Investing in the stock market is an effective way to build wealth over time. Many people use a strategy called buy-and-hold investing to grow their money long-term. This approach involves buying stocks and ETFs and keeping them for years, often a decade or more. It’s a simple method that can work well for investors who don’t want to watch the market constantly.

Buy-and-hold investing has some big advantages. Research shows it can be more profitable than frequently trading stocks or investing in other assets like bonds or real estate. For investors who want to try this strategy, there are proven tactics to help them pick good stocks and stick with them through market ups and downs. The key is finding solid companies and having the patience to let your investments grow over time.

In my opinion, buy-and-hold works best when buying broad-market ETFs and combining long-term dollar-cost averaging and compounding. This is the only guaranteed way to outperform the market. Its how I structure my investments.

1. Understand Why Buy-and-Hold Outperforms Day Trading

Buy-and-hold investing means buying stocks and ETFs and keeping them for 10 to 30 years. It takes less work than active investing and often leads to better results. Day trading, on the other hand, is very risky. Many people try it, hoping to get rich fast, but it rarely works out. In fact, 85% of day traders lose all their money within six months.

Only a few traders who study and test their methods carefully have a shot at success. Buy-and-hold is much easier and more likely to pay off in the long run. It lets me focus on other things while my investments grow steadily over time. While it might not be as exciting as day trading, I think it’s a smarter choice for most people.

2. Buy-and-hold outperforms Bonds, Real Estate, and Gold

Buy-and-hold strategies in the stock market have consistently outperformed other asset classes over the long term. My research shows stocks have delivered impressive annual returns of 10.7%, surpassing bonds, real estate, and gold.

Here’s a breakdown of 30-year compound annual returns for different asset classes:

| Asset | 10-yr Average Return |

|---|---|

| Stocks: Nasdaq 100 | 13.10% |

| Stocks: S&P 500 | 8.20% |

| Corporate Bonds | 7.20% |

| Gold | 6.80% |

| US Treasury Bonds | 4.90% |

| Real Estate | 4.80% |

| 3-month Treasury Bills | 2.20% |

While stocks offer higher returns, they come with more volatility. It’s important to balance risk and reward in your portfolio.

Real estate has some unique benefits. It can provide steady rental income and long-term appreciation. Plus, there are tax perks like mortgage interest deductions and property depreciation.

Bonds are a safer bet. They give you regular interest payments and return your principal at maturity. Government bonds are seen as the most secure, backed by the full faith of the issuing government.

Gold has long been viewed as a hedge against inflation. Its 6.8% annual return isn’t too shabby, but it lags behind stocks.

I’ve noticed that buy-and-hold strategies are not widely discussed. Brokers prefer frequent trading to earn more commissions, but patient investors who stick to their guns often win in the long run.

3. Use the Best Buy-and-Hold Investing Tools

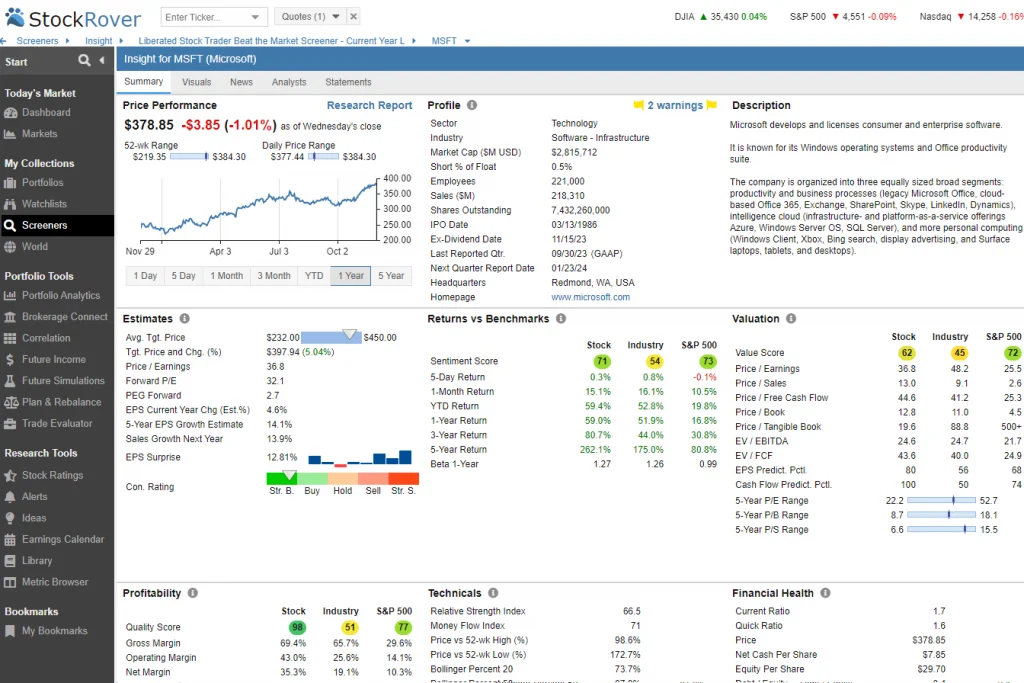

When I invest in stocks for the long haul, I need reliable tools to make smart choices. A good stock screener, detailed analysis reports, and portfolio tracking are must-haves. I’ve found that Stock Rover ticks all these boxes and more.

Stock Rover stands out as a top-notch platform for growth, value, and income investing. It offers in-depth research reports that help me spot promising stocks. I can even use Warren Buffett’s strategies to find hidden gems.

A feature I love is the broker integration. It lets me see my real-time performance across all my investments. This big-picture view is crucial for making informed decisions about which stocks to keep in my portfolio.

Stock Rover also helps me manage my investment mix. Its automated portfolio rebalancing keeps my target allocations in check, so I don’t have to worry about one stock or sector taking up too much space in my portfolio.

I’ve been using Stock Rover to manage all my stock investments, and it’s made a big difference in my investing journey. If you’re serious about buy-and-hold investing, I recommend giving Stock Rover a try. For further information, read my Stock Rover review.

Stock Rover – The Smart Choice for Savvy Long-term Investors

As an investor, I’ve always wanted powerful insights without the complexity. Stock Rover changed the game for me. With its deep screening tools and hundreds of metrics, I can quickly find stocks and ETFs that match my strategy. It streamlined my research and made decision-making so much easier.

Comparing investments used to be a hassle—now it’s a breeze. Stock Rover lets me analyze multiple stocks, ETFs, or portfolios side by side. I get clear views on fair value, quality, and growth potential, helping me make smarter, more confident choices.

Tracking my portfolio is now seamless. By linking my brokerage, I get real-time updates and detailed analytics. Features like dividend forecasts and rebalancing tools help me stay on track and plan effectively for the long term.

Stock Rover is the only service I recommended for growth, dividend, and value investors.

4. Adopt a Dividend-Focused Buy-and-Hold Strategy

High dividend yield stocks can be tempting, but they’re not always the best choice. While a high yield might seem great, it can also mean the company is struggling. The yield goes up when the stock price goes down. That’s why I always check the dividend payout ratio, too. It helps me see if the company can keep paying those dividends.

Implementing a High-Yield Dividend Investment Strategy

To find good, high-yield dividend stocks, I use a stock screener.

Here’s my process:

- Set market cap above $500 million

- Look for a dividend yield of over 3%

- Check for dividend growth of 2% or more in the last year and 3 years

- Make sure earnings per share have grown over 5 years

- Keep the payout ratio under 50%

A Dividend Growth Strategy

I like dividend growth stocks because they often come from strong, growing companies that keep raising their dividends year after year. The best part? Sometimes, I can find these great dividend growers at bargain prices.

Implementing a Dividend Growth Strategy

To find the best dividend growth stocks, I use these steps:

- Set dividend yield above 1.5%

- Look for 8% or more dividend growth over 1, 3, 5, and 10 years

- Keep the payout ratio between 10% and 40%

- Check for a positive margin of safety

This method helps me spot stocks that are likely to continue growing their dividends. It’s a great way to build wealth over time, and I can often buy these stocks at good prices.

Buy-and-hold dividend investing is a solid way to grow my money. It gives me steady cash, even when the market is down. If I reinvest those dividends, my returns can really add up. It’s not flashy, but it works. Just remember: It’s all about picking the right stocks and sticking with them for the long haul.

5. Develop a Long-Term Value Investing Strategy

Master Value Investing Like Warren Buffett

I’ve learned that Warren Buffett and Charlie Munger are the kings of value investing. Thanks to their smart choices, their company, Berkshire Hathaway, is worth over $750 billion. They’ve made an average of 23.3% returns each year for 50 years. That’s amazing!

Buffett and Munger look for companies worth more than their stock price suggests. They buy these stocks and hold them for a long time, allowing them to make big profits as the stock price grows to match the company’s true value.

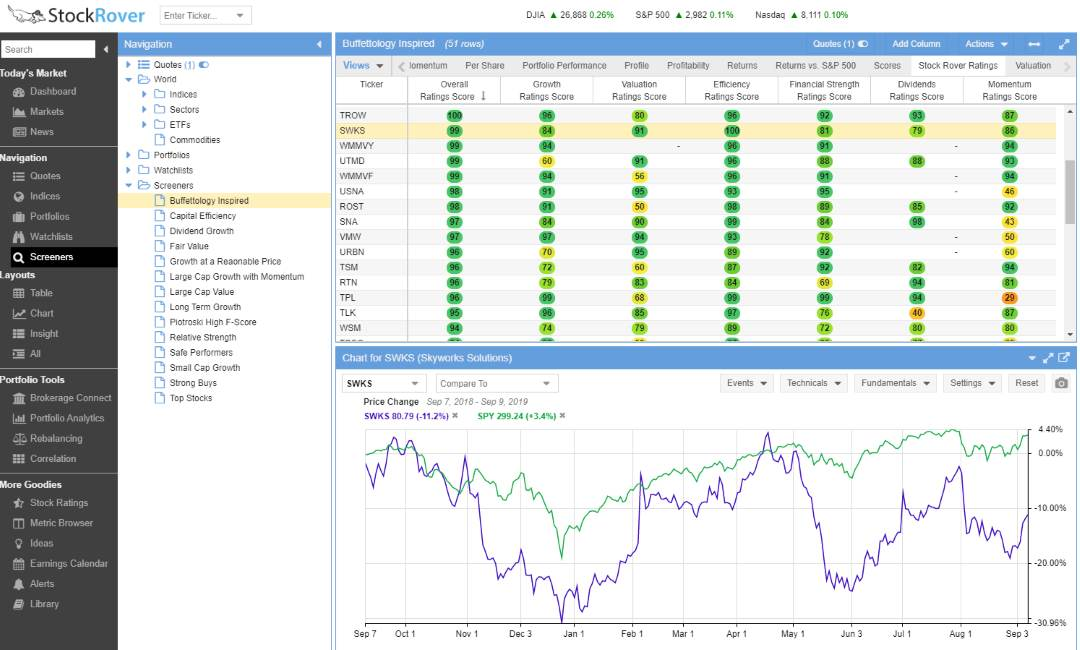

Establish a Value Stock Buy-and-Hold Strategy

I recommend using a stock screener to find good-value stocks.

Here’s how:

- Get a free Stock Rover Premium trial

- Go to Screener > Browse Screener Library

- Import the “Buffettology Inspired” screener

This screener helps find stocks with the following:

- Good long-term profits

- Low debt

- Strong market leadership

- Growing cash flow and revenue

- A history of paying dividends

- High margin of safety

- Low to medium price-to-earnings ratio

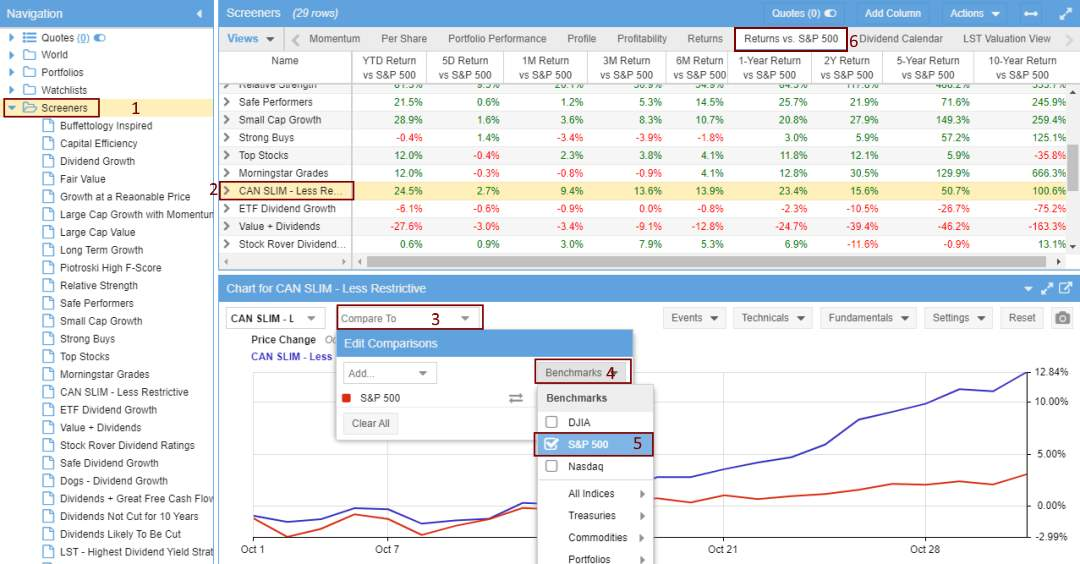

6. Launch a Buy-and-Hold Growth Stock Strategy

A buy-and-hold growth stock strategy can be a smart way to accumulate wealth over time. I look for companies with strong financial metrics, such as revenue growth, rising earnings per share, and solid cash flow. By holding these stocks for years, I aim to benefit from their long-term growth potential.

To find promising growth stocks, I create a list of criteria and use stock screening tools. This helps me identify fundamentally sound companies that could outperform the market.

Use the CANSLIM Growth Strategy

CANSLIM is a strategy created by William J. O’Neil to find high-performing stocks.

Here’s what each letter stands for:

- C: Current quarterly earnings

- A: Annual earnings growth

- N: New products or management

- S: Supply and demand

- L: Leader in its industry

- I: Institutional sponsorship

- M: Market direction

I use this strategy to find companies with:

- High earnings growth

- New, innovative products

- Low institutional investment

- Strong performance in bull markets

When using a buy-and-hold growth strategy, I always keep in mind that my chosen stocks need to outperform the market. If I’m not confident in my stock-picking skills, I might consider an index-tracking ETF instead.

Some popular growth stocks to watch include:

- Apple – Known for its innovative tech products

- Amazon – Dominant in e-commerce and cloud services (AWS)

- Alphabet (Google) – Leader in search and digital advertising

- Coca-Cola – Strong brand and consistent growth

- Chevron – Energy sector giant with growth potential

Pay attention to sectors like technology and health care, which often house many growth stocks. By focusing on companies with strong financials and growth prospects, I aim to build a portfolio that can deliver solid returns over time.

7. Invest in Buy-and-Hold ETFs

Top ETFs for Buy-and-Hold Investors

Several ETFs are great for long-term investors. These funds offer an easy way to own many stocks at once without buying them all separately, helping spread out risk and keeping costs low.

Here are three top ETFs I recommend for buy-and-hold investing:

1. Vanguard S&P 500 ETF (VOO)

- Tracks the 500 largest US. companies

- Has a very low 0.03% expense ratio

- Good for US stock market exposure

2. Invesco S&P 500 Equal Weight ETF (RSP)

- Holds S&P 500 stocks in equal amounts

- Spreads risk across all 500 stocks

- Has a 0.2% expense ratio

3. iShares MSCI World ETF (URTH)

- Invests in stocks from 23 developed countries

- Offers global market exposure

- Has a 0.24% expense ratio

These ETFs are built to match the performance of big stock indexes. This means I don’t have to worry about a fund manager making bad choices. Instead, I can ride the market’s ups and downs over time. One big plus of buy-and-hold ETFs is their low costs. The expense ratios I listed above are much lower than those of many actively managed funds. This means more of my money stays invested and can grow over time.

Another benefit is tax savings. By holding these ETFs for years, I can avoid short-term capital gains taxes. I’ll only owe taxes on any profits when I sell, which could be far in the future. ETFs also pay dividends on the stocks they hold. This gives me a steady stream of income that I can reinvest to buy more shares. Over time, this can really boost my returns through the power of compounding.

For new investors, these ETFs offer an easy way to start investing in the stock market. I don’t need to pick individual stocks or time the market. I can buy shares of these ETFs and hold them for the long run.

8. Make the Most of Dollar-Cost Averaging

Dollar-cost averaging is a smart investment strategy. It’s simple:

I invest a fixed amount of money in the same security at regular intervals, no matter the price. This approach helps me navigate market ups and downs. When prices are low, I get more shares for my money. When they’re high, I buy fewer. Over time, this can lead to better returns and lower average costs per share.

Here’s why I like it:

- Reduces emotional decision-making

- Spreads out market risk

- Works well for long-term investing

- Fits various financial situations and goals

For example, I might set aside $500 monthly to buy an index fund ETF. In some months, I’ll receive more shares, and in others, I’ll receive fewer, but I’m consistently building my portfolio. Jack Bogle, founder of Vanguard, was a big fan of this method. He believed it helped investors stay disciplined and avoid trying to time the market.

9. Unleash compounding

Compounding is a powerful investment strategy, and I can’t stress it enough. It involves reinvesting profits to grow one’s wealth over time. I’ve seen firsthand how this approach can lead to impressive long-term returns.

Here’s why compounding is so effective:

- It multiplies your gains year after year

- Small initial investments can grow into large sums

- Time is your ally – the longer you compound, the more you earn

To maximize compounding, I recommend combining it with dollar-cost averaging. This means investing a fixed amount regularly, regardless of market conditions. It’s a smart way to build wealth steadily.

Warren Buffett is a prime example of compounding success. He bought Berkshire Hathaway shares in the 1960s and kept reinvesting. Now he’s one of the richest people alive! But you don’t have to be Buffett to benefit from compounding.

Even as a small investor, I can use this strategy.

I simply:

- Choose solid, dividend-paying stocks

- Reinvest all dividends automatically

- Add new money to my investments regularly

- Stay patient and let time work its magic

Remember, compounding works best over long periods. Start early, stay consistent, and watch your wealth grow. It’s a simple yet powerful way to build a strong financial future.

10. Managing a Buy-and-Hold Portfolio

Managing a buy-and-hold portfolio is easier with the right tools. Stock Rover is one such tool that can help investors like me keep track of their investments. It lets me see how my stocks are doing in real time and compare them to market benchmarks.

Stock Rover connects to my brokerage account and looks at my portfolio. It helps me find new stocks to buy by screening different types of assets. This is great for value, income, and growth investors who want to pick stocks that fit their goals.

Some key features I like about Stock Rover are:

- Portfolio correlation and balancing

- Screening for dividends, value, and growth stocks

- Detailed charts and tables

- Performance forecasts

These tools help me manage risk and identify new investment opportunities. They also make it simple to monitor my stocks’ revenue, cash flow, and market share.

FAQ

How does a buy-and-hold strategy work?

I pick companies that have done well for a long time. To lower my risk, I spread my money across different types of stocks. I also check on my stocks periodically and make small changes if needed. This way, I aim for steady growth with fewer ups and downs than if I traded a lot.

Is a buy-and-hold strategy risk-free?

No, there’s always some risk when I invest. Stock prices can fluctuate greatly. However, if I hold on to stocks for at least ten years, I can usually avoid big problems caused by short-term changes.

What’s the minimum recommended time horizon for a buy-and-hold strategy?

I think it’s best to plan on keeping stocks for at least ten years. In the past thirty years, stocks in theUSS have grown by an average of about 10.5% each year.

Can all types of stocks be used in a buy-and-hold strategy?

I can hold any stock, but I prefer big, stable companies for the long term. I avoid very cheap stocks or ones that aren’t on the main stock markets.

Is diversification important for a buy-and-hold strategy?

Yes, I think it’s very important to spread my money around. I might buy stocks, bonds, and mutual funds. This way, if one part of the market does poorly, I don’t lose all my money. I might also invest in things from other countries to give myself even more chances to grow my money over time.