Algorithmic trading allows traders to create and execute automated strategies with remarkable speed and accuracy. By leveraging data analysis and historical patterns, algorithms can perform trades far faster than humans.

My testing shows that TrendSpider, Trade Ideas, TradingView, and Ticker are the top algorithm trading tools. Each offers unique features for designing, testing, and implementing trading models tailored to your needs and goals.

As markets become more complex, algorithmic trading software is increasingly essential for both individuals and institutional traders who want to gain an advantage.

My Verdict on Algo Trading Tools

TrendSpider offers a point-and-click interface and AI assistance for creating, testing, and running trading algorithms. It’s perfect for traders without coding knowledge.

Trade Ideas is a top choice for pre-built algorithmic solutions. Its ready-to-use strategies provide rapid signals for day traders.

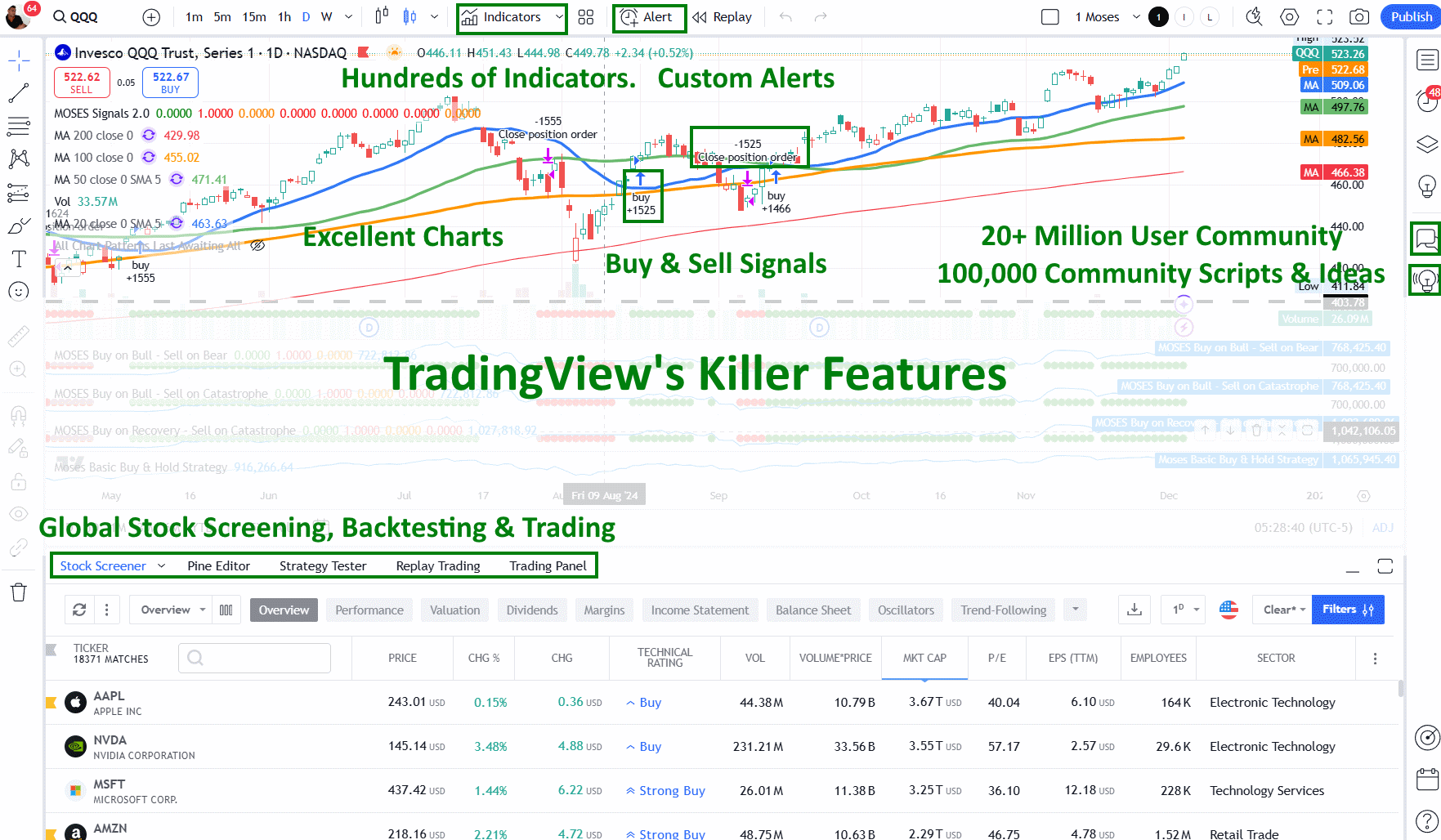

TradingView’s tools allow users to create algorithms for all assets and markets globally, but you will need to learn Pine script coding.

Tickeron impresses with its vast library of tested and community-uploaded trading algorithms. Users can choose from hundreds of strategies.

When choosing algo trading software, I consider factors like ease of use, customization options, and support quality. It’s crucial to pick a platform that aligns with your trading goals and technical skills.

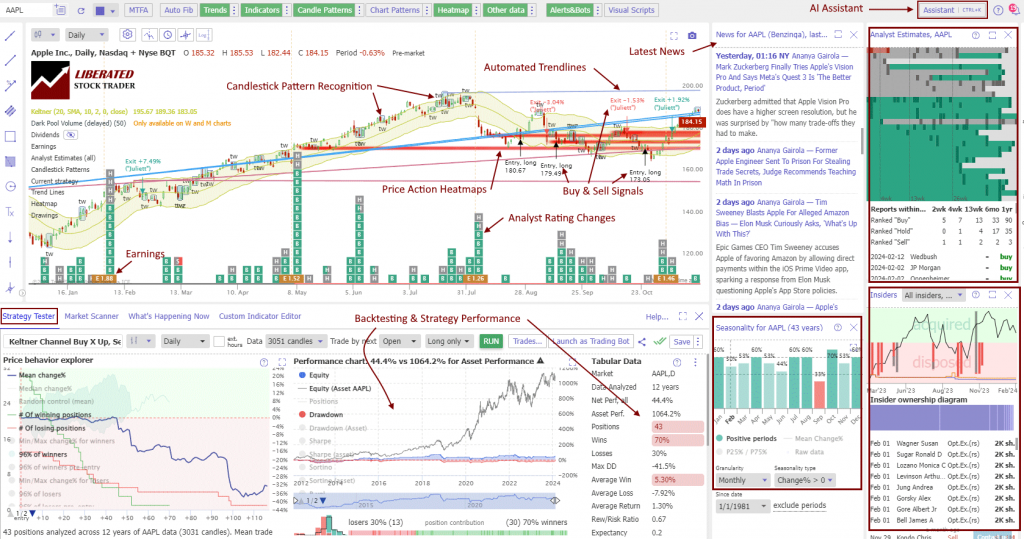

1. TrendSpider: Winner Best Algo Tool Overall

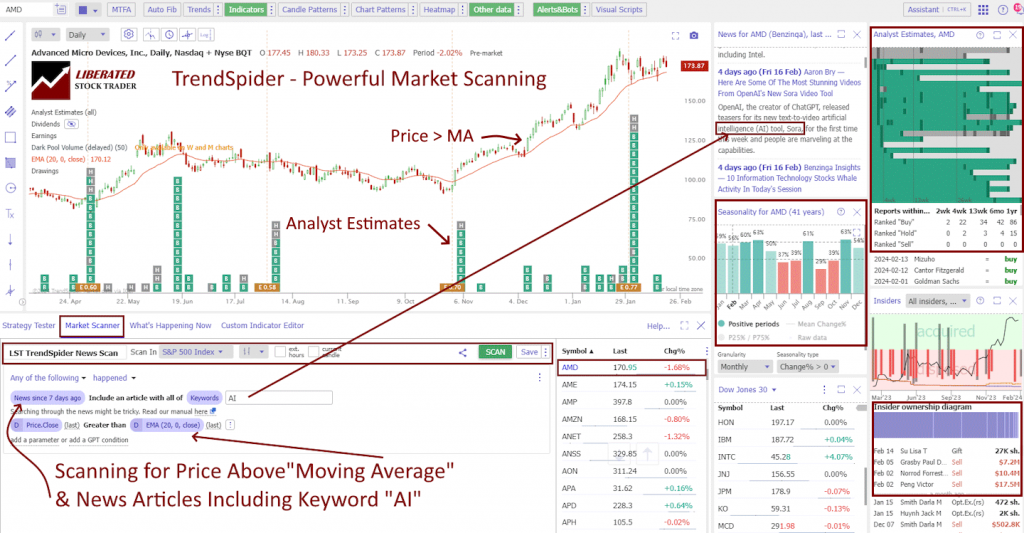

TrendSpider is a great algorithmic trading platform. It offers a blend of powerful features that cater to both beginners and seasoned traders. Its comprehensive technical analysis tools are impressive, especially the automated trendline detection and multi-timeframe analysis capabilities.

TrendSpider Rating: 4.8/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Backtesting: ★★★★★ |

| Trading: ★★★★✩ | Pattern Recognition: ★★★★★ |

| Scanning: ★★★★★ | Candlestick Recognition: ★★★★★ |

| Charts & Analysis: ★★★★★ | Usability: ★★★★★ |

| Features | Rating ★★★★★ |

|---|---|

| Buy/Sell Signals | ✅ |

| Automatic Trade Execution | ✅ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ✅ |

| Backtesting | ✅ |

| Code-Free Backtesting | ✅ |

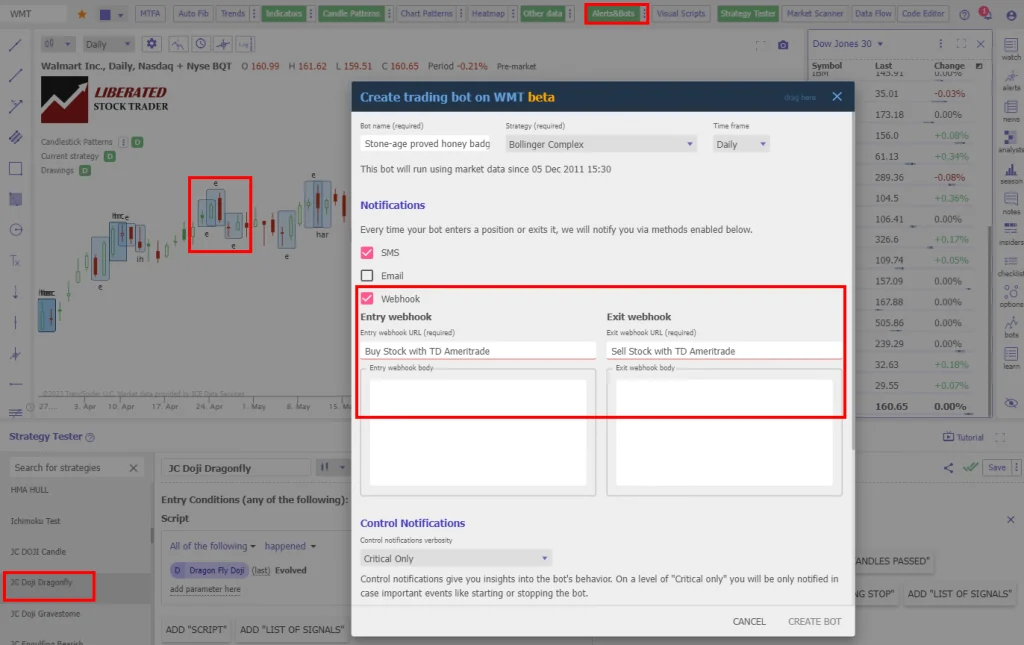

| Auto-Trading Bots | ✅ |

| Markets Covered | USA |

| Assets | Stocks, Fx, Crypto, ETFs |

| Free Trial | ✅ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Price | From $54/mo |

| Discount Available | Use Code “LST30” for -30% on monthly or -63% off annual plans |

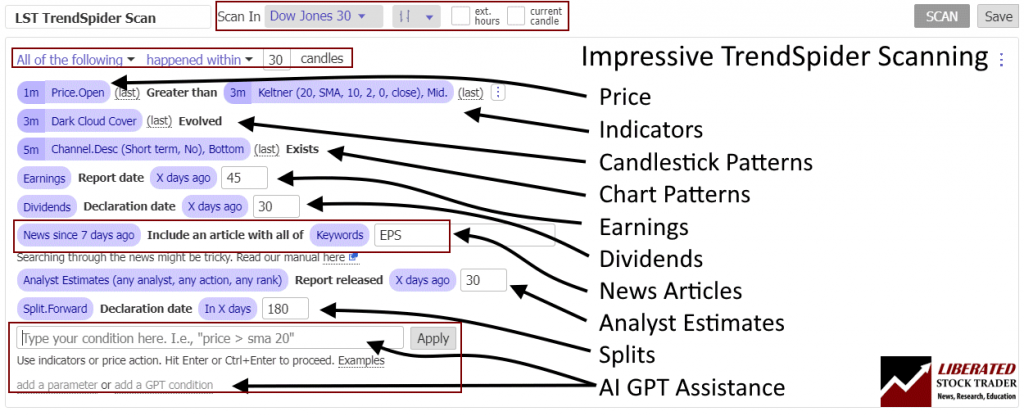

One of TrendSpider’s features is its pattern recognition system. It can identify 150 candlestick patterns and work with 220 chart indicators, all in real time across multiple timeframes.

TrendSpider’s AI assistant has been a game-changer for me. You can type out what I want to test, and it handles the coding. This feature has made it much easier for me to experiment with different strategies without getting bogged down in complex programming.

Here’s a quick breakdown of TrendSpider’s key features:

- Automated trendline and Fibonacci pattern detection

- AI-powered strategy tester

- Real-time data included in all subscriptions

- Support for stocks, ETFs, forex, crypto, indices, and futures

- Integrated backtesting with win rate, profitability, and drawdown analysis

- Personal 1-on-1 training for all customers

I’ve found TrendSpider’s pricing to be competitive, especially considering the wealth of features it offers. At $107 per month or $48 per month with an annual subscription, it provides excellent value for serious traders. Plus, they often run promotional offers, like their current Black Friday sale, which offers significant discounts on both monthly and yearly plans.

TrendSpider’s user interface is intuitive and easy to navigate. Its web-based platform allows me to access it from any device with a browser, which adds to its flexibility.

For those new to the platform, TrendSpider offers a 7-day premium trial for just $9. This gives ample time to explore its features and decide if it’s the right fit. If you decide to subscribe, you can use the code “LST30” for additional discounts on monthly or annual plans.

As a certified market analyst, I’ve found TrendSpider to be an invaluable tool for recognizing and testing chart patterns and indicators for reliability and profitability.

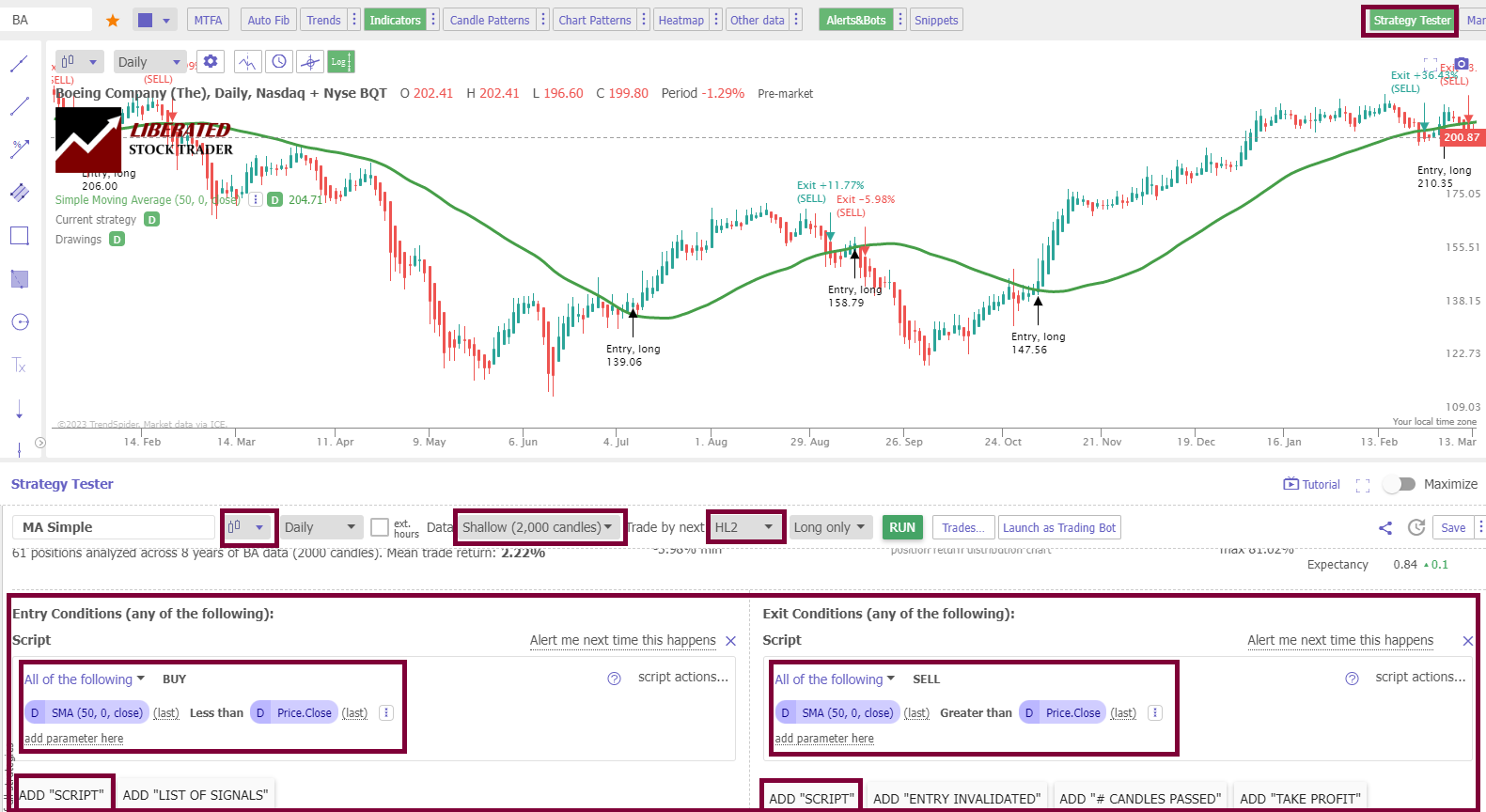

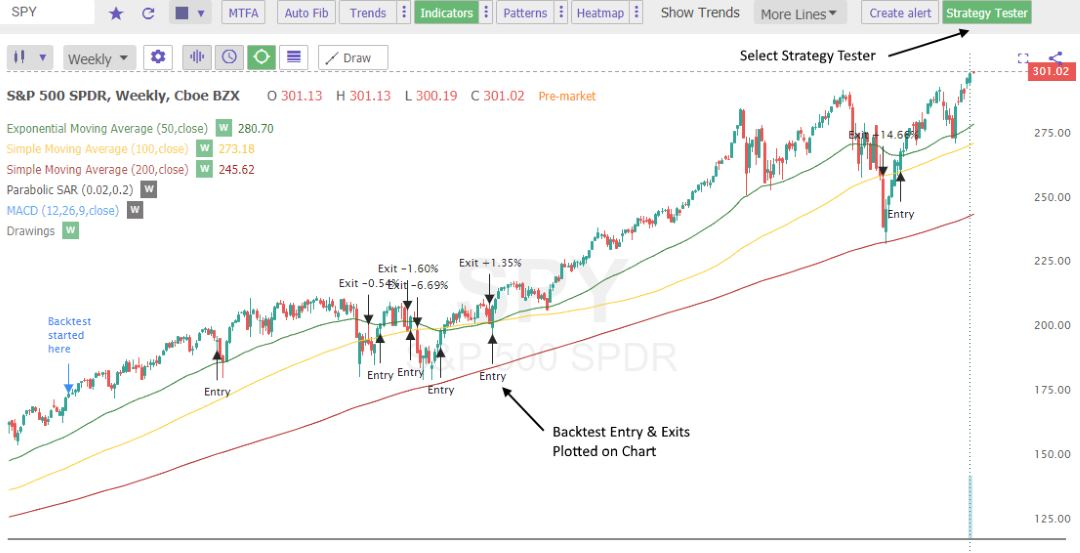

Backtesting

TrendSpider recently released an upgrade to their Strategy Tester, introducing progression tracking data. This new feature allows for even more in-depth analysis of trading strategies over time. While I can’t embed the video directly here, I encourage you to check out TrendSpider’s official channels for a demonstration of this new functionality.

The Strategy Tester’s progression tracking is a strong addition that helps me understand how my strategies perform over different market conditions. It’s not just about the overall win rate or profitability; I can now see how these metrics evolve. This insight is crucial for refining and adapting strategies as market dynamics change.

I’ve found this new feature particularly useful for:

- Identifying strategy decay

- Spotting seasonal patterns in strategy performance

- Understanding how different markets affect my strategies

- Fine-tuning entry and exit points based on historical performance

The progression tracking data is presented in an easy-to-understand visual format, making it simple to spot trends and patterns at a glance. I can quickly see if a strategy that worked well in the past is starting to lose its edge or if it performs better in certain market conditions.

In my trading journey, I’ve learned that having the right tools can make all the difference. TrendSpider’s combination of automated analysis, powerful backtesting, and progression tracking has significantly improved my trading process. It’s not about replacing human decision-making but rather augmenting it with data-driven insights.

Read the full TrendSpider review.

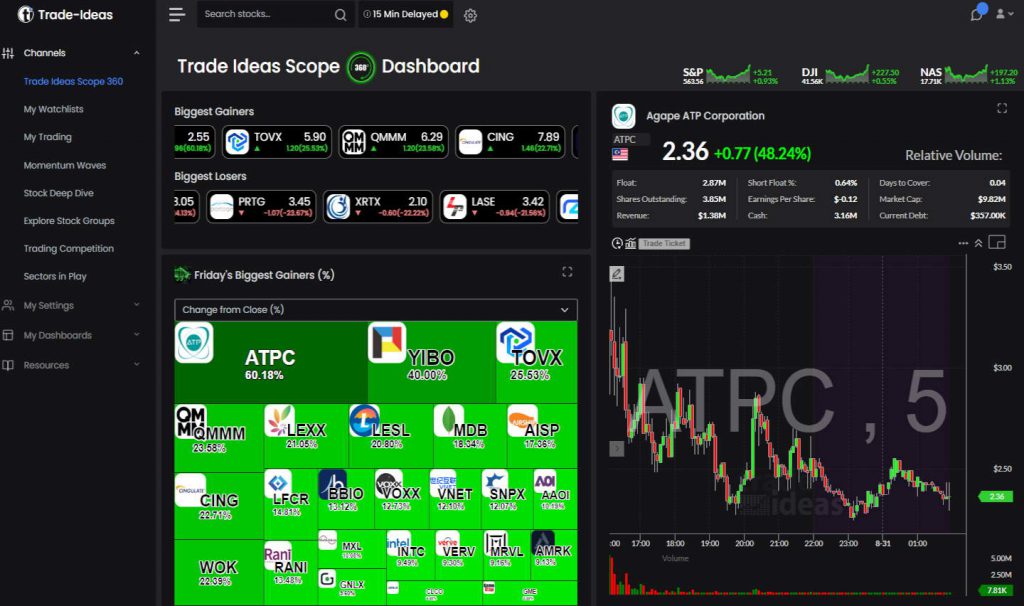

2. Trade Ideas: Best Day Trading Black Box Algo Tool

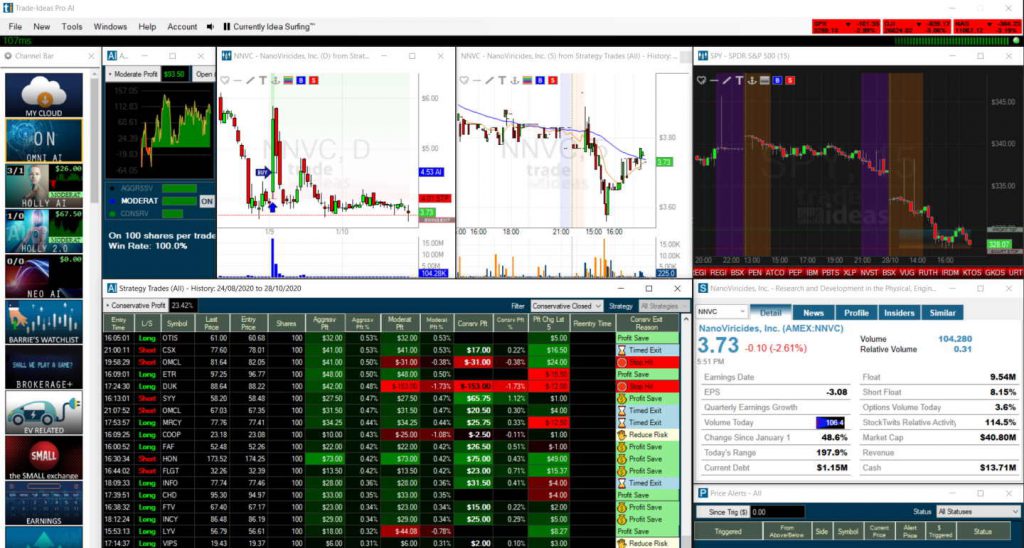

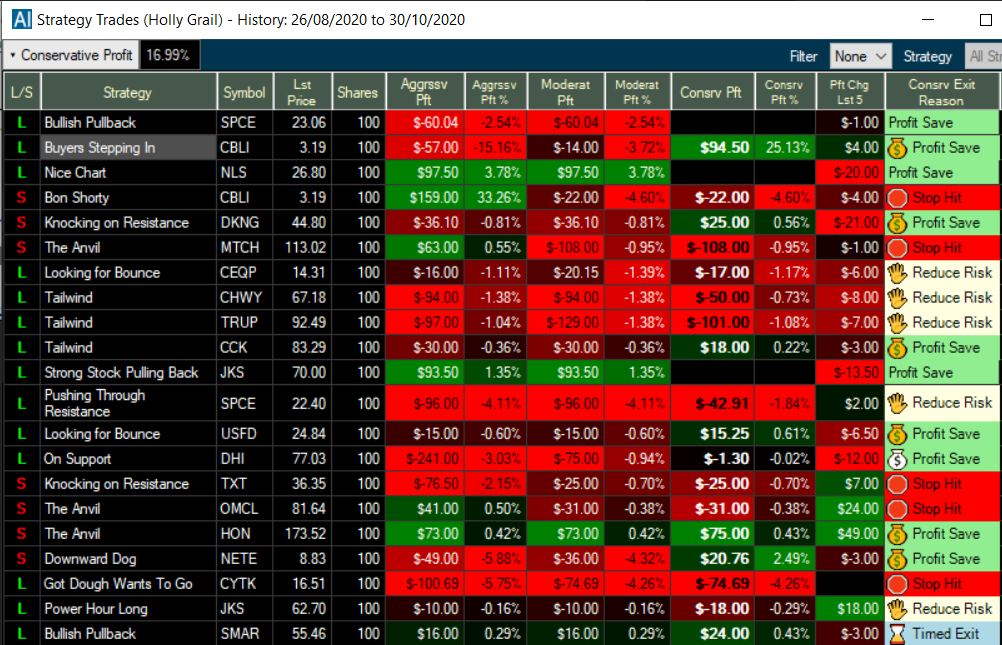

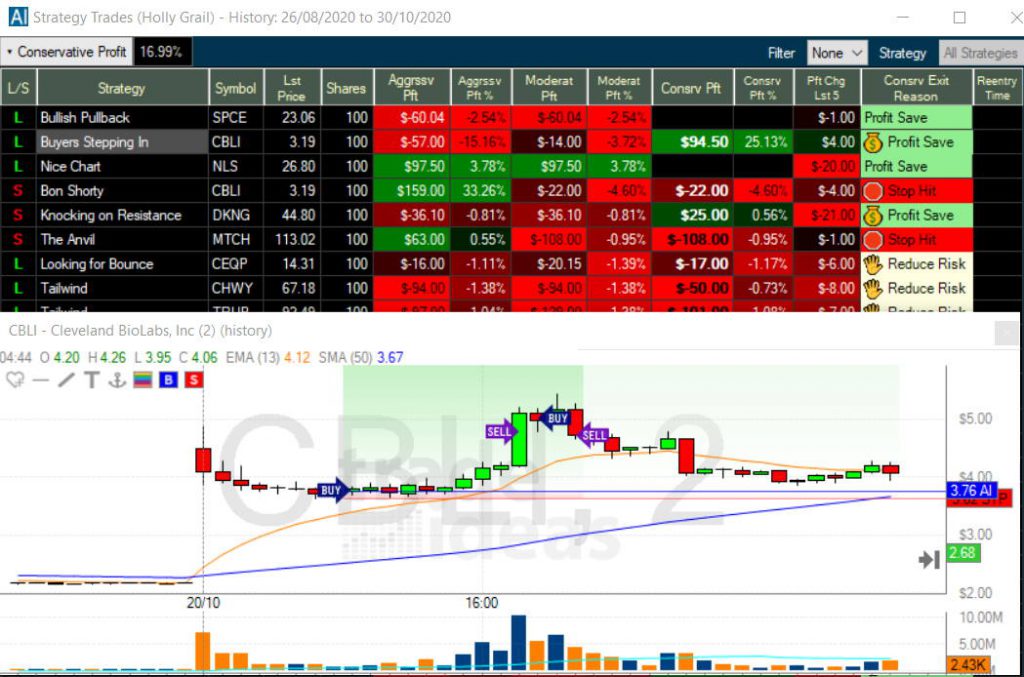

Trade Ideas has developed four effective trading algorithms that I find impressive. The Holly and Money Machine algos scan the market and provide real-time trading signals to users.

Trade Ideas Rating: 4.7/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Backtesting: ★★★★✩ |

| Trading: ★★★★★ | Pattern Recognition: ★★★★★ |

| Scanning: ★★★★✩ | Candlestick Recognition: ★★★★★ |

| Charts & Analysis: ★★★★★ | Usability: ★★★★✩ |

| Features | Rating ★★★★★ |

|---|---|

| Buy/Sell Signals | ✅ |

| Automatic Trade Execution | ✅ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ✅ |

| Backtesting | ✅ |

| Code-Free Backtesting | ✅ |

| Auto-Trading Bots | ✅ |

| Markets Covered | USA |

| Assets | Stocks |

| Free Trial | ✅ |

| Community & Chat | ❌ |

| OS | Web Browser, Windows |

| Discount Available | -15% Discount Link: Use Code “LIBERATED” |

Holly, the original algorithm, analyzes over 8,000 stocks daily using 70 different strategies. It recommends trades with a 60%+ success rate and a 2:1 risk-reward ratio. This conservative approach helps minimize losses while maximizing potential gains.

Holly 2.0 takes a more aggressive stance. It’s designed for active day traders looking for higher returns. In my testing, Holly 2.0 produced the best results of the three algos.

The newest addition, Holly Neo, focuses on real-time chart patterns. It uses four main strategies:

- Pullback Long: Buys stocks during price dips with signs of upward movement

- Breakout Long: Identifies stocks breaking through resistance levels

- Pullback Short: Finds short opportunities during price pullbacks

- Breakdown Short: Spots weakening upward momentum for short positions

Trade Ideas displays buy and sell signals directly on charts. This visual approach makes it easy to spot potential trades, such as a trade for Cleveland Biolabs (CBLI) that made a 25% profit in just 4 hours.

One of the standout features is the ability to automate trades. While Holly’s signals can’t be auto-traded, you can set up automated trading based on custom scans. This works with eTrade and Interactive Brokers accounts.

The Premium and Premium Plus plans include access to Holly and more advanced features. Here’s a quick breakdown:

| Plan | Price (Monthly) | Price (Annual) | Holly Access |

|---|---|---|---|

| Standard | $118 | $999 | No |

| Premium | $228 | $1,999 | Yes |

| Premium Plus | $254 | $2,268 | Yes |

For those ready to sign up, use the discount code “LIBERATED” to save 15% on your subscription.

Trade Ideas is a solid choice for US-based day traders. Its combination of powerful algorithms, real-time signals, and auto-trading capabilities makes it a standout in the algorithm trading software market.

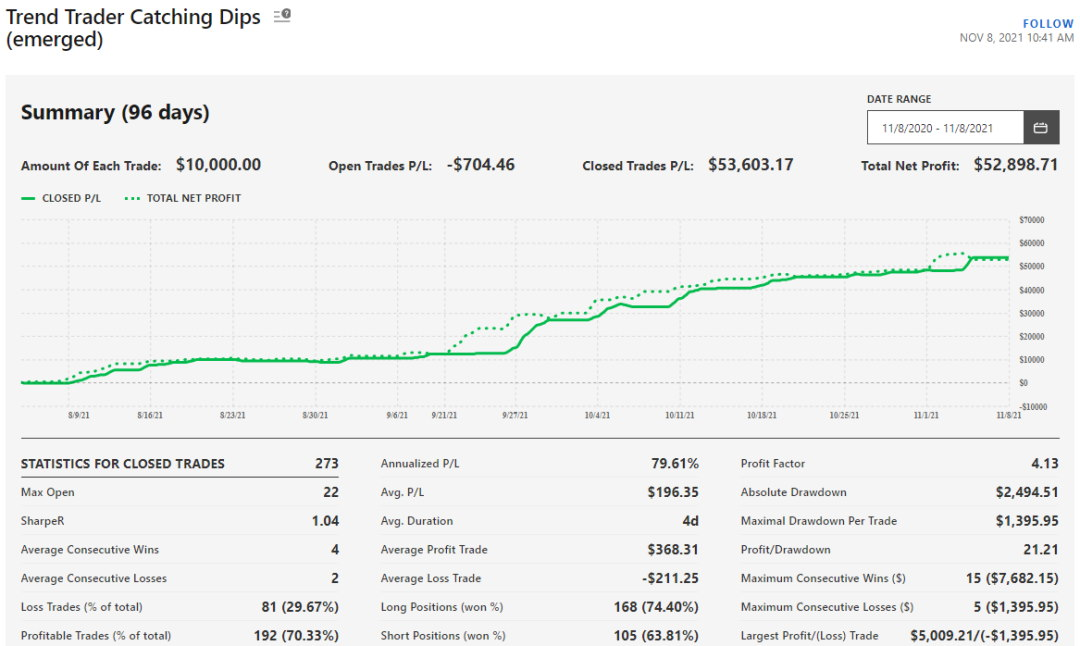

This image shows Holly’s trade history over 65 days. It’s a great way to see the Algo’s performance at a glance.

Trade Ideas works best for active traders who want data-driven insights. The platform’s strength lies in its ability to quickly identify potential trades across thousands of stocks, which can be a game-changer for traders looking to stay ahead in fast-moving markets.

Read the full Trade Ideas review.

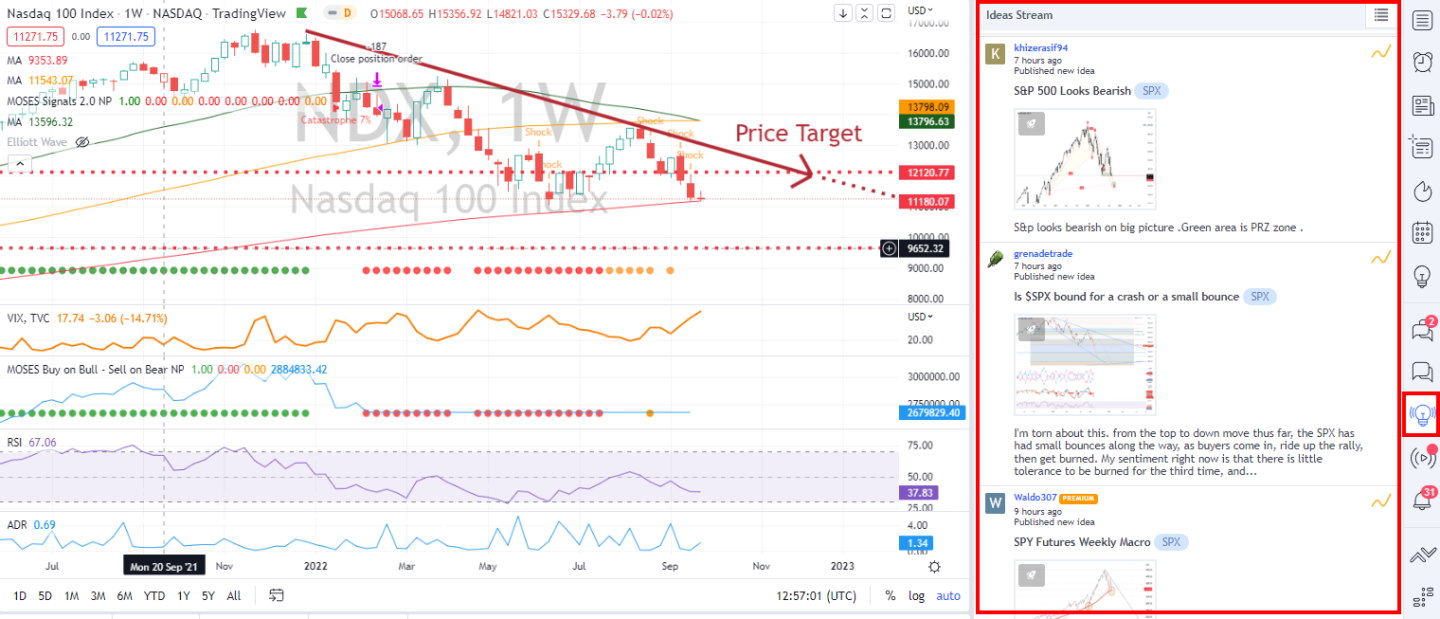

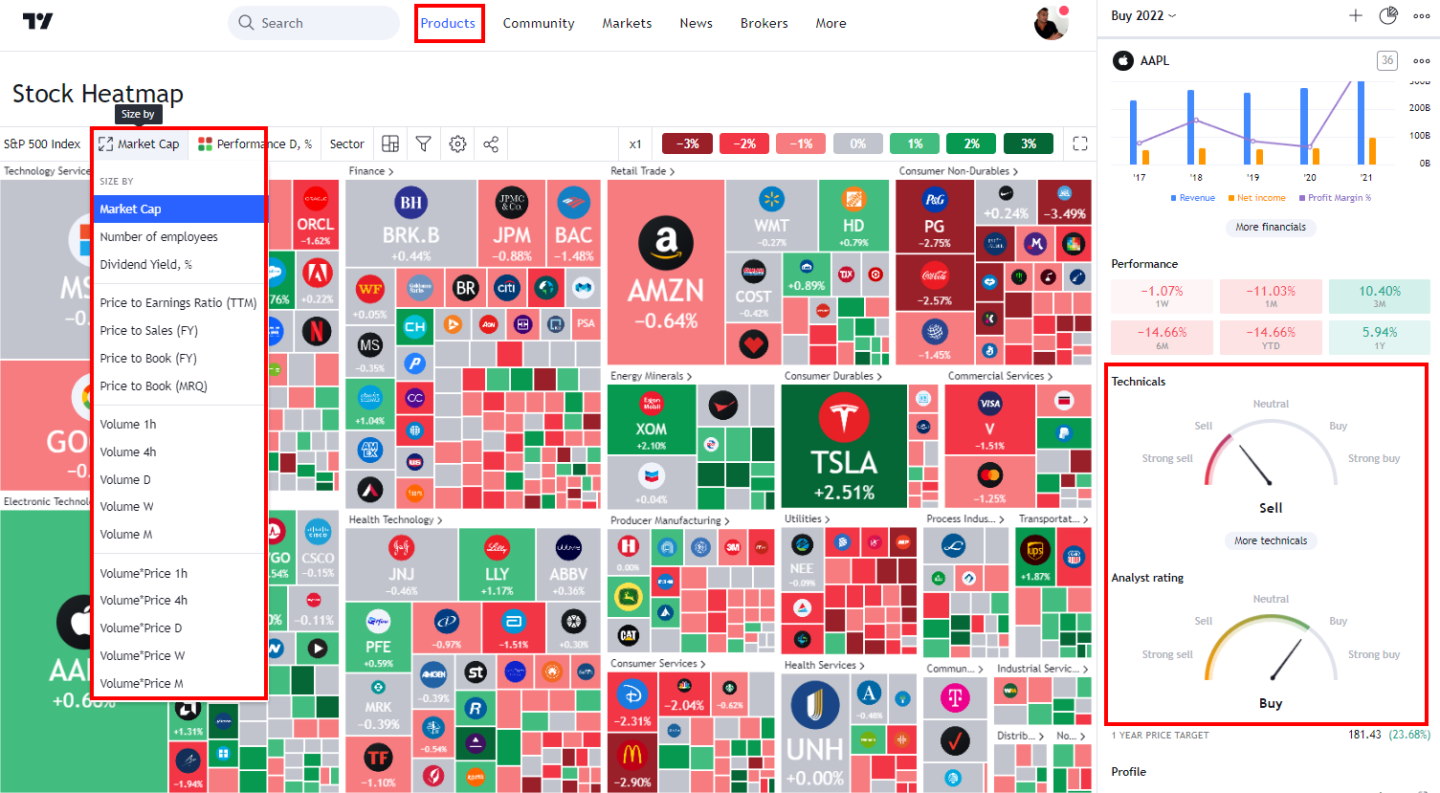

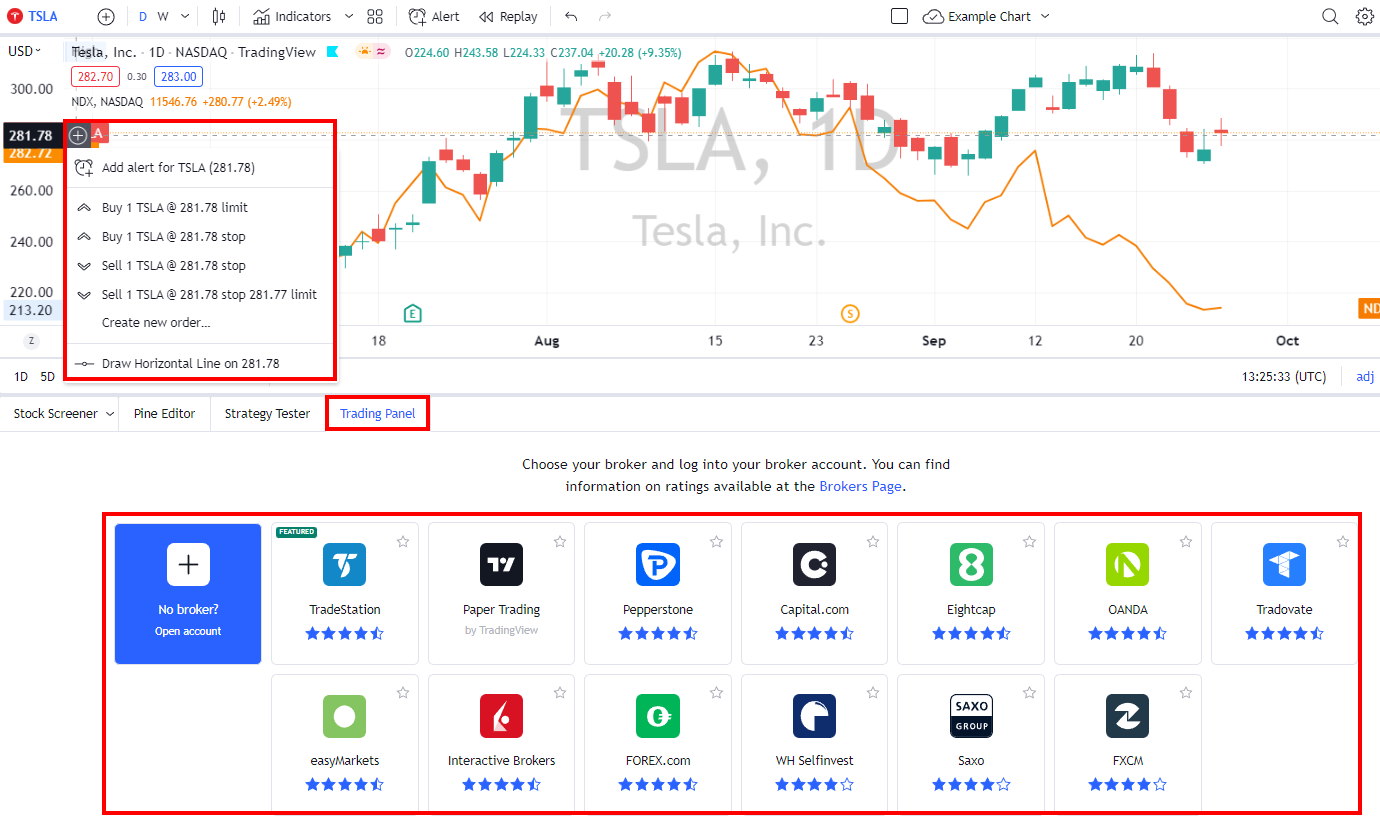

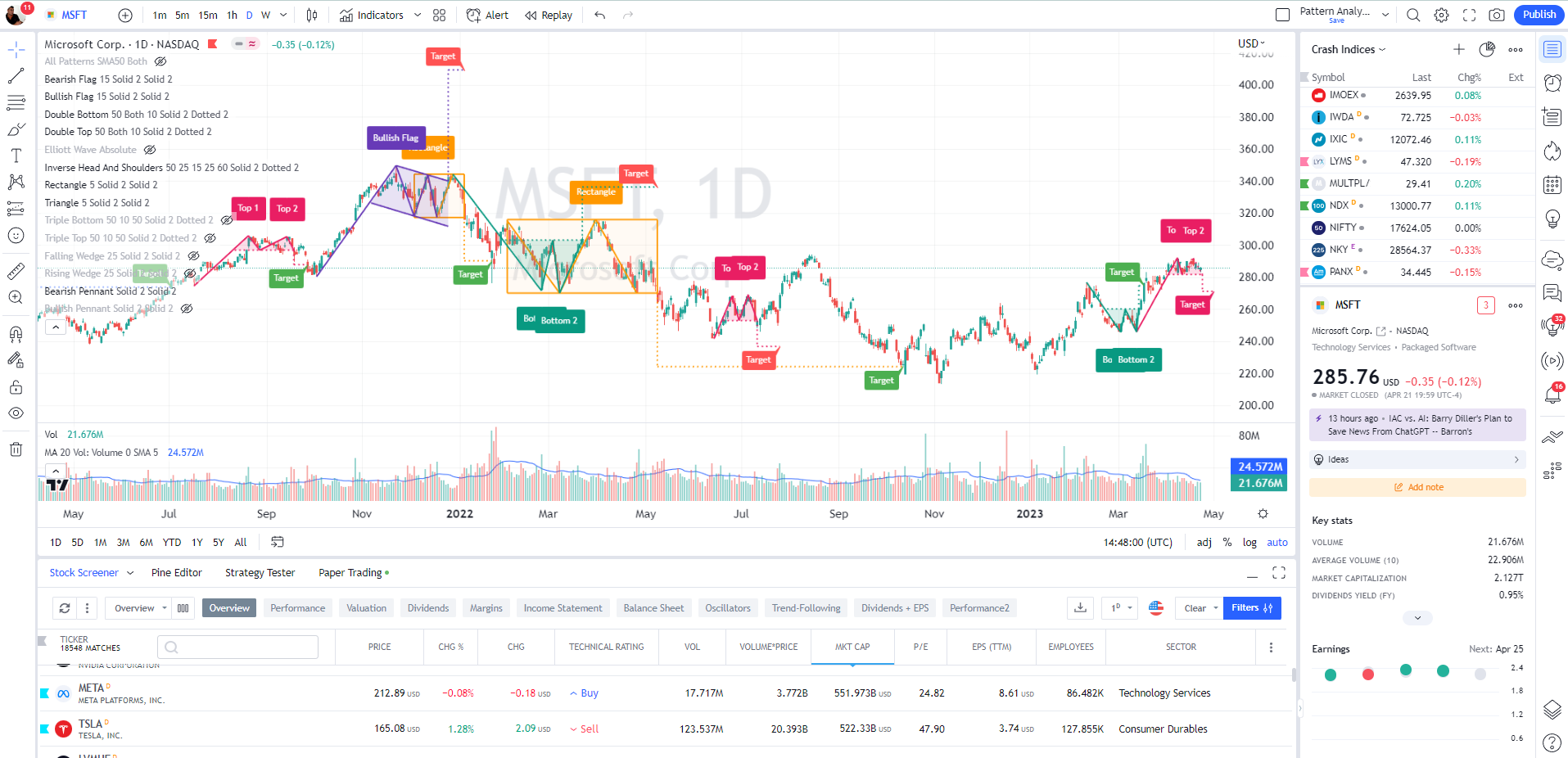

3. TradingView: Best for Global Markets

I have created many algorithms in TradingView, and I find it powerful and incredibly flexible. I can also backtest them using the strategy tester functionality. The only downside is that you need to learn to code in Pine script, and hand-coding script is incredibly time-consuming.

TradingView Rating: 4.7/5.0

| Pricing: ★★★★★ | News & Social: ★★★★★ |

| Software: ★★★★★ | Backtesting: ★★★★✩ |

| Trading: ★★★★✩ | Pattern Recognition: ★★★★✩ |

| Scanning: ★★★★✩ | Candlestick Recognition: ★★★★★ |

| Charts & Analysis: ★★★★★ | Usability: ★★★★★ |

| Features | Rating ★★★★★ |

|---|---|

| Buy/Sell Signals | ✅ |

| Automatic Trade Execution | ✅ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ✅ |

| Backtesting | ✅ |

| Code-Free Backtesting | ❌ |

| Auto-Trading Bots | ✅ |

| Markets Covered | Global, USA, India, Europe, Asia |

| Assets | Stocks, Crypto, Fx, ETFs, Futures |

| Free Trial | ✅ |

| Community & Chat | ✅ |

| OS | Web Browser, Windows |

| Price/Month | From $12.95 |

| Discount Available | $15 Discount & 16% Annual Plan Discount |

What sets TradingView apart is its social aspect. You can share your strategies and learn from other traders worldwide. It’s not just a trading platform; it’s a community.

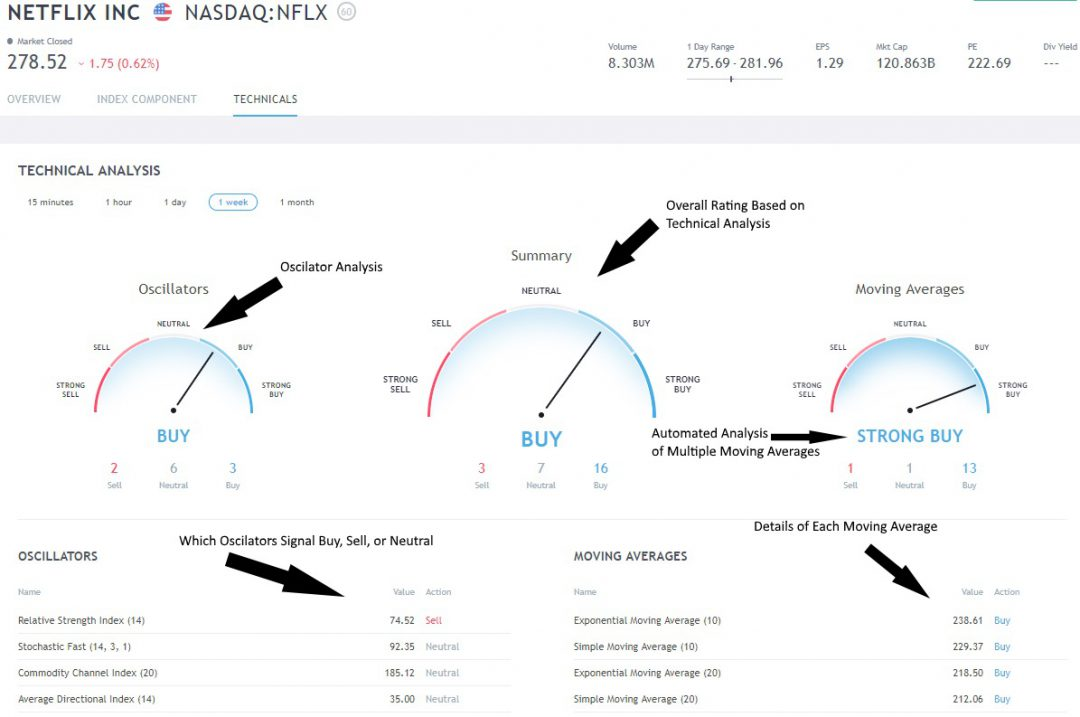

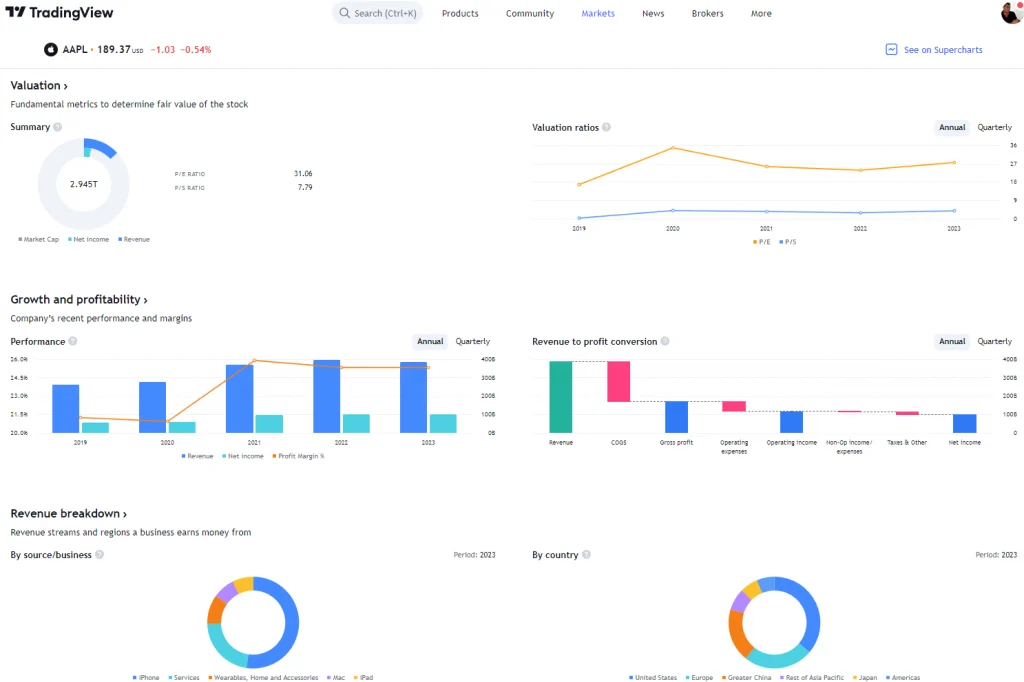

For international stock, forex, and crypto traders, TradingView is hard to beat. I’m particularly impressed by its automatic detection of chart and candlestick patterns. This feature saves me time and helps me spot opportunities I might have missed.

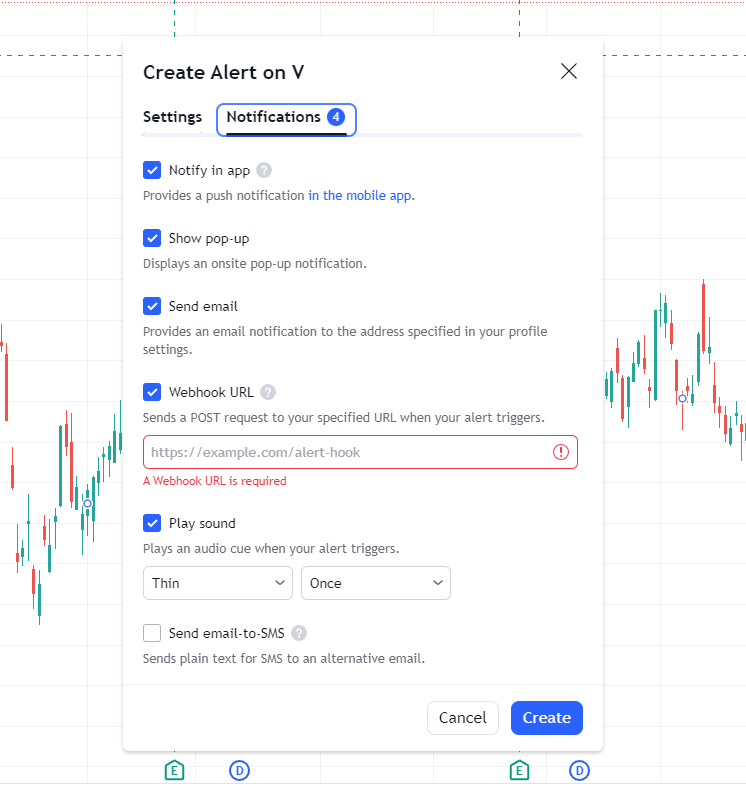

I find TradingView’s backtesting capabilities robust. It can automatically identify complex trading setups and send Webhook alerts to systems like SignalStack for execution.

Setting up algo trading on TradingView is straightforward. Here’s how I do it:

- Right-click on a chart

- Select “Add Alert.”

- Click “Notification.s”

- Add a Webhook URL

TradingView has a wide range of integrated brokers. This feature ensures I have access to reputable brokers worldwide for smooth trade execution. As the world’s leading investing website, TradingView hosts the largest global community of traders.

What I find most valuable about TradingView is its global coverage. Whether I’m trading stocks, ETFs, forex, or crypto, I can access markets worldwide from a single platform. This makes it my go-to choice for global trading.

Read the in-depth TradingView review.

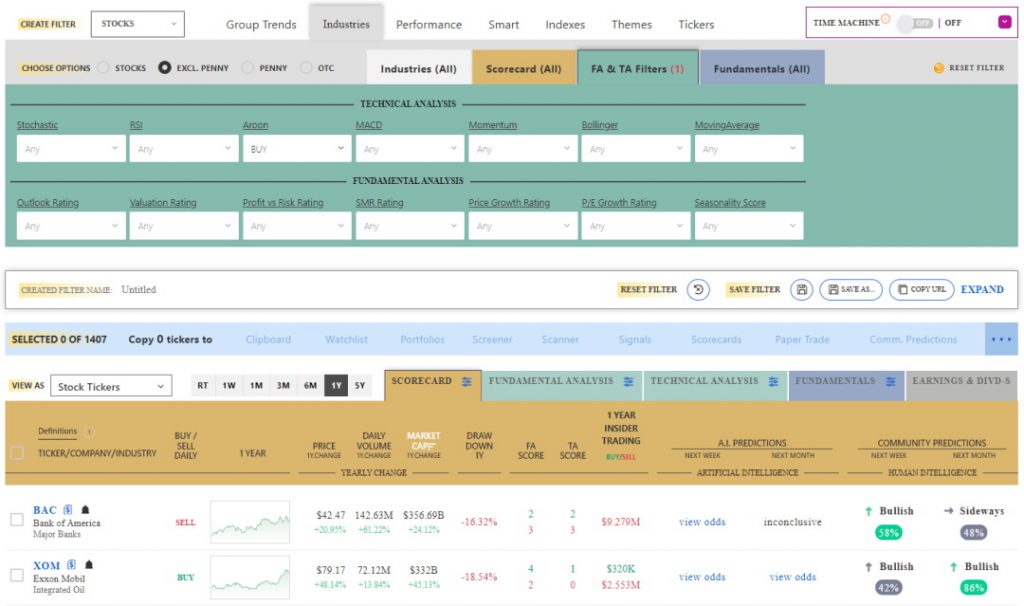

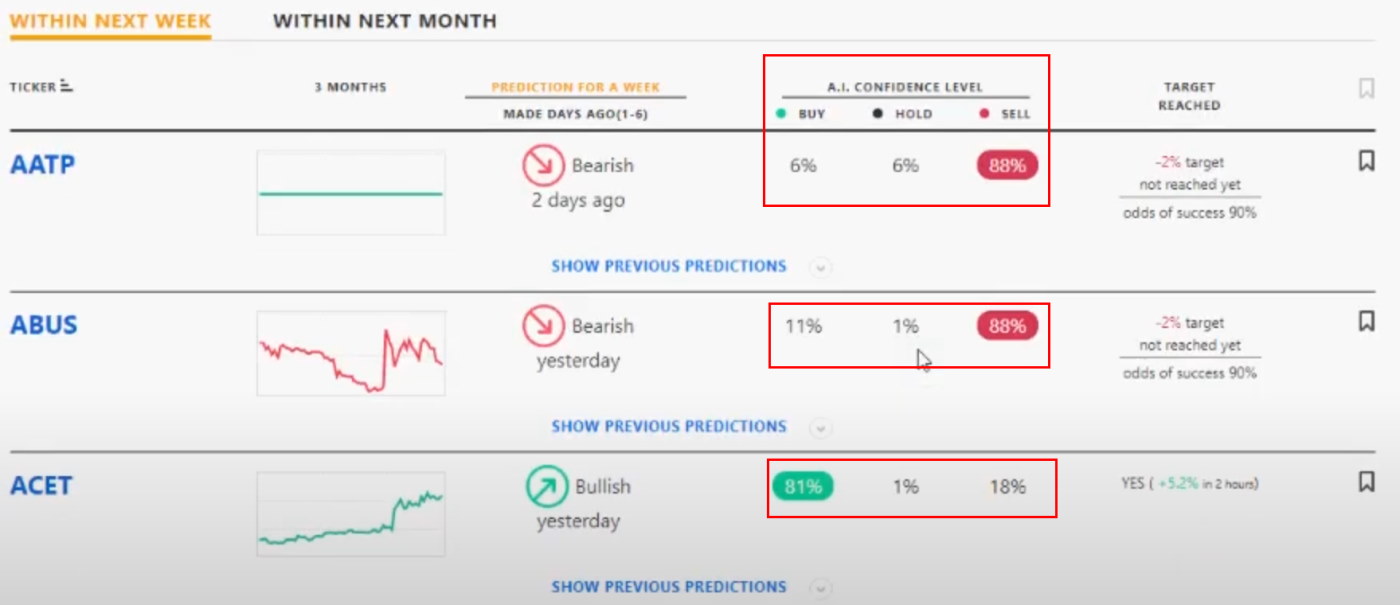

4. Tickeron: Good Pre-Made Algos

Tickeron offers a strong lineup of pre-made algorithms for traders. Their platform uses smart tech to spot stock chart patterns and predict future trends. It also gives users 45 different streams of trading ideas, which is pretty impressive.

Tickeron Rating: 4.4/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Backtesting: ★★★✩✩ |

| Trading: ★★★★✩ | Pattern Recognition: ★★★★✩ |

| Scanning: ★★★★★ | Candlestick Recognition: ★★★★✩ |

| Charts & Analysis: ★★★★✩ | Usability: ★★★★★ |

| Features | Rating ★★★★☆ |

|---|---|

| Buy/Sell Signals | ✅ |

| Automatic Trade Execution | ❌ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ❌ |

| Backtesting | ✅ |

| Code-Free Backtesting | ❌ |

| Markets Covered | USA |

| Assets | Stocks, ETFs, forex, and cryptocurrencies |

| Free Trial | ❌ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Price/Month | $125 |

| Discount Available | Get -50% off annual plans |

The company is backed by SAS Global, a big name in data analytics, which gives Tickeron some serious credibility. Their system looks for technical patterns in stocks and uses a Trend Prediction Engine to make forecasts. It’s a solid approach that combines proven methods with new tech.

Most of their Trading Bots show yearly gains between 40% and 169%, which is way above average. They also audit all trades, which I think is great for transparency.

One of their algos, the Day Trader Stock >$20, claims a 61.64% win rate. That’s really high for day trading. It’s important to look at individual trade results too. Tickeron lets you see all past trades, wins, and losses. This openness is key when picking a trading system.

Here’s what I like about Tickeron:

- It can analyze specific indexes or watchlists

- It finds trading chances in stocks you pick

- It offers advanced portfolios for diversification and high returns

I’ve tested Tickeron myself. It’s easy to use but still feels professional and advanced. The results it delivers are solid. If you’re into algo trading, I think it’s worth trying out.

Tickeron offers different price plans. You can start with a free account or pay $250 a month. If you choose a yearly plan, the monthly fee drops to $125. They also offer a 14-day free trial, which is a good way to test it out. Right now, they’re offering 50% off all yearly plans.

For short-term traders looking for AI-powered insights, Tickeron could be a great fit. Its combination of pattern recognition, real-time signals, and proven results makes it stand out in the algorithm trading world.

Read the full Tickeron review.

5: VectorVest: Tested Algo Trading Strategies

VectorVest Rating: 4.1/5.0

| Pricing: ★★★✩✩ | News & Social: ★★✩✩✩ |

| Software: ★★★★✩ | Backtesting: ★★★✩✩ |

| Trading: ★★★★✩ | Pattern Recognition: ★★★✩✩ |

| Scanning: ★★★✩✩ | Candlestick Recognition: ★★★✩✩ |

| Charts & Analysis: ★★★★✩ | Usability: ★★★★★ |

| Features | Rating ★★★★★ |

|---|---|

| Buy/Sell Signals | ❌ |

| Automatic Trade Execution | ✅ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ✅ |

| Backtesting | ✅ |

| Code-Free Backtesting | ❌ |

| Auto-Trading Bots | ✅ |

| Markets Covered | USA |

| Assets | Stocks, Crypto, Fx, ETFs, Futures |

| Free Trial | ✅ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Discount Available | 1st Month $0.99 |

VectorVest has caught my eye as a powerful tool for algorithmic trading. It blends fundamental and technical analysis and offers a variety of automated strategies. I’ve found its market timing signals particularly useful for streamlining my trading decisions.

The system’s core strength lies in its proprietary stock rating methodology. It focuses on three key factors: Value, Safety, and Timing (VST)

These elements combine to form the VST indicator, which I’ve come to rely on for quick stock assessments.

Here’s a breakdown of VectorVest’s rating components:

| Rating | Description |

|---|---|

| RV (Relative Value) | Estimates return vs. AAA Corporate Bond |

| RS (Relative Safety) | Measures consistency of company financials |

| RT (Relative Timing) | Technical indicator for short-term stock trends |

| VST | Aggregates RV, RS, and RT into one number |

The software’s user-friendly interface has made it easier for me to find stocks that fit the VectorVest system. It provides clear buy and sell signals, which I’ve found helpful in my trading decisions.

One aspect I appreciate is the simplification of stock market indicators. VectorVest’s continuous evaluation of stocks across various exchanges gives me confidence in its algo ratings. I’ve found this real-time analysis valuable for staying on top of market trends.

While VectorVest is good for algo trading, I personally would not use it because it is not flexible enough to create customized trading systems.

The platform’s emphasis on trading stocks with strong fundamentals aligning with market uptrends resonates with my investment philosophy. It’s become a cornerstone of my stock selection process.

Those interested in trying VectorVest can get a discounted first month at $0.99. After that, the monthly subscription is $149. I’ve found the web browser-based platform accessible and convenient for my trading needs.

Choosing the Right Algo Trading Tools

When I’m looking for algorithmic trading software, I consider several key factors.

First, I would think about my tech skills. If I’m good at coding, I might choose a platform like TradingView that lets me write scripts. But if I’m not a programmer, I’d pick something easier to use, like TrendSpider, where I can create strategies without coding.

Next, I examine the markets and assets the software covers. Some focus on stocks, while others handle forex or crypto. TrendSpider works for crypto, stocks, and futures, while TradingView covers all of these globally.

Cost is another big factor for me. I compare subscription fees, one-time costs, and free options that work with certain brokers. I always think about the long-term price of using the software.

I also care a lot about how well the software runs. I want something that rarely goes down and gives me real-time data, which can greatly affect the performance of my trades.

Lastly, I value good support and an active user community. If I run into problems, I want help quickly. TradingView has a great global trading community, and TrendSpider offers one-on-one training and US-based support, which I find really helpful.

Key Features of Algo Trading Software

Technical Indicators and Charts

Top-notch algo trading software offers a wide range of technical indicators and charting tools, which are crucial for spotting market trends and price movements. Moving averages, Bollinger Bands, and RSI are key indicators I use to make smart trading choices. TradingView and TrendSpider stand out in this area.

Backtesting Capabilities

I can’t stress enough how important backtesting is. It lets me test my strategies using past market data before I risk real money. This helps me see how well a strategy might work and how it handles risk in different market situations. TrendSpider is the clear winner for backtesting features.

Automation and Execution Speed

I rely on automation to run trades based on set rules without my constant input. Fast execution is vital, especially when markets are volatile and prices change quickly. For the best trade execution, I turn to TrendSpider and Trade Ideas.

Building Your Trading Bots

If you can code, creating custom trading bots is a game-changer. I love being able to craft strategies that fit my exact needs, from simple scripts to complex algorithms.

APIs and Compatibility

APIs are essential for connecting trading software with data feeds, brokers, and other tools. A strong API lets me implement custom strategies and expand the platform’s capabilities. SignalStack is my go-to for top-notch API integration.

FAQ

What are the top algorithmic trading platforms for beginners?

For newcomers to algo trading, I recommend Trade Ideas and TrendSpider. They’re easy to use and offer great learning resources.

How does algorithmic trading software integrate with brokers?

Most algo trading tools connect to brokers through APIs, often called webhooks. This webhook allows automatic trade execution and real-time data sharing between the platform and the broker.

What are the standout features to look for in algorithmic trading software?

I look for strong backtesting tools, fast, reliable data feeds, easy strategy setup, and solid security. Fast processing and AI-powered analysis are also big pluses.

Can you find effective algo trading software that is available for free?

Yes, TradingView allows you to customize algorithmic trading strategies at no cost. However, the free version comes with certain limitations, such as access to only two indicators and a restricted number of alerts.

What is the cost of premium algo trading software?

Prices vary widely, from $50 to $200 per month. The cost depends on features, data quality, and support level.

I always weigh the potential returns against the price tag.