Investing in the stock market offers a pathway to financial growth that many find appealing. With proper strategy and patience, stocks can generate substantial returns over time, helping investors build wealth and work toward financial independence. The market presents multiple approaches to generating income, each with its own risk-reward profile and time commitment.

I’ve found that successful stock investing typically follows one of five proven strategies: long-term ETF investing, value stock selection, growth stock portfolios, dividend investing, or active trading.

These methods range from passive, lower-risk approaches to more active strategies requiring greater market knowledge and time investment. Understanding these options helps investors choose paths that align with their financial goals and personal circumstances.

Key Takeaways

- Remaining invested in the market over time is crucial for maximizing potential returns and building wealth through stocks.

- Different investment approaches, such as index funds, value stocks, and dividend investing, offer varying risk-reward profiles to match your financial goals.

- Consider your preferred level of involvement when choosing between passive options like robo-advisors and more active strategies requiring personal market analysis.

1. ETF Investing for Long-term Growth

Index ETFs represent the simplest path to stock market profits. Based on decades of market data, passive investing has grown dramatically, now accounting for nearly half of all assets in US stock funds—up from just a quarter ten years ago. This popularity stems from their simplicity and effectiveness.

I’ve found that index ETFs eliminate the need for stock selection while providing instant diversification. The low management fees mean more of your returns stay in your pocket rather than going to fund managers.

When you invest in broad market index funds and hold them for 20+ years, you’re using a strategy backed by historical performance. Looking at any 20 years since 1930, US stock markets have consistently delivered positive returns.

Stock Market Performance Over 10 Years

The last decade has shown remarkable differences in performance across global markets. US indices have dramatically outperformed their international counterparts.

The NASDAQ 100 stands out with an impressive 344% total growth over 10 years, making it the clear leader among major indices. Here’s how the major markets performed:

| Index | 15-Year Total Growth |

|---|---|

| NASDAQ 100 | 344% |

| S&P 500 | 173% |

| India Sensex | 164% |

| Russell 3000 | 164% |

| DAX Germany | 109% |

I find this particularly compelling evidence for long-term investing strategies.

Minimizing Risk with ETFs

Index ETF investing offers built-in risk management through diversification across all stocks in the underlying index. While this won’t protect you completely from market downturns, it does shield you from individual company failures.

I appreciate the minimal effort required with this approach. You simply:

- Select a broad-market ETF

- Purchase shares regularly (ideally through dollar-cost averaging)

- Hold for the long term

- Rebalance occasionally if using multiple ETFs

This strategy works well through most brokers or automated investment platforms, making it accessible to investors at all experience levels.

The power of compounding becomes evident when looking at long-term performance. In the previous 20 years, the NASDAQ 100 delivered 265% returns, while the Dow Jones Industrial Average gained 144%, and the S&P 500 grew by 128%.

Top US ETF Funds and Their 5-Year Performance.

When selecting an ETF, size and track record matter. Here are the largest US ETF funds by capitalization and their annual growth rates:

| Ticker | Name | Focus | Cap ($ Billions) | 5-Year Annual Growth |

|---|---|---|---|---|

| QQQ | Invesco QQQ Trust | NASDAQ 100 | $341.62 | 18.25% |

| VOO | Vanguard S&P 500 ETF | S&P 500 Index | $634.02 | 13.71% |

| SPY | SPDR S&P 500 Trust | S&P 500 Index | $635.55 | 13.71% |

| VUG | Vanguard Growth ETF | US Growth Companies | $162.72 | 13.28% |

| VTI | Vanguard Total Stock Market ETF | Total US Market | $481.07 | 13.23% |

| VO | Vanguard Mid-Cap ETF | Mid-Size US Companies | $76.65 | 7.79% |

| VB | Vanguard Small-Cap ETF | Small US Companies | $65.37 | 7.52% |

| VTV | Vanguard Value ETF | Undervalued US Stocks | $137.60 | 7.44% |

| VXUS | Vanguard Total International ETF | World Markets | $81.61 | 4.79% |

| VWO | Vanguard Emerging Markets ETF | Emerging Markets | $83.08 | 3.93% |

I’ve found the Invesco QQQ Trust (tracking the tech-heavy NASDAQ 100) to be the standout performer, returning over 17% annually for five years. That’s why I personally allocate 50% of my investment capital to QQQ, with the remainder in selected growth and value stocks.

For beginners, an S&P 500 ETF like VOO or SPY provides excellent broad-market exposure with steady returns. Those seeking higher growth potential might consider QQQ or VUG, though these typically come with somewhat higher volatility.

Your asset allocation should reflect your time horizon and risk tolerance. Longer investment periods generally allow for higher allocations to equity ETFs, while shorter timeframes might warrant more conservative approaches.

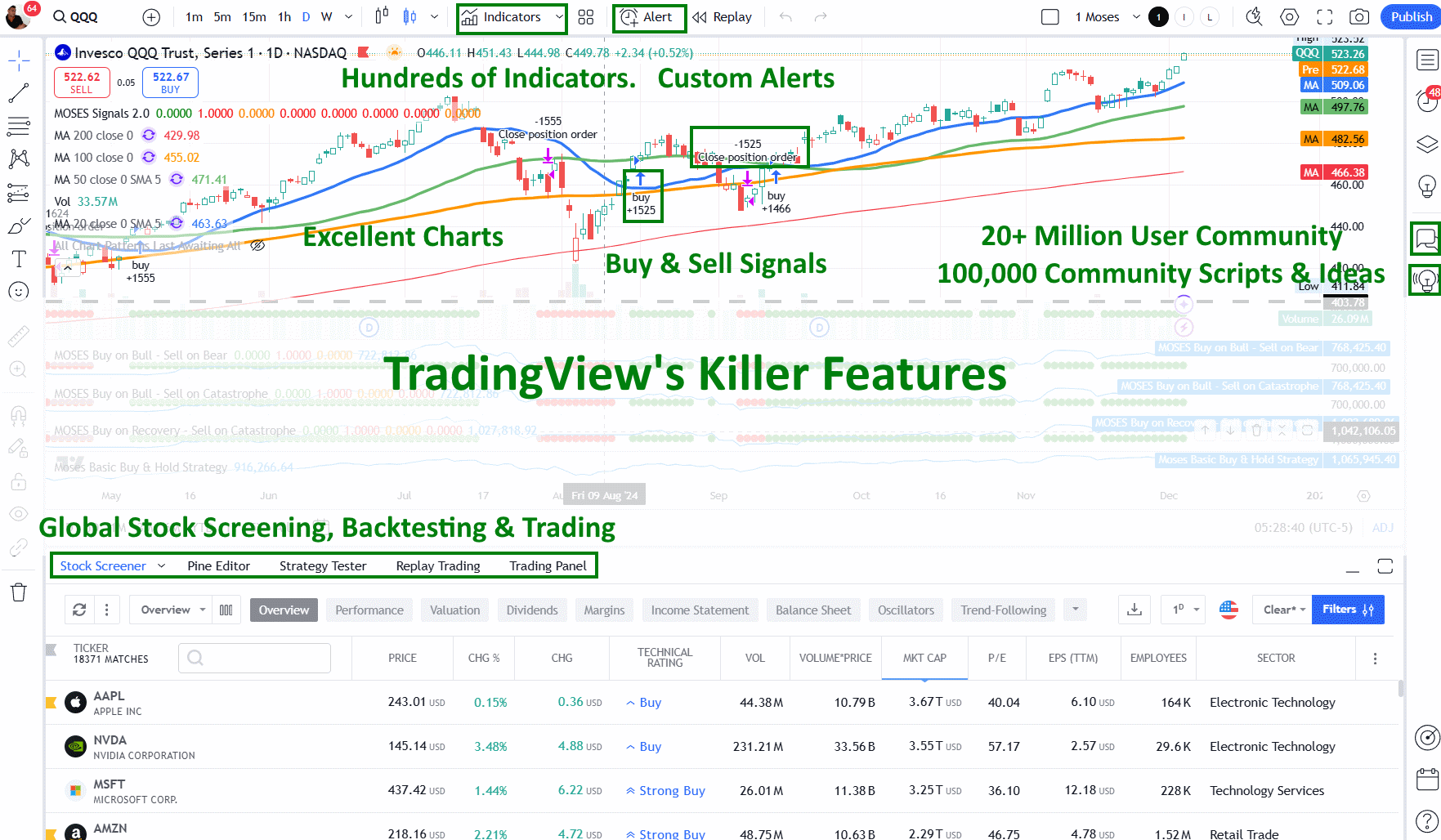

TradingView gets my top rating! It’s hands down the best trading software out there, offering built-in broker integration, powerful backtesting tools, advanced scanners, and access to the world’s largest trading community. It’s a game-changer for traders at all levels!

2. Invest in Value Stocks Long-term

Value investing remains one of the most reliable approaches to building wealth in the stock market. Following the principles established by legendary investors, I’ve found that purchasing undervalued stocks and holding them for extended periods consistently yields substantial returns while minimizing unnecessary risk.

The Buffett Method for Finding Value

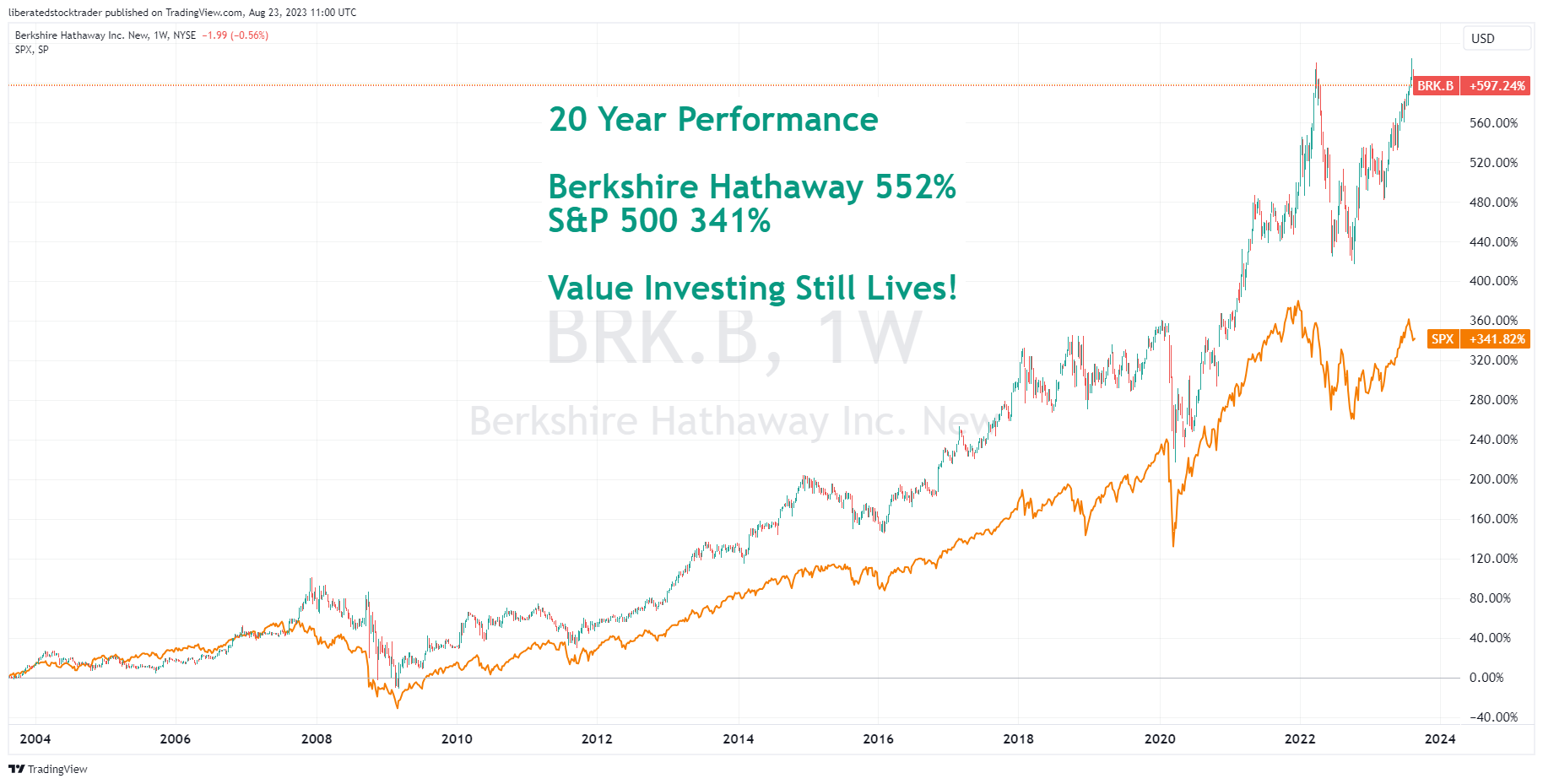

Warren Buffett has demonstrated extraordinary success over five decades with his value-focused approach, achieving average annual returns exceeding 23%. Through disciplined investment practices, his company, Berkshire Hathaway, has grown into a $500+ billion enterprise. I’ve studied his methodology extensively and found it centers on identifying businesses with strong fundamentals trading below their intrinsic value.

The key criteria for finding value stocks include:

- Consistent earnings growth over extended periods

- Strong financial position with minimal debt

- Competitive advantages that protect market position

- Skilled management with shareholder-friendly policies

- Fair price relative to earnings potential

Screening for Undervalued Companies

To find promising value investments, I focus on several critical financial metrics:

| Metric | What It Indicates | Target Range |

|---|---|---|

| P/E Ratio | Price relative to earnings | Below industry average |

| ROE | Efficiency of capital use | Consistently above 15% |

| ROIC | Returns generated from all capital | Above 12% |

| Debt-to-Equity | Financial stability | Below 0.5 |

| Free Cash Flow | Operational efficiency | Positive and growing |

The most crucial element is calculating the discount to intrinsic value. I estimate future cash flows, discount them to present value, and look for at least a 30% margin of safety between my calculation and the current market price.

Practical Value Investing Approaches

I’ve developed several value investing strategies based on extensive research:

- Classic Margin of Safety: Focusing purely on the gap between intrinsic value and market price

- Quality Value: Emphasizing companies with sustainable competitive advantages at reasonable prices

- Dividend Value: Targeting stable dividend-payers trading below fair value

- Turnaround Value: Identifying temporarily distressed companies with recovery potential

Each approach requires thorough research into company financials, competitive position, and growth prospects. I never rely solely on screening tools but use them as a starting point for deeper analysis.

Effort Required and Risk Considerations

Value investing demands more work than passive index investing but offers greater potential rewards. The typical process involves:

- Regular screening for potential investments

- Detailed financial statement analysis

- Industry and competitive research

- Valuation modeling

- Patience during market volatility

While more labor-intensive than index funds, value investing actually incorporates risk management through its core principles. By insisting on a margin of safety, I’m building protection against analytical errors or unexpected developments. This buy-and-hold approach also minimizes transaction costs and tax implications that can erode returns over time.

For investors willing to commit the necessary time, value investing provides a disciplined framework for deploying investment capital while avoiding overpriced assets and market fads.

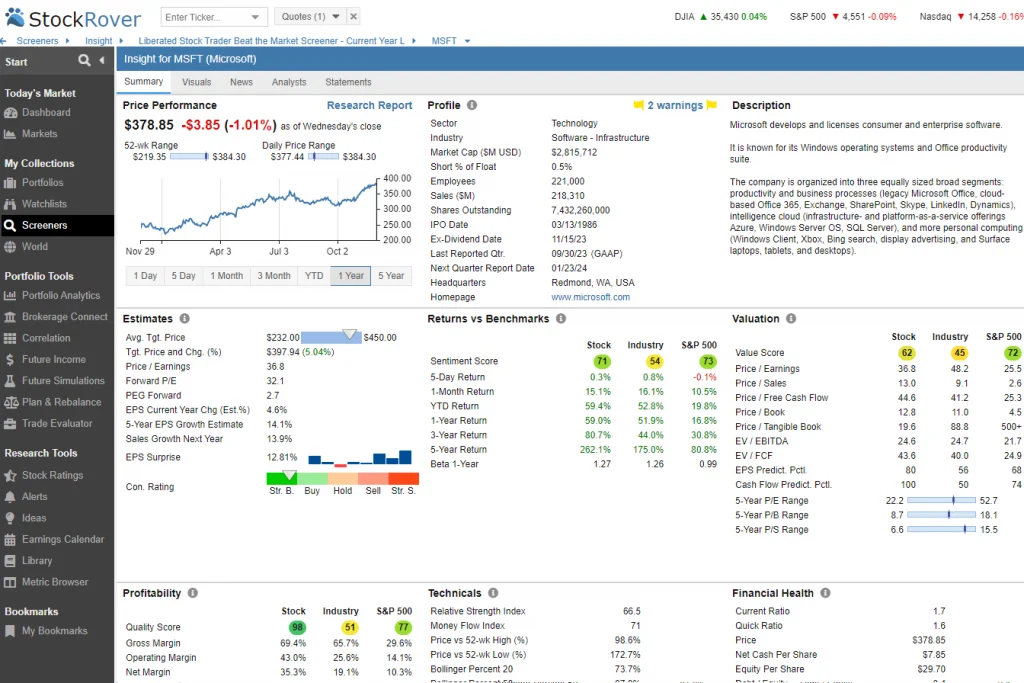

Stock Rover – The Smart Choice for Savvy Long-term Investors

As an investor, I’ve always wanted powerful insights without the complexity. Stock Rover changed the game for me. With its deep screening tools and hundreds of metrics, I can quickly find stocks and ETFs that match my strategy. It streamlined my research and made decision-making so much easier.

Comparing investments used to be a hassle—now it’s a breeze. Stock Rover lets me analyze multiple stocks, ETFs, or portfolios side by side. I get clear views on fair value, quality, and growth potential, helping me make smarter, more confident choices.

Tracking my portfolio is now seamless. By linking my brokerage, I get real-time updates and detailed analytics. Features like dividend forecasts and rebalancing tools help me stay on track and plan effectively for the long term.

Stock Rover is the only service I recommended for growth, dividend, and value investors.

3. Invest in Growth Stocks

Growth stocks represent companies with above-average growth potential compared to the overall market. I’ve found that investing in growth-focused businesses can significantly contribute to long-term wealth accumulation through stronger annualized returns. When these returns compound over time, the results can be remarkable for patient investors.

The CAN SLIM Method

The CAN SLIM approach combines fundamental and technical analysis to identify promising growth stocks. This systematic method focuses on seven key factors:

- C: Current quarterly earnings (at least 25% growth)

- A: Annual earnings growth (look for consistent increases)

- N: New products, management, or price highs

- S: Supply and demand dynamics affecting share price

- L: Leading stocks in leading industries

- I: Institutional ownership showing professional confidence

- M: Market direction (align with overall market trends)

When used properly, this methodology helps identify companies with strong growth trajectories before their major price movements occur.

Using Screening Tools for Growth Selection

Implementing a growth stock strategy becomes manageable with proper screening tools. Here’s how I approach it:

| Screening Criteria | Typical Threshold | Importance |

|---|---|---|

| Quarterly Earnings Growth | >25% | High |

| Revenue Growth | >15% | High |

| ROE | >15% | Medium |

| Debt/Equity | <0.5 | Medium |

| Price/Sales | Industry dependent | Medium |

Growth Stock Risks and Effort Required

Investing in growth stocks requires more active management than other strategies. I’ve learned that successful growth investing demands:

- Regular monitoring

- Weekly price action checks

- Quarterly earnings analysis

- Industry trend awareness

Growth stocks typically trade at premium valuations, making them vulnerable to sharp declines if they miss earnings expectations. Unlike value investing, which provides downside protection through undervaluation, growth investing relies on continued performance.

Higher valuations mean greater volatility. A stock priced for perfection can drop 20-30% after a single disappointing quarter. This makes diversification particularly important for growth investors.

The compounding effect works powerfully with growth stocks. A portfolio of well-selected growth companies can achieve 15-20% annualized returns compared to the market’s historical 10%, creating substantial long-term wealth differences. However, this requires accepting higher volatility and maintaining discipline during market corrections.

4. Dividend Investing

Dividend investing offers a powerful avenue for generating passive income while potentially benefiting from stock appreciation. I’ve found this approach particularly appealing for those seeking steady returns that often exceed what traditional bonds provide. When companies share their profits through dividend payments, investors can create income streams without selling their holdings.

Companies that consistently pay dividends typically demonstrate financial strength and stability. The real magic happens when you reinvest these dividends to purchase additional shares, creating a compounding effect on your investment over time.

Dividend Champions Long-Term Growth Approach

The most disciplined dividend investors focus on companies with impressive track records of not just paying but increasing their dividends year after year. Here are my recommended screening criteria for identifying these dividend champions:

Essential Metrics for Dividend Growth Selection:

| Criterion | Target | Rationale |

|---|---|---|

| Current Yield | >1.5% | Ensures meaningful income above inflation |

| 1-Year Dividend Growth | >8% | Confirms recent commitment to shareholder returns |

| 3-Year Average Growth | >8% | Shows consistent medium-term dividend increases |

| 5-Year Average Growth | >8% | Demonstrates longer-term dividend commitment |

| 10-Year Average Growth | >8% | Proves sustained dividend growth policy |

| Payout Ratio | 10-40% | Indicates sustainable dividends with room for growth |

| 5-Year Sales Growth | >4% | Verifies business expansion to support future dividends |

| Margin of Safety | >0 | Suggests the stock trades below its intrinsic value |

This rigorous filtering process typically identifies only about 2% of stocks listed on major exchanges. These elite companies have demonstrated remarkable consistency in rewarding shareholders through economic cycles.

When implementing this strategy, I recommend starting with quality companies in defensive sectors like consumer staples, utilities, or healthcare, as they tend to maintain dividend payments even during economic downturns.

Dividend Investing Effort and Risk

The effort required to maintain a dividend portfolio has decreased significantly with modern investment tools. Specialized stock screeners can quickly identify companies meeting your dividend criteria, eliminating hours of manual research. Many platforms now offer dividend forecasting features to project your future income stream based on historical growth patterns.

Despite their stability, dividend stocks aren’t without risks:

- Dividend cuts: Even established dividend payers may reduce or eliminate dividends during financial difficulties

- Interest rate sensitivity: Rising rates can make dividend stocks less attractive compared to bonds

- Sector concentration: Many dividend payers cluster in certain industries, potentially creating portfolio imbalance

To mitigate these risks, I recommend diversifying across different sectors and company sizes. Additionally, regularly reviewing each holding’s dividend coverage ratios and payout sustainability helps avoid dividend trap situations, where high yields mask underlying business problems.

By focusing on companies with sustainable payout ratios and consistent dividend growth rather than merely chasing the highest current yields, investors can build reliable income portfolios that deliver results over decades.

5. Stock Trading Strategies

Stock trading represents one of the quickest paths to generating income in the financial markets, though it comes with considerable risk. Unlike long-term investing, trading focuses on capturing shorter-term price movements through techniques like day trading, swing trading, and momentum-based approaches.

Day trading involves completing trades within a single market session. It often targets stocks in dynamic indexes like the NASDAQ 100. This method requires quick decision-making and close market monitoring.

Swing trading takes a slightly longer view. It involves holding positions for several days to weeks to capitalize on expected price movements. I find this approach offers a balance between the intensity of day trading and the patience of long-term investing.

Risk management is essential when trading stocks. Always use stop-loss orders to protect your capital and avoid risking more than 1-2% of your portfolio on any single trade.

Final Thoughts

When it comes to making money in stocks, there’s no one-size-fits-all approach—it’s all about what works for you! If you’re just starting out, index-tracking ETFs are a simple and smart way to dive in. Love digging into research and picking your own stocks? Value and growth investing can be incredibly rewarding. Feeling adventurous and ready to put in the time? Trading might be the perfect challenge for you. The key is finding the path that excites you and fits your style!

FAQ

What software is best for each investing style?

When selecting a platform for stock investing, consider your specific strategy needs. I’ve found Stock Rover particularly effective for dividend, value, and growth investing research. Day traders often prefer Trade Ideas for its real-time scanning capabilities, while swing traders gravitate toward TrendSpider for pattern recognition. TradingView stands out for international investors due to its global market coverage and charting tools.

How do you reduce risk in stock investing?

Want to make money in stocks while keeping risks low? Diversify your portfolio! By investing in different sectors and industries, you spread your risk and avoid relying on the performance of just one company. It’s a smarter, safer way to grow your wealth!

What tool is best for dividend stock investing?

If you’re serious about earning money with dividend stocks, Stock Rover is your ultimate tool. With Stock Rover, you can craft powerful dividend investing strategies, forecast future income, and even rebalance your portfolio to maximize returns. It’s like having a personal advisor dedicated to growing your dividend income!

What software is best for value stock investing?

Stock Rover stands out as the ultimate software for profiting from value stocks. With its advanced screening features, it allows you to identify top-performing value stocks using metrics like fair value, margin of safety, the Graham number, and intrinsic value. Intuitive and powerful, Stock Rover is designed to help you make smarter investment decisions with ease.