I’ve been closely following Motley Fool’s stock-picking service for two decades, watching its evolving performance. Over the past four years, I took a deep dive into their stock recommendations, carefully analyzing their database using Stock Rover, a powerful screening tool. This allowed me to assess the true value of their stock advisor service independently.

My 2-year investigation into the Motley Fool has shown it has an excellent track record, outperforming the S&P 500 by four times.

I’ll share the real upsides and downsides of their service, helping you decide if it’s a worthwhile investment for your portfolio. The results of my audit are quite noteworthy and may surprise you.

Motley Fool Stock Advisor Ratings

I’ve found the Motley Fool Stock Advisor to be a top-notch investment tool. Their stock picks and rankings are impressive, with a 4.6 out of 5 rating overall. The pricing and software get perfect scores, which I think is well-deserved. Their stock picking is also excellent, helping investors find promising companies.

Motley Fool Rating: 4.6/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Stock Selection: ★★★★★ |

| Screening: ★★★★★ | Usability: ★★★★★ |

| Features | Rating ★★★★★ |

|---|---|

| Stock Selection | ✅ |

| Broker Integration | ❌ |

| Charts | ✅ |

| Research Reports | ✅ |

| Portfolio Management | ✅ |

| Financial News | ✅ |

| Markets Covered | USA |

| Assets | Stocks, ETFs |

| Free Trial | ❌ |

| OS | Web Browser |

| Price |

The screening tools and news features are good but not outstanding, scoring 3 out of 5 stars each. Charts and analysis also get 3 stars. I think these areas could use some improvement, but they’re still solid.

The Motley Fool’s recommendations have a strong track record. They focus on finding high-growth stocks and warning investors about risky picks. This approach has helped many people build strong portfolios over time.

Review & Test Summary

I conducted a thorough review of Motley Fool Stock Advisor over two years. The service has a strong track record of beating the market. Their stock picks often outperform the S&P 500, which is impressive.

The Motley Fool community is active and engaged. Members share ideas on discussion boards and highlight favorite picks, creating a helpful investment community for subscribers.

Stock Advisor provides clear buy and sell recommendations. They explain their rationale for each pick. I found their analysis thoughtful and well-researched.

My tests showed consistent market-beating returns from their stock selections. While not every pick was a winner, the overall performance was solid. For long-term growth investors, I think Stock Advisor offers good value.

Pros

I’ve found several key advantages to using Motley Fool:

• Consistently beats the market over 20+ years

• Build watchlists and full portfolios

• Very affordable service

• Transparent stock pick performance tracking

• User-friendly website

• Large, engaged 700,000+ member community

I appreciate being able to see exactly how their picks have performed over time and the proven long-term market outperformance.

Cons

There are a couple of potential drawbacks to consider:

• Basic stock screening tool

• Original research reports can be hard to locate

While the stock screener works for basic needs, more advanced investors may find it lacking. I’ve also occasionally struggled to find specific older research reports.

What is Motley Fool?

Motley Fool is a private company founded by brothers Tom and David Gardner. For over two decades, they’ve provided down-to-earth investing advice, championing index funds and growth stocks. Their 1997 book “The Motley Fool Investment Guide” inspired me to start investing myself.

The Stock Advisor service offers stock picks, research, and educational resources. I’ve found their straightforward approach and proven track record quite compelling. With a passionate community of investors and affordable pricing, it’s an appealing option for many looking to grow their wealth through the stock market.

Pricing

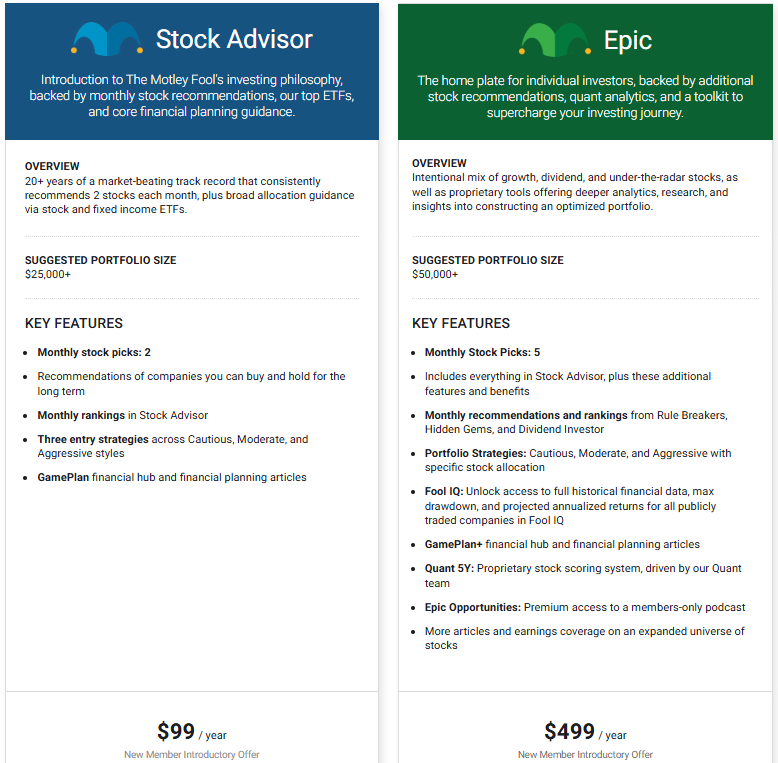

I’m excited to share some great news about Motley Fool’s premium services. As a new client, you can get amazing discounts on their top stock-picking subscriptions. The Stock Advisor service, usually priced at $199 per year, is now available at half off for your first year. That’s just $99 for 12 months of expert stock recommendations!

But wait, there’s more! If you’re interested in Epic, their service is focused on high-growth stocks, so you can snag an even bigger discount. New clients can get Epic for only $499 for the first year, which is a whopping 50% off the regular $999 price.

Here’s a quick comparison of what you’ll get with each service:

| Feature | Stock Advisor | Epic |

|---|---|---|

| New Stock Picks | 2 per month | 5 per month |

| Best Stocks to Buy Now | 10 | 5 |

| Starter Stock List | Yes | Yes |

| Community Access | Yes | Yes |

| Videos & Podcasts | Yes | Yes |

| Regular Price | $199/year | $999/year |

| New Client Price | $99/year | $499/year |

Both services offer great value, but I personally use and love Stock Advisor. It has a proven track record of beating the market. These discounts are auto-renewing subscriptions, so keep that in mind when signing up. But don’t worry – you can cancel anytime if you’re not satisfied.

I think these prices are a steal for the quality of advice you get. For less than $2 per week, you get access to expert stock picks, educational resources, and a supportive community. It’s a small price to pay for the potential to grow your wealth in the stock market.

My Stock Advisor Independent Performance Test

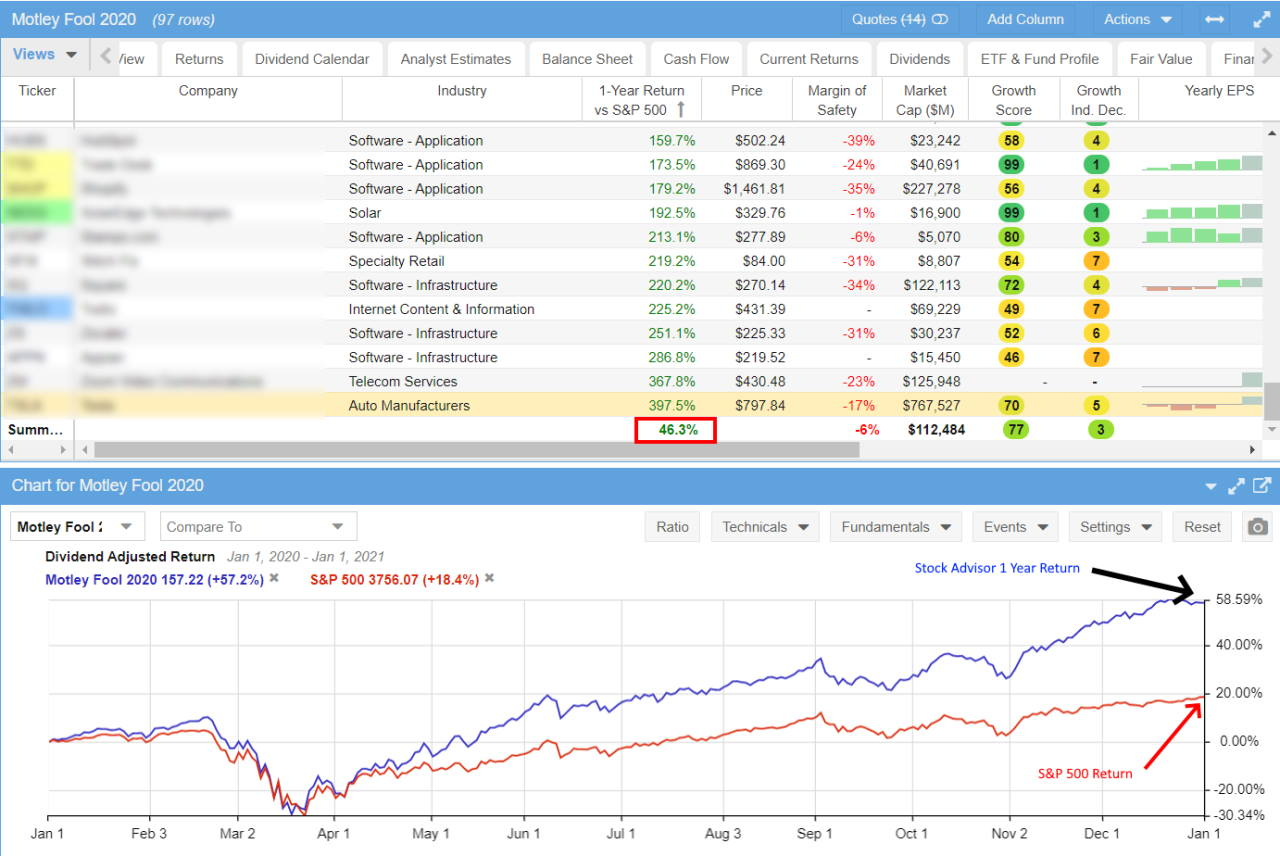

I ran my test of the Motley Fool’s performance using Stock Rover. For the year ending January 1, 2021, the Stock Advisor service achieved a 52.7% profit, compared to the S&P 500’s 18.4% return. That’s an impressive 34.3% market beat.

Looking at 2020 in detail:

- 97 stocks picked

- 62 beat the S&P 500 (average outperformance: 83%)

- 35 underperformed (average underperformance: 20%)

- Overall average return vs S&P 500: 46.3%

Stock Advisor Long-term Performance Test

My test of the Motley Fool Stock Advisor returns confirms a 46.3% profit. Here’s a breakdown of their performance:

- 310 individual stock picks recommended

- 72% of stocks were profitable

- 48% beat the market

- The average winning stock outperformed the market by 780%

- Average profit on successful picks: 680%

- Average loss on unsuccessful picks: 42%

- Best pick: Netflix in 2004, with a 29,990% profit

These numbers paint a picture of a service that consistently finds winners, even if not every pick is a home run.

Is Motley Fool Legit?

I’ve found The Motley Fool to be a legit business. They’ve been around since 1993, giving stock advice and teaching investors. With over 300 employees based in Virginia, they’ve never had any run-ins with the SEC. That’s a good sign in my book.

The Motley Fool has even spoken to Congress four times. They’ve stood up for regular investors like you and me, argued against high mutual fund fees, and pushed for clear financial information. That shows they care about more than just making money.

Is Motley Fool Reliable?

In my experience, the Motley Fool is pretty reliable. But let’s be real—no one’s perfect. They’ve made a few blunders in their 27 years.

Remember the “Foolish Four” picks in the early 2000s? They nearly sank the company. More recently, they told folks to buy Luckin Coffee stock. That turned out to be a bad call when the stock crashed 90% due to fraud.

But here’s what I like: they’re open about their wins and losses. They put their money where their mouth is. They run real-money accounts that anyone can see. That’s rare in the investment world.

A smart person once said, “The Motley Fool deserves a great deal of credit for openly supplying a vast amount of information on a timely basis.” I agree with that.

I’ve been using Motley Fool Premium for four years now. At first, I signed up just to see if it was legit. I was blown away by how simple and effective their service is.

Performance Track Record

Stock Picks Performance

I’ve analyzed the Motley Fool Stock Advisor’s track record, and the results are impressive. Since 2002, 48% of their stock picks have outperformed the S&P 500. The average winning stock beat the market by a whopping 780%. While 28% of the recommended stocks lost money (averaging a 42% loss), 82% of the picks were profitable, with an average gain of 640%.

What does this mean for investors? There’s still a 28% chance of losing money on any given recommendation. But the flip side is more encouraging – you have a 72% chance of making a profit when following their advice.

Does Motley Fool Beat the Market?

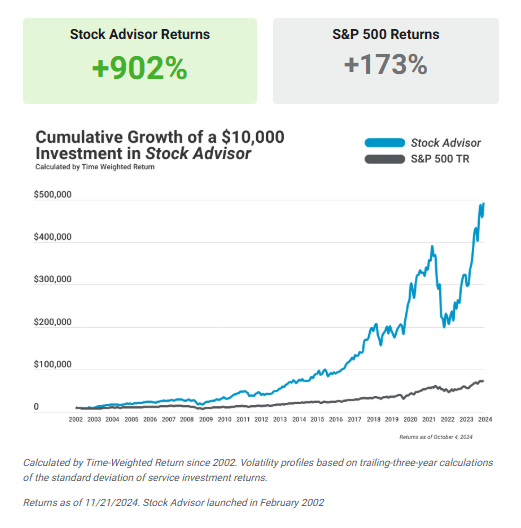

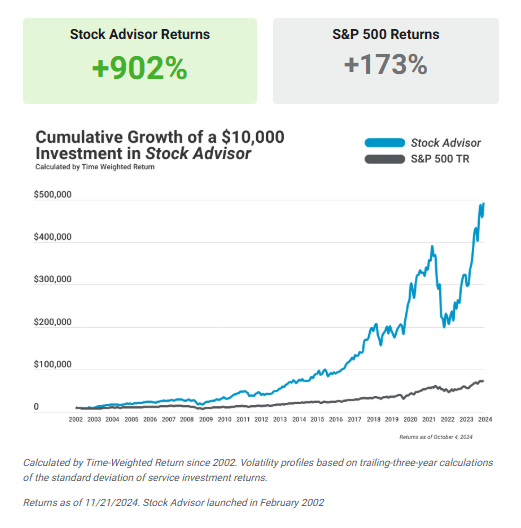

Yes, Motley Fool’s Stock Advisor Service does beat the market. Since its start in 2002, the Stock Advisor service has returned 902%, compared to the S&P 500’s 173%. As a premium member, I have had access to all their trades since 2002.

The Motley Fool’s approach focuses on finding growth stocks that can beat the market over the long term. They don’t try to cover every stock. Instead, they zero in on companies they believe will outperform, providing easy-to-read research reports explaining their rationale.

This strategy seems to pay off. Just look at the growth of a $10,000 investment in Stock Advisor compared to the S&P 500:

A $10,000 investment in Stock Advisor would have grown to $425,000, while the same amount in the S&P 500 would only reach $72,000.

These results are hard to ignore for long-term investors looking for growth stocks. The Motley Fool’s track record shows that it has a knack for finding winners that can significantly outpace the market over time.

Key Features Test

Buy 15 Stocks

I recommend buying at least 15 stocks and holding them for 3 to 5 years. This approach helps spread risk and gives stocks time to grow. About 30% of stock picks may not be big winners, so having a diverse set is smart. It’s a good way to balance your portfolio and avoid putting too much money into one company.

Help Building Your First Portfolio

When starting, I suggest picking up ten starter stocks. This is a great way to begin building a solid portfolio. It’s helpful for new investors or those looking to improve their investing results. These starter stocks provide a strong foundation upon which to build.

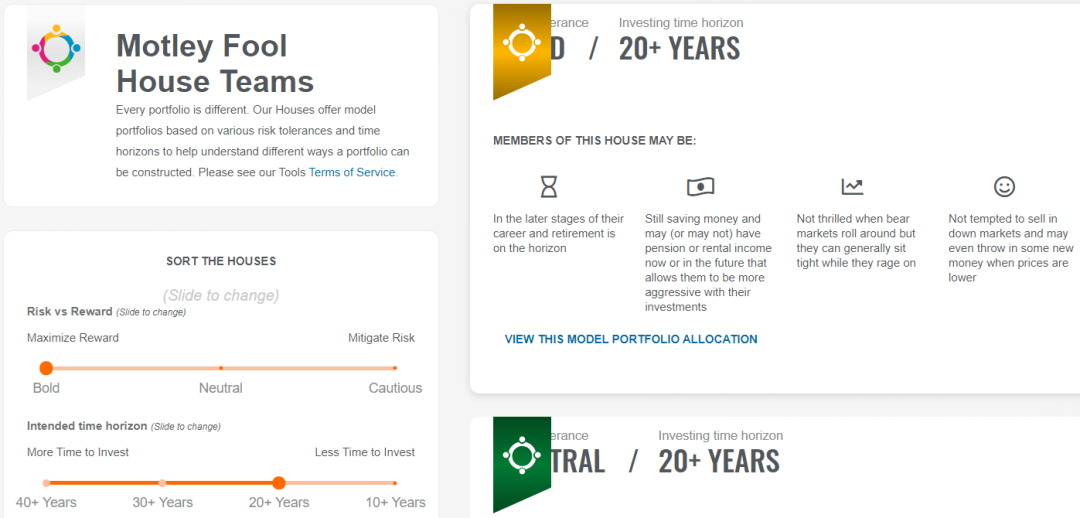

Portfolio Allocator Tool

The Portfolio Allocator is a handy tool that’s easy to use. It helps create a portfolio based on your risk comfort and investment timeline. Here’s how to use it:

- Go to the Tools menu

- Click on Allocator

- Choose your Risk/Reward level

- Set your Time to Invest

- Get portfolio suggestions

This tool is great for tailoring a portfolio to your needs. It eliminates the guesswork involved in balancing different investments.

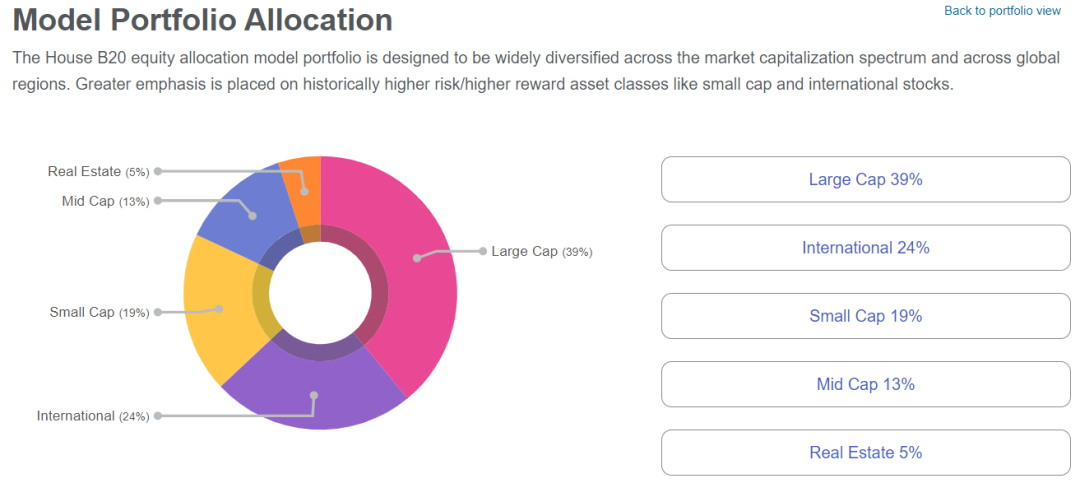

Your Model Portfolio With Stock Recommendations

The model portfolio shows a pie chart of suggested investment splits. It covers stocks, ETFs, bonds, and real estate. You can click on each slice to see specific stock recommendations.

This feature is perfect if you want a clear plan for a well-rounded portfolio. It eliminates the mystery of dividing your investments.

I find these tools really useful for both new and experienced investors. They make it easier to build a diverse portfolio without much hassle. The starter stocks and allocation tools are especially helpful for beginners. Plus, the model portfolio gives a clear picture of how to spread out investments.

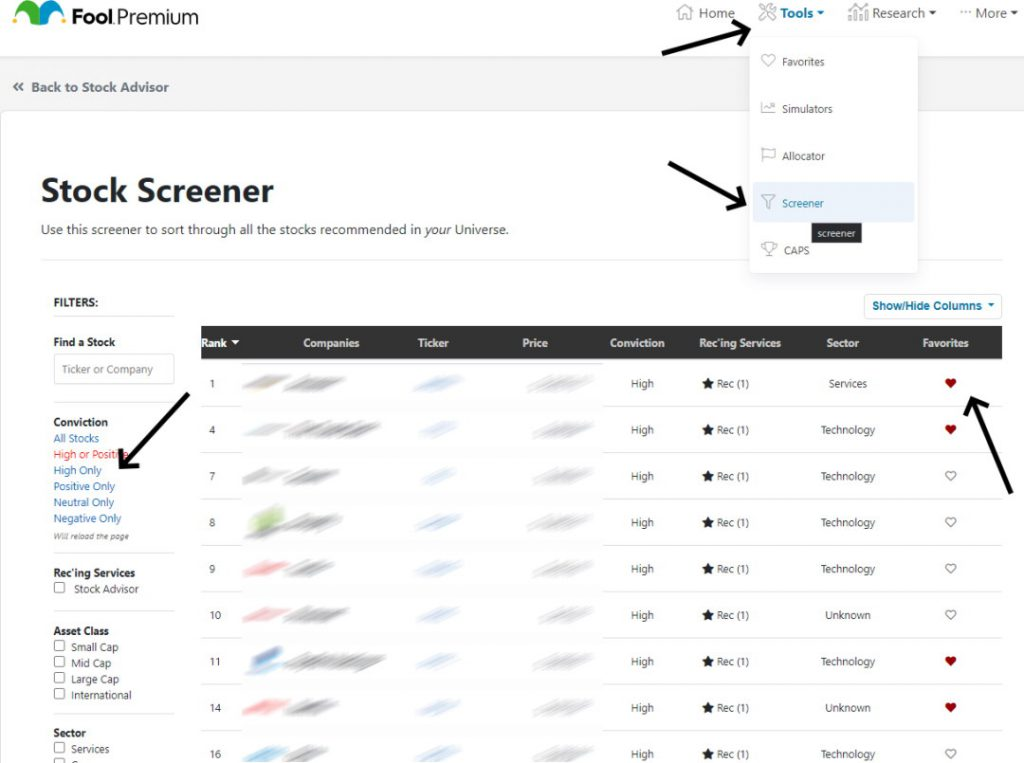

Stock Screener

I find the Motley Fool stock screener to be a powerful tool for discovering high-quality investment opportunities. It’s focused on their recommended stocks, giving me access to about 900 carefully selected companies. To use it, I go to Tools -> Screener and choose “High Only” to see their top picks.

The screener shows me stocks that Motley Fool analysts believe have strong growth potential. I can click on each one to read detailed research reports explaining why it was chosen. This helps me understand the reasoning behind each recommendation.

One feature I really like is the audit trail. It shows when a stock was first recommended and every time the buy recommendation was repeated. This gives me a clear picture of the stock’s history with Motley Fool.

While it doesn’t cover the entire market, I appreciate that it narrows down choices to stocks that experts have already vetted. This saves me time and helps me focus on potentially promising investments.

Is Motley Fool Stock Advisor Worth It?

I’ve found Motley Fool Stock Advisor to be a valuable tool for investors looking to boost their chances of picking winning stocks. With only 13% of U.S. stocks outperforming the S&P 500 in 2020, finding those gems can be challenging. Stock Advisor helps by recommending stocks that have a 48% chance of beating the market – a significant improvement over going it alone.

FAQ

What is Motley Fool Stock Advisor?

It’s Motley Fool’s main investment newsletter. Whether I’m new to investing or have been doing it for years, I find it useful for stock picks and advice.

How often does a Stock Advisor release new stock recommendations?

I get two new stock recommendations each month. It’s a nice, steady stream of ideas to consider.

What other features does Stock Advisor offer besides stock recommendations?

I appreciate the in-depth research and educational content. There’s also live market commentary and a community of investors to chat with. It’s more than just stock picks.

How are stocks chosen for Stock Advisor?

The Motley Fool team considers business quality, growth potential, and value. Their investment philosophy guides their choices.

Does a Stock Advisor provide advice on when to sell a stock?

Yes, they do give sell recommendations. When they think it’s time to let go of a stock, they let me know. This is helpful for managing my investments.