I’ve been exploring Stock Rover, a powerful tool for long-term investors. This platform packs a punch with its deep research capabilities and advanced screening tools. It specializes in powerful research for U.S. stocks, whether you’re chasing growth, hunting for value, or after steady dividend income.

I’ve spent a lot of time using Stock Rover, and I can say it’s impressive. It gives you access to industry-leading data on all stocks and ETFs. If you’re serious about digging into the numbers and finding great investment opportunities, this might be just what you need.

Test Results and Scores

I’m really impressed with Stock Rover. It earned a strong 4.7 out of 5 stars overall. The pricing and software both earned perfect 5-star scores, and their portfolio research and screening tools also got top marks.

Trading features and charting received 4 stars—still great, but with room for improvement. News and social aspects scored 3 stars, so that’s an area that could use some work.

Stock Rover Rating: 4.7/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Backtesting: ★★★★✩ |

| Trading: ★★★✩✩ | Pattern Recognition: ★✩✩✩✩ |

| Screening: ★★★★★ | Candlestick Recognition: ★✩✩✩✩ |

| Charts & Analysis: ★★★★✩ | Usability: ★★★★★ |

| Features | Rating ★★★★★ |

|---|---|

| Powerful Value, Growth & Dividend Features | ✔ |

| Broker Integration | ✔ |

| Backtesting | ✔ |

| Portfolio Management | ✔ |

| Financial News | ✔ |

| Markets Covered | USA |

| Assets | Stocks, ETFs |

| Free Trial | ✔ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Discount Available | 25% Off with Annual Plan |

Pros

✔ 650 stock & ETF screening criteria

✔ Smart ratings systems to score stocks

✔ 10 years of historical data

✔ Special value investing tools

✔ Easy to use

✔ Real-time research reports

✔ Strong portfolio management

✔ Works with your broker

Cons

❌ No place to chat with other users

❌ Not great for quick buying and selling

❌ It only works for US stocks

I love how easy Stock Rover is to use. The 5-star usability rating matches my experience with the platform. Based on these scores, Stock Rover is a great choice for investors who want solid research and screening tools.

✂ Save 25% on Stock Rover ✂

The leader in professional stock screening, research, and portfolio management.

Save 25% Sign Up for a Premium Stock Rover Trial

My Verdict

Stock Rover is perfect for investors who like to examine company finances and develop serious dividend, value, and growth investing strategies.

The 10-year historical financial database is a goldmine that gives you perspective on growth and trajectory. The research reports are top-notch, giving me a clear picture of a company’s health.

I love how I can link Stock Rover to my brokerage account; in fact, it connects over $4 billion of assets for its customers. It makes managing my portfolio a breeze. The platform lets me build complex investing strategies. This is perfect for serious investors who want to go beyond basic stock picking.

Why Stock Rover?

Stock Rover helps people find good stocks to buy and keep track of the ones they own. It has the most advanced set of metrics that will please serious long-term investors. Metrics such as intrinsic value, margin of safety, Greenblatt metrics, and Lynch fair value make Stock Rover unique.

I like how Stock Rover helps people who want to invest for the long term. It has many tools to help you find good stocks that might make you money over time. But if you’re into fast trading or want to buy Bitcoin, you should avoid it.

Stock Rover Competitors

I’ve looked at a few similar tools. Stock Rover stands out for long-term investors like me who want to build and track a stock portfolio. Other options, like TrendSpider and TradingView, are more geared towards short-term trading. They have cool AI features for spotting patterns, but that’s not my focus for my long-term wealth.

Portfolio 123 is pretty close to Stock Rover. But I think Stock Rover wins on price and has better research reports, news, and tools for digging into company financials. It just feels like a better fit for my investing style. A good free screening alternative is Finviz, but I prefer Stock Rover’s free version. Finally, TC2000 is an excellent choice for US traders looking for superior charting capabilities, particularly for options trading.

Pricing Options

Stock Rover has a few plans to pick from. I’ll break them down for you.

The Stock Rover Free plan costs nothing. It lets you look at 10,000 stocks and comes with some cool features. You can link your broker account, check out your portfolio, and get stock news. It’s great if you want the basics.

The Essentials plan is $7.99 a month. You get more with this one. It shows you five years of company money info and lets you look at over 44,000 ETFs. You also get MorningStar Ratings and 260 ways to measure stocks. This helps you dig deeper when picking stocks.

The Premium Plus plan is the best, in my opinion. It’s $27.99 a month, but you can pay less if you sign up for longer. With a 2-year plan, it’s only $16.40 a month. I think it’s worth it for serious investors. You get to see if stocks are fairly priced, get warnings about stocks, and use 650 ways to measure them. You can also look at old data to see how stocks did in the past.

I think Stock Rover’s prices are really good for what you get.

Stock Rover Discount

Want to save some money? When you start a free trial of Premium or Premium Plus, you can get 25% off for a year. If you sign up for two years, you save even more -28%!

To get the deal, sign up for a free 14-day trial of the Premium plan. Near the end of your trial, Stock Rover will email you about the discount. It works for any paid plan you choose.

Finding Great Stocks

I love how Stock Rover ranks stocks based on key factors like growth and value. It’s super helpful for picking stocks with strong financials and cash flow, and the scores make it easy to spot top performers quickly.

I find the overall ratings especially useful. They show which stocks are in the top 20% across all categories, which saves me a lot of time when I’m looking for solid investments.

Ready-Made Stock Filters

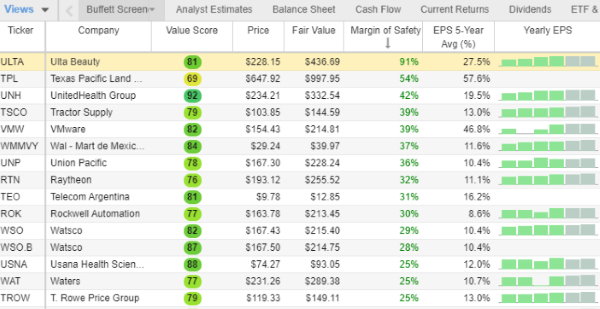

Stock Rover has over 150 pre-made stock filters you can use right away. I’ve tried out a bunch of them, and they’re really well-designed. My favorite is the one based on Warren Buffett’s strategy.

Warren Buffett-Style Screener

This screener aims to find stocks that match Warren Buffett’s investing style. It looks for companies with steady earnings, low debt, and good management. I like using it to find quality stocks that might be good long-term picks.

Fair Price and Safety Margin Rankings

This is one of my favorite Stock Rover features. It lets me see if stocks in my watchlist or portfolio are priced fairly compared to their future cash flow, which is perfect for value investing.

Figuring out fair value and safety margins is usually really hard. But Stock Rover does it automatically, which I think makes it worth the price of the premium plan.

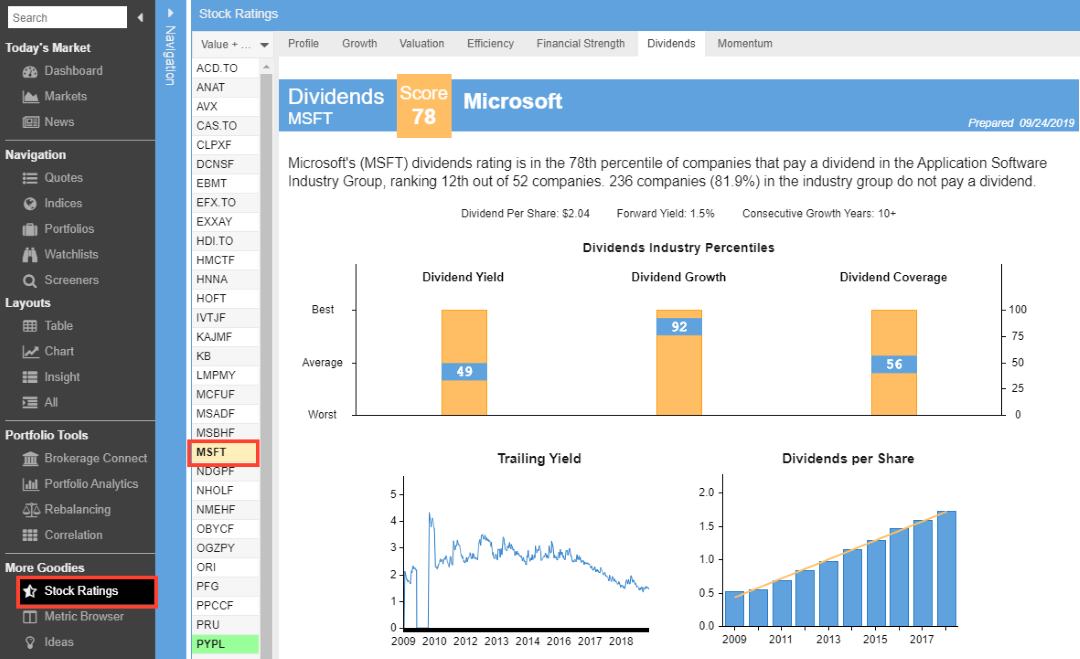

Dividend Income Tools

Stock Rover has great tools for analyzing dividends. I can see how a stock’s dividend yield and growth compare to its peers. It also predicts future dividend income for my portfolio based on current and estimated future dividends.

This is super helpful for income investing. As we all know, reinvesting dividends is key to beating the market over time. Stock Rover’s tools make it easier to plan and track dividend growth.

Latest Market Updates

Stock Rover’s markets dashboard pulls news stories from big names like Forbes and The Wall Street Journal. It’s nice to have everything in one place. I don’t need up-to-the-minute updates for my long-term investing strategy.

The news feeds aren’t real-time, but that’s okay for me. If you want instant news, you might want to look into Benzinga Pro News instead. One thing to note – Stock Rover doesn’t have any social features or chat rooms.

Here’s a quick rundown of what I like about Stock Rover’s news:

- 20+ news sources

- Saves time on research

- Covers market-moving events

- Good for long-term investors

Charts and Analysis Tools

I love using Stock Rover for its unique approach to charting. Instead of focusing on tons of technical indicators, it shines with fundamental financial charts. This is great for investors like me who care about a company’s financial health.

Stock Rover offers over 240 financial indicators and 16 technical ones. While it’s not the top choice for day trading, it’s perfect for looking at income, growth, and value. I can easily compare different stocks using ratio charts.

One cool feature is the alerts. I can set up SMS or email notifications for custom criteria. For example, I might want to know when a stock hits a certain price or meets specific financial benchmarks.

Stock Rover is working on adding trendlines and chart annotations soon. This will make it even more useful for my investing needs. Right now, I find it gives me a solid grasp of a company’s financial picture through its charts.

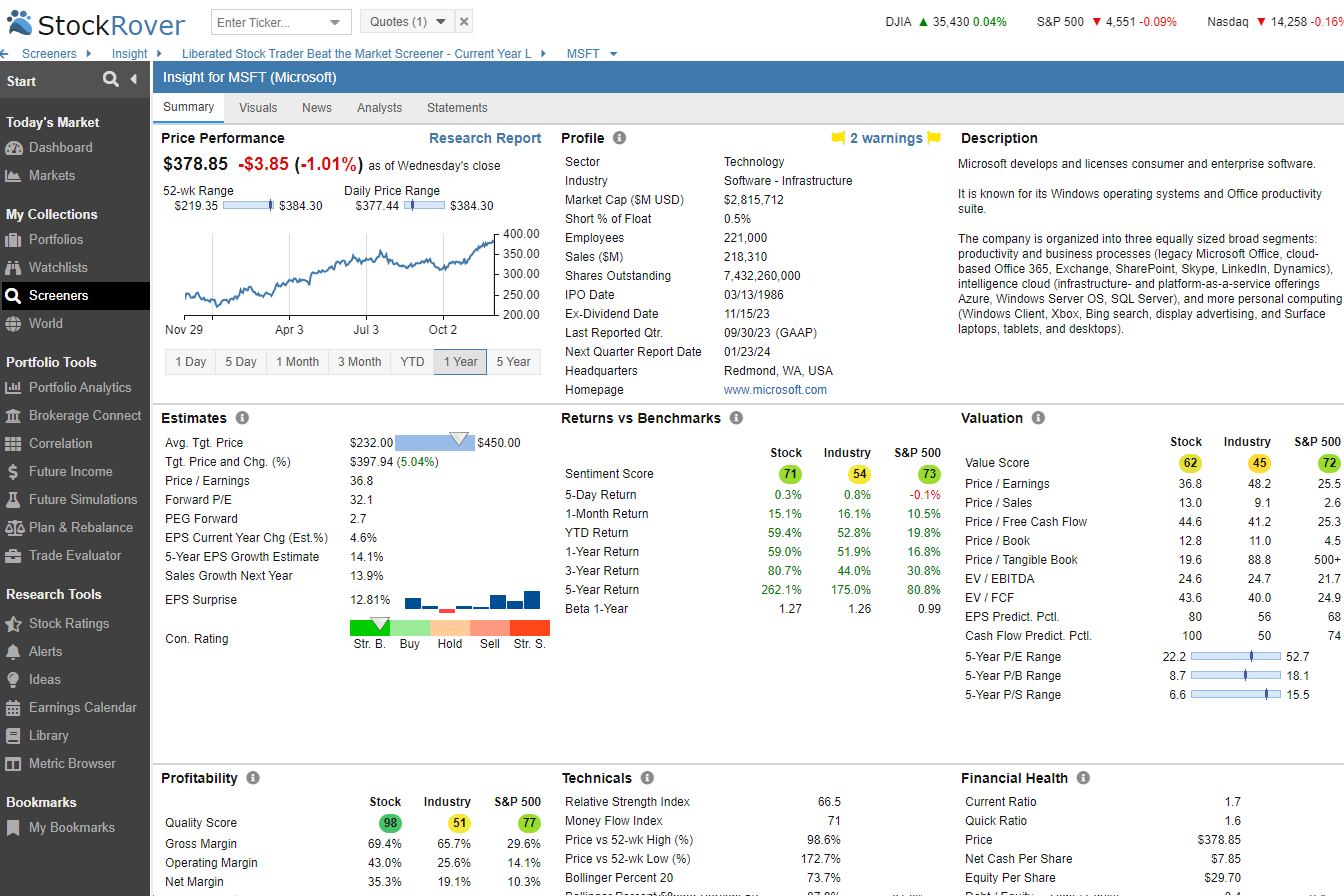

Stock Analysis at Your Fingertips

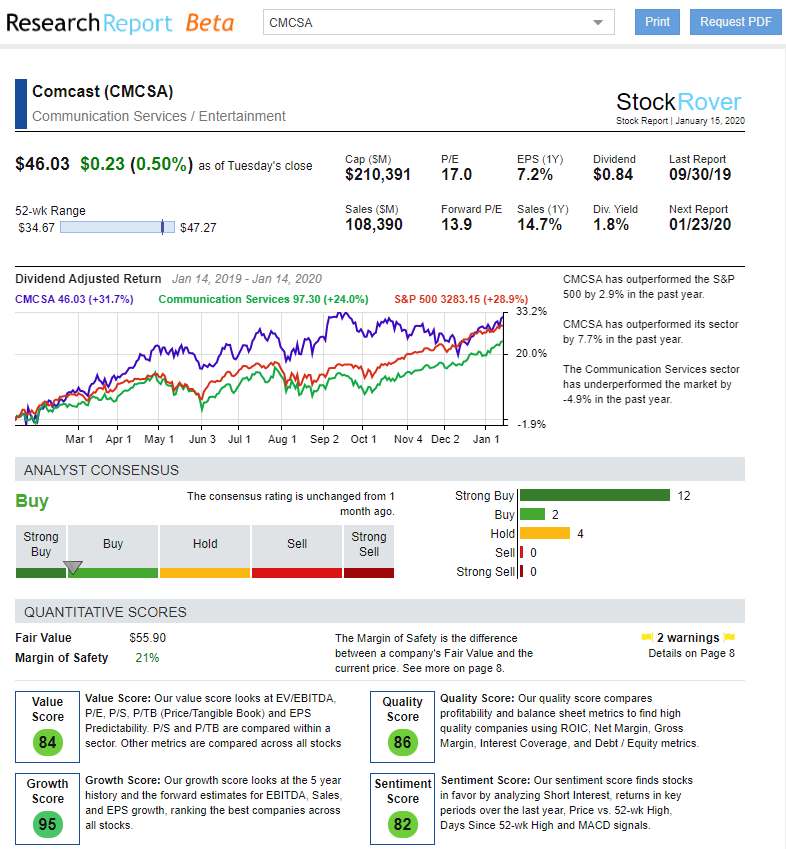

I’ve found Stock Rover’s Research Reports to be a game-changer for investors like me. These reports give me a clear picture of any stock’s performance, both current and past. What I love most is how they’re always up-to-date, using the latest data to show a company’s standing and potential.

The reports cover a lot of ground. They look at:

-

-

- How a company stacks up against competitors

- Its place in the market

- Past and possible future dividends

- Potential value returns

-

I can get reports on over 10,000 stocks from U.S. and Canadian markets. It’s super handy that I can view them online or save them as PDFs to read later or share with others.

As someone who likes visuals, I’m a big fan of how these reports present data. They use lots of charts and eye-catching tables. This makes it much easier for me to grasp complex information quickly. I used to spend hours poring over quarterly financial reports, but now I can get the key points in just a few minutes.

Let me give you an example. I recently looked at a report on Microsoft that showed how dividends affected its performance. The clear graphs and tables helped me understand the impact right away. This kind of easy-to-digest information makes Stock Rover’s reports so useful for my investment research.

Manage Your Money Wisely

Stock Rover helps me keep my investments in check. It links up with my brokerage accounts so that I can see all my stocks in one place. While I can’t buy or sell directly from the charts, I can still track how my portfolio is doing and get tips on rebalancing.

I love how Stock Rover focuses on dividends and value. As a long-term investor, I’m always looking for steady income from my stocks. The tool shows me which companies pay dividends and helps me plan for future payouts.

Another cool feature is comparing my returns to the S&P 500. I can see if I’m beating the market or falling behind. The tool also calculates things like risk-adjusted return, which helps me understand if I’m taking on too much risk for my gains.

Stock Rover lets me set up watchlists too. I can keep an eye on stocks I might want to buy later. Plus, it gives me research and news to stay informed about my investments.

Here’s a quick look at what Stock Rover portfolio management offers:

-

-

- Tracks watchlists

- Provides research and news

- Reports profits and losses

- Shows performance

- Helps with rebalancing

- Breaks down asset allocation

- Works with most brokers

- Predicts future dividends

-

I find the asset allocation view really helpful. It shows me how my money is spread out now and how it might look in the future based on my goals.

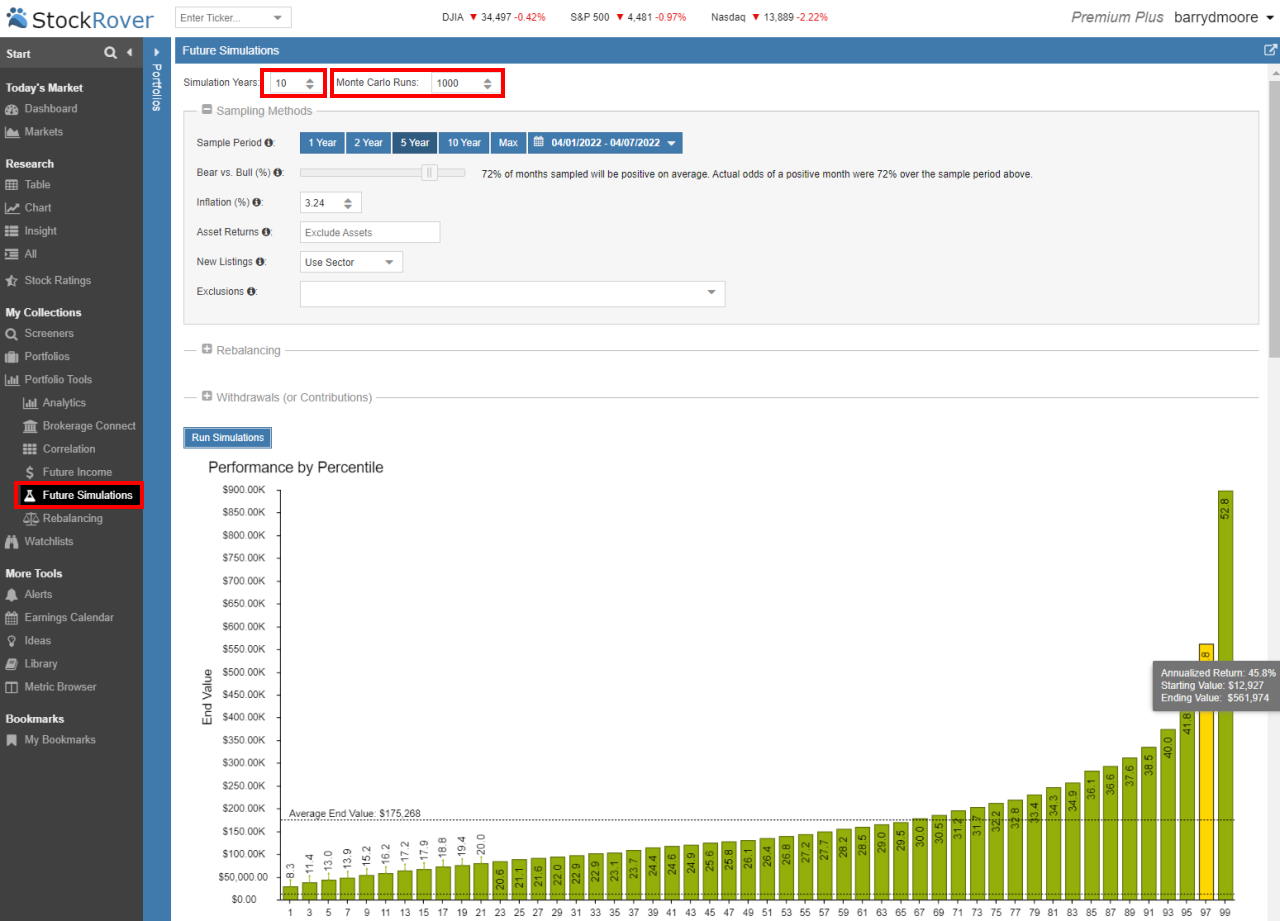

Testing Your Strategy

I love using backtesting to check if my stock picks might work well. It’s a great way to see if my ideas have been successful in the past. This can give me more confidence in my choices for the future.

I’ve found that Stock Rover is really helpful for this. They give me ten years of old financial data, which is more than most other tools. The best part? I can test my screening results to see how they would have performed in the past.

I created my own strategy called “Beat the Market.” It looks for growing, financially stable companies. I tested it for the last seven years, and the results were pretty exciting!

My strategy tries to find stocks that could do better than the S&P 500. I look for:

- Growing free cash flow

- Fast-growing earnings per share

- Good return on capital

- Strong earnings yield

When I combined all these factors, I found stocks that have performed much better than the market in five out of the last seven years. That made me feel pretty good about my approach!

Some people think beating the market is impossible for regular folks like us. But I don’t agree. With the right plan, anyone can do well in stocks.

My Take on Stock Rover

I love Stock Rover for long-term investing. It’s packed with tools for value, growth, and income strategies. The 10-year database is great for screening stocks. I find the research reports super helpful too. They even have filters based on Warren Buffett’s ideas! Plus, the charting is top-notch.

However, one of the key features I appreciate about Stock Rover is its ability to analyze a company’s free cash flow. Free cash flow, or FCF, is the cash that a company generates after accounting for capital expenditures and other necessary expenses. It can give insight into a company’s financial health and its ability to generate consistent profits.

★ Discover our list of free stock analysis software to unleash your inspiration! ★