I’ve found that buy-and-hold investing is a smart way to grow wealth over time. This approach involves buying ETFs and keeping them for many years, no matter what the market does in the short term. It’s a simple strategy that doesn’t require constant buying and selling.

When I look at the numbers, patient buy-and-hold investors have seen stocks do well. Over the last 30 years, the stock market (S&P 500) has returned about 10.7% per year on average.

Other investments, such as bonds, real estate, and gold, have also provided positive returns, though not as high as stocks. Buy-and-hold investing can be a good fit for people who want to invest without spending a lot of time watching the markets.

30-Year Success Rates of Buy-and-Hold Strategies

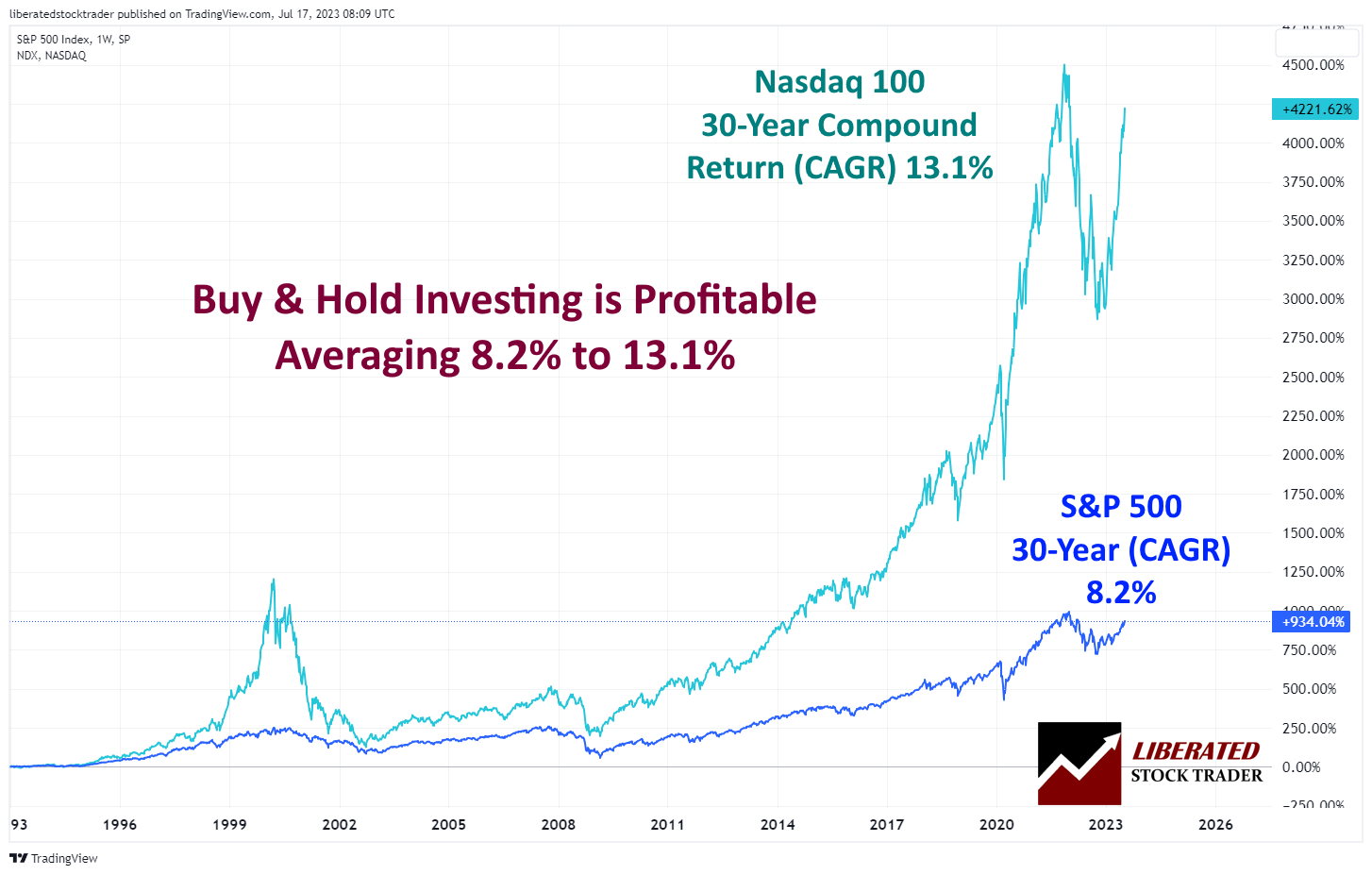

I’ve found that buying and holding stocks can be quite profitable. The S&P 500 grew by 8.2% each year from 1993 to 2023, and the Nasdaq 100 did even better, with a 13.1% yearly return.

These gains came even with big market drops in 2000, 2008, and 2021. This shows stocks can be a solid long-term bet. They tend to beat other choices like bonds, real estate, and gold over time.

Here’s a chart showing how the S&P 500 and Nasdaq 100 have grown over 30 years:

What is Buy-and-Hold Investing?

Buy-and-hold investing is a strategy I use to build wealth over time. I purchase stocks or other assets and keep them for years, ignoring short-term market ups and downs. This approach is based on my belief that investments will grow in value in the long term.

I focus on:

• Choose at least 30 high-quality stocks or invest in broad-market ETFs.

• Staying patient.

• Avoiding frequent trading.

Understanding Buy-and-Hold Investing

I believe in the power of patience when it comes to investing. Buy-and-hold is a strategy where I purchase stocks or other assets and keep them for years, ignoring short-term market ups and downs. My focus is on solid business fundamentals and a strong investment thesis. This approach can be less stressful and time-consuming than active trading.

I believe the buy-and-hold stocks strategy is a smart way to invest for the long haul. With this approach, I pick solid companies and hang onto their stocks for years, no matter what the market does day-to-day. Blue-chip stocks, index funds, and dividend-growth stocks are great choices. I like that it’s low-risk and doesn’t need much hands-on management. It’s perfect for me since I want steady growth over time without watching the market constantly.

Buy-and-hold vs. Short-term Trading

Buy-and-hold investing focuses on long-term growth, unlike short-term trading, which aims to profit from quick price changes. While markets tend to rise over time, there can be big drops, too. I think it’s smart to diversify and review my portfolio regularly to lower risks. Active traders try timing the market, but I prefer a more patient approach.

Buy-and-Hold Real-Estate Returns

Real estate can also be a good long-term investment. In the past twenty years, homes have grown in value by 10.6% per year, and business buildings have gone up by 9.5% yearly.

But not all studies agree. One from NYU says real estate only grew by 4.8% per year. The type of property makes a big difference in how much money you can make.

To get a full picture, I like to look at the S&P 500 Real Estate Index. It tracks many types of real estate across the U.S., including houses, apartments, and office buildings.

Buy and Hold Bond Returns

Bonds are another long-term investing option. From 1960 to 2023, short-term Treasury bills grew by 3.33% per year. Longer-term 10-year Treasury bonds did better, with 5.11% yearly growth.

Bonds are less risky than stocks. Their value doesn’t jump around as much. This makes them good for goals like saving for retirement. You know what you’ll get, which can be nice.

Another plus is that bonds are simple. You don’t need to know a lot about finance to buy them. This makes bonds a good choice if you want to invest without spending lots of time studying the market.

I’ve seen that bonds, stocks, and real estate can all grow over time. Each has its pros and cons. The key is to pick what fits your goals and how much risk you’re okay with.

Buy & Hold Profits: Real Estate vs. Stocks, Bonds & Gold

I’ve analyzed long-term returns across various asset classes, and the results are eye-opening. Over 30 years, stocks have outperformed other investments. The S&P 500 has delivered an average annual return of 8.2%, while the Nasdaq 100 has soared even higher at 13.1%.

Real estate, often touted as a safe bet, has yielded a more modest 4.8% annually. It does have some unique perks, though. Investors can earn a steady income from rent and potentially gain from property value increases. There are also tax benefits, like mortgage interest deductions and depreciation write-offs.

Bonds offer stability but lower returns. U.S. Treasury bonds have returned 4.9% yearly, while corporate bonds have fared slightly better at 7.2%. The main draw of bonds is their reliability – you get regular interest payments and usually get your principal back when the bond matures.

Here’s a breakdown of average annual returns:

| Asset | 30-Year Avg Annual Return |

|---|---|

| Nasdaq 100 ETF QQQ | 13.1% |

| S&P 500 ETF SPY | 8.2% |

| Corporate Bonds | 7.2% |

| Gold | 6.8% |

| U.S. Treasury Bond | 4.9% |

| Real Estate | 4.8% |

| 3-month T-Bill | 2.2% |

While stocks have shown the highest returns, they also come with more ups and downs. That’s why a mix of assets can help balance risk and reward in your portfolio.

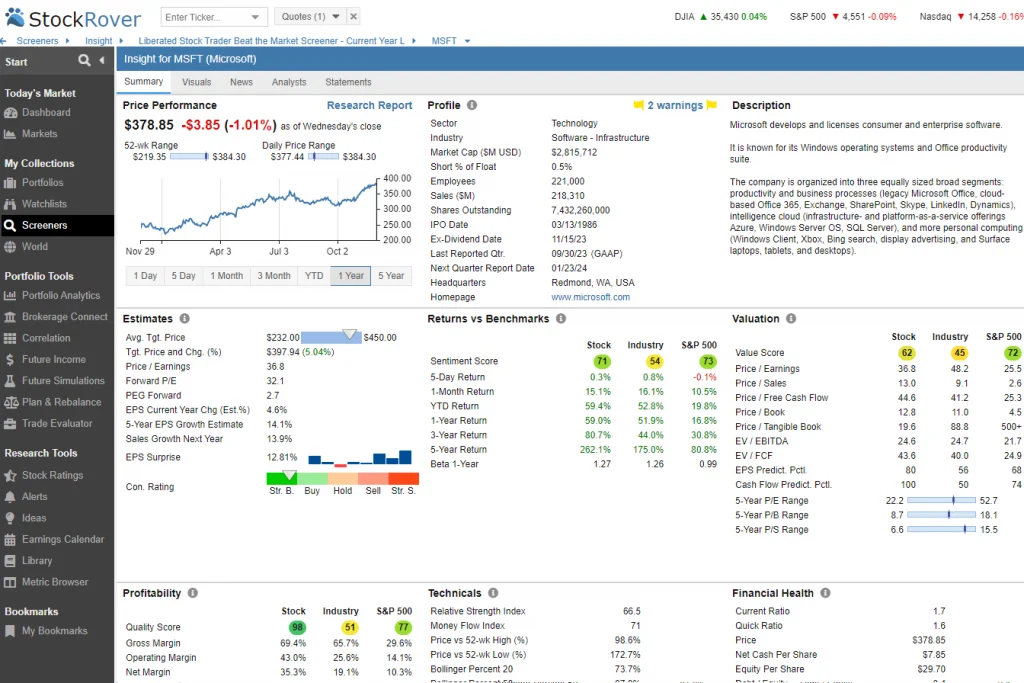

I use Stock Rover for my long-term investing.

Stock Rover – The Smart Choice for Savvy Long-term Investors

As an investor, I’ve always wanted powerful insights without the complexity. Stock Rover changed the game for me. With its deep screening tools and hundreds of metrics, I can quickly find stocks and ETFs that match my strategy. It streamlined my research and made decision-making so much easier.

Comparing investments used to be a hassle—now it’s a breeze. Stock Rover lets me analyze multiple stocks, ETFs, or portfolios side by side. I get clear views on fair value, quality, and growth potential, helping me make smarter, more confident choices.

Tracking my portfolio is now seamless. By linking my brokerage, I get real-time updates and detailed analytics. Features like dividend forecasts and rebalancing tools help me stay on track and plan effectively for the long term.

Stock Rover is the only service I recommended for growth, dividend, and value investors.

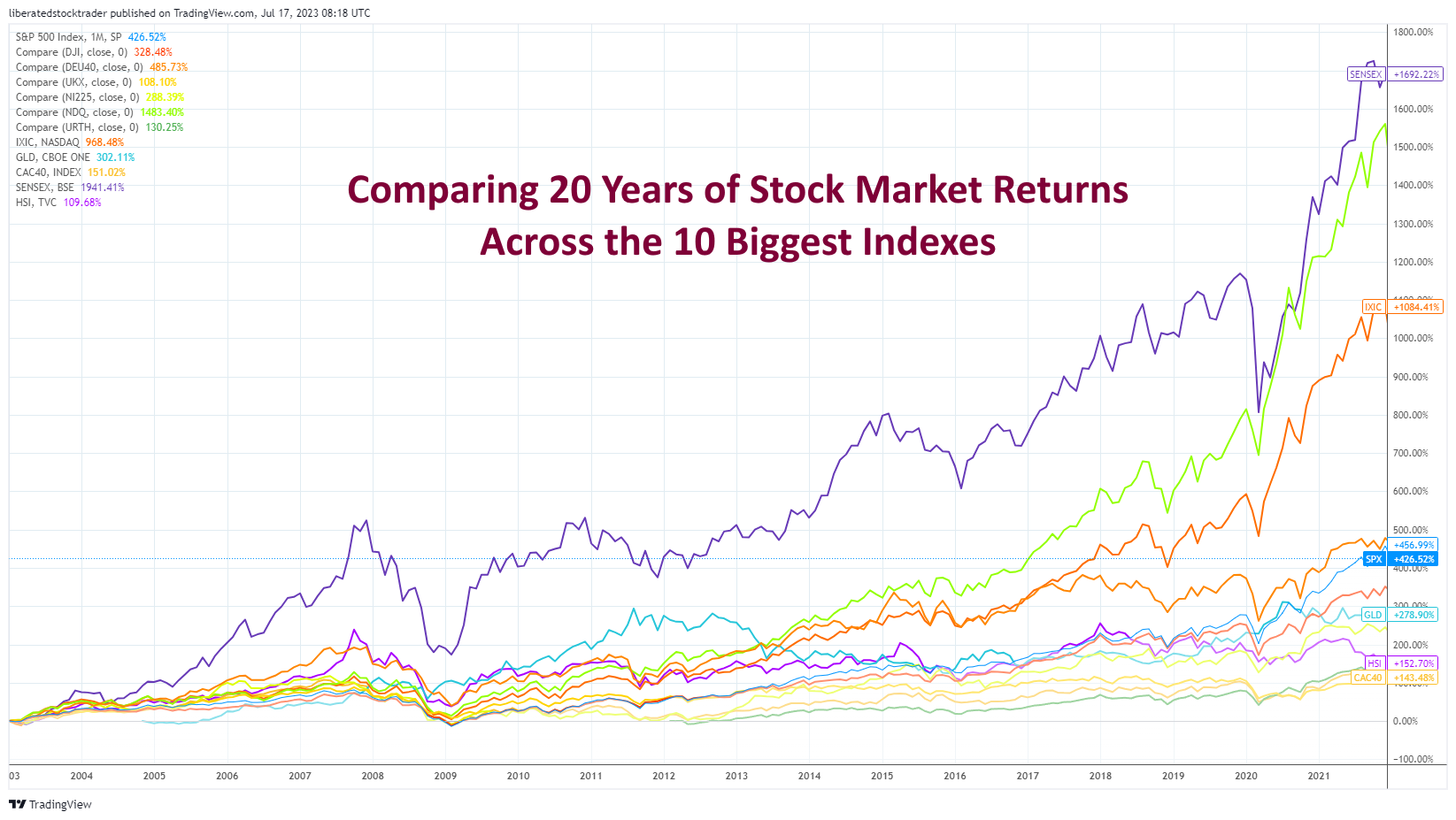

Comparing Buy-and-Hold Stock Returns Internationally

I find that comparing stock market returns across different countries can be eye-opening. To get a clear picture, I use a TradingView chart that shows the performance of major global indexes side by side. This chart includes the S&P 500, NIKKEI 225, FTSE 100, DAX, CAC40, and Indian Sensex.

By looking at how each index has performed over time, I can spot which markets might offer better returns. It’s important to remember that past results don’t guarantee future gains. When I invest in foreign stocks, I always check the tax rules and consider risks like currency changes or political issues in those countries. This helps me make smarter choices about where to put my money for the long term.

What Software is Best for Buy-and-Hold Investing

I’ve found Stock Rover to be the top choice for buy-and-hold investing. It excels at fundamental analysis, which is crucial for this strategy. The software makes it easy to evaluate companies’ financials and determine their long-term potential. It’s particularly useful for value, dividend, and growth investing approaches.

Key Benefits

Buy-and-hold investing offers several advantages. I find it requires minimal effort, allowing me to focus on other aspects of my life while still pursuing market returns. The lower trading costs are a big plus, as I’m not constantly buying and selling. This passive strategy helps me avoid the stress of market volatility. I can benefit from long-term growth potential and tax advantages. Compounding returns from dividends and stock splits can boost my investments over time. I also appreciate how buy-and-hold naturally promotes diversification, as I can spread my investments across different sectors and hold them for extended periods.

Limitations

I find that buy-and-hold investing can be inflexible. It’s hard to change course when markets shift quickly. This strategy needs a patient, long-term outlook that not everyone has. It also exposes me to potential losses if I can’t sell declining assets fast enough. However, it can help reduce capital gains taxes through the long-term capital gains rate. Risk management is crucial with this approach.

I’ve noticed several myths about buy-and-hold investing that need clearing up. First, buy-and-hold isn’t a risk-free approach. While it can lower some risks, all investments carry uncertainty. I can’t stress enough that no strategy guarantees profits. Markets are unpredictable, and past results don’t promise future gains.

Buy-and-hold isn’t one-size-fits-all either. I believe it works best for patient investors with long-term goals. Here’s a quick breakdown:

- Suits: Long-term planners, retirement savers

- May not fit: Short-term traders, those needing quick cash

Remember, the efficient market hypothesis suggests prices reflect all info. But I’ve seen how emotions and unexpected events can shake things up. That’s why I always say to match your strategy to your own needs and risk comfort.

Best Practices

I recommend doing thorough research before picking investments. It’s smart to choose stocks and bonds with strong fundamentals that can grow over time.

I like to spread my money across different types of assets to lower risk. Keeping an eye on the market helps me make tweaks when needed. But I try not to react to every up and down. Staying calm when prices drop lets me stick to my long-term plan.

Dollar-cost averaging is a good way to invest regularly. It’s simple and can save money on fees. I put in the same amount each month, which helps smooth out price swings.

Selecting the Right Assets

I believe choosing the right assets is crucial for a successful buy-and-hold strategy. When I look at stocks, I focus on companies with strong financials, steady income, and growth potential. I pay attention to healthy balance sheets and operating income.

For ETFs, I carefully evaluate the underlying assets and management fees.

I consider factors like:

- Liquidity

- Volatility

- Dividend yields

These help me make smart choices. I also aim for investments with low costs to maximize my returns over time. A mix of value and growth stocks can create a well-rounded portfolio. By picking solid companies and funds, I set myself up for long-term success with my buy-and-hold approach.

FAQ

What is the recommended software for buy-and-hold investing?

I recommend Stock Rover for buy-and-hold investing. It offers great tools for researching stocks, ETFs, REITs, and bonds, which helps me build a diverse, long-term portfolio with confidence.

How does buy-and-hold investing differ from active trading?

Buy-and-hold investing takes less time and effort than active trading. I don’t have to watch the market daily or trade frequently, letting me focus on other things while my investments grow. Active trading is often more stressful and time-consuming.

Buy-and-hold also costs less, with fewer trading fees and no short-term capital gains taxes. Active traders, however, face higher fees and taxes from frequent trades.

The downside is missing short-term market gains, but for most people, the benefits outweigh the risks.

What are the best investments for a buy-and-hold strategy?

I look for investments with steady growth histories for buy-and-hold. Some good options are:

Blue-chip stocks

Index funds

Dividend-growth stocks

What strategies can I explore when investing in the stock market?

Besides buy-and-hold, you could try:

Value investing: Buying undervalued stocks

Growth investing: Focusing on fast-growing companies

Dividend investing: Choosing stocks with high dividend yields

Index investing: Buying funds that track market indexes

Dollar-cost averaging: Investing a set amount regularly