Investors who want to make smart, calculated decisions need to learn how to calculate a stock’s intrinsic or fair value. I’ll explain how to estimate a stock’s true worth using the discounted cash flow model. This method, favored by Warren Buffett, looks at a company’s future cash flows and adjusts them for inflation.

By dividing this number by the total shares, we get a fair value for each share. This is a useful tool for determining whether a stock is overpriced or undervalued compared to its current market price.

In my stock selection, fair value and margin of safety are core to success. Buying overvalued stocks at all-time highs is a recipe for an underperforming stock portfolio.

I’ll also show you a quick way to find the intrinsic values of all US stocks. This can save you time and help you spot good investment opportunities. By comparing a stock’s intrinsic value to its market price, you can make smarter choices about which stocks to buy or sell.

Understanding the Intrinsic Value of a Stock

Calculating a stock’s intrinsic value is key to making smart investment choices. This true value shows what a company’s shares are really worth beyond market prices. To calculate it, I look at future cash flows over about 10 years and discount them for factors like inflation. After that, I divide the total by the number of shares.

Here’s a simple way to think about it:

- Estimate future cash flows

- Apply discounts

- Divide by outstanding shares

This gives me a fair value per share, which I can compare to the current stock price to see if it’s a good deal. A big gap between intrinsic value and market price means there’s a safety margin.

The Formula for Calculating Intrinsic Value

I use a formula to determine a stock’s true worth. The formula adds up future cash flows, adjusted for time.

Here’s how it works:

- Estimate future cash flows

- Apply a discount rate

- Sum up the discounted values

The formula looks like this:

Intrinsic Value = [CF0 /(1+r)0] + [CF1 /(1+r)1] + [CF2 /(1+r)2] + …..+ [CFn /(1+r)n

CF = Cash Flow

r = Discount Rate

n = Number of Periods

This helps me determine if a stock is overvalued or undervalued.

Calculating Intrinsic Value Using the Buffett Model

Warren Buffett’s method for determining a stock’s true worth is pretty smart. I’ll explain it in easy steps. First, I multiply the company’s free cash flow for the first year by how much I think it’ll grow. Then, I divide that by a discount rate to determine its current value. I will do this for the next ten years.

Next, I add up all those present values. For the 10th year, I multiply by 12 to get a sell-off value. Then, I add that to the sum from before, plus any cash and short-term investments the company has. This gives me the value for the whole company.

To get the value per share, I divide by the number of shares out there. It’s that simple!

Here’s a quick list of the steps:

- Calculate future cash flows

- Find present values

- Sum up the values

- Add sell-off value and cash

- Divide by shares

This method helps me determine what I should pay for a stock, not what the market says. It’s all about examining the company’s real money-making power over time.

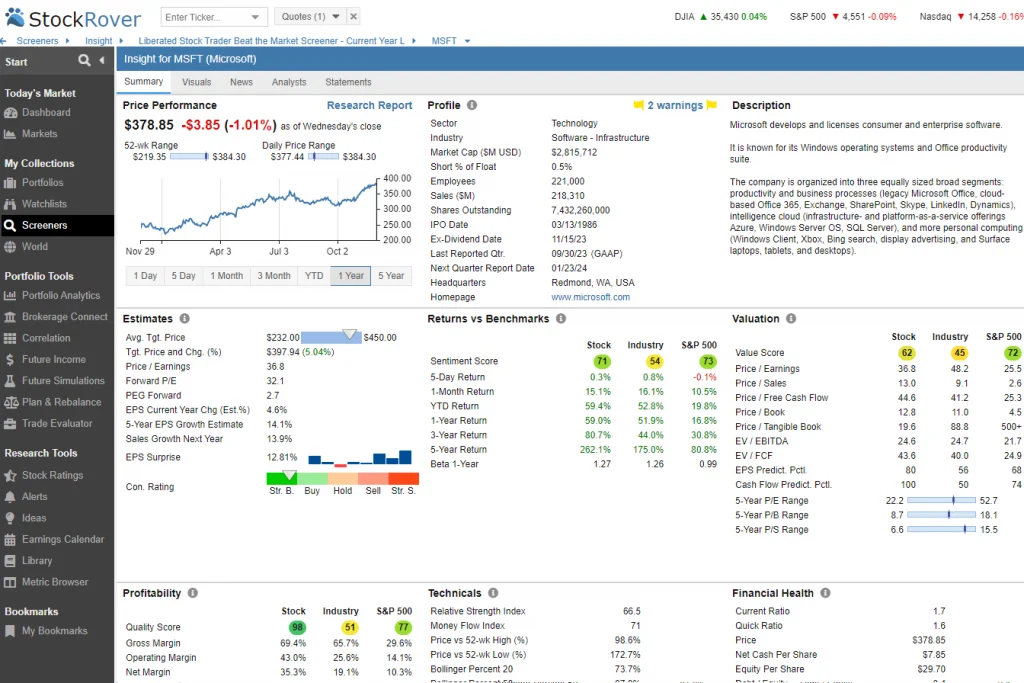

The Ultimate Intrinsic Value Calculator

Stock Rover is my top pick for intrinsic and fair value calculations. It automatically computes Fair Value, Academic Fair Value, Intrinsic Value, Intrinsic Value to Sales, and Intrinsic Value Exit Multiple for all US stocks.

Stock Rover is an excellent tool for value investing. It offers a fair-value screener, charts, news, and watchlists. I especially like its 10-year financial database and broker integration.

Stock Rover caters to growth, dividend, and value investors. They offer a 14-day free trial, and you can get a 25% discount during the premium trial period.

Here’s what makes Stock Rover stand out:

- Powerful screening tools

- Portfolio management features

- Extensive financial data

While Excel is free for basic calculations, it’s not efficient for analyzing many stocks. Stock Rover lets me scan thousands of companies to find those meeting Warren Buffett’s or Ben Graham’s criteria.

Stock Rover – The Smart Choice for Savvy Long-term Investors

As an investor, I’ve always wanted powerful insights without the complexity. Stock Rover changed the game for me. With its deep screening tools and hundreds of metrics, I can quickly find stocks and ETFs that match my strategy. It streamlined my research and made decision-making so much easier.

Comparing investments used to be a hassle—now it’s a breeze. Stock Rover lets me analyze multiple stocks, ETFs, or portfolios side by side. I get clear views on fair value, quality, and growth potential, helping me make smarter, more confident choices.

Tracking my portfolio is now seamless. By linking my brokerage, I get real-time updates and detailed analytics. Features like dividend forecasts and rebalancing tools help me stay on track and plan effectively for the long term.

Stock Rover is the only service I recommended for growth, dividend, and value investors.

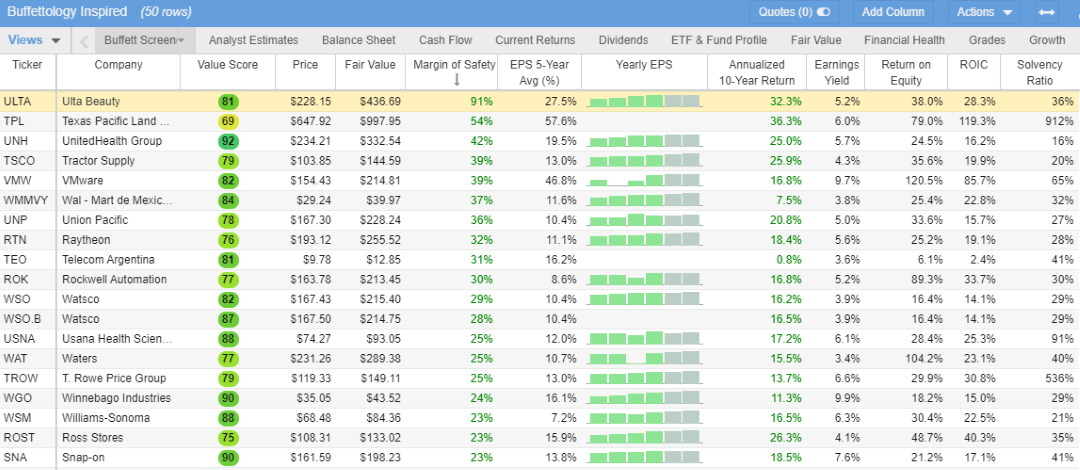

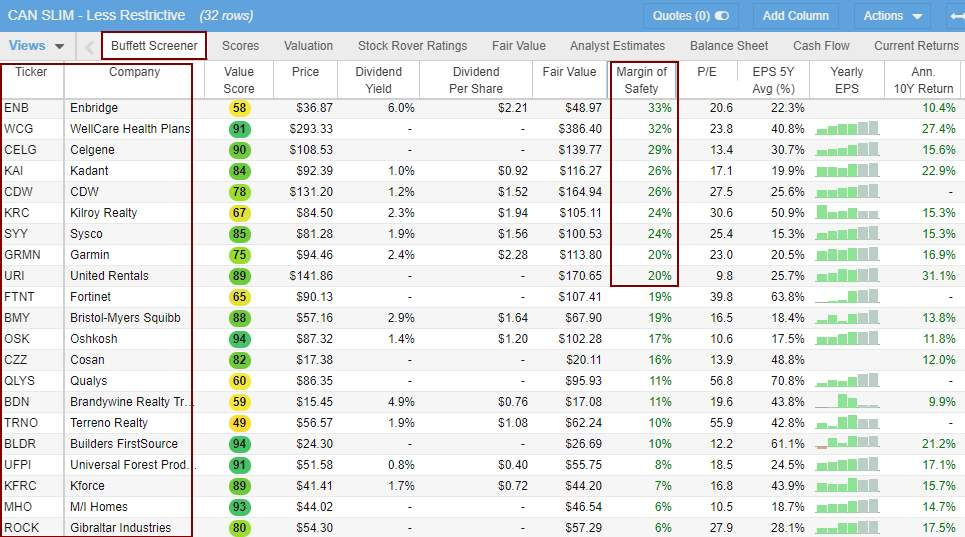

Stock Rover’s Premium Plus service gives access to over 150 pre-built screeners. These include metrics based on Warren Buffett and Benjamin Graham’s investing strategies. This is really helpful for value investors trying to find undervalued stocks.

Here are the five intrinsic value calculation methods Stock Rover uses:

Intrinsic Value Exit MultipleI appreciate that Stock Rover focuses on the US market. It saves me time and helps me make better investment choices.

Fair Value (discounted cash flow analysis)

Fair Value (Academic)

Intrinsic Value (Academic)

Intrinsic Value EV to Sales

I like that Stock Rover automatically performs these complex calculations. It saves a lot of time and reduces the chance of errors. The software also calculates other key metrics, such as the margin of safety. For visual learners, Stock Rover has a user-friendly interface.

You can see an example of their Warren Buffett stock screener in action:

If you want to learn more, read my in-depth Stock Rover review.

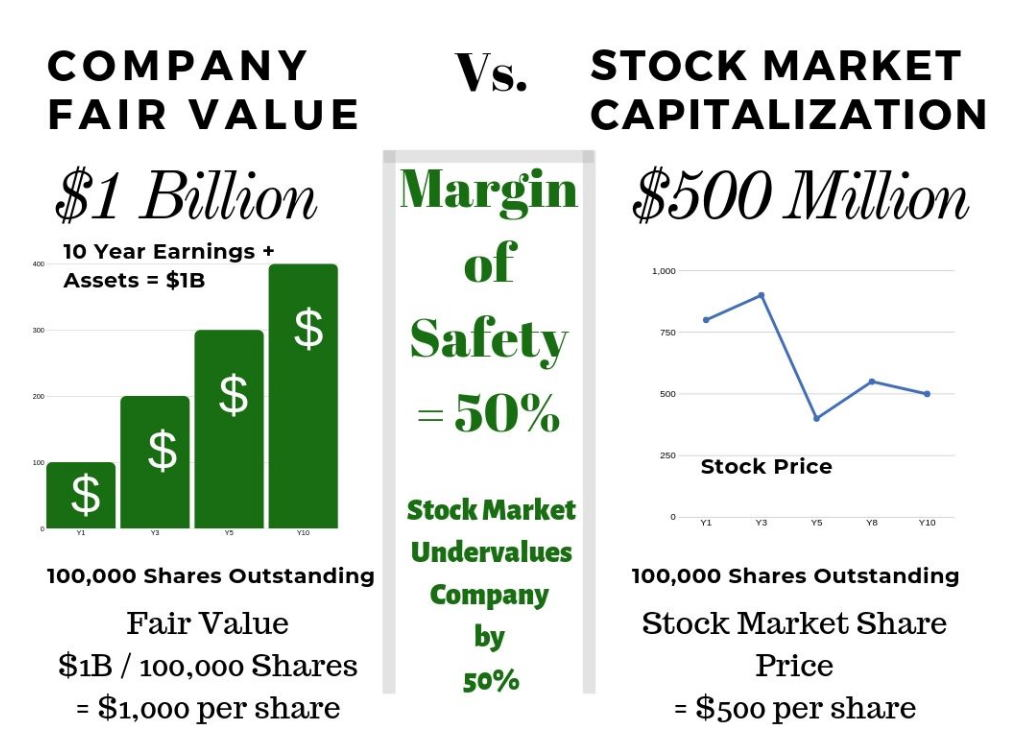

The Margin of Safety: Determining the Right Price for a Stock

I’ve found that comparing a stock’s intrinsic value to its market price is key for smart investing. The margin of safety is the difference between these two figures. It’s a buffer that can protect you if the stock price drops.

Warren Buffett, an investing legend, looks for a margin of safety over 30%. This means he aims to buy stocks at a price that’s at least 30% below their calculated intrinsic value. It’s a safety net for his investments.

To figure out your margin of safety:

- Calculate the stock’s intrinsic value

- Compare it to the current market price

- Find the percentage difference

For example:

- Intrinsic value: $100

- Market price: $70

- Margin of safety: 30%

I always aim for a healthy margin of safety. It helps me avoid overpaying and gives me peace of mind. Remember, the bigger the margin, the more protection you have against potential losses.

Alternative Methods for Calculating Intrinsic Value

I’ve found that calculating intrinsic value isn’t a one-size-fits-all process. Different investors use various methods based on what they think matters most. Some focus on cash and profits, while others look at less tangible things like patents or brand names.

For example, I might use a discounted cash flow (DCF) analysis to estimate future cash flows and discount them to present value. Or I could apply a residual income model, which factors in a company’s book value and expected earnings.

Here’s a simple formula using the price-to-earnings (P/E) ratio:

Intrinsic Value = Earnings per Share x (1 + Growth Rate) x P/E Ratio

It’s important to remember that these calculations are just estimates. A company’s true value often includes hard-to-measure assets like its reputation or intellectual property. That’s why I always consider multiple approaches when assessing a stock’s worth.

Intrinsic Value vs. Book Value

Book value and intrinsic value are two ways I measure a company’s worth. Book value looks at the tangible assets a company owns right now. It’s like adding up all the physical stuff a business has—cash, buildings, equipment, and so on. Then, I subtract what the company owes to get the book value.

Intrinsic value is trickier. It tries to figure out what a company will be worth in the future. I look at things like future cash flows, growth potential, and market position. This method is popular with value investors like Benjamin Graham.

Here’s a quick comparison:

| Book Value | Intrinsic Value |

|---|---|

| Based on current assets | Based on future potential |

| Easier to calculate | Requires more analysis |

| Used in liquidation scenarios | Used to find undervalued stocks |

Comparing book value to intrinsic value can be really useful. If a stock’s market price is below both its book value and my estimate of its intrinsic value, it might be undervalued. That’s the kind of opportunity value investors look for.

Comparing the Price-to-Earnings Ratio and Intrinsic Value

The Price-to-earnings (P/E) Ratio is a popular tool for comparing stocks, but I find it doesn’t tell the whole story about a stock’s true worth. While the P/E Ratio can give us a quick snapshot of how the market values a company’s earnings, it doesn’t directly measure intrinsic value.

To calculate the P/E Ratio, I divide the stock price by earnings per share (EPS). This gives me a sense of how much investors are willing to pay for each dollar of earnings. A high P/E might suggest that the stock is overvalued, while a low P/E could indicate that it’s undervalued.

But here’s the catch: The P/E Ratio is more useful for short-term analysis and comparing similar companies. It doesn’t account for future growth prospects or a company’s overall financial health.

Intrinsic value, on the other hand, tries to determine a stock’s “true” worth based on fundamentals like cash flow and growth potential. While more complex to calculate, I believe it offers a more complete picture of a stock’s value.

Intrinsic Value Calculation Methods

1. The Dividend Discount Model

The Dividend Discount Model is a straightforward way to estimate a stock’s intrinsic value based on its dividends.

Here’s how it works:

Add up future dividend payments

Add this sum to the current stock price

Let’s look at an example using Walmart (NYSE: WMT):

- Current stock price: $100.04 (as of May 15, 2019)

- Upcoming quarterly dividend: $0.53

To find the intrinsic value for next year, I’d add four quarters of dividends to the stock price:

$100.04 + (4 * $0.53) = $102.16

This means a dividend investor would pay $100.04 now to get $2.12 in dividends over the next year.

Pros of the Dividend Discount Model:

- Easy to calculate

- Focuses on real cash returns to shareholders

Cons:

- Only works for dividend-paying stocks

- Doesn’t account for dividend changes

- Ignores other factors that affect stock value

2. The Discounted Cash Flow Model: Warren Buffett’s Approach to Calculating Intrinsic Value

Buffett favors the discounted cash flow (DCF) model for estimating intrinsic value.

This method looks at a company’s future free cash flows. Here’s a simplified version of how it works:

Project free cash flows for the next 10 years

Calculate the net present value (NPV) of these cash flows

Estimate a terminal value (selling price) at year 10

Add up all the NPVs and the terminal value

Add cash and short-term investments

Divide by the number of shares outstanding

Here’s a step-by-step breakdown:

Take this year’s free cash flow and multiply by the expected growth rate

Divide by the discount rate to get the NPV

Repeat for 10 years

Sum up all 10 years of NPVs

Multiply year 10’s value by 12 for the terminal value

Add steps 4 and 5, plus cash and investments

Divide by shares outstanding for per-share intrinsic value

Pros of the DCF Model:

- Considers long-term cash generation

- Accounts for growth and risk (through the discount rate)

- Can be used for any company with a positive cash flow

Cons:

- Relies heavily on growth and discount rate assumptions

- Cash flows can be volatile and hard to predict

- Complex calculations compared to simpler models

Both models have their place in stock valuation. The Dividend Discount Model is quick and easy for stable, dividend-paying companies. The DCF model offers a more comprehensive look at a company’s value but requires more assumptions and calculations.

I find it helpful to use multiple valuation methods and compare results. This gives me a range of possible intrinsic values and helps account for the limitations of any single approach.

The Boundaries of Intrinsic Value

When analyzing stocks, intrinsic value has drawbacks. Financial analysts often struggle with intangible assets and outside factors that can impact a company’s worth. For example, oil prices greatly affect companies like Exxon-Mobil (NYSE: XOM), whose cash flow can change quickly based on market conditions. Estimates of intrinsic value are not always accurate.

They don’t account for:

- Sudden market shifts

- Changes in consumer behavior

- New technologies

- Regulatory changes

I believe it’s important to use intrinsic value as just one tool in financial analysis. Relying too heavily on it can lead to mistakes. It’s best to look at both intrinsic and extrinsic value when making investment choices.

Summary

Understanding intrinsic value is key for value investors. While manual calculations can be time-consuming, tools like Stock Rover’s Screener Review Winning Stock Screener make it easier to identify undervalued companies on major exchanges. It helps streamline the process of finding potential investment opportunities.

FAQ

What is intrinsic value?

Intrinsic value is the true worth of an asset or investment beyond its market price. It considers both tangible and intangible factors like a company’s financials, growth potential, and competitive edge. When I assess intrinsic value, I look at the big picture of what makes a company valuable in the long run.

How to calculate the intrinsic value of a stock?

To determine a stock’s intrinsic value, I take a comprehensive approach that combines both quantitative and qualitative analysis. My process includes:

Reviewing financial statements

Forecasting future earnings and cash flows

Evaluating the company’s competitive position

Analyzing industry trends and market dynamics

Assessing management quality and corporate strategy

I then apply valuation models such as discounted cash flow (DCF) and comparable company analysis to estimate a fair value. This process blends analytical precision with business insight—it is part science, part art.

What is an example of an intrinsic value?

Imagine a company trading at $50 per share. After careful analysis, I estimate its intrinsic value to be $60 based on the following factors:

A robust balance sheet with minimal debt

Reliable and consistent cash flow generation

A projected annual growth rate of 15%

A leading position in a growing industry

A skilled management team with a proven track record

This $10 difference between the market price and the estimated intrinsic value suggests a compelling investment opportunity.

What are some risks associated with calculating intrinsic value?

While intrinsic value is a powerful tool for evaluating investments, it comes with several inherent risks:

Subjectivity: Personal assumptions and biases can distort your calculations.

Uncertainty: Accurately predicting future cash flows and growth rates is challenging.

Changing Conditions: Economic shifts or market dynamics can drastically impact a company’s prospects.

Incomplete Information: Critical data about the business may be unavailable or overlooked.

Complexity: Certain businesses are inherently difficult to value with precision.

Time Horizon: Short-term fluctuations can obscure a company’s long-term potential.

To navigate these risks, adopt a cautious approach. Use conservative estimates, apply multiple valuation methods, and regularly revisit your assumptions. Most importantly, maintain a margin of safety to account for potential miscalculations or unforeseen changes.