Sector rotation can be effective but not highly profitable. It involves shifting investments among different sectors based on economic cycles to maximize returns. When done correctly, it can outperform the market by capitalizing on sectors expected to perform well in specific phases of the cycle. However, it requires good timing, market knowledge, and active management. Mistimed moves or inaccurate forecasts can lead to underperformance.

The idea behind sector rotation has been around for a long time. It’s based on how the economy goes through ups and downs. By switching investments between different sectors, like energy, tech, or healthcare, investors hope to stay ahead of these changes. This can be a tricky but exciting way to manage a stock portfolio.

Understanding Sector Rotation

Sector rotation is an investment strategy that moves money between different industries based on economic cycles. By shifting funds to sectors that might do well next, investors aim to boost returns and cut risks. For example, I might buy tech stocks when the economy grows and switch to utilities during slowdowns.

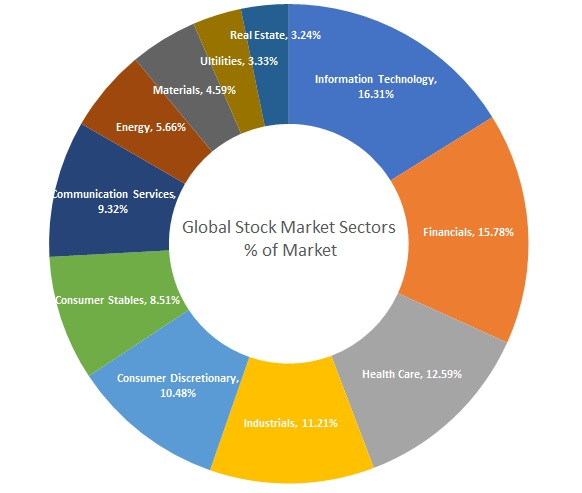

This chart shows different sectors:

Is Sector Rotation an Effective Strategy?

I believe sector rotation is an ineffective strategy. My sector rotation ETF analysis shows all have underperformed compared to the S&P 500 over the past five years.

For instance, the SPDR SSGA U.S. Sector Rotation ETF delivered a modest 54% gain, while the PeakShares Sector Rotation ETF managed just 13%. In contrast, the S&P 500 surged by an impressive 79% during the same period.

SPDR SSGA U.S. Sector Rotation ETF: 5-Year Gain 54%

Sector rotation doesn’t consistently beat market averages. There’s little proof that it can reliably produce outsized returns. While it might offer some protection during economic shifts, success is far from guaranteed.

PeakShares Sector Rotation ETF: 5-Year Gain 13%

S&P 500 – 5-Year Gain 79%

To use sector rotation well, you need deep economic knowledge and a clear view of the business cycle. This is tough—even top economists struggle with it. Even if I rotate sectors perfectly, I still have to pick the right companies or funds to invest in. That’s no easy task.

Here’s a simple breakdown of sector rotation challenges:

- Hard-to-time economic cycles

- Difficult to choose the best investments

- There is no guarantee of beating the market

- Requires constant monitoring

Sector rotation can be an interesting strategy, but it’s not a sure path to investing success.

The 5 Phases of Sector Rotation:

1. The Expansion Phase

During this stage, the economy grows rapidly. I’ve seen strong performance in the tech, consumer discretionary, and industrial sectors, and investors often flock to these areas to capture growth. Companies invest more, hire more workers, and consumer spending rises. This phase can last several years, with steady GDP growth and low inflation.

2. The Peak Phase

The economy reaches its high point here. I notice a shift towards defensive sectors like healthcare and utilities. These offer more stable returns as growth slows. Investors start to worry about overvaluation and look for safer options. The job market is tight, and wages may rise, potentially leading to inflation concerns.

3. The Contraction Phase

Growth slows down in this phase. I see a move towards more secure investments. Bonds have become more popular. Utilities and some cyclical industries may do well. It’s smart to be cautious with high-risk stocks now. The stock market might start to decline, and companies may cut back on spending and hiring.

4. The Recession Phase

The economy shrinks in this stage. I focus on defensive stocks with steady cash flow and low debt. Consumer staples often hold up well. People still need to buy food, toiletries, and other basics. Unemployment rises, and interest rates often drop to boost growth. Gold and silver can be good options during this time.

5. The Recovery Phase

As the economy starts to grow again, I look for stocks with good growth potential. Tech and industrial companies often do well in this phase. Value stocks that were beaten down in the recession can be good picks. Transportation and auto companies might see more profits if the job market improves and consumer confidence starts to rise.

Key sectors to watch in each phase:

| Phase | Sectors to Consider |

|---|---|

| Expansion | Tech, Consumer Discretionary, Industrials |

| Peak | Healthcare, Utilities |

| Contraction | Utilities, Energy, Transportation |

| Recession | Consumer Staples, Healthcare, Gold/Silver |

| Recovery | Tech, Industrials, Value Stocks |

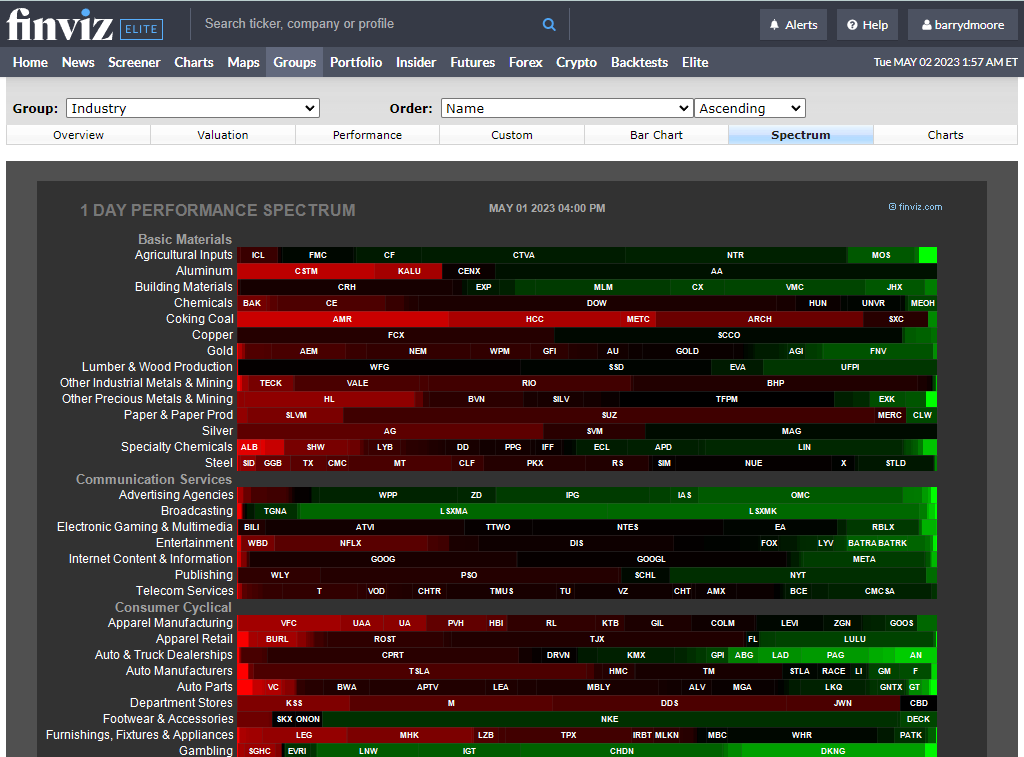

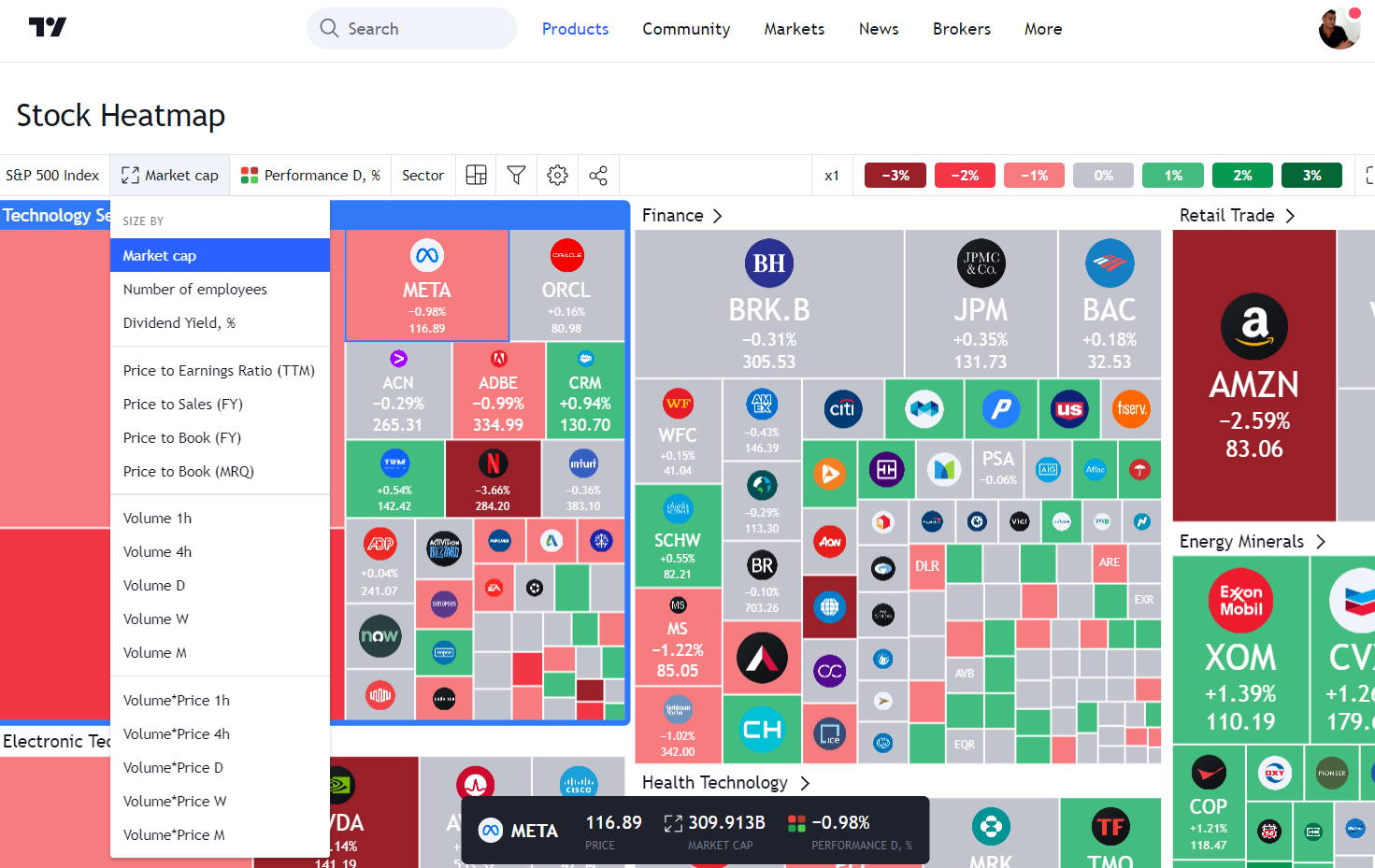

I find it helpful to use sector heatmaps to spot trends. They show which sectors are hot or cold at a glance. This can help guide investment choices as the economy moves through these phases.

Here’s a TradingView heatmap example:

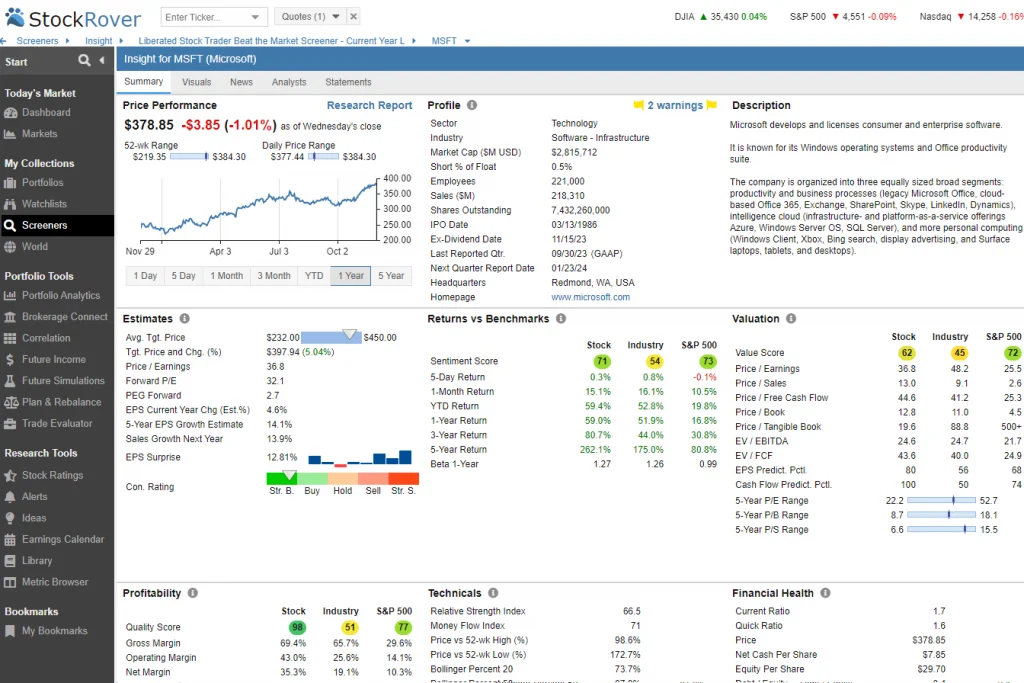

The Best Sector Rotation Investing Tool

Effective sector rotation strategies require choosing the right software. Stock Rover stands out as a top choice in this area. It offers useful tools for researching industries, sectors, and individual stocks. I appreciate its robust financial screeners that cover all sectors, making it easy to spot trends and opportunities.

Stock Rover excels at comparing companies within the same sector, which is vital for making sector rotation decisions. Its portfolio management features are user-friendly, allowing me to rebalance my holdings with ease. Its ability to connect with brokers provides detailed analytics on portfolio correlation.

I actively use Stock Rover for my investments, and it’s become an essential tool.

Stock Rover offers a free version to get started. For serious sector rotation strategies, I think it’s worth considering their paid plans for more advanced features.

Stock Rover – The Smart Choice for Savvy Long-term Investors

As an investor, I’ve always wanted powerful insights without the complexity. Stock Rover changed the game for me. With its deep screening tools and hundreds of metrics, I can quickly find stocks and ETFs that match my strategy. It streamlined my research and made decision-making so much easier.

Comparing investments used to be a hassle—now it’s a breeze. Stock Rover lets me analyze multiple stocks, ETFs, or portfolios side by side. I get clear views on fair value, quality, and growth potential, helping me make smarter, more confident choices.

Tracking my portfolio is now seamless. By linking my brokerage, I get real-time updates and detailed analytics. Features like dividend forecasts and rebalancing tools help me stay on track and plan effectively for the long term.

Stock Rover is the only service I recommended for growth, dividend, and value investors.

Real-World Examples of Sector Rotation

Post-2008 Financial Crisis Recovery (2009-2010):

Rotation: As the economy began recovering, investors shifted from defensive sectors like Utilities and Consumer Staples (which performed better during the recession) to Cyclical sectors like Technology, Consumer Discretionary, and Industrials.

Reason: Cyclical sectors tend to outperform when economic growth resumes.

COVID-19 Pandemic Crash and Recovery (2020-2021):

Rotation: During the initial COVID-19 crash, investors favored Healthcare and Technology due to remote work trends and vaccine development. As economies reopened in 2021, the focus shifted to Energy, Financials, and Travel & Leisure sectors.

Reason: Reopening boosted demand for oil, travel, and banking services.

Inflation and Interest Rate Hikes (2022):

Rotation: With rising inflation and aggressive rate hikes by central banks, investors moved from Growth sectors like Technology to Value sectors such as Energy, Financials, and Utilities.

Reason: Value sectors typically perform better during high inflation and rising interest rates because of stable cash flows and pricing power.

These examples show how sector rotation aligns with macroeconomic trends and investor expectations.

Duration of Sector Rotation

Sector rotation typically lasts between 2 to 2.5 years on average. This timing aligns with economic cycles and market trends. The Juglar Cycle, a key economic theory, plays a role in sector rotation. It spans about 9.2 years and ranges from 7 to 11 years. This cycle matches up closely with the 10-year stock market cycle.

The length of each rotation stage can vary based on economic conditions. As markets shift, different sectors may lead or lag. I’ve noticed that investors often move their money between sectors as they try to capture gains and avoid losses. This movement creates the rotation effect we see in the markets.

The Effort to Maintain a Sector Rotation Strategy

Keeping up a sector rotation strategy takes real work. I need to always monitor the economy and know a lot about different companies.

This means spending time looking things over and making choices. I have to decide when to sell stocks in one area and buy new ones in another.

I use TrendSpider to help me. It’s a smart tool that uses AI to analyze stock charts. It finds patterns and tests whether they work well, saving me time and helping me make better choices.

10 Steps in Conducting a Sector Analysis

I find sector analysis crucial for making informed investment decisions, but it is a labor-intensive job.

- Understand the Economic Cycle. Identify the current phase of the business cycle (expansion, peak, contraction, or trough).

Different sectors perform better in specific phases (e.g., Technology in expansion, Utilities in recession). - Analyze Sector Fundamentals. Evaluate sector growth prospects, profitability, and financial health. Review key metrics like earnings growth, P/E ratios, and revenue trends.

- Assess Macroeconomic Factors. Consider interest rates, inflation, GDP growth, and government policies. For example, financials benefit from rising rates, while consumer staples are resilient to downturns.

- Evaluate Industry Trends and Innovations: Identify technological advancements, regulatory changes, or consumer behavior shifts affecting the sector. For example, renewable energy trends are boosting the energy sector.

- Compare Sector Performance. Analyze historical and relative performance using indices or ETFs that represent sectors (e.g., S&P 500 sector indices). Look for sectors outperforming or underperforming in the broader market.

- Conduct Competitive Analysis. Identify leading companies in the sector and assess their market share, strategies, and growth potential.

Strong leaders often indicate a healthy sector. - Risk Assessment: Understand sector-specific risks like regulatory challenges, commodity price volatility, or geopolitical factors.

For instance, Energy is sensitive to oil price fluctuations. - Determine Valuation: Compare sector valuations to historical averages and other sectors using metrics like P/E, P/B, or EV/EBITDA.

Identify sectors that are overvalued or undervalued relative to market conditions. - Set Investment Strategy: Based on the analysis, decide whether to be overweight, underweight, or maintain neutral exposure.

Align the sector allocation with your risk tolerance and market outlook. - Monitor and Adjust. Continuously track sector performance and adjust allocations as macroeconomic conditions and sector fundamentals change.

When doing my investment research, I use tools like:

- Economic calendars

- Sector performance charts

- Industry-specific news sources

By staying up-to-date with these indicators, I can spot potential sector rotations and adjust my portfolio accordingly.

Does Sector Rotation Drive Profits?

In my opinion, individual investors should avoid sector rotation due to time, cost and performance considerations. Sector rotation can be profitable, but it’s not a sure thing, and even professional funds do not get it right. It depends on your ability to predict economic shifts accurately.

If you guess right about which sectors will do well next, I might make more money than if I just bought and held stocks. But it’s tricky. Even professional investors often struggle with this strategy. It’s not easy to consistently beat the market this way.

Sector Rotation Complexity

Timing market shifts is a major hurdle in sector rotation. It’s tough to predict economic cycles accurately.

Active management takes a lot of time and effort, too. I’ve noticed increased volatility when rotating sectors frequently. Transaction costs can eat into returns if I’m not careful.

Market downturns and economic uncertainty make sector calls trickier. I need to stay on top of interest rates, inflation, and unemployment data. Rotating effectively while managing risks is a balancing act.

Identifying Top Stocks in Thriving Sectors

First, I check if the market is on an upward trend. Then, I identify which industry sectors are leading the pack. Next, I pinpoint the top companies within those sectors. Finally, I will research those companies. This approach helps me find potentially strong investment opportunities.

Some tools I use:

- Sector ETFs

- Momentum stocks

- Stocks trading near lows

- Sector-tracking funds

What is an Industry Sector?

Industry sectors are typically defined using classification systems. These group companies are based on their main business activities.

Some common systems include the SIC, ISIC, and GICS. The GICS, created by Morgan Stanley and S&P, divides the market into 11 sectors:

- Consumer Staples

- Industrials

- Information Technology

- Utilities

- Consumer Discretionary

- Materials

- Energy

- Financials

- Health Care

- Communication Services

- Real Estate

These classifications help me analyze market trends and compare similar companies.