Investing in dividend stocks can help you build wealth over time. This strategy offers both income and potential growth, making it appealing for many investors. Dividend stocks are shares of companies that regularly pay out a portion of their profits to shareholders. By reinvesting these dividends, investors can potentially harness the power of compounding to grow their wealth even faster.

When looking at dividend growth stocks, you should consider factors like yield, payout ratio, and the company’s track record of dividend increases. Some investors focus on the Dividend Aristocrats, a group of S&P 500 companies that have raised their dividends for at least 25 years straight. This approach can help you find stable, reliable dividend payers for a long-term portfolio.

1. Buying and Holding Dividend Stocks

Buying and holding dividend stocks is a smart way to build wealth over time. To get started, I recommend opening a brokerage account with a reputable firm that offers easy dividend reinvestment. This allows your dividends to compound by purchasing more shares automatically.

When choosing stocks, look for companies with strong financials and a history of consistent dividend growth.

While high yields can be tempting, you should focus on quality companies that can sustain and grow their payouts long-term. Oil giants and preferred stocks can offer higher yields but may carry more risk.

2. What’s the Ideal Number of Dividend Stocks to Own?

I believe 25 to 30 dividend stocks are a good starting point for most investors. This range offers a balance between diversification and manageability. With fewer than 10 stocks, you might be taking on too much risk. More than 30 can become difficult to keep track of effectively.

It’s important to remember that there is no one-size-fits-all answer. Your ideal number depends on your investment goals, risk tolerance, research time, and portfolio size. I recommend starting with a smaller number of carefully chosen stocks and gradually expanding as you gain experience. This approach allows you to learn about each company thoroughly and make informed decisions.

3. How Much Should You Allocate?

I recommend investing only money you won’t need for several years. The exact amount varies for each person, but it’s unwise to invest funds you might need soon. Short-term investing limits compound growth and risks losses. It’s best to use truly long-term savings for investments.

The more you can invest, the better your potential for growth over time. Focus on gradually building your investment portfolio. Start with what you can comfortably set aside each month, and try to increase your investments as your income grows.

Remember, investing is just one part of a solid financial plan. Balance it with other goals, such as an emergency fund and retirement savings. When deciding how much to invest in dividend stocks, always consider your overall financial picture.

4. Criteria for Safe Dividends

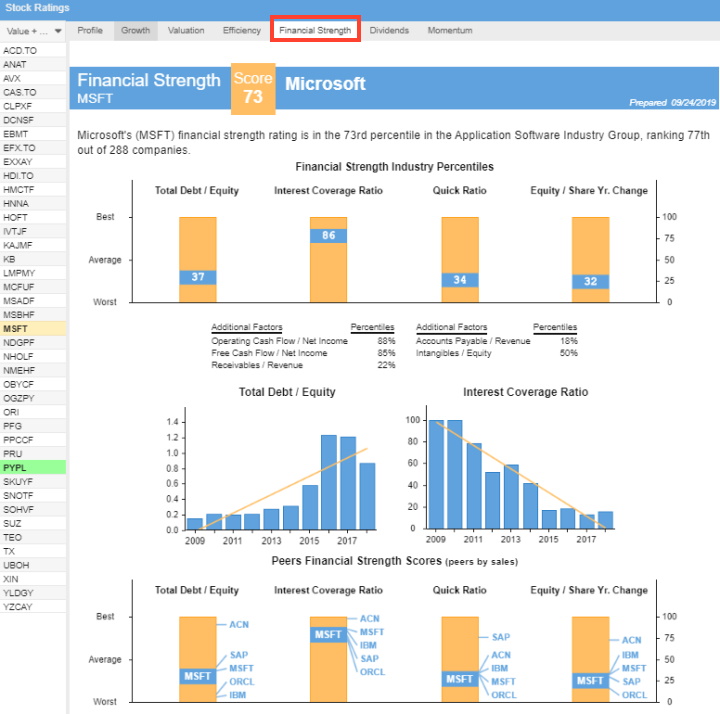

Dividend safety is crucial for investors like me. I gauge this by examining the payout ratio, which is the dividend divided by earnings, shown as a percentage. A lower ratio is better, as it means earnings cover the dividend well, making it safer. Companies with low payout ratios also have more room to raise dividends.

If you want to ensure the dividends you rely on remain secure, consider additional factors to strengthen your confidence in their sustainability.

Focus on larger, well-capitalized companies with a market capitalization of over $2 billion. Lowering your dividend yield expectations to above 1.5% will help identify companies with more sustainable dividend payouts. Additionally, relax your criteria for dividend growth by setting the 1-year, 3-year, and 5-year dividend change percentages to greater than 0%. This ensures the companies you consider have consistently paid dividends over time.

Choose stocks listed on major, well-regulated exchanges like the NYSE, NASDAQ, LSE, or DAX to add an extra layer of credibility and oversight.

It’s also wise to adjust your payout ratio threshold to below 50%, ensuring the company isn’t overextending itself by paying out a disproportionate share of its earnings as dividends.

Lastly, prioritize companies demonstrating sales growth that outpaces or at least aligns with their dividend growth. Strong sales growth is a reassuring indicator that the company’s dividends are less likely to face disruptions in the future.

Key Criteria for Screening Safe Dividends

- Market Capitalization: > $2 billion

- Dividend Yield: > 1.5%

- 1-Year Dividend Change: > 0%

- 3-Year Dividend Average: > 0%

- 5-Year Dividend Average: > 0%

- Payout Ratio: < 50%

By applying these criteria, you can identify reliable, sustainable dividend-paying companies that align with your investment goals.

5. Growth in Earnings

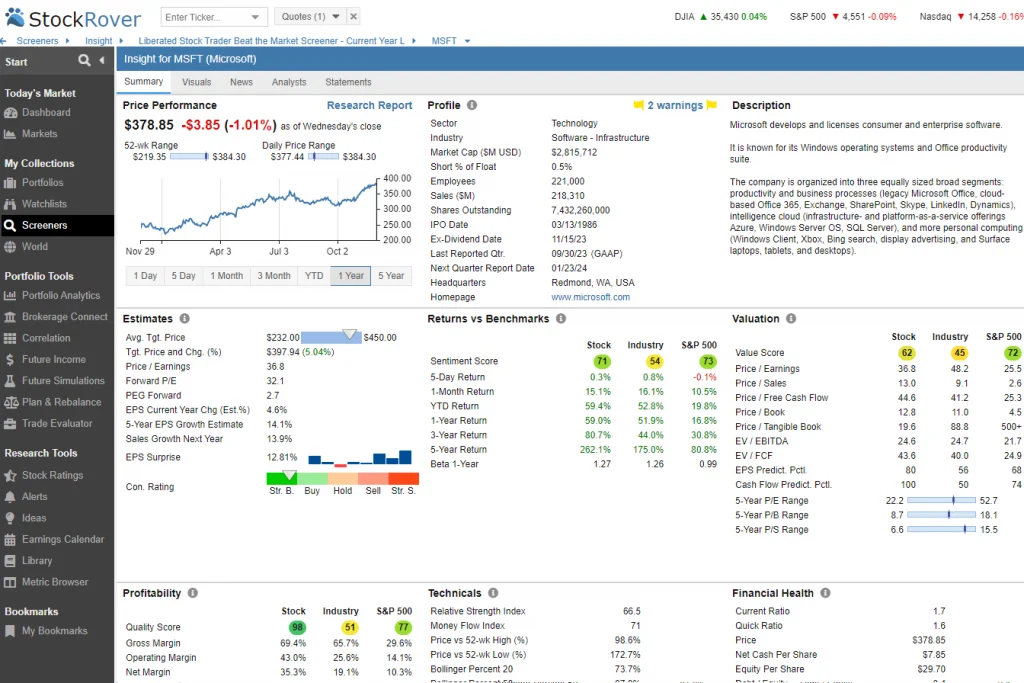

Earnings growth is key for dividend investors like me. I look at a company’s ability to boost profits over time, as this impacts dividend sustainability and increases.

Strong earnings growth means a safer current dividend and room for bigger payouts down the road. This matters most for dividend growth strategies, but I see it as crucial for all dividend stocks. Dividend Aristocrats and Kings often have solid earnings growth track records, helping them raise dividends for decades. I always check earnings trends before buying dividend stocks.

6. Building Resilience in a Recession

Recession resilience is crucial for dividend stocks. I’ve found that companies with a track record of maintaining dividends during tough times are often more reliable investments. The Dividend Aristocrats stand out here. These companies have increased their dividends for at least 25 years straight, even through recessions.

When the economy slows, many companies cut or stop dividends to save cash. However, the best dividend stocks keep paying, which shows financial strength and good management.

I look at how a stock performed in past downturns. Did it keep paying dividends? Did it grow them?

Interest rates can also affect dividend stocks during recessions. When rates fall, dividend yields become more attractive. However, high rates can make bonds more competitive with dividend stocks.

Here’s a quick checklist I use:

- Check dividend history through past recessions

- Look for consistent dividend growth

- Consider the company’s debt levels

- Assess the industry’s recession resistance

7. Important Tax Factors to Consider

Dividend stocks have some tax perks. I have liked holding them for a long time because I only pay capital gains tax when I sell them. Plus, dividend income is taxed at lower rates than my job income. I still owe some taxes each year, but it’s not too bad. If I want to avoid taxes completely, I can put my dividend stocks in a tax-free account like an IRA.

There are two types of dividends: qualified and ordinary. Qualified dividends receive better tax treatment. Some investors use dividend reinvestment plans (DRIPs) to buy more shares with their dividends automatically.

8. Diversification

I believe in spreading investments across different areas. Owning stocks from various sectors helps smooth out market ups and downs. For example, consumer goods stocks often move opposite to utility stocks.

I suggest owning stocks from at least 5-6 different sectors.

Some options to consider:

- REITs (Real Estate Investment Trusts)

- Dividend ETFs

- Index funds

- Renewable energy stocks

- Communication infrastructure companies

- Technology

The right mix depends on your comfort level with risk. Some investors are fine with more concentration, while others prefer the broad diversification of index funds. When deciding how to spread out my investments, I consider my risk tolerance. There is no perfect answer; it’s about finding the right balance.

9. How Long Should You Keep Dividend Stocks?

In my opinion, the best approach is to hold dividend stocks for as long as possible. The longer you keep these stocks, the more you benefit from dividend compounding and delay taxes on capital gains.

I recommend aiming to hold quality dividend stocks “forever” unless there’s a clear reason to sell, like poor performance.

When considering how long to hold, keep these key dates in mind:

- Record date: When you must own the stock to receive the dividend

- Ex-dividend date: The day the stock price typically drops by the dividend amount

Remember, your holding period may vary based on your retirement goals or overall investment strategy. The key is finding great dividend stocks and sticking with them for the long haul.

10. Managing and Monitoring Your Portfolio

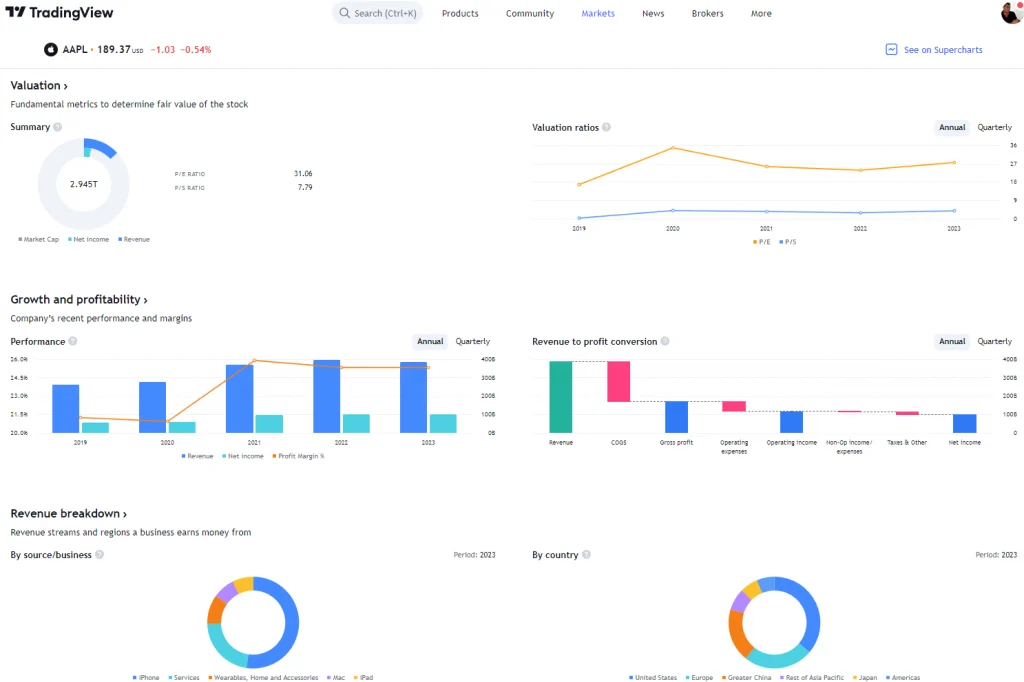

I closely track the performance of my portfolio. I carefully analyze each company’s earnings reports to identify any potential red flags that might impact profits or dividends. Additionally, I consistently assess dividend safety to minimize the risk of unexpected cuts.

Many online tools help me track these things, but it still takes time to manage my investments well.

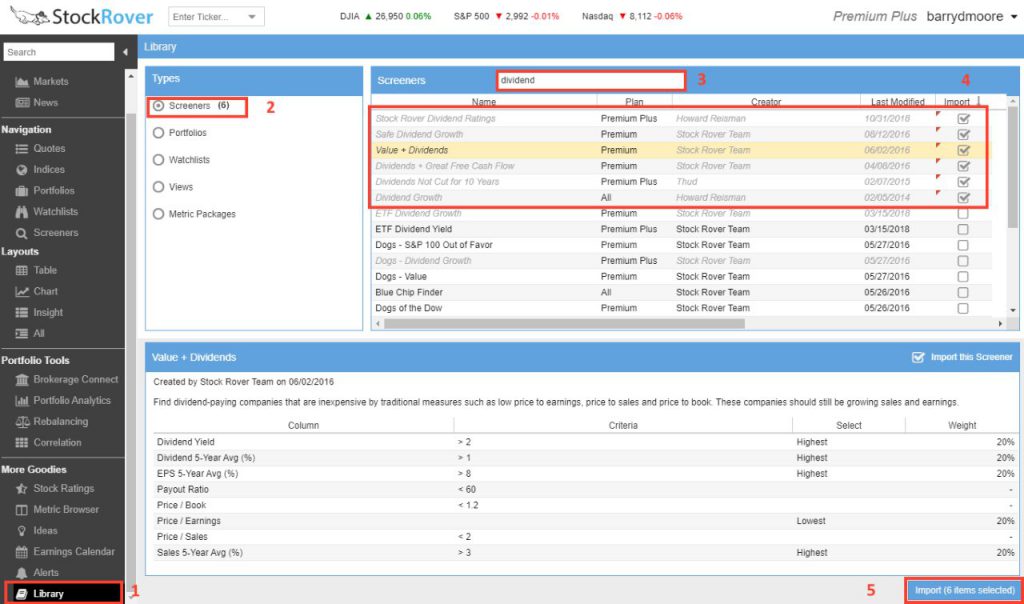

Stock Rover – The Smart Choice for Savvy Long-term Investors

As an investor, I’ve always wanted powerful insights without the complexity. Stock Rover changed the game for me. With its deep screening tools and hundreds of metrics, I can quickly find stocks and ETFs that match my strategy. It streamlined my research and made decision-making so much easier.

Comparing investments used to be a hassle—now it’s a breeze. Stock Rover lets me analyze multiple stocks, ETFs, or portfolios side by side. I get clear views on fair value, quality, and growth potential, helping me make smarter, more confident choices.

Tracking my portfolio is now seamless. By linking my brokerage, I get real-time updates and detailed analytics. Features like dividend forecasts and rebalancing tools help me stay on track and plan effectively for the long term.

Stock Rover is the only service I recommended for growth, dividend, and value investors.

I don’t believe in blind buy-and-hold strategies. Smart investing requires ongoing effort. I own at most 30 stocks to keep monitoring manageable.

Here’s what I watch:

- Stock prices

- P/E ratios

- Morningstar ratings

- Drawdown levels

- Buyback activity

I use these data points to guide my investment choices. By monitoring my portfolio, I can make better decisions about when to buy, sell, or hold my stocks.

Final Thoughts

Buying and holding high-quality dividend stocks is a smart path to building long-term wealth. These stocks can provide steady income and potential growth over time.

While no investment is without risk, dividend-paying companies tend to be more stable and established. I’ve found that reinvesting dividends can really boost returns through compounding.

It’s important to research carefully and pick stocks with solid financials and consistent dividend histories. Diversifying across sectors also helps reduce risk.