Portfolio123 is an innovative tool for investors and portfolio managers. It offers a wide range of features for developing and testing investment strategies. The platform has a large database of financial data spanning 10 years, which is great for backtesting investment ideas.

It offers a wide range of features for developing and testing investment strategies. The platform boasts a large database of financial data spanning 10 years, which is great for backtesting ideas.

One standout feature is the mix of technical and fundamental signals available. This allows users to create complex screens and models. The portfolio management tools are also impressive, letting investors track and adjust their holdings easily.

While Portfolio123 has many strengths, it’s not without some downsides that you should keep in mind.

Test Results & Ratings

I tested Portfolio123 and came away impressed. The platform earned 4.1 out of 5 stars overall. It shines brightest in key areas like pricing, software quality, and screening capabilities—all earning perfect 5-star ratings. The backtesting and portfolio research tools are also top-notch.

Trading features and charting/analysis tools are very good but have some room for improvement, earning 4 stars each. The only real weak spot I found was news and social media integration, which scored just 1 star.

Portfolio 123 Rating: 4.1/5.0

| Pricing: ★★★★★ | News & Social: ★✩✩✩✩ |

| Software: ★★★★★ | Backtesting: ★★★★✩ |

| Trading: ★★★✩✩ | Pattern Recognition: ★✩✩✩✩ |

| Screening: ★★★★★ | Candlestick Recognition: ★✩✩✩✩ |

| Charts & Analysis: ★★★★✩ | Usability: ★★★★✩ |

| Features | Rating ★★★★✩ |

|---|---|

| Value, Growth & Dividend Features | ✅ |

| Broker Integration | ❌ |

| Backtesting | ✅ |

| Portfolio Management | ✅ |

| Financial News | ✅ |

| Markets Covered | USA |

| Assets | Stocks, ETFs |

| Free Trial | ✅ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Discount Available | Free Plan or $25/mo |

Review Summary

Portfolio123 is a strong investment research platform for retail investors. Its stock screening tools and extensive financial database open up many investment opportunities. The software integrates seamlessly with Tradier for commission-free trading.

I see it as useful for income, value, and growth investors, as well as swing traders. While it covers US and Canadian stocks, ETFs, and fixed income, it’s not ideal for international investing.

I was impressed by the ability to set up automated real-time trading strategies that can buy and sell based on custom screens.

Key Features

Portfolio123 is a stock screening and portfolio management platform I find particularly useful for experienced investors. Founded in 2004, it offers a robust set of tools for stock research, backtesting, and strategy development. The web-based software provides access to a wealth of financial data, allowing me to dive deep into company financials and market metrics.

Pros

- Extensive Screening Capabilities: With over 470 metrics available, I can create highly targeted stock screens.

- Powerful Backtesting: The 10-year backtesting engine lets me test investment strategies thoroughly.

- Rich Historical Data: Access to 10 years of historical data helps me spot long-term trends.

- Pre-built Models: I can use ready-made screeners to jumpstart my research.

- In-depth Financial Analysis: 260 financial ratios give me a comprehensive view of company performance.

- Integrated Trading: The platform offers $0 trading, streamlining my investment process.

Cons

- Learning Curve: I found the platform initially complex to navigate.

- Limited News Integration: There’s no built-in news feed, which I miss for quick market updates.

- No Mobile App: The lack of Android or iOS apps limits my on-the-go access.

- Valuation Metrics: I noticed some key metrics like fair value and margin of safety are missing.

- Technical Analysis: The charting tools could use some improvement for better technical analysis.

Compare to Similar Products

I find Portfolio123 excels at fundamental portfolio backtesting and management. However, my Stock Rover review shows offers better features for the same price, including research reports, news, and value investing criteria. TrendSpider and TradingView focus more on trading tools like AI pattern recognition and technical scanning, though they do have some investing capabilities, too.

Pricing

Portfolio123’s Free plan is a great starting point. I can use it to connect my Tradier or Interactive Brokers account without ads. It’s perfect if I want to see fundamental charts, check the earnings calendar, or view all my brokerage accounts in one place.

Retail Plan

I can upgrade to the Retail plan for $25 a month. This gives me full access to Portfolio123’s financial database, including five years of company financials. I can screen all stocks and ETFs using over 460 metrics, covering financial, technical, and sentiment data.

The Screener plan is my top pick for most investors. It offers a lot of value for the price. Unless I’m a hardcore trading system developer, this plan should meet all my needs.

For those who want even more, there’s the Pro plan at $83 monthly. It lets me create very detailed trading systems with specific buy and sell rules. I can do rolling backtests and access 20 years of historical data. But for most people, including myself, the Screener plan is the sweet spot.

Platform

Portfolio123 offers a cloud-based platform accessible across various devices. I can use it on my PC, Mac, tablet, or smartphone without any installation. The software runs smoothly in web browsers, making it convenient for me to access my portfolio data anywhere.

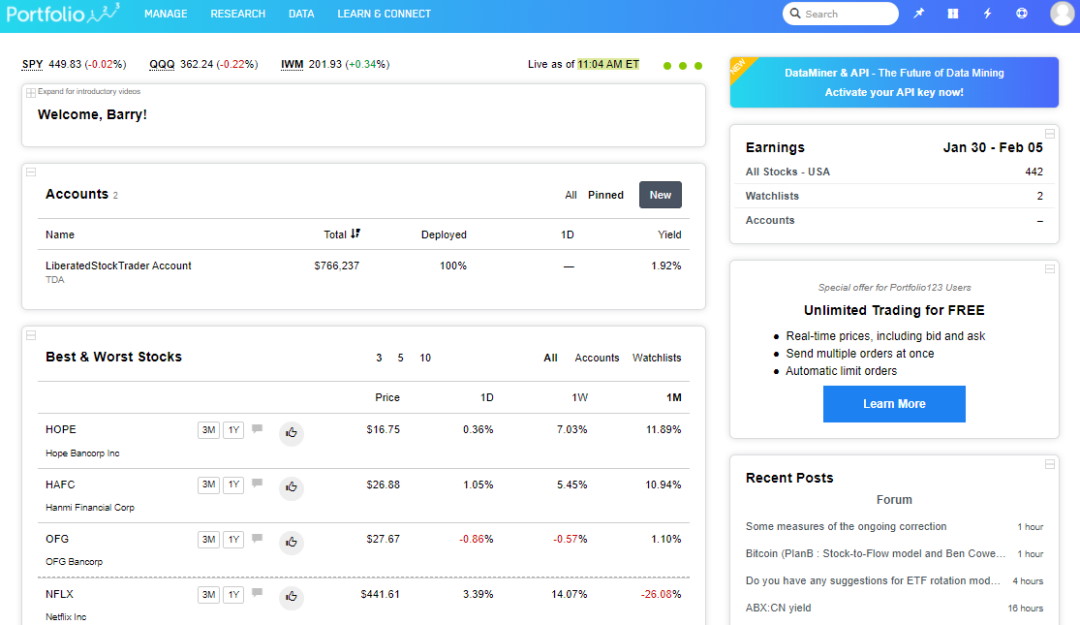

When I log in, I’m greeted by a dashboard that gives me a quick snapshot of market performance and my portfolio’s status. This feature helps me stay on top of my investments at a glance.

The platform focuses on US and Canadian markets, providing historical stock data and global market insights. All the data processing and chart generation happen on their servers, so I don’t need to worry about my device’s capabilities.

While there’s no specific app for Android or iOS, I find the web interface works well on my tablet. The cloud-based architecture means I always have access to the latest features and data without needing to update any software on my end.

Portfolio Features

I find Portfolio123 offers a robust set of tools for managing investments. It integrates with Tradier and Interactive Brokers, allowing automated trading based on custom rules. While I can’t place trades directly from charts, I can issue bulk orders efficiently. The platform handles profit and loss reporting, saving me time.

Key features to appreciate:

• Watchlist tracking

• In-depth research capabilities

• Performance reporting

• Portfolio rebalancing

• Asset allocation tools

These help manage investments and make data-driven decisions. The automated features let me set strategies and have the system execute them consistently.

Screener

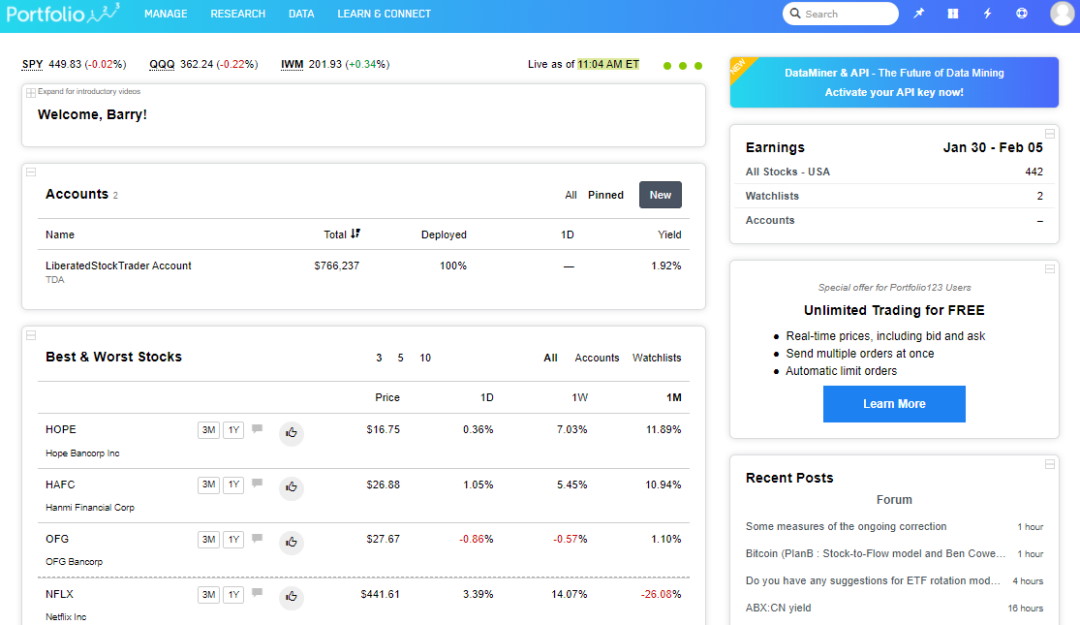

Pre-Built Screeners

Portfolio123’s screener is a great tool for filtering stocks and ETFs. It lets me search through over 10,000 stocks and 44,000 ETFs to find investments that match my exact criteria. What I really like is the ranked screening feature, which helps me narrow down hundreds of stocks to just a handful of top picks.

The screener offers more than 225 data points for fundamental analysis and 460 criteria, including analyst revisions, estimates, and technical data. This gives me a lot of flexibility in how I screen for stocks.

One cool feature I’ve used is screening stocks based on their performance relative to benchmarks like the S&P 500. This has helped me develop strategies to select stocks that have historically outperformed the market.

Portfolio123 stands out for including the Sortino and Sharpe ratios in its screening options. These are important tools for managing risk in professional portfolios.

It has a great range of factors available for screening. I can use data from financial reports and technical factors and even create my own custom factors. The screener lets me filter by industry or sector, rank stocks within those categories, and adjust my criteria based on economic conditions.

While you don’t need coding skills to use the basic screener, I’ve found that some knowledge of coding logic helps when creating more complex screening rules.

Portfolio123 offers over 76 pre-built screeners that I can import and use with a Screener subscription. I’ve tried many of these and found them to be well-designed. One of my favorites is the “Small Cap Winners” screener.

This strategy aims to balance growth, value, quality, and sentiment factors for small-cap stocks. It’s delivered impressive results, with a 5-year return of 189% compared to the Russell 2000’s 58% return.

The “Small Cap Winners” strategy focuses on recent quarterly earnings announcements and analyst estimates. It has a high turnover, which means it actively adjusts to new market information.

Backtesting

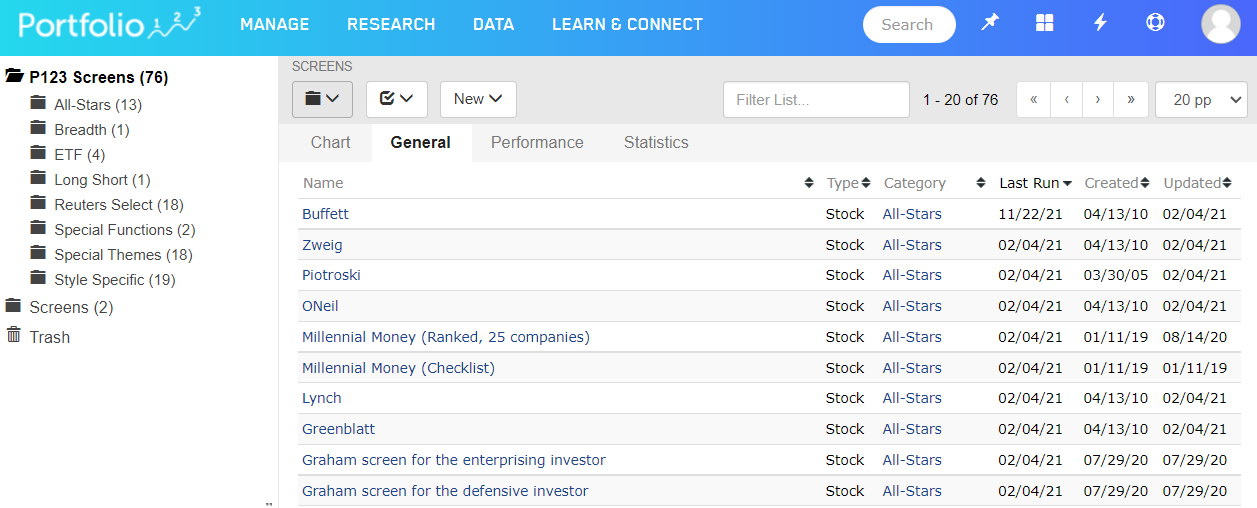

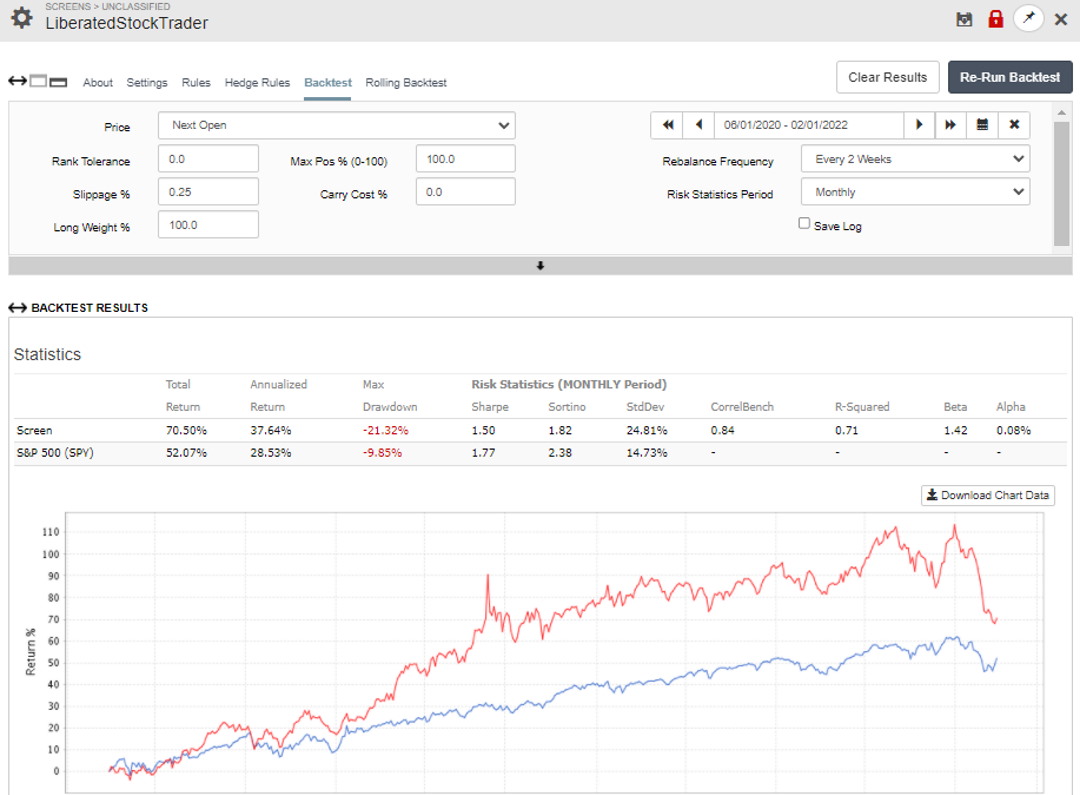

Portfolio123’s backtesting engine is top-notch. I’ve found it to be fast, highly configurable, and perfect for testing fundamental strategies. The software lets me set up tests with great detail, adjusting entry rules, slippage, weighing, and rebalance frequency.

You can use your stock universe, create multi-factor rankings, and run various types of backtests. The data quality is impressive, too – they’ve been working on it since 2004, handling tricky issues like N/A numbers in early reports.

I recently tested a screener I made for two years. It beat the market, returning 70.5% compared to the S&P 500’s 52%. Here’s a look at the results:

The news tab is basic, pulling from Yahoo Finance for watchlist stocks. It’s not a full news service, but it works for my needs as a long-term investor. The community features are limited to an old-school forum. It’s okay to ask questions, but it doesn’t compare to more social platforms.

If you need real-time news, you’ll want to look elsewhere. The lack of social features might be a downside if you like sharing ideas with others. However, for me, the focus on solid backtesting and data quality makes up for these gaps.

Stock Charting

I’ve found that Portfolio123 has a unique approach to stock charting. It’s not your typical technical analysis tool. Instead, it focuses on charting fundamental financial strength indicators. This sets it apart from other popular platforms like MetaStock and TradingView.

Portfolio123 offers over 160 financial indicators but only two technical analysis indicators. This makes it less suited for frequent traders or those heavily reliant on technical analysis. However, it’s a great fit for fundamental, income, growth, and value investors.

One drawback I’ve noticed is that you can’t draw trendlines or add annotations to charts, which limits some customization options. But there’s a silver lining—the Multi Charts feature. It lets you plot and compare over 108 economic indicators, including things like SP500 Shiller Dividend, Gold Price, and various interest rates.

Using Portfolio123 is straightforward, but mastering it takes time. The pre-built screeners are helpful for getting started, but to create truly custom strategies, you’ll need to invest some effort. The charting tools, while powerful, aren’t the most intuitive, which can slow down your workflow at first.

Summary

Portfolio123 is ideal for swing traders and medium-term growth investors. The platform offers a wide selection of fundamental criteria. The 20-year financial database and robust backtesting engine are also major strengths.

For stock system developers with experience, Portfolio123 offers a lot of value. Its focus on fundamental analysis sets it apart in the crowded field of stock analysis tools. While it may not be the go-to for pure technical analysts, it’s a powerful tool for those who prioritize financial fundamentals in their investment strategies.