After testing Scanz, it’s clear that the platform is designed for day traders to quickly find short-term trading opportunities across the entire market.

What sets Scanz apart is its real-time news, exchange data, and liquidity insights, which can be crucial for making fast decisions.

While Scanz offers a lot for traders of all levels, the stock analysis tools landscape is competitive. With rivals like TradingView, MetaStock, and TrendSpider, what makes Scanz special?

Scanz’s “Scan It, Find It, Profit” approach seems promising, so let’s dive in.

Test Results & Ratings

Scanz is a solid platform for day traders, scoring 4.1 out of 5.0 overall. The software is good at providing real-time market information and customizable scans.

Trading features and news integration are also impressive. The platform offers good usability, making it easy to navigate and set up scans. Charts and analysis tools are adequate but could be improved.

One area where Scanz falls short is backtesting, receiving only 1 star. This limits its usefulness for strategy development and historical analysis.

Scanz Rating: 4.1/5.0

| Pricing: ★★★✩✩ | News & Social: ★★★★★ |

| Software: ★★★★★ | Backtesting: ★✩✩✩✩ |

| Trading: ★★★★✩ | Pattern Recognition: ★✩✩✩✩ |

| Scanning: ★★★★★ | Liquidity, Time & Sales: ★★★★★ |

| Charts & Analysis: ★★★✩✩ | Usability: ★★★★✩ |

| Features | Rating ★★★★✩ |

|---|---|

| Real-time News | ✅ |

| Automatic Trade Execution | ❌ |

| Real-time Data Included | ✅ |

| Pattern Recognition | ✅ |

| Broker Integration | ✅ |

| Backtesting | ❌ |

| Trading Signals | ✅ |

| Deep Liquidity Reporting | ✅ |

| Markets Covered | USA |

| Assets | Stocks |

| Free Trial | ✅ 14-Day |

| Community & Chat | ❌ |

| OS | Web Browser, Windows |

| Discount Available | Try Scanz Free for 14 Days |

Key Features

Scanz offers real-time charts and news, plus powerful screening tools. It stands out with LII data, dollar volume tracking, and broker integration. The platform caters to day traders, providing technical indicators like moving averages, Bollinger Bands, and MACD. Custom filters let you scan for specific stock types and ETFs.

Review Summary

Scanz is a tool for US day traders. It combines real-time Level I/II prices and news scanning in one package. It’s useful for tracking market movements and making quick decisions. The platform scans the entire US stock market in real time, helping to spot short-term trading opportunities. I can easily access SEC filings and use the market scanning features to trade based on breaking news.

Pros

- Real-time data: I get up-to-the-minute Level I/II prices and news.

- Comprehensive scanning: The platform covers the whole US stock market.

- Broker integration: I can trade directly through the platform.

- User-friendly: The interface is easy to navigate.

- Dollar volume metrics: This feature helps me gauge market interest.

- All-in-one package: I don’t need multiple subscriptions for different features.

Cons

- Price: At $197 per month, it’s more expensive than some alternatives.

- Limited community: There’s no built-in social network for traders.

- No backtesting: I can’t test strategies on historical data.

- US-focused: It may not be ideal for traders interested in international markets.

- pattern recognition: Lacks chart price and candlestick pattern recognition.

I appreciate Scanz’s streamlined workflow and its ability to handle various aspects of day trading. The real-time streaming charts and news feeds keep me informed about market movements. While the cost is higher than some other platforms, I find the comprehensive feature set justifies the price for serious day traders like myself.

Compared to Similar Products

I’ve tested Scanz against its leading competitors. My TrendSpider testing shows it’s better for automated chart analysis, backtesting, and AI bot trading. My TradingView review suggests it outshines Scanz with its global data, asset coverage, and 20+ million community. Stock Rover beats Scanz for long-term growth, dividend, and value investing. Trade Ideas leads in AI-driven day trading. For real-time news, Benzinga Pro is a cheaper option than Scanz. Each tool has its strengths, so your choice depends on your specific trading needs and style.

However, Scanz shines for its powerful real-time news, data, level I/II liquidity data, and day trading speed.

Benefits

The real-time scanning capability from 4:00 a.m. to 8:00 p.m. EST is incredibly valuable. It lets me track market movements throughout the trading day, giving me a big edge.

The customizable scans are a game-changer. I can create scans that match my exact trading style and needs. Plus, with over 70 pre-made scans, I’m never at a loss for ideas.

The filters are top-notch. I can zero in on stocks based on price, volume, moving averages, and more. This helps me find the best opportunities quickly.

Fundamental filters let me check a company’s financials and market cap before I invest. It’s like having a personal financial analyst at my fingertips.

The market and stock type scanning is super handy. Whether I’m looking at Nasdaq stocks or ETFs, I’ve got it covered.

Auto-sorting saves me tons of time. I can spot high volatility and liquidity stocks in seconds.

The data columns remember my settings for each scan, so my results are always relevant to what I’m looking for.

Real-time data is crucial for my trading. I get up-to-the-second level 2 data, time and sales, and float information. This helps me make quick, informed decisions.

I set up notifications for volume breakouts or price movements, so I never miss a trading opportunity.

Lastly, the broker integration is seamless. I can act on my findings right away, making trades without switching platforms.

Pricing & Software

Scanz’s pricing is on the higher end, at $199 per month, but it’s packed with value for serious traders. You get real-time news and exchange data, which is crucial for day trading. The data speeds are impressive, and the US market coverage is comprehensive. It includes OTC markets like BB, OTCQX, OTCQB, OTCPINK, and GREY.

Trading

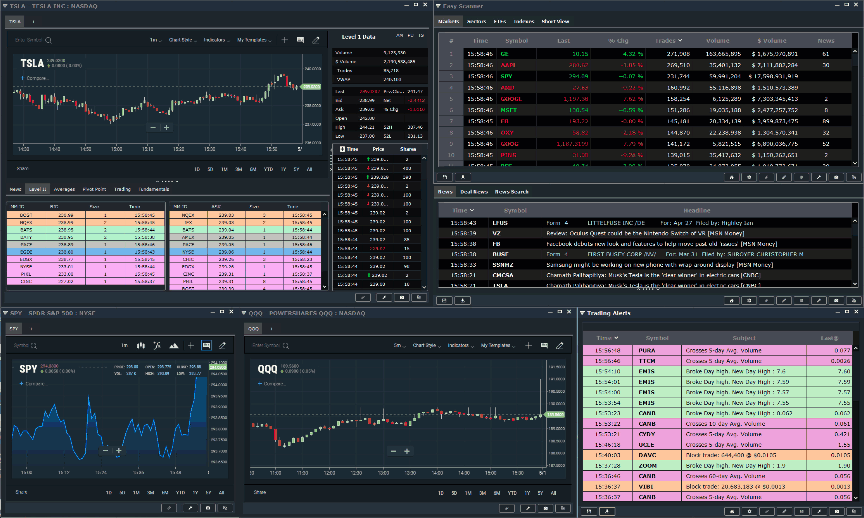

I’ve found that Scanz offers some powerful tools for traders. Its Chart Montage feature packs a lot of key data into one window, including real-time news and level 2 information. What sets it apart is the dollar volume data – something I haven’t seen in other platforms.

For those who want to act fast, Scanz lets you trade right from the charts with ten large brokers, including Schwab and Interactive Brokers. This can save precious seconds when making moves.

Scanning

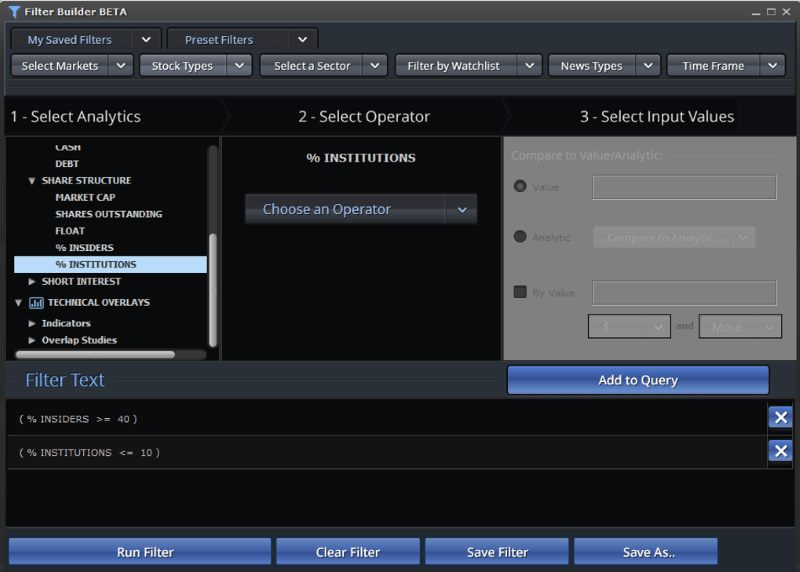

I find Scanz to be a powerful tool for day traders looking to scan the stock market efficiently. Its scanning platform lets me filter entire markets without any coding needed. I can easily set up rules to find stocks with high liquidity, volume patterns, and volatility – key factors for profitable day trading.

The interface is flexible yet straightforward. I select my target markets and scanning criteria from dropdown menus. For example, I can filter based on institutional ownership percentages or insider holdings. The system even lets me screen for stock float, which affects a stock’s traceability.

Real-time News

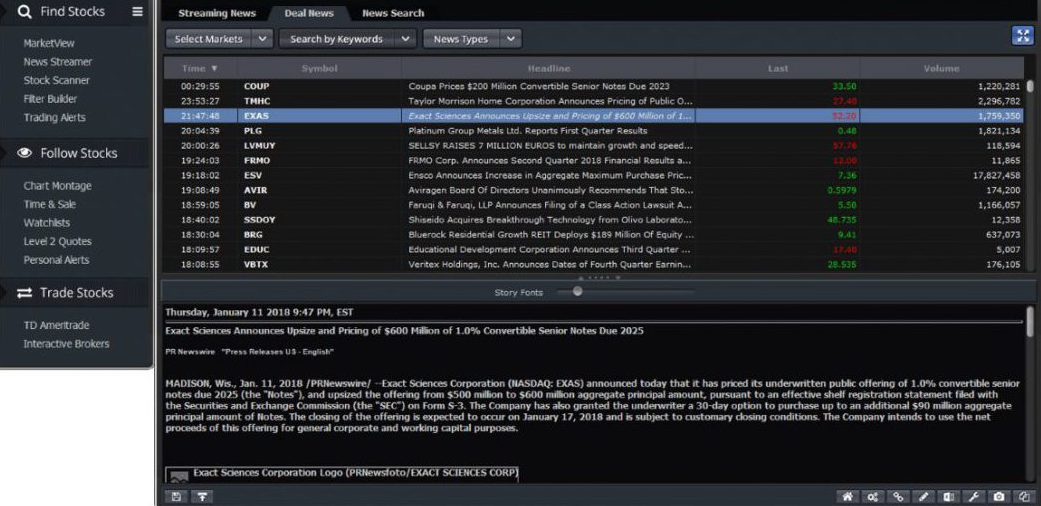

Scanz’s deal news section is a standout feature this year. It offers a straightforward way to get updates on company contracts and deals. By examining how these deals affect a company’s finances, I can gain valuable insights.

For those seeking affordable real-time news options, I recommend checking out Scanz, Benzinga Pro, and MetaStock R/T. These products deliver up-to-the-minute information without breaking the bank.

Real-time news feeds and alerts are key tools for monitoring market changes. They help me spot trends and make quick decisions based on fresh data.

Ease of Use

Scanz impresses me with its user-friendly interface. The developers have done a great job keeping things simple on the surface while packing in powerful features underneath. With just a few clicks, I can access Level II liquidity data and buy directly from charts. This streamlined approach makes it easy for traders of all levels to navigate and use the software effectively.

I’ve noticed significant improvements in Scanz’s product over time. Their feature set clearly focuses on meeting the needs of day traders. The real-time updates for technical and liquidity scans are particularly useful for staying on top of market movements.

Is Scanz Worth It?

For day traders who rely on news events, Level II data, and dollar volume surges, Scanz is a valuable tool. Its reliability and robust scanning capabilities make it stand out in the market.

These features can help traders spot opportunities quickly and execute trades efficiently. While it’s not perfect for everyone, I believe it’s worth trying if you’re looking to enhance your day trading strategy.

Summary

Scanz shines in its real-time data offerings and scanning capabilities. The software provides:

- Streaming Level I/II data

- Fast news and SEC filing scans

- Real-time technical and liquidity scans

These features come together to create a strong toolkit for day traders. The broker integration options add another layer of convenience, allowing for seamless trading execution.

Here’s a detailed summary of Scanz’s features:

| Feature | Details |

|---|---|

| Pricing | $199/month |

| Customer Service | Email-only |

| Market Coverage | USA including OTC |

| Data Speed | Excellent |

| Asset Types | Stocks, ETFs, Bonds |

| Trade Management | Broker integration, trades from charts, live P&L |

| Scanning | Real-time scanning, fundamentals |

| Charts | Multiple per desktop, various types |

| Indicators | 11 total, including MACD, RSI, Moving Averages |

| News | Real-time feed, market commentary |

| Backtesting | Limited capabilities |

| Ease of Use | 5/5 |