Welcome to my ultimate guide on finding, selecting, and investing in defensive stocks and ETFs! Whether you’re looking to protect your portfolio during market turbulence or want to make smarter investment decisions, this guide has you covered. Packed with insights and backed by academic research and interactive charts, it’s everything you need to navigate uncertain times with confidence.

Defensive stocks are a smart choice if you’re worried about your money during tough economic times. They might not outperform the market during boom times, but they can help keep your savings steady when other stocks are falling.

Companies that make everyday things people always need, like food, medicine, and energy, are often considered defensive stocks. These businesses keep making money in good times and bad, which is why their stocks are safer bets.

Big companies that have been around for a long time pay regular dividends and are often good defensive picks. If you want to feel more secure about your investments, it’s worth looking into these stocks.

Understanding Defensive Stocks

A defensive stock typically belongs to companies that provide essential goods and services that remain in demand regardless of economic conditions. These stocks tend to perform relatively well during market downturns because they offer consistent returns and are less sensitive to economic cycles.

Defensive stocks are my go-to picks for stability in shaky markets. These companies provide essential goods and services we can’t live without, like utilities, transportation, and consumer staples. My research shows they tend to keep steady profits and dividends even when the economy slumps.

What I love about defensive stocks is their reliability, especially when the market gets unpredictable. They’re less volatile than other stocks, meaning they don’t swing wildly with economic changes. This stability gives me peace of mind, knowing my portfolio isn’t overly exposed to sudden market shocks.

Defensive stocks also hold their value better during downturns because they’re tied to essential products and services like healthcare, utilities, and consumer staples. People need these regardless of the economy, which keeps these stocks resilient. Plus, they often provide consistent dividends, offering a steady income stream or the chance to reinvest for long-term growth.

Finally, investing in companies that provide everyday essentials feels secure. There’s always demand for their products, making defensive stocks a dependable cornerstone in any investment strategy.

Academic Research on Defensive Stocks

Research shows that defensive stocks, known for low volatility and stable dividends, often hold their value better than growth stocks during market downturns. A study of five major declines between 1987 and 2008 found that value stocks, similar to defensive ones, were less affected by market drops, even after adjusting for factors like beta, size, and industry. This suggests that value-focused investments may be more resilient during market stress. Souce: quantpedia.com

Research on the Indian stock market (January 2000 to December 2023) examined defensive sectors like FMCG and Pharmaceuticals. The findings show that investing in these sectors can help protect against market downturns, highlighting the stable, long-term returns of defensive stocks. Source: esearchgate.net

The low-volatility anomaly shows that low-volatility stocks often outperform high-volatility ones over time. This suggests investors can achieve better risk-adjusted returns by focusing on more stable, defensive stocks. Source: en.wikipedia.org

In summary, empirical evidence from various markets and timeframes indicates that defensive stocks generally hold their value better than growth stocks during market declines, offering investors a potential buffer against volatility.

Key Characteristics of Defensive Stocks:

- Stable Earnings: Companies have predictable and consistent revenue streams, even during recessions.

- Essential Products/Services: Operate in industries like utilities, healthcare, consumer staples (e.g., food, beverages, household products), and telecom.

- Low Volatility: Prices of defensive stocks fluctuate less compared to growth or cyclical stocks.

- Regular Dividends: Often pay steady dividends due to strong cash flows.

- Lower Sensitivity to Economic Cycles (Low Beta): Typically have a beta of less than 1, meaning they are less volatile than the broader market.

- Strong Balance Sheets: Minimal debt levels and robust financial positions that support resilience in tough markets.

Why Defensive Stocks Hold Value During Market Declines:

- Their consistent cash flows allow them to maintain dividend payments, attracting income-focused investors.

- Demand for their products/services doesn’t drop significantly in recessions.

- Investors often shift to defensive stocks, seeking stability and income during uncertain times.

Top Defensive Stocks by Market Sector

I’ve compiled a list of defensive stocks across various market sectors. In healthcare, Johnson & Johnson, Pfizer, and Merck are strong contenders. For consumer staples, Coca-Cola, PepsiCo, and Procter & Gamble offer stability. The utilities sector includes Duke Energy, Southern Company, and American Electric Power.

Food companies like Hershey, Kraft Heinz, and General Mills are also popular defensive picks. In transportation, FedEx, UPS, and CSX provide reliable options. For telecommunications, AT&T and Verizon are solid choices.

Healthcare – Johnson & Johnson (JNJ)

Johnson & Johnson is a global healthcare leader that operates through its Innovative Medicine and MedTech segments. The company is renowned for its diverse product portfolio, including pharmaceuticals, medical devices, and consumer health products. In July 2024, J&J received FDA approval for DARZALEX FASPRO, enhancing treatment options for multiple myeloma patients. Additionally, the acquisition of Yellow Jersey Therapeutics expanded its pipeline with promising dermatological treatments.

Healthcare – Pfizer Inc. (PFE)

Pfizer is a multinational pharmaceutical corporation dedicated to discovering, developing, and delivering innovative medicines. In July 2024, the European Commission granted conditional marketing authorization for Pfizer’s gene therapy, DURVEQTIX, targeting severe hemophilia B. This approval underscores Pfizer’s commitment to advancing gene therapies and addressing unmet medical needs.

Consumer Staples – Procter & Gamble Co. (PG)

Procter & Gamble is a leading consumer goods company with a vast portfolio of trusted brands spanning beauty, health, fabric, and home care. Known for products like Tide, Pampers, and Gillette, P&G’s consistent demand and global reach make it a staple in households worldwide. The company’s focus on innovation and brand strength has solidified its position as a defensive stock, providing steady dividends and stable earnings.

Consumer Staples – The Coca-Cola Company (KO)

The Coca-Cola Company is a global beverage leader, offering a wide range of non-alcoholic drinks, including its flagship Coca-Cola soda. With a presence in over 200 countries, Coca-Cola’s extensive distribution network and brand recognition contribute to its resilience in various economic climates. The company’s ability to adapt to consumer preferences, such as expanding its portfolio to include healthier options, reinforces its status as a defensive investment.

Utilities – NextEra Energy, Inc. (NEE)

NextEra Energy is a prominent clean energy company and the world’s largest producer of wind and solar energy. Through its subsidiaries, including Florida Power & Light Company, it provides electricity to millions of customers. NextEra’s commitment to renewable energy and infrastructure investments positions it as a stable utility stock with consistent dividends, appealing to defensive-minded investors.

Utilities – Duke Energy Corporation (DUK)

Duke Energy is one of the largest electric power holding companies in the United States, supplying and delivering energy to approximately 7.9 million customers. Operating in the Southeast and Midwest, Duke Energy’s regulated and stable revenue streams, along with investments in grid modernization and renewable energy, make it a reliable choice for those seeking defensive stocks in the utility sector.

Food – Nestlé S.A. (NSRGY)

Nestlé is a Swiss multinational food and beverage conglomerate recognized as the largest food company globally. Its diverse product range includes brands like Nescafé, KitKat, and Gerber. Nestlé’s extensive global footprint and focus on nutrition, health, and wellness enable it to maintain steady performance, even during economic downturns, making it a quintessential defensive stock in the food sector.

Food – General Mills, Inc. (GIS)

General Mills is an American multinational manufacturer and marketer of branded consumer foods known for brands like Cheerios, Yoplait, and Haagen-Dazs. The company’s focus on essential food products ensures consistent consumer demand. General Mills’ strategic acquisitions and innovation in product offerings contribute to its stability and appeal as a defensive investment.

Transportation – Union Pacific Corporation (UNP)

Union Pacific operates the largest railroad network in the United States, covering 23 states across the western two-thirds of the country. The company’s rail services are crucial for transporting goods, including agricultural products, automotive, and industrial commodities. Union Pacific’s extensive infrastructure and essential role in supply chains provide it with a stable revenue base, appealing to defensive investors.

Transportation – United Parcel Service, Inc. (UPS)

UPS is a global package delivery and supply chain management company that serves millions of customers daily. With the growth of e-commerce, UPS’s logistics services have become increasingly vital. The company’s expansive delivery network and commitment to efficiency and reliability make it a strong contender for those seeking defensive stocks in the transportation sector.

Telecoms – Verizon Communications Inc. (VZ)

Verizon is a leading telecommunications company in the United States, providing wireless and wireline services to consumers and businesses. With a robust 5G network rollout and a focus on reliable connectivity, Verizon’s services remain essential, ensuring consistent revenue streams. The company’s strong market position and commitment to innovation make it a staple defensive stock in the telecom industry.

Telecoms – AT&T Inc. (T)

AT&T is a multinational conglomerate holding company recognized as one of the largest telecommunications providers globally. Offering a range of services, including mobile and fixed-line telephony, broadband, and digital television, AT&T’s diversified portfolio caters to a broad customer base. Its established infrastructure and recurring service revenues contribute to its stability, appealing to investors seeking defensive positions in the telecom sector.

These companies exemplify stability and consistent performance across their respective sectors, making them attractive options for defensive investment strategies.

Top 4 Defensive ETFs

I’ve identified four defensive stock ETFs that could help protect your portfolio during market turbulence. These ETFs focus on sectors that tend to perform well even in tough economic times. They offer a mix of stability, income, and potential for growth.

Vanguard Consumer Staples ETF (VDC):

The Vanguard Consumer Staples ETF (VDC) seeks to replicate the performance of the MSCI US Investable Market Consumer Staples 25/50 Index, providing investors with exposure to companies that produce essential products such as food, beverages, and household items. This ETF includes holdings in well-established corporations like Procter & Gamble, Coca-Cola, and PepsiCo, offering a diversified portfolio within the consumer staples sector.

VDC manages total net assets of approximately $8.48 billion. The fund’s focus on non-cyclical consumer goods makes it a popular choice for investors seeking stability and consistent returns, especially during economic downturns when demand for essential products remains steady.

Utilities Select Sector SPDR Fund (XLU):

The Utilities Select Sector SPDR Fund (XLU) aims to track the performance of the Utilities Select Sector Index, offering exposure to companies involved in the production and distribution of electricity, gas, and water. Major holdings include NextEra Energy, Duke Energy, and Southern Company, providing investors with access to key players in the utilities sector.

XLU boasts assets under management totaling approximately $18.24 billion. The utility sector is often viewed as defensive due to its essential services and regulated environment, making XLU an attractive option for investors seeking steady income through dividends and reduced volatility.

iShares U.S. Healthcare Providers ETF (IHF):

The iShares U.S. Healthcare Providers ETF (IHF) seeks to track the performance of the Dow Jones U.S. Select Healthcare Providers Index, offering exposure to U.S. companies that provide healthcare services. This includes firms operating in healthcare facilities, managed healthcare, and specialized services, with notable holdings such as UnitedHealth Group, CVS Health, and HCA Healthcare.

IHF manages significant assets, reflecting investor confidence in the healthcare providers sector. The ETF provides investors with targeted access to this defensive sector, which benefits from consistent demand for medical services, making it a potential hedge against market volatility.

Vanguard Short-Term Corporate Bond ETF (VCSH):

The Vanguard Short-Term Corporate Bond ETF (VCSH) aims to track the performance of the Bloomberg U.S. 1-5 Year Corporate Bond Index, providing exposure to short-term investment-grade corporate bonds. The fund invests in high-quality (rated Baa or higher) corporate bonds with maturities between one and five years, offering a balance between yield and interest rate risk.

VCSH manages substantial assets, appealing to investors seeking income with lower interest rate sensitivity. The ETF’s focus on short-term, high-quality corporate debt provides a conservative approach to fixed-income investing, suitable for those looking to preserve capital while earning modest returns.

These ETFs offer exposure to various defensive sectors and asset classes, catering to investors aiming for stability and consistent returns in their portfolios.

These four ETFs offer strong options for defensive investing. They each have unique strengths and track records of steady performance. As always, it’s smart to research further and consider your own financial goals before investing.

Stock Rover – The Smart Choice for Savvy Long-term Investors

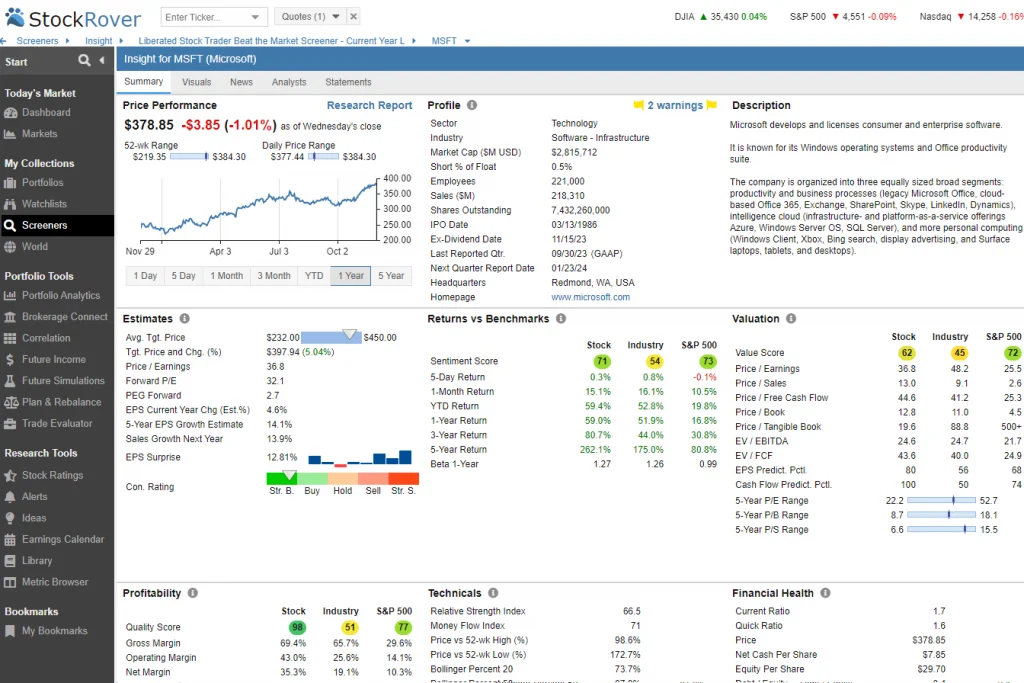

As an investor, I’ve always wanted powerful insights without the complexity. Stock Rover changed the game for me. With its deep screening tools and hundreds of metrics, I can quickly find stocks and ETFs that match my strategy. It streamlined my research and made decision-making so much easier.

Comparing investments used to be a hassle—now it’s a breeze. Stock Rover lets me analyze multiple stocks, ETFs, or portfolios side by side. I get clear views on fair value, quality, and growth potential, helping me make smarter, more confident choices.

Tracking my portfolio is now seamless. By linking my brokerage, I get real-time updates and detailed analytics. Features like dividend forecasts and rebalancing tools help me stay on track and plan effectively for the long term.

Stock Rover is the only service I recommended for growth, dividend, and value investors.

Ben Graham’s 7 Principles for Selecting Defensive Stocks

I use stock screeners to find defensive stocks based on updated criteria from Benjamin Graham’s “The Intelligent Investor.” These tools help me filter companies with strong financials, low debt, and steady dividend growth. I look for stocks with lower volatility and stable earnings, which often perform better in down markets. By focusing on these factors, I can identify potentially safer investments for uncertain times.

- Optimal Enterprise Size: Benjamin Graham’s criteria for defensive stocks start with company size. While he originally suggested a minimum market cap of $100 million, I think $1 billion is more fitting today. This ensures the company has enough resources to weather tough times.

- Robust Financial Health: Graham believed a 2:1 current ratio was ideal, meaning a company should have twice the current assets to current liabilities. I prefer a slightly more lenient 1.8:1 ratio for modern markets. This still shows the company can handle short-term obligations.

- Stable Earnings: Graham wanted to see earnings for common stock in each of the past ten years. I agree this shows consistent profitability, which is key for defensive stocks.

- Dividend History: Graham looked for 20 years of uninterrupted dividend payments. Five years of consecutive dividend growth is a good modern equivalent. This shows that the company values returning profits to shareholders.

- Growth in Earnings: Graham wanted to see at least 30% earnings per share growth over ten years. I prefer looking for steady growth of at least 3% each year for a decade. This indicates reliable, sustainable growth.

- Balanced Price-to-Earnings Ratio: Graham recommended a P/E ratio below 15. I’m a bit more flexible, using 20 as the upper limit. This allows for more growth potential while still avoiding overvalued stocks.

- Balanced Price-to-Asset Ratio: Graham suggested the stock price shouldn’t exceed 2.5 times the book value. I use these same criteria or look for a Price to Graham Number less than 1. This helps ensure you’re not overpaying for the company’s assets.

These seven criteria form a solid foundation for finding defensive stocks. They focus on financial stability, consistent growth, and fair valuation.

Find Defensive Stocks With Stock Rover

Stock Rover is a great tool for creating a defensive stock screening strategy. It’s an award-winning platform that lets you import pre-made screeners. I recommend downloading their Ben Graham Stock Screener file to get started. You can sign up for Stock Rover and use this screener to find defensive stocks that match Graham’s criteria.

I use Stock Rover to set up the Ben Graham defensive stocks strategy. The screening criteria are shown in the image below. This tool helps find stocks that meet Graham’s strict standards for safety and value. To learn more, read my Stock Rover review.

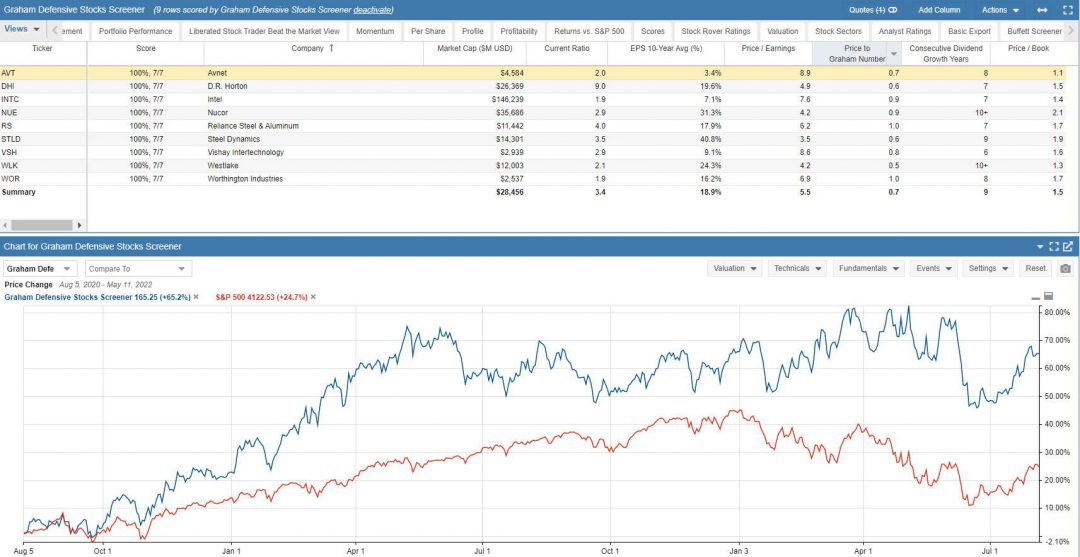

Defensive Stocks Results

This chart highlights how the Graham defensive investor stock strategy outperformed the market over two years, even during the challenges of the Covid crash and the 2022 downturn.

By applying Graham’s seven criteria for defensive stock investing, the nine companies in our analysis delivered an impressive 65% return, compared to just 25% from the S&P 500 over the same period.

FAQ

How do defensive stocks fare in a recession?

In my experience, defensive stocks often hold up well or fall less than other stocks during recessions. Their revenue and profits usually stay steady since they’re in sectors that aren’t heavily impacted by economic swings.

Are defensive stocks a good fit for every investor?

Defensive stocks can work well for risk-averse investors who want stable dividends and relatively secure capital. However, they might not be the best fit for those chasing high-growth investments.

Do Defensive Stocks Offer Dividends?

Yes, many defensive stocks pay dividends. That’s why they’re popular among investors looking for reliable income. Dividend yields can vary, but I’ve seen them range from about 1% to 5%, depending on the stock and market conditions.

What are the potential risks of investing in defensive stocks?

Like all investments, defensive stocks come with some risks. I’ve noticed they might lag during strong bull markets. If you rely too heavily on these stocks, you could miss out on bigger gains elsewhere.