Dividend yield is an important metric for evaluating stock investments. I’ll explain how to calculate it and why it matters for maximizing profits. The formula is simple: divide the annual dividend per share by the current stock price. This gives you the percentage return from dividends relative to the share price. Understanding dividend yield can help shareholders assess the income potential of different stocks.

Stock market volatility creates opportunities for boosting dividend yields. When prices drop during market panics, yields go up since you’re getting the same dividend payout for a lower stock price. By strategically buying quality dividend stocks during downturns, I’ve been able to lock in higher yields for my portfolio. It’s all about recognizing the inverse relationship between price and yield to find the best values.

Understanding Dividends

- A dividend is money a company pays shareholders as a reward for owning its stock. Businesses share profits through dividends, which can be paid in cash, extra shares, or other forms.

- Not all companies pay dividends, but around 2,800 stocks on major U.S. markets do. These are usually large, stable companies with steady incomes that can regularly pay shareholders.

- The company’s board of directors decides on dividends, considering profits after taxes and how much to share. For investors like me, dividends are extra income on top of stock price gains.

Understanding Dividend Yield

Dividend yield is a key metric I use to gauge a stock’s income potential. It’s the percentage of a company’s share price paid out as dividends annually. I calculate it by dividing the yearly dividend per share by the current stock price.

Here’s a simple example:

Company XYZ stock price: $50

Annual dividend: $2 per share

Dividend yield = ($2 / $50) x 100 = 4%

This means that for every $100 invested, I expect to receive $4 in dividends over a year.

I consider dividend yield an effective metric for evaluating the income potential of different stocks. However, I must keep in mind that it can change as stock prices move up or down.

A few key points about dividend yield:

- Higher yields can mean more income but may also signal higher risk

- Yields vary widely across industries and companies

- It’s just one factor to consider when picking stocks

Remember, past dividends don’t guarantee future payouts. I always research a company thoroughly before investing based on yield alone.

Why Does Dividend Yield Rise as Stock Price Falls?

One might notice that dividend yield and share price have an interesting relationship. When a stock’s price drops, its dividend yield goes up. This might seem odd at first, but it makes sense when you consider it.

Let’s say a company pays $2 per share in dividends each year. If the stock costs $100, the yield is 2%. But if the price falls to $80, that same $2 dividend now gives a 2.5% yield. The dividend didn’t change, but it’s now a bigger slice of the pie.

Here’s a simple example:

| Stock Price | Annual Dividend | Dividend Yield |

|---|---|---|

| $100 | $2 | 2% |

| $80 | $2 | 2.5% |

This chart shows how Microsoft’s dividend yield and stock price have moved in opposite directions over 20 years:

It’s wise to remember that a higher yield doesn’t always mean a better investment. Sometimes, a stock price drops because the company is in trouble. The dividend might look good on paper, but it could be at risk of being cut.

Also, dividends aren’t the whole story. A falling share price can still mean you’re losing money, even if the yield goes up. I’ve learned it’s smart to look at the big picture, both dividend income and the potential for the stock price to grow.

Stocks with higher yields can be appealing. But I always make sure to dig deeper and understand why the yield is high before making any moves.

Understanding the Dividend Yield Formula

The dividend yield formula is simple yet powerful. I calculate it by dividing a stock’s annual dividend payment by its current share price. For example, if a company pays $2 in yearly dividends and its stock trades at $50, the dividend yield is 4%. This percentage shows how much income I can expect from dividends relative to the stock’s price. I find this formula helpful for comparing dividend-paying stocks and assessing potential income from my investments.

Some key points about the dividend yield formula:

- Calculate the annual dividend.

- Identify the current stock price.

- Divide the annual dividend by the stock price.

- Multiply the result by 100 to express it as a percentage.

Example: How to Calculate Dividend Yield?

Let me walk you through calculating dividend yield with a real-world example. I’ll use ABC Company to illustrate.

I own 1,000 shares of ABC Company, each worth $10. My total investment is $10,000.

ABC pays a dividend of $0.50 per share. To find the dividend yield, I divide the dividend by the share price:

$0.50 / $10 = 0.05 or 5%

This 5% is my dividend yield. It’s what I earn from dividends, not counting any changes in stock price.

Here’s a quick breakdown:

- Shares owned: 1000

- Share price: $10

- Total investment: $10,000

- Dividend per share: $0.50

- Dividend yield: 5%

A dividend yield calculator can make this process easier. Just input the dividend amount and current stock price.

It’s important to note that stock prices can change. If ABC’s stock price drops 5% while I earn 5% in dividends, my net profit would be zero if I sold my shares.

To use a dividend calculator effectively:

- Find the annual dividend amount

- Note the current stock price

- Divide the dividend by the stock price

- Multiply by 100 for percentage

This simple method helps me compare different dividend-paying stocks and make informed investment choices.

The Inverse Relationship Between Stock Prices and Dividend Yields

Stock prices and dividend yields have a seesaw-like connection. When a stock’s price goes up, its dividend yield usually goes down. And when the price drops, the yield tends to climb.

Here’s a simple example to show how this works:

- Stock price: $100

- Annual dividend: $5

- Dividend yield: 5% ($5 / $100)

If the stock price jumps to $120:

- New dividend yield: 4.17% ($5 / $120)

If the stock price falls to $80:

- New dividend yield: 6.25% ($5 / $80)

This relationship matters for investors like me. A higher stock price might mean more capital gains, but it can lead to a lower dividend yield. On the flip side, a price drop could boost the yield, even if it means a paper loss on the investment.

I think it’s key to look at both factors when picking stocks. A high yield might seem attractive, but it could signal a falling stock price. Balancing yield and price helps me make smarter choices for my portfolio.

The Price You Pay Influences Dividend Yield

I’ve found that dividend yield can change based on when I buy a stock. Let’s say I buy a stock for $1 that pays a 5% dividend. I’ll get 5 cents per share. If I hold onto that stock for 10 years and its price grows to $10, still with a 5% dividend, I’ll now get 50 cents per share.

That’s a big difference! Even though the stock’s current yield is 5%, I’m actually getting a 50% yield on my original $1 investment. This shows why holding dividend stocks for a long time can be so powerful.

It’s important to remember:

- My actual yield depends on what I paid

- Time can boost my returns

- The current stock price affects new buyers differently

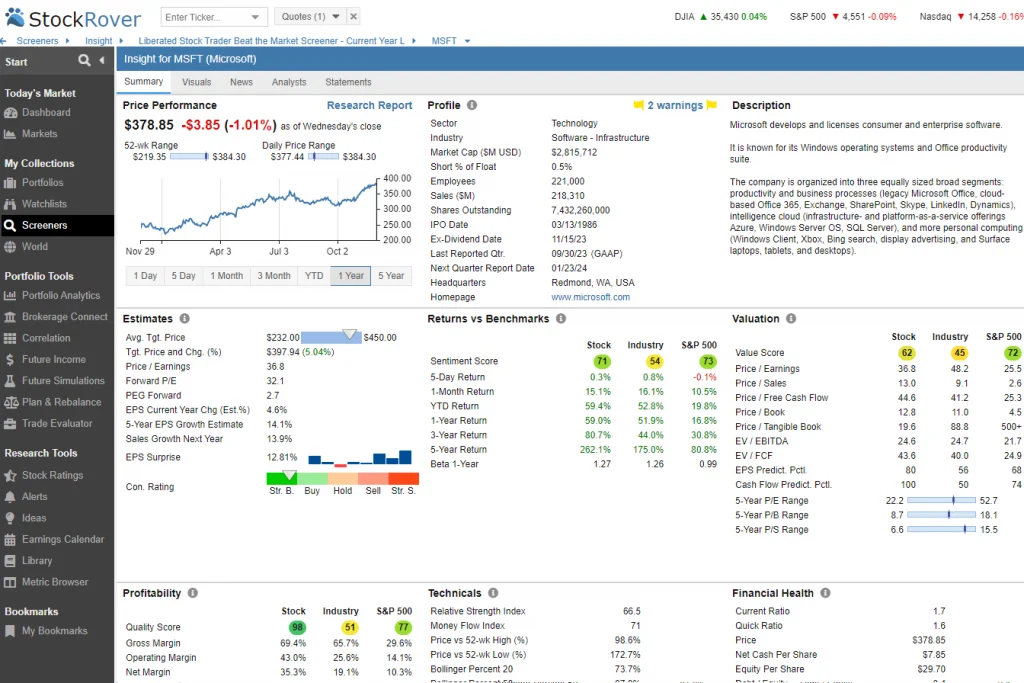

I want to show you how dividend yield and stock price are linked. Let’s look at Microsoft (MSFT) as an example. Here’s a chart of MSFT’s stock price and dividend yield over 13 years:

The chart shows some key points:

- In 2009, MSFT’s stock hit $15. The dividend yield was 3% then.

- By 2013, the stock price doubled to $30. The yield dropped to 2.75%.

- As the stock price went up, the yield went down.

Let’s break this down:

- In 2009: $15 stock price * 3% yield = $0.45 dividend per share

- In 2013: $30 stock price * 2.75% yield = $0.75 dividend per share

Even though the yield went down, the actual dividend went up. This is because MSFT raised its dividend payment.

I found that MSFT kept raising its dividend. In 2017:

- May: $0.36 per share

- August: $0.39 per share

- November: $0.42 per share

This shows that while stock price and yield often move in opposite ways, it’s not always simple. Companies can change their dividend payments, which affects the yield, too.

When a stock’s price falls, its yield often goes up. However, if a company cuts its dividend, the yield might fall even if the stock price drops.

I think it’s smart to look at both the yield and the actual dividend amount. This gives a fuller picture of what you’re getting as an investor.

Stock Rover – The Smart Choice for Savvy Long-term Investors

As an investor, I’ve always wanted powerful insights without the complexity. Stock Rover changed the game for me. With its deep screening tools and hundreds of metrics, I can quickly find stocks and ETFs that match my strategy. It streamlined my research and made decision-making so much easier.

Comparing investments used to be a hassle—now it’s a breeze. Stock Rover lets me analyze multiple stocks, ETFs, or portfolios side by side. I get clear views on fair value, quality, and growth potential, helping me make smarter, more confident choices.

Tracking my portfolio is now seamless. By linking my brokerage, I get real-time updates and detailed analytics. Features like dividend forecasts and rebalancing tools help me stay on track and plan effectively for the long term.

Stock Rover is the only service I recommended for growth, dividend, and value investors.

The Best Yields on Great Stocks

I’ve found that timing is key for investors seeking top dividend yields. By watching stock price movements, you can snag higher yields when prices dip. For example, Microsoft’s yield has ranged from 1% to over 3% in recent years. Remember, your actual yield depends on your purchase price. If I bought Microsoft at $100 per share with a $1.68 annual dividend, I’d get a 1.68% yield. To boost yields, I look for solid dividend stocks during market downturns. I also keep an eye out for dividend raises, which can increase my yield on cost over time.

Key Principles of Dividend Payments for Long-Term Investments

Three rules for dividend payments on long-term investments are.

- Consistency is crucial. Companies that steadily pay dividends tend to be more stable. I look for firms with a history of regular payments.

- Growth matters. I prefer stocks that increase their dividends over time. This can boost my returns significantly.

- Yield isn’t everything. A high dividend yield might seem attractive, but it’s not always sustainable. I focus on companies that can maintain their payouts long-term.

By following these rules, I’ve seen my dividend income grow steadily over the years.

Dividend Yield Rules to Remember

I buy dividend stocks when prices dip artificially low. This boosts my yield.

I make sure price drops won’t hurt the company’s long-term profits. Good businesses bounce back.

I focus on my yield based on what I paid, not the current stock price.

These rules help me find high dividend yields and grow my income over time.

Triple Your Profits with Dividend Yield Investing

When quality stocks crash temporarily, their yields can skyrocket. For example, a 66% price drop can triple the yield. This happened with Wells Fargo in 2020.

By targeting these opportunities, I can potentially triple my dividend income. It’s crucial to focus on solid companies with strong financials and dividend histories.

Wells Fargo Example

I want to share an exciting opportunity that arose during the 2020 market crash. Wells Fargo’s stock price plummeted, creating a golden chance for savvy investors.

By purchasing shares at around $20 when the crash hit, you could have instantly tripled your dividend yield from 2.5% to 7.97%.

Take a look at this chart showing Wells Fargo’s dividend yield spike:

This example shows why it’s crucial to watch for market dips. By investing in solid, dividend-paying companies during crashes, you can lock in higher yields and set yourself up for big gains when prices recover.

To make the most of these chances:

- Do your homework on why the stock crashed

- Make sure the company is financially strong

- Have a plan to manage your risk

Remember, crashes can be scary, but they often bring amazing deals for patient investors.

Why Dividend Yield Matters

Dividend yield is a key metric I use to compare different stocks. It shows me how much income I can expect from my investment. I find it especially useful for evaluating established companies in sectors like utilities, consumer staples, and energy.

When I look at dividend yields, I also consider:

- Payout ratio

- Company’s financial health

- Cash flow stability

- Total return potential

High yields can be tempting, but I’m careful. They might signal problems. I always check other factors before investing. REITs and MLPs often have higher yields, which can be attractive for income-focused portfolios.

FAQ

How is dividend yield calculated?

Calculate dividend yield by dividing the annual dividends per share by the stock’s price per share. The formula is:

Dividend Yield = Annual Dividends per Share / Price per Share.

Does a high dividend yield mean the stock is a good investment?

While a high yield can be tempting, I don’t think it automatically makes a stock a good investment. I dive into the company’s financial health, payout ratio, and dividend growth rate to get the full picture. Remember, a high yield isn’t always a win—it could be a red flag for financial trouble.

What software calculates dividend yields automatically?

In my experience, Stock Rover is great for U.S. investors. For international markets, I prefer TradingView. Both offer free and premium services that I find useful for dividend calculations.