Dividend investing is a strategy for building long-term wealth in the stock market. Companies with a history of consistently raising their dividends can provide stable income and growth potential. These stocks often come from established businesses with strong financials and competitive advantages.

Using dividend screeners, you can identify promising candidates that meet specific criteria like dividend growth streaks, payout ratios, and sales growth. This approach helps you focus on quality companies that are likely to continue rewarding shareholders over time. The right dividend-growth stocks can form the backbone of a robust, income-generating portfolio.

Careful stock selection is key when pursuing dividend growth investing. Look for companies with at least 10 years of dividend increases, sustainable payout ratios, and healthy sales growth. It’s also important to buy these stocks at a good value. By combining these factors, you aim to build a diversified group of reliable dividend payers that can provide rising income for years to come. Dividend growth investing requires patience, but it can be a rewarding strategy for long-term wealth building in the stock market.

1. Select a Dividend Stock Screener

Stock Rover for USA & Canada

Stock Rover is the top choice for dividend stock screening in the USA and Canada. It’s a powerful and user-friendly platform that’s perfect for implementing dividend growth investing strategies. It’s particularly useful for finding value stocks using Warren Buffett’s strategies and identifying safe, regular dividend-paying stocks. Read the full Stock Rover review.

Stock Rover offers:

- 10-year dividend and financial history

- Fair value calculations

- The margin of safety criteria

Stock Rover excels in:

- Growth Investing

- Value Investing

- Income Investing

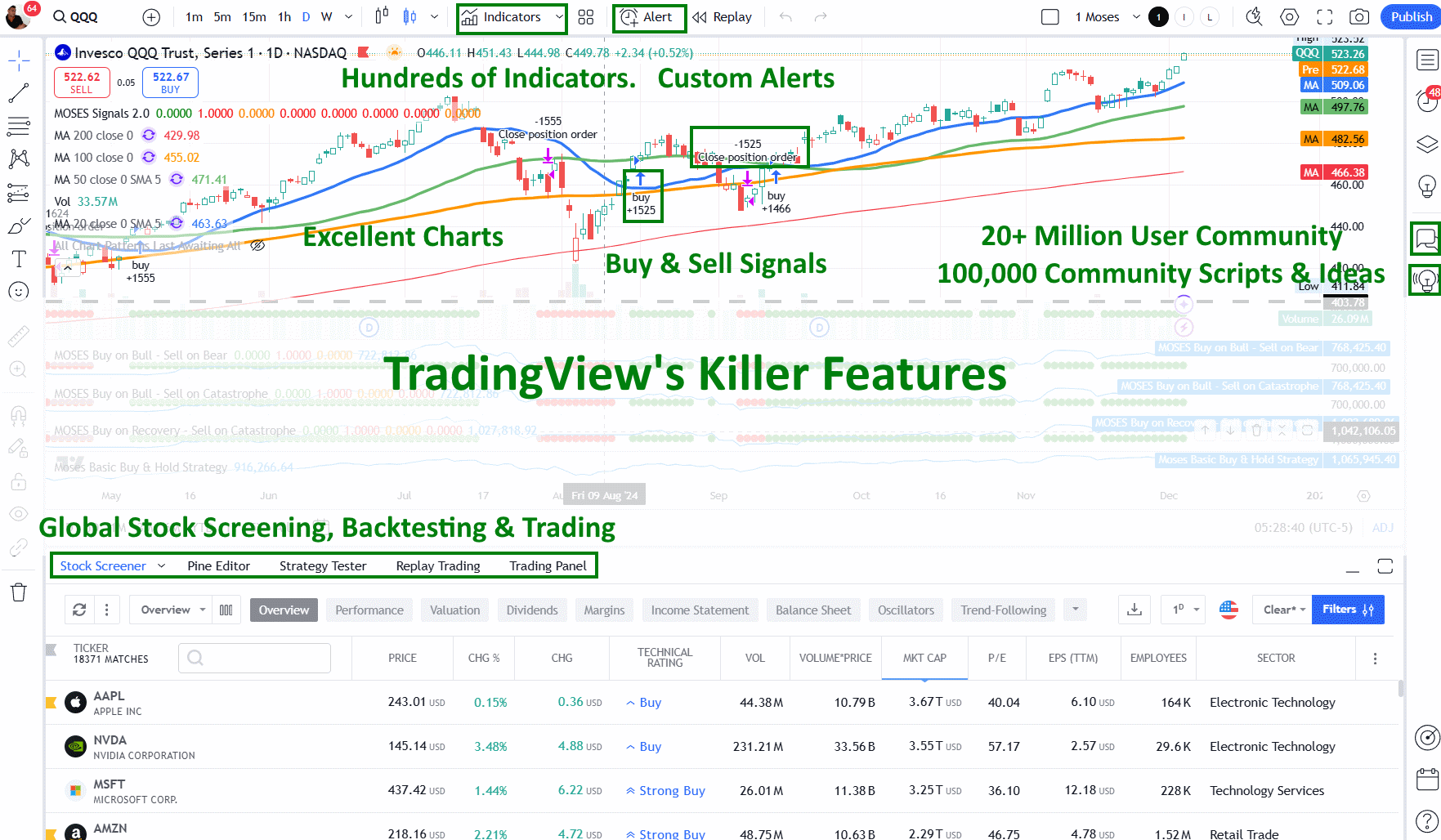

TradingView for all international markets

TradingView is particularly useful for investing in US and international stock markets. It provides real-time data and charts, as well as a community of traders with which to share insights and strategies. Whether you are a novice investor or an experienced trader, TradingView has something for everyone.

In addition to its user-friendly design, TradingView also offers a wide range of technical analysis tools. These can help investors make more informed decisions by analyzing market trends and patterns. From simple moving averages to advanced indicators like Fibonacci retracements, there is a tool for every type of investor on TradingView.

TradingView gets my top rating! It’s hands down the best trading software out there, offering built-in broker integration, powerful backtesting tools, advanced scanners, and access to the world’s largest trading community. It’s a game-changer for traders at all levels!

2. Apply the Dividend Growth Strategy

Now you have selected your stock screening, we can implement a strategy. I’ve developed a robust strategy for finding top dividend growth stocks. Let’s break down the key criteria I use to screen for these gems.

Dividend Yield > 1.5%

Start by looking for stocks with a dividend yield above 1.5%. This ensures you’re not wasting time on companies that pay too little. A yield this size at least keeps pace with inflation, giving your money a chance to grow.

Dividend 1 Year Change > 8%

Next, check if the company boosted its dividend by more than 8% in the past year. This shows that the business is doing well enough to share more profits with its owners, and it’s a good sign for future growth.

Dividend 3-Year Change > 8%

Then, look at the 3-year dividend growth rate. If it’s over 8%, you know the company has been steadily increasing its payouts. This tells you it’s not a one-time event.

Dividend 5-Year Change > 8%

A 5-year dividend growth rate above 8% really catches my eye. It means the company has been raising dividends for a while, which suggests that it’s likely a strong, well-run business that cares about its shareholders.

Dividend 10-Year Change > 8%

When you see a 10-year dividend growth rate over 8%, get excited. This is a sign of a truly solid company that has weathered different market conditions and continued to grow its dividend.

Payout Ratio >10 < 40

Always check the payout ratio. You want it between 10% and 40%. This tells you the company is paying out enough to be worthwhile but not so much that it cannot invest in its future. It’s a sweet spot for sustainable dividend growth.

Sales 5-Year Average (%) > 4%

You should also look for sales growth. A 5-year average growth rate above 4% shows that the company is expanding its business, which supports future dividend increases.

Margin of Safety > 0

I’m a big fan of buying stocks below their true value, so I look for a positive margin of safety. It gives me a cushion if things don’t go as planned, and the bigger this margin, the better I feel about my investment.

Consecutive Dividend Growth Years > 10

Lastly, you want to see at least 10 years of straight dividend growth. This is a key sign of a quality dividend stock. It shows that the company has a strong, steady cash flow and is committed to rewarding shareholders.

3. Focus on Dividend Growth Stocks for Your Portfolio

Targeting dividend growth stocks can be a smart strategy for building long-term wealth. These stocks offer the potential for both income and capital appreciation over time.

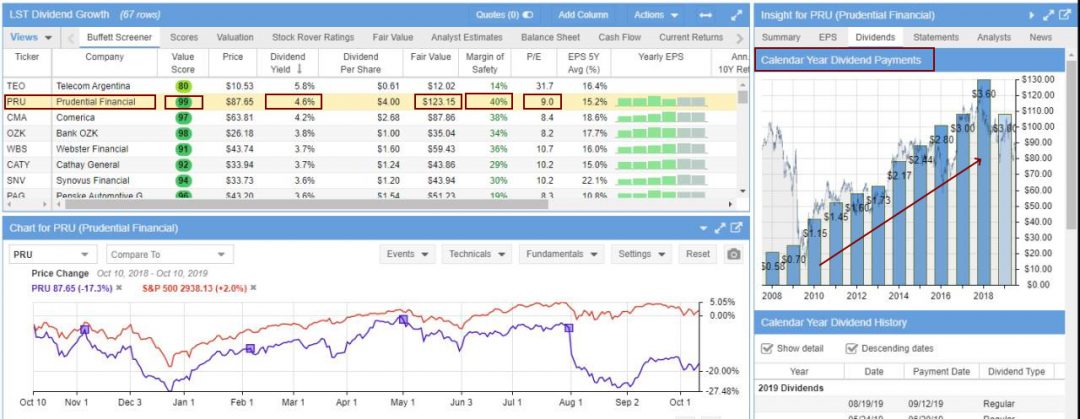

Dividend Growth Screening Example

When searching for dividend growth stocks, I like to use screening tools to narrow down the options. In a recent scan, I found 39 stocks that met my criteria for dividend growth potential. Some familiar names like Accenture, Comcast, and Prudential made the cut.

Let’s take Prudential (PRU) as an example. It caught my eye with its 4.6% dividend yield. Based on discounted cash flow analysis, the stock also looks undervalued. With a current price of $87 and an estimated fair value of $123, there’s a 40% margin of safety.

Prudential scores high on other metrics, too. It has a solid 10-year history of dividend increases and its impressive Stock Rover Value Score of 99 out of 100 factors in valuation ratios like EV/EBITDA, P/E, and Price/Sales.

Example Dividend Growth Stocks

To give you a better idea of what dividend growth stocks can look like, I’ve compiled a table of 15 examples:

| Ticker | Company | Dividend Yield | 3-Year Dividend Growth | 5-Year Dividend Growth | 5-Year EPS Growth | Payout Ratio | Years of Dividend Growth | Margin of Safety |

|---|---|---|---|---|---|---|---|---|

| RHI | Robert Half | 2.60% | 12.20% | 11.40% | 12.90% | 35.90% | 10+ | 11% |

| TTC | Toro | 1.70% | 10.80% | 11.20% | 14.90% | 25.90% | 10+ | 7% |

| MCHP | Microchip Technology | 1.90% | 30.60% | 17.60% | 79.00% | 31.40% | 10+ | 13% |

| BC | Brunswick | 2.10% | 18.60% | 16.10% | 34.10% | 20.00% | 10+ | 23% |

| DOX | Amdocs | 2.00% | 9.90% | 11.70% | 10.10% | 35.20% | 10+ | 33% |

| NDAQ | Nasdaq | 1.70% | 10.40% | 8.40% | 8.20% | 36.60% | 10+ | 24% |

| NXST | Nexstar Media Gr | 4.00% | 34.10% | 29.20% | 9.00% | 24.20% | 9 | 65% |

| ALLE | Allegion | 1.70% | 12.00% | 16.50% | 14.40% | 29.40% | 8 | 10% |

| DKS | Dick’s Sporting Goods | 3.60% | 47.40% | 34.80% | 28.40% | 24.10% | 8 | 16% |

| MDC | MDC Holdings | 4.50% | 21.60% | 16.40% | 13.90% | 36.40% | 6 | 28% |

| SIRI | Sirius XM Holdings | 2.30% | 22.10% | 17.10% | 10.80% | 31.50% | 6 | 24% |

| SSNC | SS & C Techs Hldgs | 1.70% | 19.70% | 24.60% | 18.90% | 32.30% | 6 | 44% |

| VRTS | Virtus Inv | 3.80% | 35.00% | 29.70% | 17.20% | 34.60% | 5 | 20% |

| LZB | La-Z-Boy | 2.40% | 37.40% | 8.60% | 12.10% | 21.90% | 2 | 16% |

| OXM | Oxford Industries | 2.70% | 37.50% | 13.80% | 18.50% | 23.10% | 2 | 23% |

This table shows a mix of yields, growth rates, and other key metrics. A few stocks stand out to me:

Dick’s Sporting Goods (DKS) has an impressive 3-year dividend growth rate of 47.40% and a solid 3.60% yield. Its 5-year earnings per share growth of 28.40% supports the dividend increases.

Microchip Technology (MCHP) shows strong growth across the board. Its 5-year EPS growth of 79% is remarkable, though likely not sustainable long-term.

MDC Holdings (MDC) offers the highest yield at 4.50% with decent growth rates. Its 28% margin of safety suggests it might be undervalued.

Brunswick (BC) has a good balance of yield, growth, and a low payout ratio, which allows for future dividend increases.

When building a dividend growth portfolio, aim for diversity. You might pick stocks from different sectors with varying growth rates and yields. This helps balance income and growth potential while managing risk.

4. Analyze Dividend Growth Stocks Effectively

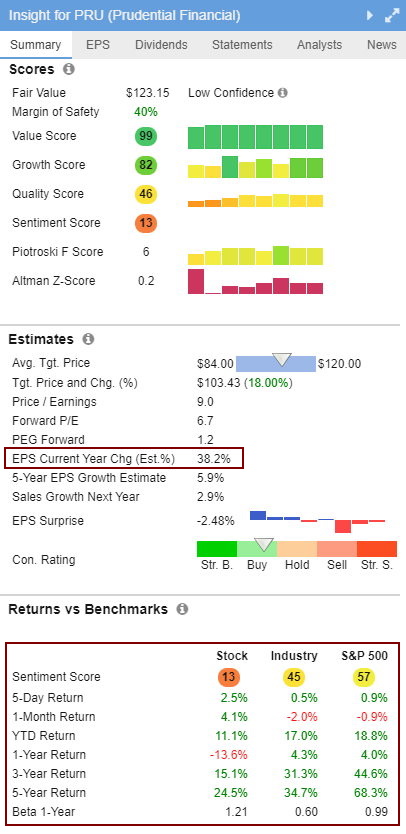

I’ve found that using Stock Rover helps me quickly assess a company’s financials. For example, Prudential Financial has had a stable Value Score of 99 over the last eight years. The Growth Score is also improving strongly at 82.

The Quality Score, which looks at profitability and balance sheet metrics, has improved to 46. This score includes factors like ROIC, Net Margin, Gross Margin, Interest Coverage, and Debt / Equity ratio. A score of 100 is the best, while zero is the worst.

The sentiment score is low at 13. This can be good for finding undervalued stocks, as market sentiment should be very low.

Earnings per Share (EPS) for the current year is expected to improve by 38.2%.

Looking at Returns vs. Benchmark, Prudential has historically lagged behind the S&P 500. However, given its current low valuation, it might be worth considering whether it can keep up its stable 10-year dividend growth rate.

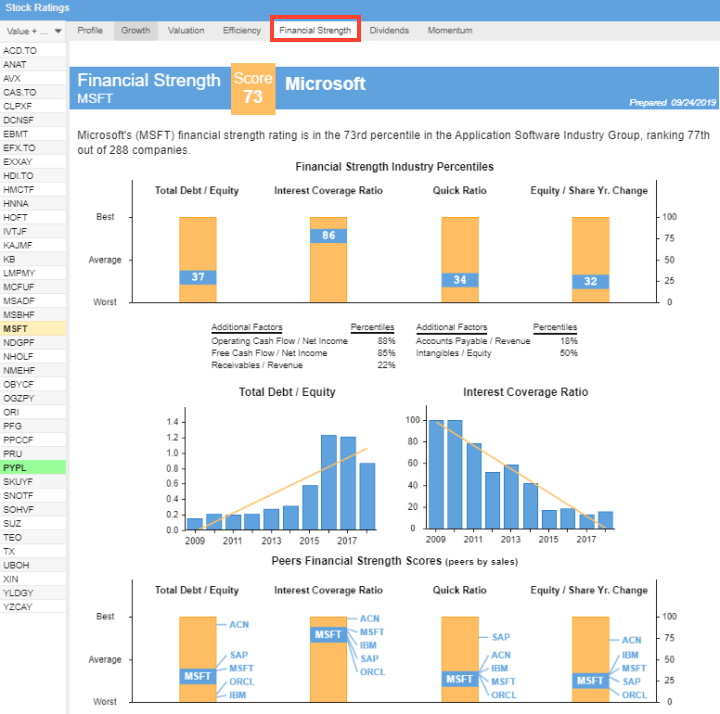

Review the Financial Strength

When I look at Microsoft’s financial strength, I see Stock Rover gives it a score of 73 out of 100. This tells me about the company’s financial health.

The Financial Strength Industry Percentiles chart shows Microsoft is below the industry average for Debt to Equity but higher than average for Interest Coverage Ratio.

I can also see 10-year trends for the Total Debt to Equity and Interest Coverage Ratio, which gives me a long-term view of the company’s financial position.

The Peers Financial Strength Scores chart is really useful. It lets me compare Microsoft’s financial strength to that of its competitors, which can help me spot new investment opportunities.

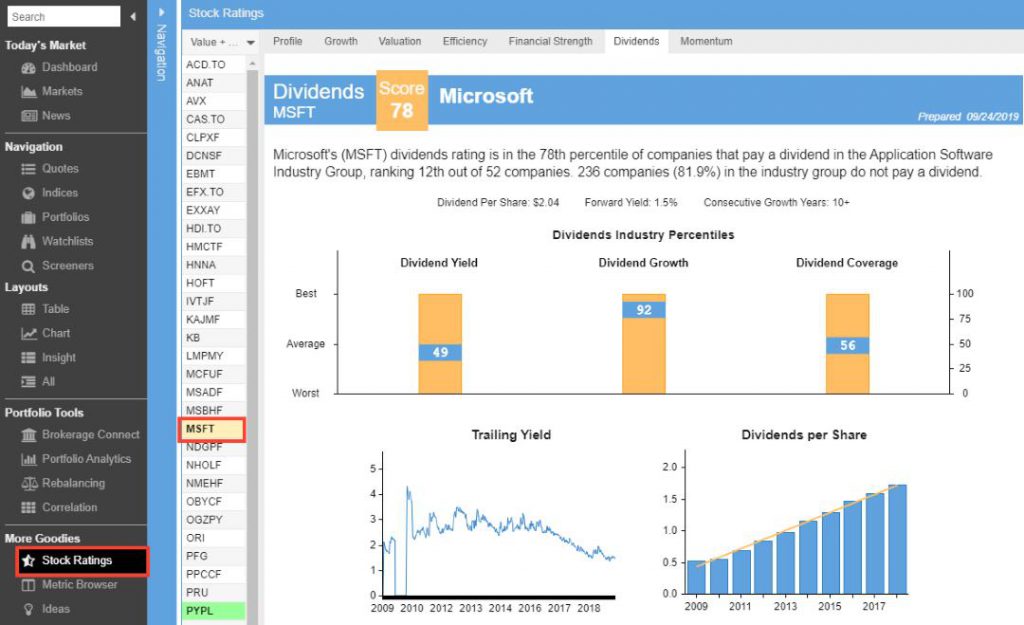

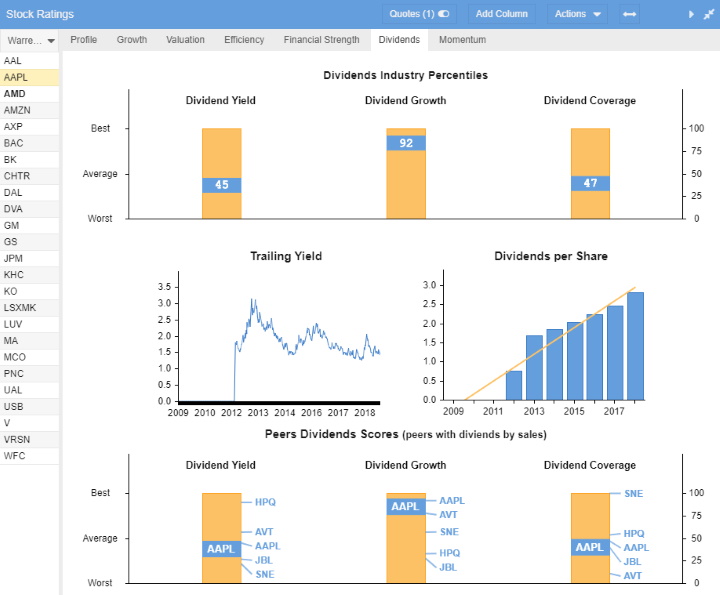

Assess the Dividend Analysis Report

Let’s look at Apple (AAPL) in the Dividends section of Stock Ratings.

The Dividend Industry Percentiles chart shows Apple’s dividend yield is slightly below average (45th percentile) for its industry. But its dividend growth is among the best (92nd percentile). This could be very promising.

The Trailing Yield chart shows Apple has kept its dividend yield between 1.5% and 2.5% of the stock price. Apple started paying dividends again in 2012, and the Dividend per Share has grown a lot since then.

In the Peers Dividend Scores report, I see that Hewlett Packard Inc. (HPQ) currently offers a much higher Dividend Yield, but Apple leads the industry in Dividend Growth.

5. Use Portfolio Analytics

Stock Rover’s tools give you deep insights into your dividend portfolio. You can:

- Compare stock performance

- Check risk and return metrics

- Chart dividend yields

- Analyze individual positions

- Forecast dividends

- Run stress tests

These features help you spot trends and make smart choices for your portfolio.

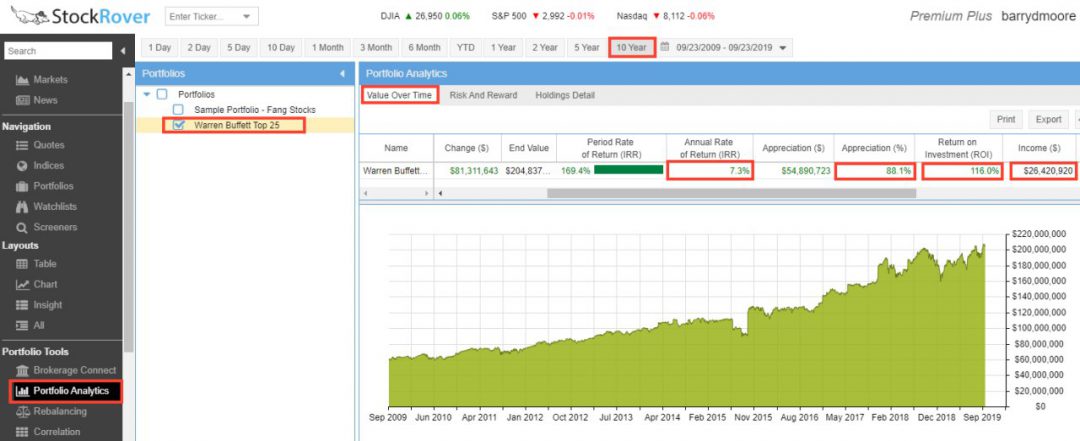

Portfolio Analysis Example

Let’s look at Warren Buffett’s Top 25 Holdings as a sample portfolio. Here’s what I found:

- 7.3% annual return over 10 years

- 88.1% stock value increase

- 116% total return on investment

- $26 million in dividend income

This breakdown shows the power of a well-chosen dividend portfolio.

I always aim for a mix of sectors in my dividend portfolio. REITs and MLPs can offer high yields, while Dividend Aristocrats provide steady growth. A blend of these, along with stocks from various industries, helps spread risk.

My strategy focuses on:

- Picking stocks with solid dividend histories

- Watching payout ratios for sustainability

- Looking for companies with steady earnings growth

- Balancing high-yield options with dividend growers

I review my portfolio regularly, making sure it stays in line with my goals. This ongoing process helps me build a strong, income-producing portfolio over time.