Automated trading has revolutionized the stock market. Computer algorithms now handle many trades without constant human oversight. These smart programs crunch market data and make lightning-fast decisions based on rules set by traders.

The technology frees up investors from watching price tickers all day. Top platforms like TrendSpider, Trade Ideas, and TradingView offer auto-trading bots that can spot patterns and execute trades automatically. I’ve tested hundreds of automation features and found these to be the most robust options for hands-off investing. They provide essential tools like backtesting to refine strategies before risking real money.

Leading Automated Trading Platforms Summary

I’ve found several top automated trading platforms worth considering.

- TrendSpider offers full automation for analysis and backtesting.

- Trade Ideas uses AI algorithms for automated trading.

- TradingView provides auto pattern recognition and signals.

My Top 3 Picks for Automated Trading

My three standout platforms for automated trading are:

- TrendSpider – Offers a full suite of automated features

- Trade Ideas – Provides a black box auto-trading solution

- TradingView – Combines automation with a global trading community

Each platform has unique strengths to suit different trading styles and needs. I recommend exploring these options to find the best fit for your automated trading goals.

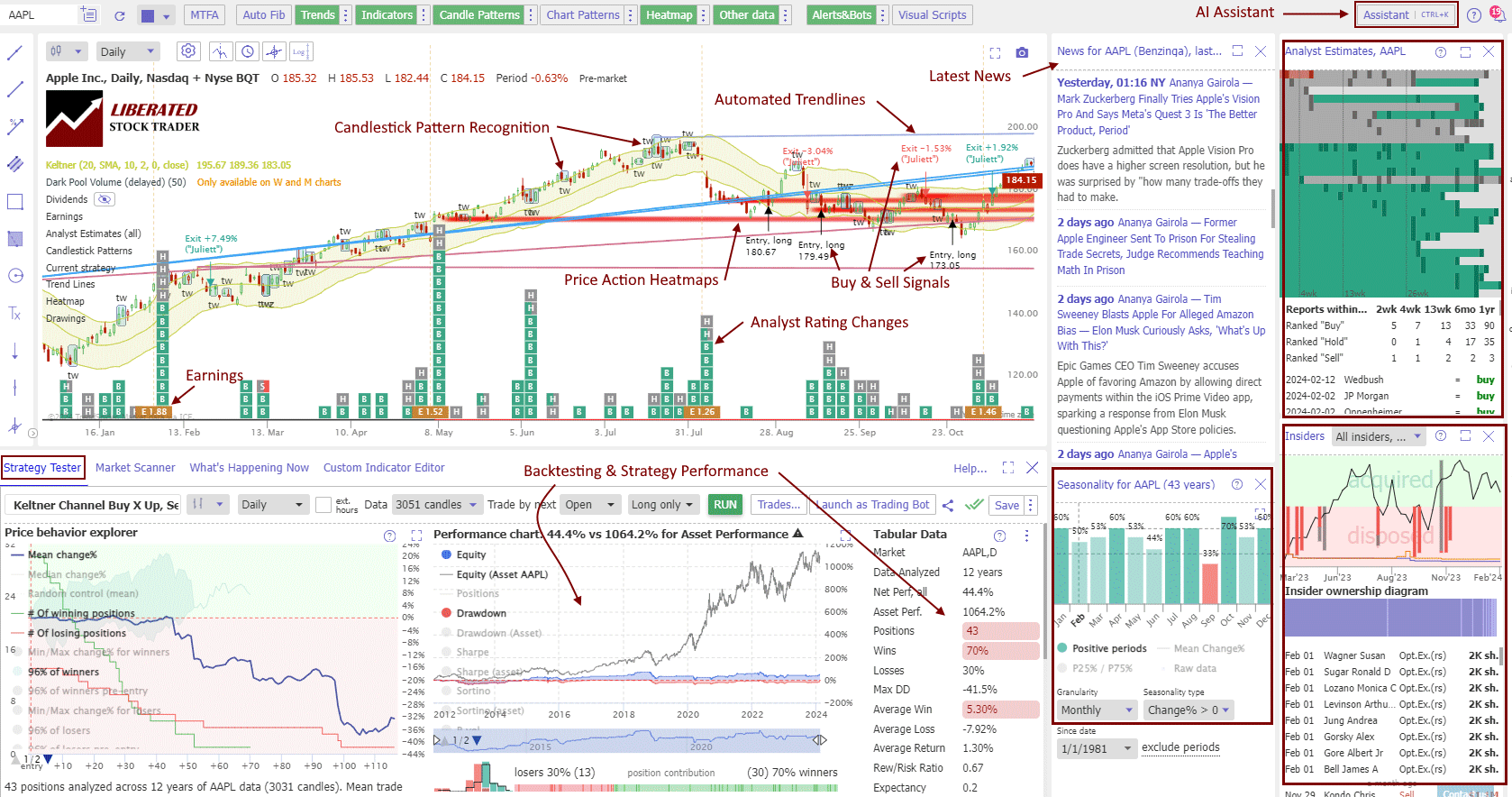

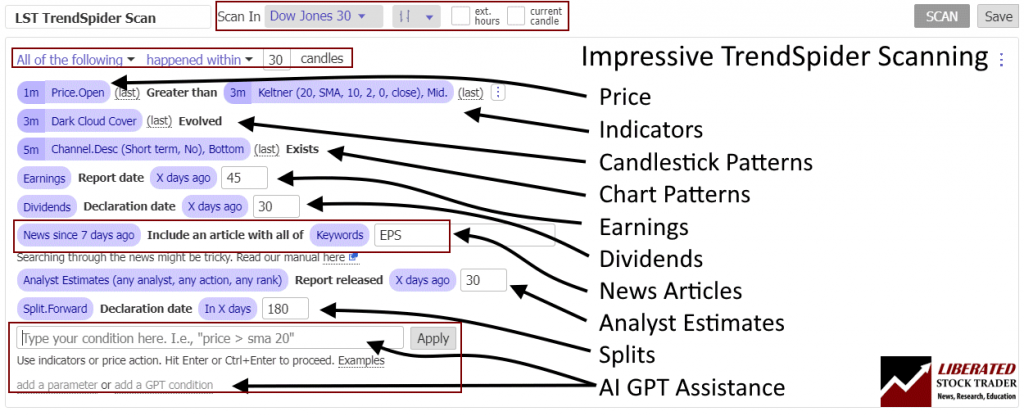

1. TrendSpider

TrendSpider is a top-notch automated trading platform. I have conducted thousands of backtests and countless hours of strategy development using TrendSpider. For me, it is the best.

It stands out for its ability to scan markets, backtest strategies, spot chart patterns, analyze trendlines, and execute trades automatically.

TrendSpider Rating: 4.8/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Backtesting: ★★★★★ |

| Trading: ★★★★✩ | Pattern Recognition: ★★★★★ |

| Scanning: ★★★★★ | Candlestick Recognition: ★★★★★ |

| Charts & Analysis: ★★★★★ | Usability: ★★★★★ |

| Features | Rating ★★★★★ |

|---|---|

| Buy/Sell Signals | ✅ |

| Automatic Trade Execution | ✅ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ✅ |

| Backtesting | ✅ |

| Code-Free Backtesting | ✅ |

| Auto-Trading Bots | ✅ |

| Markets Covered | USA |

| Assets | Stocks, Fx, Crypto, ETFs |

| Free Trial | ✅ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Price | From $54/mo |

| Discount Available | Use Code “LST30” for -30% on monthly or -63% off annual plans |

TrendSpider’s auto-pattern recognition is a game-changer. It saves me time and often beats human analysis in accuracy. The software can find profitable patterns like Inverse Head and Shoulders, giving me an edge in the market.

One of TrendSpider’s unique features is its trendline detection across multiple timeframes, all visible on a single chart. It can also spot and trade over 123 candlestick patterns automatically.

✂ Save 30% on TrendSpider, the Leader in AI Trading ✂

Use Code “LST30”

I’m particularly impressed with the “Strategy Tester” feature. It’s a code-free backtesting tool that lets me create detailed trading strategies without needing programming skills. I’ve used it to test indicators, charts, and candle patterns to check their profitability.

TrendSpider also offers automated trade execution through its “Alerts & Bots” system. I can link it to my broker’s API, allowing for automatic buying and selling based on my tested strategies.

Unlike anything I have seen before, TrendSpider employs artificial intelligence to detect trends not seen by humans. I have met Dan and his team, and I can assure you this platform is the most innovative in the industry, led by a man with great integrity.

The platform works with US stocks and crypto exchanges, making it a solid choice for automated trading in these markets.

Its scanning capabilities are incredible, from news scanning to analyst ratings changes, it has it all.

As a certified market analyst, I use TrendSpider for my trading research. Its AI-powered tools help me spot and test chart patterns and indicators for reliability and profit potential.

Key features I find useful:

- AI-driven chart analysis

- Quick, point-and-click backtesting

- Ability to turn tested strategies into trading bots

My TrendSpider review shows that it removes the guesswork from trading strategies. Instead of wondering if a strategy works, I can test it and know for sure.

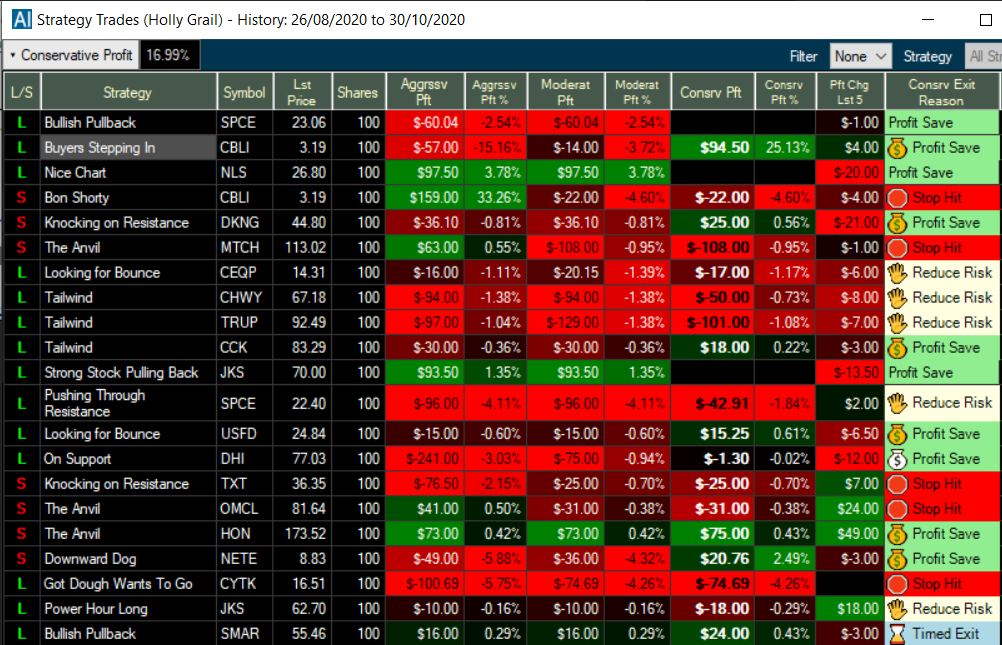

2. Trade Ideas

Trade Ideas stands out as a cutting-edge automated trading platform that I’ve found incredibly useful for generating high-probability trade opportunities. The platform’s AI-driven algorithms, particularly Holly AI, are impressive. I’ve seen Holly scan thousands of stocks in real time, analyzing hundreds of variables to find potential market edges.

Here’s a quick overview of Trade Ideas’ key features:

Trade Ideas Rating: 4.7/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Backtesting: ★★★★✩ |

| Trading: ★★★★★ | Pattern Recognition: ★★★★★ |

| Scanning: ★★★★✩ | Candlestick Recognition: ★★★★★ |

| Charts & Analysis: ★★★★★ | Usability: ★★★★✩ |

| Features | Rating ★★★★★ |

|---|---|

| Buy/Sell Signals | ✅ |

| Automatic Trade Execution | ✅ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ✅ |

| Backtesting | ✅ |

| Code-Free Backtesting | ✅ |

| Auto-Trading Bots | ✅ |

| Markets Covered | USA |

| Assets | Stocks |

| Free Trial | ✅ |

| Community & Chat | ❌ |

| OS | Web Browser, Windows |

| Discount Available | -15% Discount Link: Use Code “LIBERATED” |

✂ Trade Ideas Year-Round Discount ✂

Save 15% Now

Use the code “LIBERATED” to save 15% on Trade Ideas.

Get Trade Ideas With Code “LIBERATED”

I’ve noticed that Trade Ideas focuses on US markets and offers a 15% discount with the code “LIBERATED”.

One aspect I really like is the platform’s broker integration. It allows me to automate and execute trading strategies without manually entering each trade. Trade Ideas connects with Interactive Brokers, Etrade, and Esignal for stock trading. The Brokerage Plus feature, available in the Standard and Premium plans, lets me auto-execute alert window scans in a sandbox or live with my brokerage.

The primary advantage of Trade Ideas’ Holly AI algorithms lies in their powerful capabilities for day traders. The Pro AI system features three distinct AI bots: Holly, Holly 2.0, and Holly Neo. These bots embody the most cutting-edge trading AI solutions available to retail investors today.

I’ve found the pre-built strategies for market scanning to be quite extensive. The automated trading functionality makes implementing these strategies straightforward. It’s worth noting that Trade Ideas is a black-box solution, which might not suit traders looking to create unique strategies from scratch.

I’ve been impressed by Holly AI’s performance track record. It averages about 25% per year on its stock picks, which I find quite remarkable.

In my experience, Trade Ideas offers a powerful set of tools for traders looking to leverage AI and automation in their trading strategies. Its real-time scanning and backtesting capabilities have helped me identify promising trade ideas more efficiently than I could on my own. For further details, dive into my Trade Ideas review.

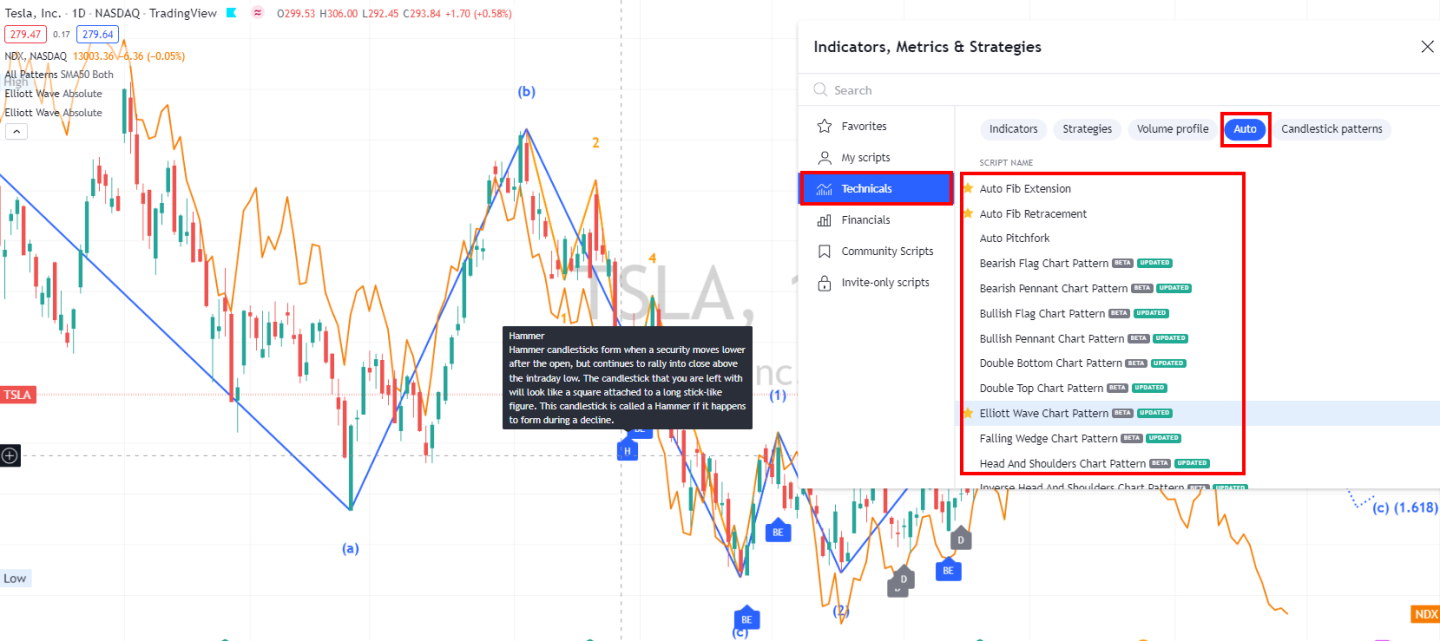

3. TradingView

TradingView is my go-to platform for stock, forex, and crypto trading. It’s packed with features that make analysis and trading easier and more efficient.

One of the standout features is the automatic pattern recognition. TradingView scans entire markets to spot chart patterns like double tops and rectangles. It also identifies bullish and bearish candle patterns such as Harami, Doji, and Marubozu. This saves me tons of time in my analysis.

Here’s a quick rundown of TradingView’s key features:

TradingView Rating: 4.7/5.0

| Pricing: ★★★★★ | News & Social: ★★★★★ |

| Software: ★★★★★ | Backtesting: ★★★★✩ |

| Trading: ★★★★✩ | Pattern Recognition: ★★★★✩ |

| Scanning: ★★★★✩ | Candlestick Recognition: ★★★★★ |

| Charts & Analysis: ★★★★★ | Usability: ★★★★★ |

| Features | Rating ★★★★★ |

|---|---|

| Buy/Sell Signals | ✅ |

| Automatic Trade Execution | ✅ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ✅ |

| Backtesting | ✅ |

| Code-Free Backtesting | ❌ |

| Auto-Trading Bots | ✅ |

| Markets Covered | Global, USA, India, Europe, Asia |

| Assets | Stocks, Crypto, Fx, ETFs, Futures |

| Free Trial | ✅ |

| Community & Chat | ✅ |

| OS | Web Browser, Windows |

| Price/Month | From $12.95 |

| Discount Available | $15 Discount & 16% Annual Plan Discount |

✂ Save 16% With a TradingView Annual Subscription ✂

TradingView offers powerful backtesting tools. I can set up complex trading scenarios and get actionable alerts. The catch? I need to learn some basic Pine scripting to use it. There’s no code-free option for backtesting or creating indicators./im

I’ve used TradingView to develop my own trading systems. It helps me spot potential market downturns and good buying opportunities.

Testing the TradingView stock screener reveals its exceptional ability to filter and analyze technical indicators. It offers real-time scanning across 172 metrics, which includes 42 financial filters. Additionally, TradingView’s stock screener features a valuable scan for technical buy and sell ratings.

With access to the Federal Reserve database, TradingView boasts a wealth of economic data, including Federal Funds Rates and World Economic Growth figures.

The screening watchlists on TradingView organize fundamental data into categories such as Performance, Valuation, Dividends, Margin, Income Statement, and Balance Sheet. One of its standout features is the ability to chart economic indicators, allowing for comparisons like the civilian unemployment rate against company profit growth. Users can also set the screening watchlist and filters to refresh every minute for up-to-date information.

A big plus is TradingView’s wide range of integrated brokers. No matter where I live, I can find a trusted broker to execute trades automatically.

TradingView boasts the largest community of traders worldwide. It’s the top investing website globally, covering stocks, ETFs, forex, and crypto exchanges. For me, it’s a top choice for all my trading needs. For more insight, dive into my TradingView review.

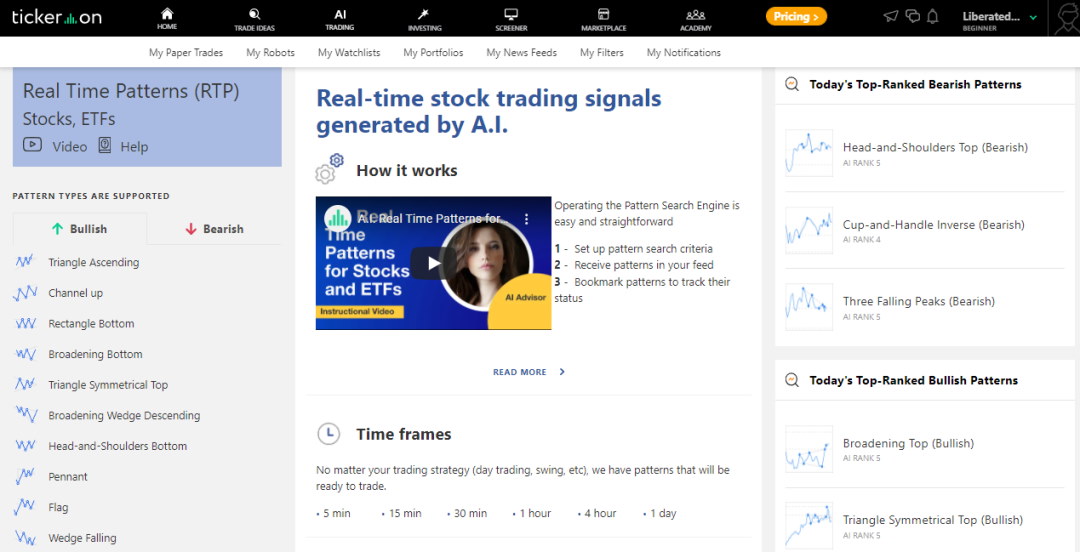

4. Tickeron

I’ve found Tickeron to be a standout platform for AI-powered stock analysis. It offers chart pattern recognition for stocks, ETFs, forex, and cryptocurrencies. What sets it apart is its use of AI to predict market trends with confidence levels.

Tickeron Rating: 4.4/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Backtesting: ★★★✩✩ |

| Trading: ★★★★✩ | Pattern Recognition: ★★★★✩ |

| Scanning: ★★★★★ | Candlestick Recognition: ★★★★✩ |

| Charts & Analysis: ★★★★✩ | Usability: ★★★★★ |

| Features | Rating ★★★★☆ |

|---|---|

| Buy/Sell Signals | ✅ |

| Automatic Trade Execution | ❌ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ❌ |

| Backtesting | ✅ |

| Code-Free Backtesting | ❌ |

| Markets Covered | USA |

| Assets | Stocks, ETFs, forex, and cryptocurrencies |

| Free Trial | ❌ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Price/Month | $125 |

| Discount Available | Get -50% off annual plans |

Tickeron’s features include:

- Buy/sell signals

- Trendline recognition

- Chart pattern recognition

- Backtesting tools

The platform covers US markets and currently offers a 50% discount on all annual plans.

One of Tickeron’s key strengths is its AI Confidence Level. This tool looks at past stock data, pattern success rates, and market direction to give a confidence score for trade predictions. I find this really useful for making more informed decisions.

I like how Tickeron mixes AI analysis with human insights. This lets me compare what the machines think with what people say. It’s great for different trading styles, such as day trading, swing trading, or long-term investing.

A standout feature of Tickeron is its capability to compare forecasts from the AI prediction engine with community predictions. The image above reveals that 58% of the community anticipates an increase in Bank of America’s stock price. This intriguing insight piques my interest, and I eagerly await Tickeron’s research on the accuracy of human predictions compared to artificial intelligence algorithms.

While my Tickeron review shows it offers many strong features, it doesn’t have candlestick recognition or code-free backtesting. It also lacks automatic trade execution, which might be a drawback for some traders.

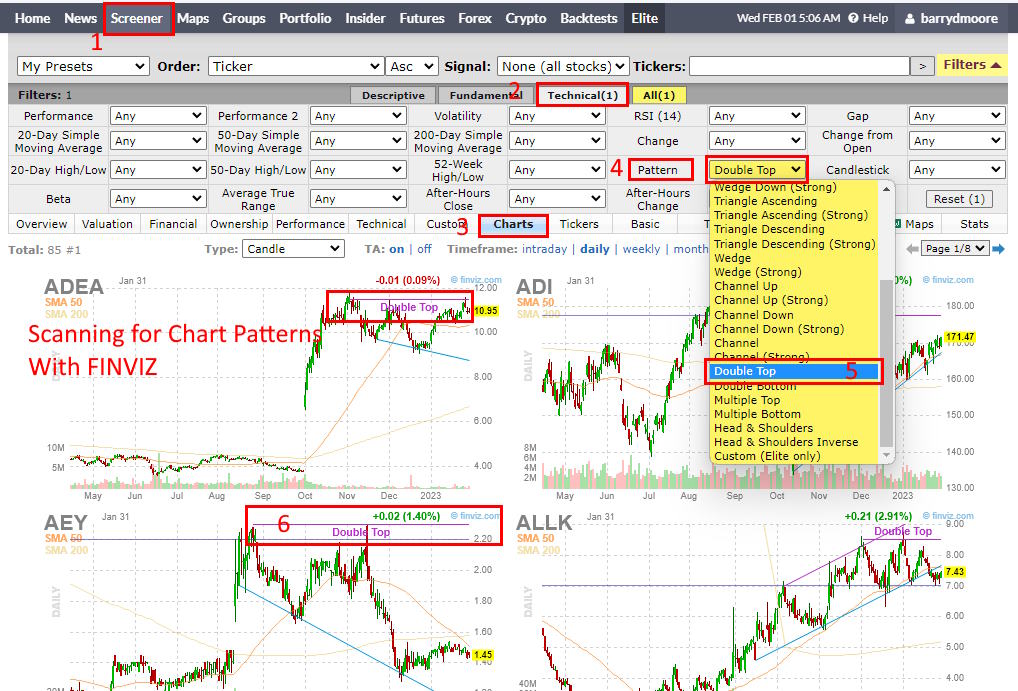

5. Finviz

Finviz is a powerful tool I’ve found invaluable for stock analysis and trading. It offers automated candlestick and trendline recognition for all US stocks, saving me countless hours of manual chart analysis.

I love how Finviz lets me scan for 10 major candlestick patterns and 30 stock chart patterns with just a few clicks. This blend of technical and fundamental screening makes it perfect for my short and medium-term investing strategies.

Here’s a quick overview of Finviz’s key features:

Finviz Rating: 4.4/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★✩ | Backtesting: ★★★★✩ |

| Trading: ★★★✩✩ | Pattern Recognition: ★★★★✩ |

| Scanning: ★★★★✩ | Candlestick Recognition: ★★★★✩ |

| Charts & Analysis: ★★★★✩ | Usability: ★★★★★ |

| Features | Rating ★★★★✩ |

|---|---|

| Buy/Sell Signals | ❌ |

| Automatic Trade Execution | ❌ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ✅ |

| Backtesting | ✅ With Elite |

| Code-Free Backtesting | ❌ |

| Auto-Trading Bots | ❌ |

| Markets Covered | USA |

| Assets | Stocks, ETFs |

| Free Trial | ✅ |

| Community & Chat | ✅ |

| OS | Web Browser, Windows |

| Price/Month | $25 |

| Discount Available | 40% Off with Annual Plan |

Finviz’s stock, forex, and crypto heat maps are game-changers. They give me a bird’s-eye view of market action in seconds. The backtester is another standout feature. With over 100 indicators and built-in chart pattern recognition, I can create and test trading systems without any coding skills.

The Finviz screener enables quick filtering of over 8,500 major stocks and ETFs. It’s important to note that this selection represents only prominent stocks, as there are more than 10,000 stocks available in the USA alone.

This stock screener is exceptionally efficient, allowing users to apply filters based on 67 fundamental and technical criteria. You can refine your search using specific chart-based signals, including new highs and lows, oversold conditions, analyst upgrades, insider buying, or even chart patterns like double tops and head-and-shoulders.

While it’s not perfect, it offers solid value, especially with the 40% discount on annual plans.

6. VectorVest

VectorVest is a powerful stock analysis tool that I’ve found helpful for automated investing. It uses complex algorithms to rate stocks on value, safety, and timing, and I appreciate how it saves me hours of manual research.

The software provides buy/sell signals and stop-loss recommendations for stocks. While VectorVest claims to be unique in offering these signals, I’ve noticed other platforms like Trade Ideas and MetaStock have similar features.

Here’s a quick overview of VectorVest’s key features:

VectorVest Rating: 4.1/5.0

| Pricing: ★★★✩✩ | News & Social: ★★✩✩✩ |

| Software: ★★★★✩ | Backtesting: ★★★✩✩ |

| Trading: ★★★★✩ | Pattern Recognition: ★★★✩✩ |

| Scanning: ★★★✩✩ | Candlestick Recognition: ★★★✩✩ |

| Charts & Analysis: ★★★★✩ | Usability: ★★★★★ |

| Features | Rating ★★★★★ |

|---|---|

| Buy/Sell Signals | ❌ |

| Automatic Trade Execution | ✅ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ✅ |

| Backtesting | ✅ |

| Code-Free Backtesting | ❌ |

| Auto-Trading Bots | ✅ |

| Markets Covered | USA |

| Assets | Stocks, Crypto, Fx, ETFs, Futures |

| Free Trial | ✅ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Discount Available | 1st Month $0.99 |

VectorVest’s market timing signals are a standout feature. They use historical data and technical indicators to suggest optimal times to buy or sell stocks. I find this automated insight into market trends very valuable.

The premium package is pricey, but it can be worth it for large investments. I’ve found the time savings and analytical power justify the cost for my needs.

VectorVest’s rating system is straightforward: The VectorVest Engine checks out over 16,000 stocks every day and gives you an easy buy, sell, or hold rating for each one. It’s a handy tool that helps you know the right time to buy low and sell high!

This makes it easy for me to quickly assess stocks at a glance. While it’s a solid tool, I always recommend comparing it with other sources before making investment decisions.

Table: Features Comparison

I’ve compiled a comprehensive table comparing key features of popular automated trading platforms. This comparison will help traders understand each platform’s strengths and capabilities.

| Features | TrendSpider | Trade Ideas | TradingView | Tickeron | Finviz | Vectorvest |

|---|---|---|---|---|---|---|

| Buy/Sell Signals | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ |

| Trendline Recognition | ✅ | ✅ | ❌ | ✅ | ✅ | ❌ |

| Chart Pattern Recognition | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ |

| Candlestick Recognition | ✅ | ✅ | ✅ | ❌ | ✅ | ❌ |

| Backtesting | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Code-Free Backtesting | ✅ | ❌ | ❌ | ❌ | ✅ | ❌ |

| Auto-Trade Execution | ✅ | ✅ | ✅ | ❌ | ❌ | ✅ |

| Broker Integration | ✅ | ✅ | ✅ | ❌ | ❌ | ✅ |

| Portfolio Management | ❌ | ❌ | ❌ | ✅ | ❌ | ✅ |

FAQ

Which automated trading software is the best?

I’ve found that TrendSpider stands out as the best automated trading software. It offers a complete package with pattern recognition, strong code-free scanning, backtesting, and auto-trade execution. In my tests, it ticked every box.

What automated trading tools are best for international traders?

For international investors, I recommend TradingView. It provides extensive automation and integrates with brokers in most countries. Plus, it has a global community of traders, which is a big plus for those looking to connect with others worldwide.

What is the best automated day trading platform?

Trade Ideas takes the top spot for automated day trading. It gives you trading signals powered by institutional-grade AI and allows commission-free auto trading through its Holly AI Bot. While it comes at a cost, serious day traders will find it worth the investment.

Who has the best trading bot?

Based on its audited performance track record, Trade Ideas appears to have the most effective trading bot. Their website indicates an average annual profit of 23-25 percent, which is commendable in the realm of automated trading.