Building a strong stock portfolio is a key step in successful investing. Many investors struggle with deciding how many stocks to include.

Studies show that owning 10-30 stocks can provide good diversification. This range helps spread risk while keeping the portfolio manageable.

I’ll explore why this number works well for most investors and how it can lead to better performance. We’ll also look at the balance between diversity and focus on stock selection.

Understanding Portfolio Management

Portfolio management is how I choose and oversee investments to reach my financial goals. I pick stocks, bonds, and funds based on numbers and qualities that fit my needs. I spread my money across different types of assets to lower risk. This helps protect me when markets get bumpy. I look for companies with strong advantages over competitors. These “moats” can help my investments do well in the long term. I also think about how much risk I’m comfortable with when deciding what to buy.

Portfolio Diversification

Portfolio diversification is a smart way to spread out my investments. I put my money into different types of assets to lower my overall risk. This means I don’t put all my eggs in one basket. I might buy stocks from various companies in different industries. I could also invest in bonds and real estate or even keep some cash on hand.

Diversification helps safeguard against significant losses if a specific market sector takes a downturn. Relying solely on tech stocks could spell trouble in the event of a sector crash, but with a mix of investments, I’m safer.

Most experts say I should own 20 to 30 different stocks. It’s also good to pick stocks from 7 to 8 different sectors. This helps make sure I’m truly spread out.

Remember, it’s not just about having lots of different investments. The key is picking ones that don’t all move in the same direction at once.

Research: Academic Insights on Portfolio Diversification

Markowitz’s Research and the Evolution of Modern Portfolio Theory

Harry Markowitz’s work on Modern Portfolio Theory is crucial for investors. MPT suggests spreading investments across various non-correlated assets like stocks, bonds, and commodities. This approach helps manage risk and boost returns.

Markowitz’s 1952 study showed that diversification can reduce risk while maintaining high return potential. His research recommends holding 20 to 30 different stocks to lower market volatility exposure.

Here’s a quick breakdown of MPT’s key ideas:

- Spread investments across asset types

- Pick non-correlated assets

- Aim for 20-30 stocks minimum

- Balance risk and return

MPT offers a solid foundation for smart investing. It’s not just about picking good stocks; it’s about building a balanced portfolio.

Academic Insights on Portfolio Diversification by Surz & Price

Ronald J. Surz and Mitchell Price’s work adds to our understanding of portfolio diversification. In their 2000 paper, they suggest owning at least 20 stocks.

I’ve noted a few key points from their research:

- There’s no perfect number of stocks to own

- Risk tolerance and investment goals matter

- 20-30 stocks can give good diversification

- Spreading risk across asset classes is smart

Surz and Price’s work fits well with Modern Portfolio Theory. They stress that different assets in a portfolio can improve its risk-return profile.

I think their advice to own 20-30 stocks is practical for most investors. It’s enough to spread risk without making a portfolio too hard to manage.

Alexeev & Tapon: How Many Stocks Should You Hold in Your Portfolio?

Vitali Alexeev and Francis Tapon’s 2012 study digs deeper into portfolio diversification. They looked at five big markets and found that the number of stocks needed changes based on the market.

Their main findings:

- At least 30 stocks are needed for good diversification

- Fewer stocks are needed as the market cap goes up

- More stocks in a portfolio can mean less volatility and better returns

- Investing in different asset types and using various investment tools is smart

I find their work valuable because it gives specific numbers. Knowing that 30 stocks is a good target can help investors plan better.

Their advice on using different investment types, such as mutual funds and ETFs, is also helpful. It shows that diversification isn’t just about the number of stocks.

Equity Portfolio Diversification: Research by Alexeev & Dungey

In 2014, Alexeev and Dungey looked at how many stocks are needed for a well-spread portfolio.

They discovered intriguing and noteworthy results:

- 7 equally weighted stocks can cut 85% of risk

- 10 equally weighted stocks can cut 90% of risk

- Company size doesn’t matter much for cutting risk

- Industry and country-level spread are important

Their research suggests that investors don’t need as many stocks as we might think. Just 10 stocks, if picked well, can provide great diversification.

The study also points out that it’s better to spread money across more companies than to focus on specific industries or countries. This is useful advice for building a strong portfolio.

Which Software is Best for Managing a Diversified Portfolio?

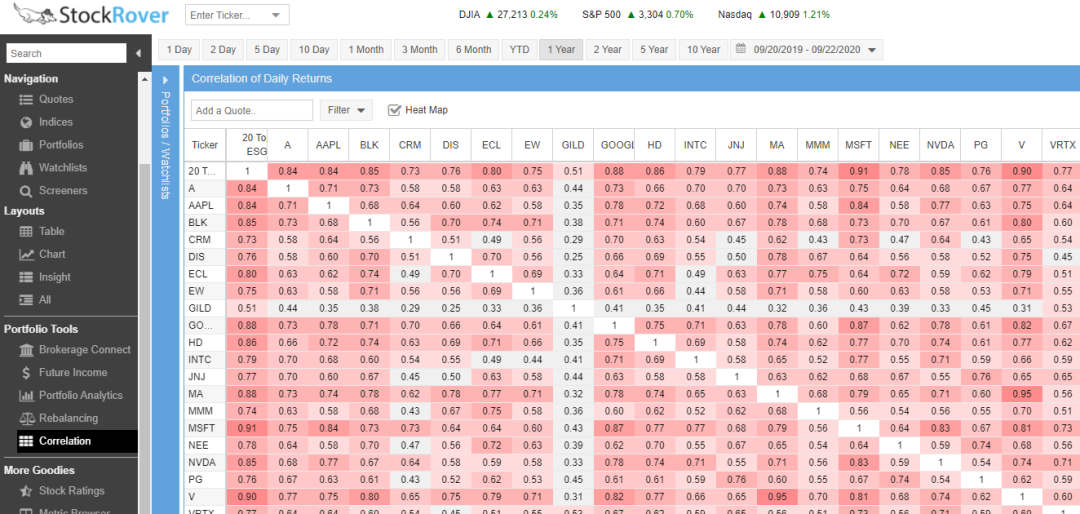

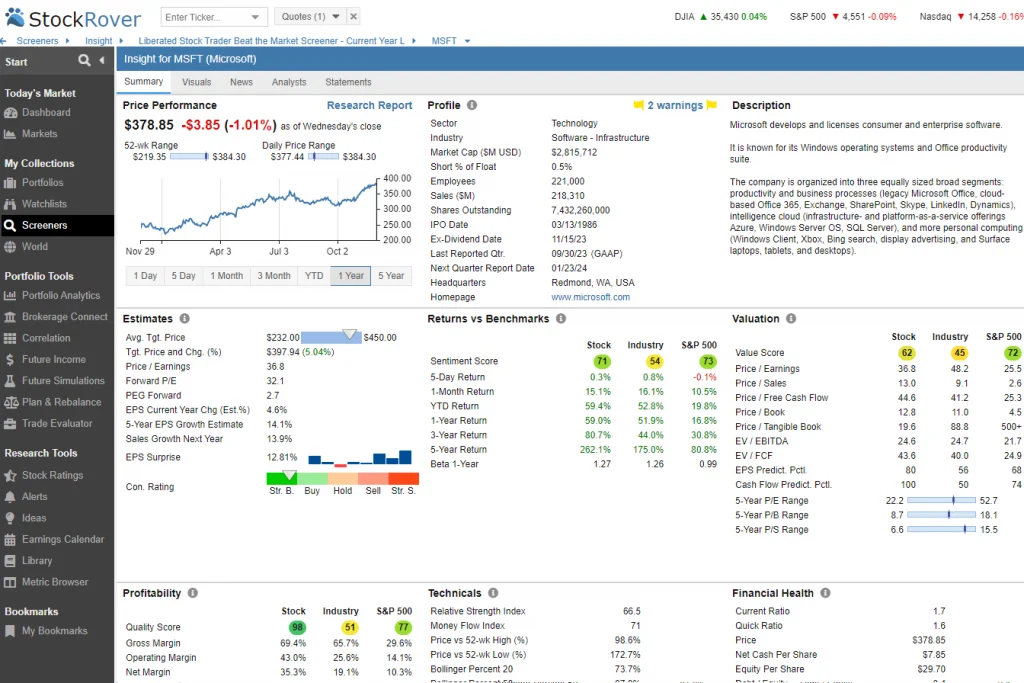

Stock Rover is an excellent tool for managing a diversified portfolio. Its analytics allow me to compare portfolio returns, assess risk, and evaluate performance against benchmarks. I can easily calculate important metrics like correlation to the S&P 500, risk-adjusted returns, and Sharpe ratios.

One feature I really appreciate is the ability to analyze correlations between different holdings. This helps me identify and replace highly correlated investments to achieve better diversification and reduce overall portfolio risk.

Stock Rover – The Smart Choice for Savvy Long-term Investors

As an investor, I’ve always wanted powerful insights without the complexity. Stock Rover changed the game for me. With its deep screening tools and hundreds of metrics, I can quickly find stocks and ETFs that match my strategy. It streamlined my research and made decision-making so much easier.

Comparing investments used to be a hassle—now it’s a breeze. Stock Rover lets me analyze multiple stocks, ETFs, or portfolios side by side. I get clear views on fair value, quality, and growth potential, helping me make smarter, more confident choices.

Tracking my portfolio is now seamless. By linking my brokerage, I get real-time updates and detailed analytics. Features like dividend forecasts and rebalancing tools help me stay on track and plan effectively for the long term.

Stock Rover is the only service I recommended for growth, dividend, and value investors.

How to Assess Portfolio Diversification?

Correlation coefficients are a simple and effective way to measure portfolio diversification. These numbers show how closely two investments move together. When the coefficient is low, it means the assets tend to behave independently.

To build a well-diversified portfolio, I look for investments with low correlations to each other. This helps reduce overall volatility and risk.

Tools like Stock Rover make it easy to check correlation coefficients and track portfolio diversification. Their charts clearly show how different stocks in my portfolio relate to each other.

I also compare my portfolio’s performance to a benchmark like the S&P 500. This gives me a good idea of how well I’ve diversified compared to the broader market.

• Low correlation = Better diversification

• Use tools to visualize correlations

• Compare to market benchmarks

How Many Stocks Should You Hold?

I recommend owning at least 10-30 different stocks in your portfolio. This range helps spread out risk and improve diversification. For smaller portfolios under $5,000, 2-3 stocks can work. As your portfolio grows, add more stocks. Aim for 20-30 stocks once you have over $20,000 invested.

Some experts suggest 15 stocks with similar risk levels to the whole market, while others say 25 is ideal. The exact number depends on your goals and risk tolerance.

Remember to balance your holdings. Don’t put 50% in one stock and 1% in the rest. Try to keep stocks roughly equal-weighted in your portfolio.

FAQ

How many stocks should I own to diversify my portfolio?

I recommend owning at least 10-20 stocks for basic diversification. For larger portfolios, aiming for 20-30 different stocks can provide even better risk reduction.

What’s the benefit of owning multiple stocks?

By spreading investments across multiple companies and sectors, I can lower my overall portfolio risk and volatility. This helps protect against major losses if one stock or sector underperforms.

Is there a maximum number of stocks I should own?

While there’s no strict limit, I find that around 30 stocks provide strong diversification. Beyond that, additional stocks have minimal impact on reducing risk further.

Do ETFs offer good diversification opportunities?

ETFs are excellent for diversification. In a single trade, I can gain exposure to entire markets or sectors. They’re also cost-effective and tax-efficient compared to buying individual stocks.

Can individual stock selection improve my results over time?

Careful stock selection can potentially boost returns. I focus on finding industry leaders and undervalued companies with strong fundamentals. This approach has helped me outperform market indexes over time.