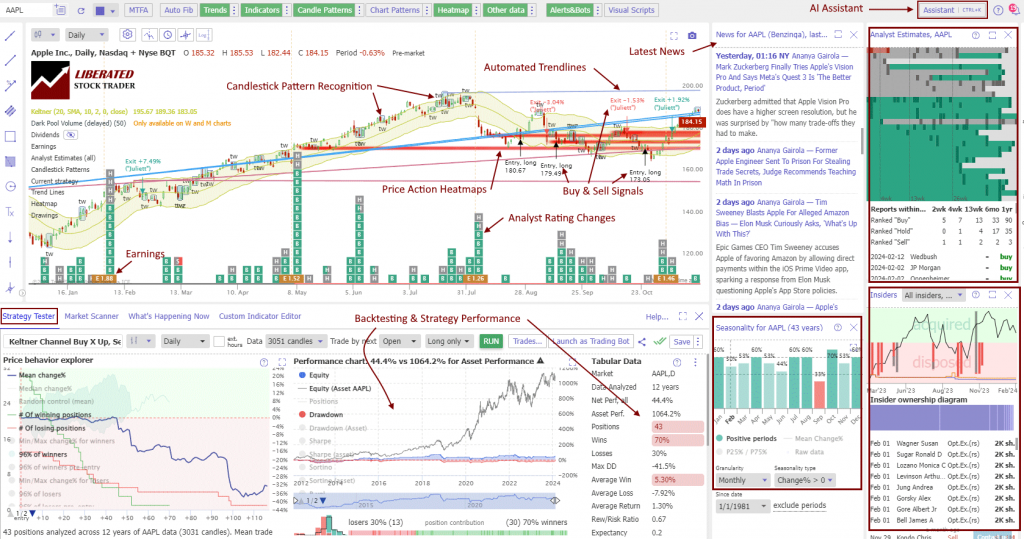

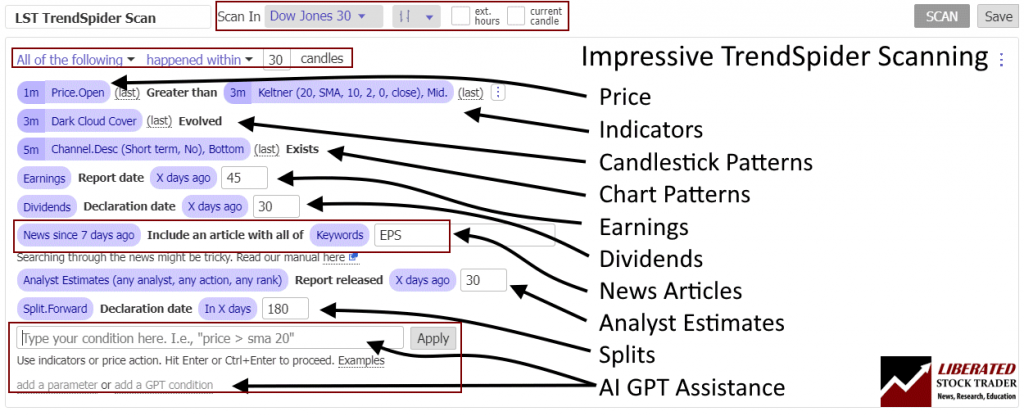

3. TrendSpider: AI-Powered News Analysis

TrendSpider is a cutting-edge platform designed to revolutionize the way traders and investors analyze financial markets. With a suite of advanced tools, TrendSpider offers unparalleled capabilities for integrating financial news into technical analysis. This review delves into TrendSpider’s features and benefits, particularly focusing on its news scanning, charting, and backtesting functionalities.

Automated News Scanning and Charting

One of TrendSpider’s standout features is its ability to scan and chart news events. This functionality allows users to stay ahead of the market by quickly identifying significant news that could impact stock prices. The platform’s sophisticated algorithms scan a vast array of news sources, ensuring that users receive timely and relevant information.

The integration of news events into charts is seamless. Users can overlay news events directly onto price charts, providing a visual representation of how news impacts market movements. This feature is particularly beneficial for traders who rely on news-driven strategies, as it allows them to see the immediate and historical effects of news on stock performance.

Analyst Estimates and Changes

In addition to news events, TrendSpider also tracks analyst estimates and changes. This feature is crucial for investors who consider analyst opinions in their decision-making process. By incorporating analyst estimates into the platform, TrendSpider provides a comprehensive view of market sentiment and potential stock movements.

Users can see how changes in analyst ratings and price targets correlate with stock performance. This information is invaluable for making informed trading decisions, as it highlights potential opportunities and risks associated with analyst revisions.

Backtesting News Events

Another significant advantage of TrendSpider is its backtesting capabilities. The platform allows users to backtest how news events have historically affected stock prices, which is essential for developing and refining news-based trading strategies.

By backtesting news events, traders can identify patterns and trends that may not be immediately apparent. This historical analysis helps in understanding the potential impact of similar news in the future, thereby improving the accuracy and profitability of trading strategies.

Beyond news integration, TrendSpider offers a comprehensive suite of technical analysis tools. Features such as automated trendline detection, multi-timeframe analysis, and dynamic price alerts enhance the platform’s utility. These tools work in tandem with news and analyst data to provide a holistic view of the market.

TrendSpider stands out as a powerful tool for traders and investors looking to integrate financial news into their technical analysis. The platform’s ability to scan, chart, and backtest news events, along with tracking analyst estimates and changes, provides a comprehensive approach to market analysis. Read the detailed TrendSpider testing.

4. Bloomberg: Top Financial TV News

Bloomberg is my go-to source for financial news and market updates. Their coverage is unmatched in depth and quality.

The channel features a steady stream of CEO interviews, expert analysis, and real-time data. While the ads can be repetitive, the content makes it worthwhile.

What sets Bloomberg apart is its global reach. Their reporters are stationed worldwide, providing insights into international markets that impact my investment decisions. I appreciate how they break down complex financial concepts into digestible segments.

Here’s a quick overview of Bloomberg’s key offerings:

- Live TV streams

- Bloomberg.com app

- Newsletters

- Podcasts

- Bloomberg Terminal (for professionals)

The Bloomberg Terminal is the gold standard for professional traders, but it costs $2,200 monthly. For individual investors like me, the Digital Pass is a more affordable option at $299 annually. It gives access to live TV, articles, audio news, and Bloomberg Businessweek.

I’ve found a way to save on my Bloomberg subscription:

- Log into my account before the renewal

- Go to “Your Account” then “Subscription.”

- Select “Contact Support to Cancel”

- Chat with the automated bot

- Get offered a renewal at $299, saving 40%

This trick has helped me maintain access to Bloomberg’s premium content without breaking the bank.

Bloomberg Businessweek is another valuable resource. It offers an in-depth analysis of financial markets and global business trends. Compared to other business magazines, it is more focused on finance.

One con of Bloomberg TV is the delay in broadcasting. The news I see has often already been acted upon by professional traders with premium Bloomberg services. Still, I find it invaluable for staying informed about market trends and economic news.

5. Traders Magazine: Best for Trading Strategies

Technical Analysis of Stocks & Commodities Magazine (TASC) is an important resource for technical traders. At $89 per year, it offers a wealth of knowledge for both novice and experienced traders.

TASC covers a wide range of topics, including:

- Chart patterns

- Indicators

- Trading strategies

- Market analysis

One of the things I appreciate most about TASC is its commitment to high-quality content. The magazine features articles from top traders and analysts, providing readers with expert insights and practical advice.

Here’s a quick overview of TASC’s key features:

| Feature | Description |

|---|---|

| Content | In-depth articles on technical analysis |

| Contributors | High-profile traders and analysts |

| Coverage | Stocks, options, commodities, forex |

| Digital Access | Full back catalog available |

| Free Trial | 30-day trial period |

TASC doesn’t just focus on theory; it also offers practical tools for traders. Many articles include code for popular trading platforms like MetaStock and TC2000, which lets readers implement new indicators and systems right away.

The learning articles are particularly helpful. They cover everything from basic concepts for beginners to advanced techniques for seasoned traders, making TASC a great resource no matter where you are in your trading journey.

The magazine’s market analysis is top-notch. It provides detailed technical analysis of various markets, helping readers stay on top of current trends and potential opportunities.

One of TASC’s features is its digital library. Subscribers get access to the entire back catalog.

If you’re serious about technical analysis, I highly recommend trying TASC. The 30-day free trial is a great way to test the waters. But to really benefit from the digital library, I suggest getting at least a one-year subscription.

In my experience, TASC has consistently provided value year after year. Whether you’re looking to improve your chart reading skills, develop new trading strategies, or stay informed about market trends, TASC delivers.

6. Economist: Business & Finance News

The Economist is an invaluable resource for staying informed about global business and finance. This weekly magazine offers a unique blend of political, economic, and business news that’s hard to find elsewhere.

The Economist stands out for its in-depth analysis and independent journalism. Its writers tackle complex issues with clarity, making it easier for me to grasp the nuances of global economics. I appreciate how they break down intricate financial concepts into digestible pieces.

Here are some key features that make The Economist stand out:

- Global perspective

- In-depth analysis

- High-quality journalism

- Strong focus on economic policy

The digital subscription is a game-changer. I get the full magazine delivered to my device every Friday morning. But what I love most is the audio feature. I can listen to the entire magazine through their app or online, which is perfect for commuting or doing chores.

The Economist is a goldmine of information. It helps me spot investment opportunities by providing context to global events that impact markets. The magazine’s coverage of emerging economies and industry trends has often guided my investment decisions.

The Economist isn’t just for economists or finance professionals. It’s useful for anyone wanting to understand how the world works economically and politically. Its coverage spans from small businesses to global corporations, giving a well-rounded view of the business world.

While the subscription might seem pricey at first glance, I’ve found the insights gained to be well worth the investment. The quality of reporting and analysis has consistently helped me make more informed decisions, both in my personal finances and professional life.

In today’s fast-paced world, staying ahead of the curve is crucial. The Economist helps me do just that. Its blend of current affairs and economic analysis provides a solid foundation for understanding global markets and investment trends.

7. Wall Street Journal: In-depth Financial Journalism

I find the Wall Street Journal (WSJ) to be a top source for financial news and analysis. Its website offers a wealth of information, though it’s not real-time. I appreciate the thought-provoking opinions and insightful journalism that set it apart.

The WSJ Markets section is particularly useful for stock market news and stats. It includes handy tools like stock screeners and portfolio trackers. One thing to note is the paywall – you’ll need a subscription for full access.

Here’s a quick breakdown of what WSJ offers:

- News Features: Delayed news, apps, podcasts

- Unique Selling Point: High-quality writing from WSJ journalists

- Target Audience: Investors

- Price: $9.99/month

- Free Trial: Not available

- Premium Discount: Not offered

- News Coverage: Global

With a digital subscription, I can access all the apps, podcasts, and exclusive interviews. There’s also a premium benefits program that lets me attend virtual events and seminars.

FAQ

What is the best breaking stock market news feed?

I recommend Benzinga Pro for the fastest, most accurate breaking stock news. It’s reasonably priced and includes helpful news impact ratings. For global coverage, MetaStock R/T and Bloomberg are top choices.

Where can I watch the stock market live?

I always turn to Bloomberg TV for live stock market coverage. It’s free through most cable providers and offers unparalleled market analysis and commentary.

What is the most reliable financial news source?

I trust Bloomberg, the Wall Street Journal, and The Economist for reliability. When I need real-time news, I use Benzinga Pro or MetaStock R/T.

What is the Best Magazine for Traders?

I swear by Technical Analysis of Stocks & Commodities Magazine (TASC) for in-depth technical analysis and trading strategies. It covers stocks, commodities, forex, and fixed income.

Can fake news impact the stock market?

Yes, fake news can definitely affect the stock market, especially individual stocks.

I always double-check sources and stick to reputable outlets to avoid falling for misinformation.

What is the smartest way to analyze financial news?

In my testing, TrendSpider provided the most intelligent news analysis service. It allows you to scan, backtest and build trading systems based on news events and analyst ratings.