I’ve been exploring alternatives to TradingView, the popular stock trading platform. While TradingView is widely used, I found some other platforms that offer unique benefits for different investing approaches.

TrendSpider caught my eye with its advanced chart pattern recognition and backtesting capabilities. Meanwhile, Trade Ideas impressed me with its AI-powered trading algorithms. For those focused on long-term investing strategies like dividends, growth, and value, Stock Rover seems to have a lot to offer. And if real-time financial news is a priority, Benzinga Pro’s screening tools look promising.

7 Top TradingView Alternatives

I’ve tested over 50 tools and TrendSpider, Stock Rover, Trade Ideas, and Benzinga Pro to be impressive TradingView alternatives.

TrendSpider stands out, passing 10 of 12 tests for automated chart analysis, backtesting, and bot trading. It’s a top choice for traders who want AI-powered tools.

I recommend Stock Rover for investors focused on long-term growth, dividends, and value. It offers deeper financial analysis than TradingView.

Day traders might prefer Trade Ideas. Its AI-driven black box system is great for fast-paced trading strategies.

If you need real-time news for trading, Benzinga Pro is a solid pick. It delivers faster, more targeted news than TradingView.

Here’s a quick comparison:

| Platform | Better than TradingView for: |

|---|---|

| TrendSpider | AI chart analysis, pattern recognition, backtesting, and auto-trading. |

| Stock Rover | Value, growth and dividend investing, portfolio management and financial screening. |

| Trade Ideas | Real-time AI day trading signals. |

| Benzinga Pro | Value, growth, and dividend investing, portfolio management, and financial screening. |

Other options worth checking out:

- MetaStock R/T: Strong price forecasting

- Tickeron: AI stock screening

- FinViz: Free charting and screening

Each platform has its strengths. Your choice depends on your trading style and needs.

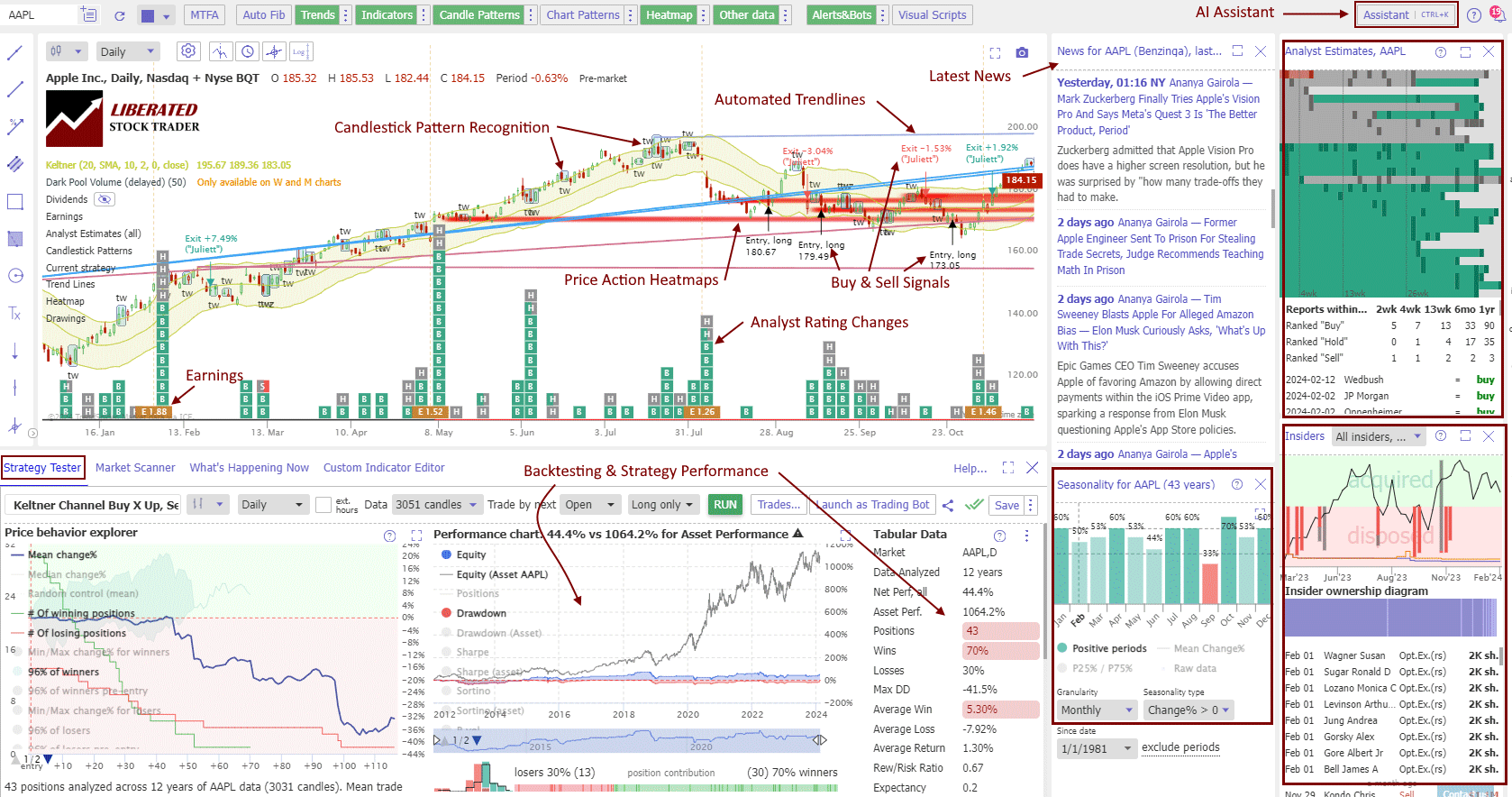

1. TrendSpider: Better AI, pattern recognition, and backtesting

TrendSpider is great for AI-driven chart analysis. I’ve used it for seven years to automate my technical analysis and test trading strategies. It’s a game-changer for traders who want to leverage artificial intelligence in their market approach.

TrendSpider Rating: 4.8/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Backtesting: ★★★★★ |

| Trading: ★★★★✩ | Pattern Recognition: ★★★★★ |

| Scanning: ★★★★★ | Candlestick Recognition: ★★★★★ |

| Charts & Analysis: ★★★★★ | Usability: ★★★★★ |

| Features | Rating ★★★★★ |

|---|---|

| Buy/Sell Signals | ✅ |

| Automatic Trade Execution | ✅ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ✅ |

| Backtesting | ✅ |

| Code-Free Backtesting | ✅ |

| Auto-Trading Bots | ✅ |

| Markets Covered | USA |

| Assets | Stocks, Fx, Crypto, ETFs |

| Free Trial | ✅ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Price | From $54/mo |

| Discount Available | Use Code “LST30” for -30% on monthly or -63% off annual plans |

TrendSpider’s backtesting tools are very good. I’ve tested over 100 indicators and patterns using the platform’s robust testing features. It’s great for US traders looking to explore stocks, indexes, futures, and forex in depth.

One other feature is the automated trading bots. These AI-powered tools can execute strategies based on the patterns and trends the system identifies. It’s like having a tireless assistant watching the markets 24/7.

I’ve found TrendSpider’s free real-time data to be a big plus. It’s accurate and reliable, which is crucial for making informed trading decisions. The platform also offers in-person 1-on-1 training, which I think is invaluable for getting the most out of its advanced features.

For serious technical traders, TrendSpider’s multi-time-frame analysis is a powerful tool. It lets you spot trends and patterns across different time scales, giving a more complete picture of market movements.

TrendSpider is having a major sale right now, with 75% off yearly and monthly plans. This is a great chance to try out these AI-powered tools at a discount. Read the full TrendSpider review.

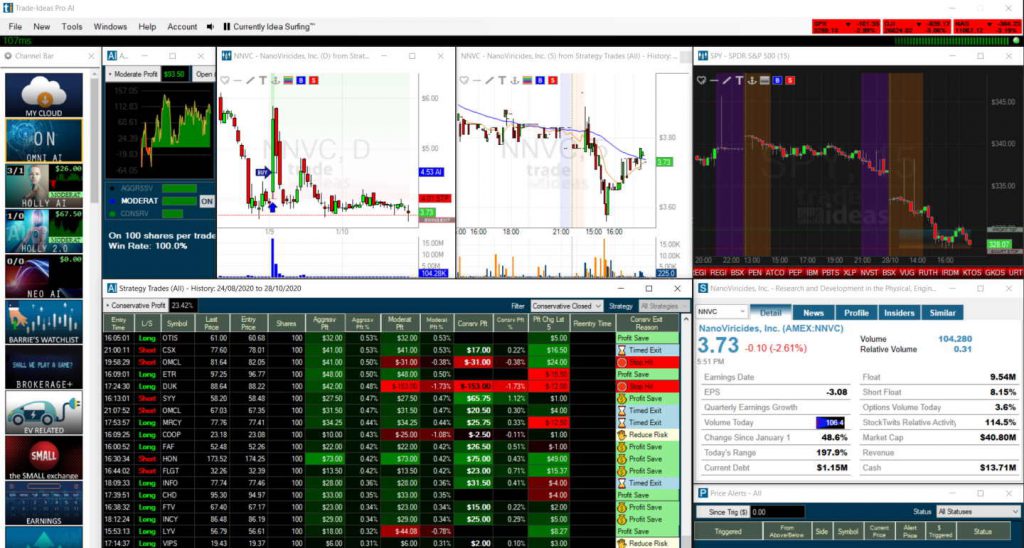

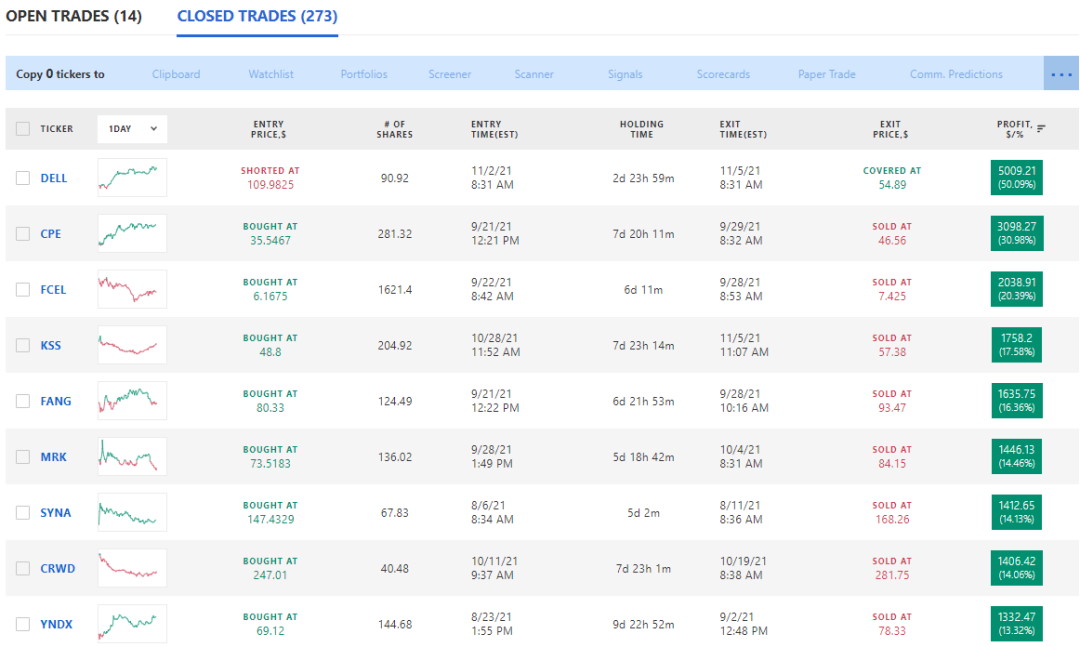

2. Trade Ideas: Better AI day trading signals

Trade Ideas stands out as a top choice for AI day trading. It offers powerful automated analysis and trading capabilities that many day traders seek. Its AI-driven approach sets it apart from platforms like TradingView.

Trade Ideas Rating: 4.7/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Backtesting: ★★★★✩ |

| Trading: ★★★★★ | Pattern Recognition: ★★★★★ |

| Scanning: ★★★★✩ | Candlestick Recognition: ★★★★★ |

| Charts & Analysis: ★★★★★ | Usability: ★★★★✩ |

| Features | Rating ★★★★★ |

|---|---|

| Buy/Sell Signals | ✅ |

| Automatic Trade Execution | ✅ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ✅ |

| Backtesting | ✅ |

| Code-Free Backtesting | ✅ |

| Auto-Trading Bots | ✅ |

| Markets Covered | USA |

| Assets | Stocks |

| Free Trial | ✅ |

| Community & Chat | ❌ |

| OS | Web Browser, Windows |

| Discount Available | -15% Discount Link: Use Code “LIBERATED” |

The heart of Trade Ideas is its AI system, Holly. Holly scans the market in real time, looking for high-probability trading opportunities. This can be a game-changer for day traders who need to make quick decisions.

Here are some key features of Trade Ideas:

- 3 AI trading bots that backtest all US stocks

- Real-time trade signals

- Automated trade execution (with eTrade or Interactive Brokers)

- Brokerage Plus for auto-executing alerts (premium plan)

The platform is designed to learn and adapt, which I think is crucial in the fast-paced world of day trading. As markets change, Trade Ideas’ AI aims to keep up.

Trade Ideas offers a compelling package. Its focus on automated analysis and potential for automated trading makes it a strong contender in the AI trading space. The platform’s real-time scanning and backtesting features can help traders find and act on opportunities quickly—a must in day trading.

While AI trading is still evolving, Trade Ideas is at the forefront of bringing this technology to day traders. Its tools can help streamline the trading process and potentially uncover opportunities that might be missed by manual analysis alone. Read the Trade Ideas review.

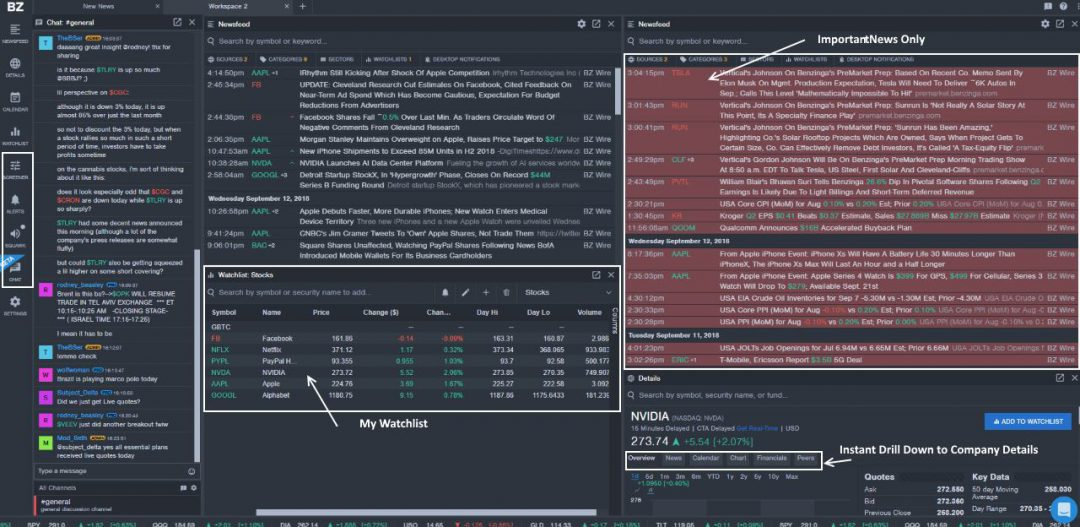

3. Benzinga Pro: Better real-time news and options trading

I’ve found Benzinga Pro to be a top choice for day traders who need quick access to breaking news. When trading stocks based on news events, every second counts. That’s why having real-time information is crucial for making fast trades and daily profits.

Benzinga Rating: 4.6/5.0

| Pricing ★★★★★ | News & Social ★★★★★ |

| Software ★★★★★ | Charts & Analysis ★★★★✩ |

| Screening ★★★★✩ | Options News ★★★★★ |

| Alerts ★★★★✩ | Usability ★★★★★ |

| Features | Rating ★★★★★ |

|---|---|

| Buy/Sell Signals | ✅ |

| Real-time News | ✅ |

| Options Trading | ✅ |

| Pattern Recognition | ❌ |

| Analyst Ratings | ✅ |

| Backtesting | ❌ |

| Charts & Screening | ✅ |

| Auto-Trading Bots | ❌ |

| Markets Covered | USA |

| Assets | Stocks, Crypto, Fx, ETFs, Futures, Options |

| Free Trial | ✅ |

| Community & Chat | ✅ |

| OS | Web Browser, Windows |

| Discount Available | 25% Discount with Code “SMARTER” |

Benzinga Pro stands out as a powerful alternative to TradingView for news-driven trading. Here’s why I think it’s worth considering:

• Lightning-fast news delivery

• Exclusive content not available to regular subscribers

• Direct access to reporters and newsdesk

• News sentiment indicators

• Market-moving alerts

The platform is built to give traders a competitive edge at a fraction of the cost of a Bloomberg terminal. I’ve been impressed by its suite of tools:

- Real-time charts

- Financial data

- Stock screening

- Options mentoring

- Comprehensive event calendars

In my testing, Benzinga Pro proved ideal for US traders wanting speed and actionable news. The platform categorizes news by importance and potential market impact, helping cut through the noise.

For active day traders and investors looking to trade on news events, I recommend trying Benzinga Pro. Its combination of fast news delivery, unique features, and fair pricing makes it a strong contender in the real-time news space.

Compared to TradingView’s delayed newsfeed, Benzinga Pro offers a clear advantage for news-driven trading strategies. The direct access to insider interviews and newsdesk staff adds extra value for serious traders seeking an information edge in the market. Read the entire Benzinga Pro review.

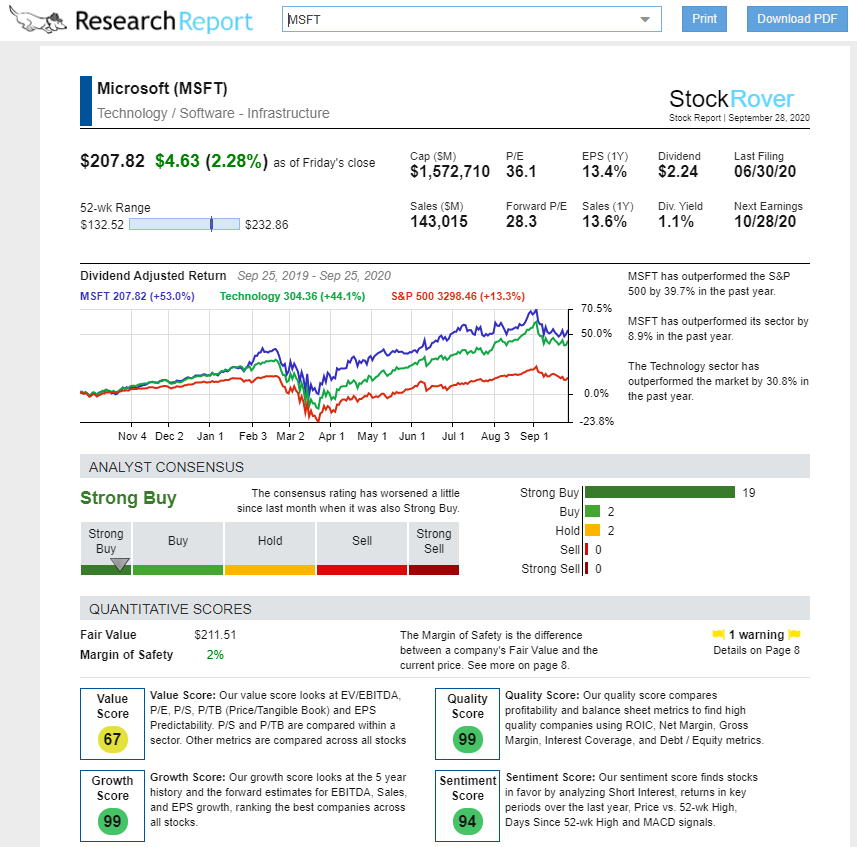

4. Stock Rover: Better financial screening for investors

Stock Rover Rating: 4.7/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Backtesting: ★★★★✩ |

| Trading: ★★★✩✩ | Pattern Recognition: ★✩✩✩✩ |

| Screening: ★★★★★ | Candlestick Recognition: ★✩✩✩✩ |

| Charts & Analysis: ★★★★✩ | Usability: ★★★★★ |

| Features | Rating ★★★★★ |

|---|---|

| Powerful Value, Growth & Dividend Features | ✅ |

| Broker Integration | ✅ |

| Backtesting | ✅ |

| Portfolio Management | ✅ |

| Financial News | ✅ |

| Markets Covered | USA |

| Assets | Stocks, ETFs |

| Free Trial | ✅ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Discount Available | 25% Off with Annual Plan |

Stock Rover is an excellent choice for long-term investors in stocks and ETFs. It’s particularly useful for those focused on growth, value, or dividend investing strategies.

Stock Rover offers tools for portfolio management and tracking. The platform’s extensive data allows you to easily monitor your investments and make informed decisions. With 650 financial metrics covering 10,000 stocks and 44,000 ETFs, it’s a goldmine of information.

The software excels at financial stock screening, allowing me to filter through thousands of options to find the best fit for my investment goals. Its 10-year financial database gives me a solid historical perspective, while the real-time research reports keep me up to date.

I’m impressed by Stock Rover’s stock ratings, which help me quickly assess potential investments. The platform’s flexibility lets me create complex investing strategies tailored to my needs.

For USA and Canadian investors like me, Stock Rover is a top pick. Its user-friendly interface makes it easy to dive into deep fundamental and financial analysis. You can:

- Screen stocks based on custom criteria

- Track my portfolio performance

- Compare stocks side-by-side

- Set up alerts for price changes or other events

Read the in-depth Stock Rover review.

5. MetaStock R/T: Better real-time news and analysis

MetaStock R/T is a game-changer for traders who need accurate price forecasts. I’ve found its forecasting engine to be unmatched in the industry. It uses hundreds of strategies to predict future stock prices, giving traders a big edge.

The MetaStock Forecaster looks at past events and their impact on stock prices. It then uses this data to make predictions. This tool is really helpful for planning trades and setting realistic profit targets.

MetaStock R/T has over 70 “recognizers” – strategies based on common chart patterns. These include:

- New 52-week highs or lows

- Candlestick patterns

- MACD crossovers

Another big plus is the real-time news feed from Refinitiv. It’s top-notch and helps traders stay on top of market-moving events.

MetaStock R/T also shines in other areas:

- Robust charting

- Advanced system backtesting

- Powerful scanning and screening tools

While the charts and tools are great, I think the interface could be a bit more user-friendly. But for serious traders who need strong technical analysis features, it’s hard to beat. Read the complete MetaStock review.

6. Tickeron: Better AI portfolios

Tickeron Rating: 4.4/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★★ | Backtesting: ★★★✩✩ |

| Trading: ★★★★✩ | Pattern Recognition: ★★★★✩ |

| Scanning: ★★★★★ | Candlestick Recognition: ★★★★✩ |

| Charts & Analysis: ★★★★✩ | Usability: ★★★★★ |

| Features | Rating ★★★★☆ |

|---|---|

| Buy/Sell Signals | ✅ |

| Automatic Trade Execution | ❌ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ❌ |

| Backtesting | ✅ |

| Code-Free Backtesting | ❌ |

| Markets Covered | USA |

| Assets | Stocks, ETFs, forex, and cryptocurrencies |

| Free Trial | ❌ |

| Community & Chat | ❌ |

| OS | Web Browser |

| Price/Month | $125 |

| Discount Available | Get -50% off annual plans |

Tickeron stands out as a top-notch AI trading platform, particularly impressive for its stock screening capabilities. It uses advanced pattern recognition to predict market trends, offering 45 different streams of trading ideas. I appreciate how Tickeron lets me build AI portfolios with predicted returns, giving me a unique edge in the market.

The platform’s AI algorithms are top-tier and backed by SAS Global’s data analytics expertise. I’ve found the AI-generated trading ideas based on pattern recognition to be quite insightful. Here’s a look at Tickeron’s AI trade audit trail:

I’m impressed by Tickeron’s use of backtested technical analysis patterns to search for matching stocks. The success rate of each pattern feeds into their Trend Prediction Engine, adding an extra layer of reliability to the AI’s forecasts. Read the full Tickeron review.

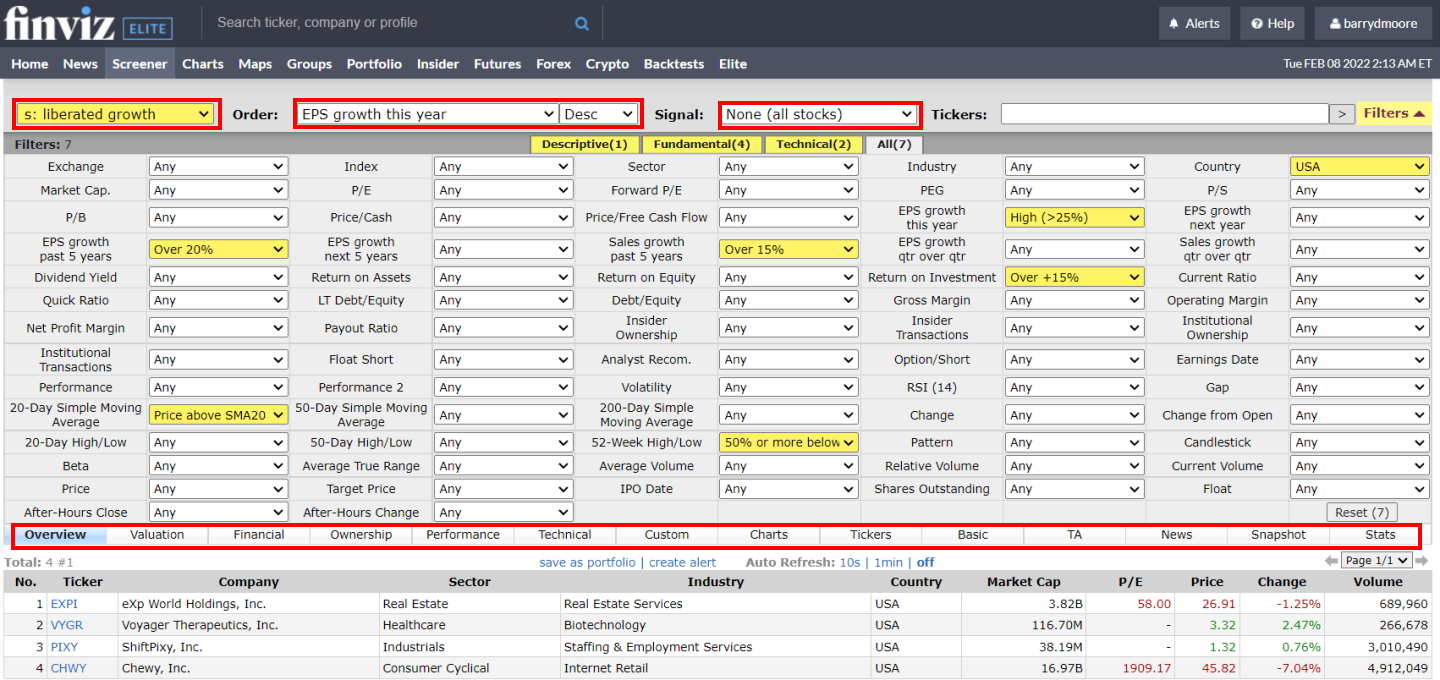

7. FinViz: A free alternative to TradingView

Finviz Rating: 4.4/5.0

| Pricing: ★★★★★ | News & Social: ★★★✩✩ |

| Software: ★★★★✩ | Backtesting: ★★★★✩ |

| Trading: ★★★✩✩ | Pattern Recognition: ★★★★✩ |

| Scanning: ★★★★✩ | Candlestick Recognition: ★★★★✩ |

| Charts & Analysis: ★★★★✩ | Usability: ★★★★★ |

| Features | Rating ★★★★✩ |

|---|---|

| Buy/Sell Signals | ❌ |

| Automatic Trade Execution | ❌ |

| Trendline Recognition | ✅ |

| Chart Pattern Recognition | ✅ |

| Candlestick Recognition | ✅ |

| Backtesting | ✅ With Elite |

| Code-Free Backtesting | ❌ |

| Auto-Trading Bots | ❌ |

| Markets Covered | USA |

| Assets | Stocks, ETFs |

| Free Trial | ✅ |

| Community & Chat | ✅ |

| OS | Web Browser, Windows |

| Price/Month | $25 |

| Discount Available | 40% Off with Annual Plan |

I’ve found FinViz to be an excellent free option for investors looking for TradingView-like features. It offers powerful stock screening, market heatmaps, and chart pattern recognition without any cost.

FinViz’s free plan includes:

- Screening of 10,000+ stocks

- Delayed charts

- News stream

- Ad-supported interface

The free version provides great value for beginners. I’ve used it to scan markets quickly and identify potential investments without fuss.

FinViz Elite, the paid version, adds:

- Real-time data

- Interactive charts

- Backtesting tools

After 14 years of using FinViz, I’ve seen significant improvements in its charting and pattern recognition capabilities. The stock screener remains top-notch, allowing users to filter stocks based on 67 different criteria. Read the in-depth Finviz review.

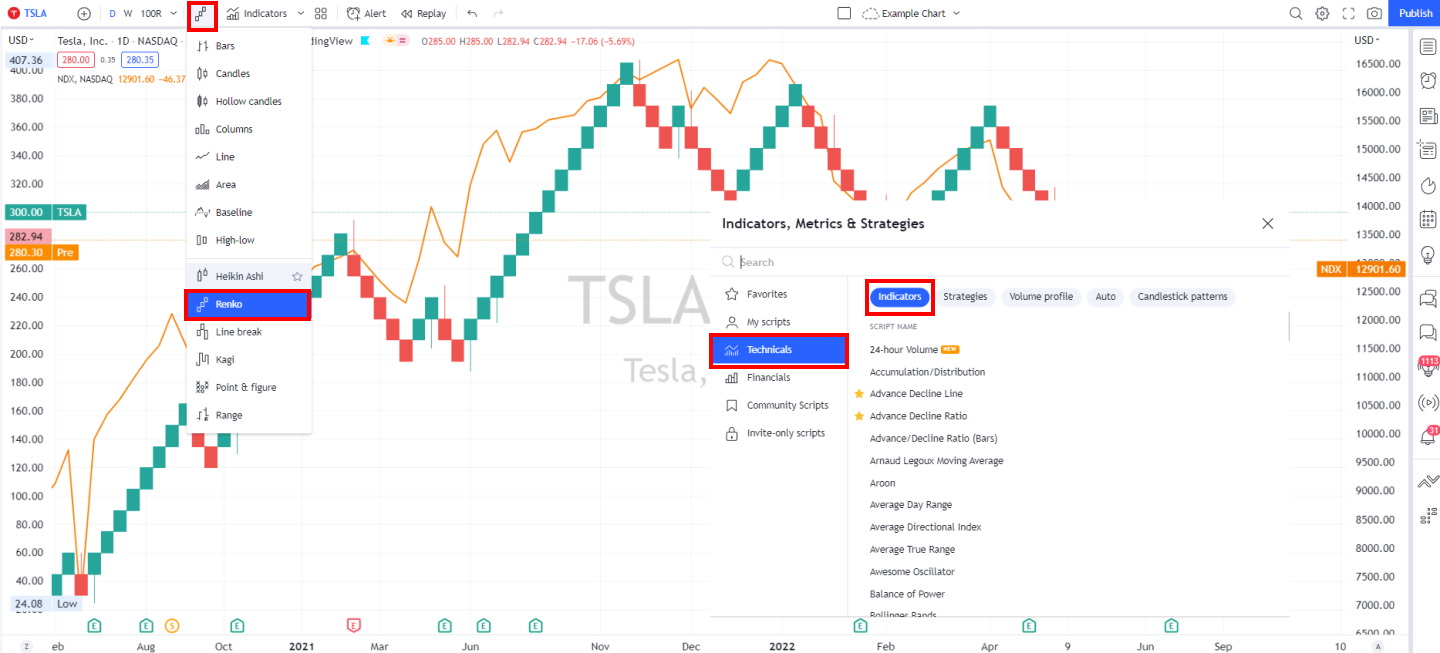

Why TradingView is Still Worth It!

Powerful Charts & Indicators

TradingView offers 14 chart types for in-depth market analysis. I find the variety impressive, from standard candlesticks to specialized Renko and point-and-figure charts. With 101 technical and 60 financial indicators, I can layer multiple data points on my charts.

I love that TradingView lets me create custom indicators using Pine script. It’s user-friendly and quick to develop new tools. I’ve made my own MOSES indicators, which have been a game-changer for my analysis.

Free Stock Data Globally

I’m amazed by TradingView’s global data coverage. It includes:

- 56 stock exchanges

- 21 forex providers

- 63 crypto exchanges

Most data has a 15-minute delay, but BATS exchange data is real-time. For other real-time data, TradingView’s prices are unbeatable. At just $2-$3 monthly, it’s a fraction of what other platforms charge.

A Huge Active Trading Community

With 29 million monthly users, TradingView’s community is a goldmine of knowledge. I can access:

- Educational articles

- Trading ideas

- Market hypotheses

- Custom indicators and strategies

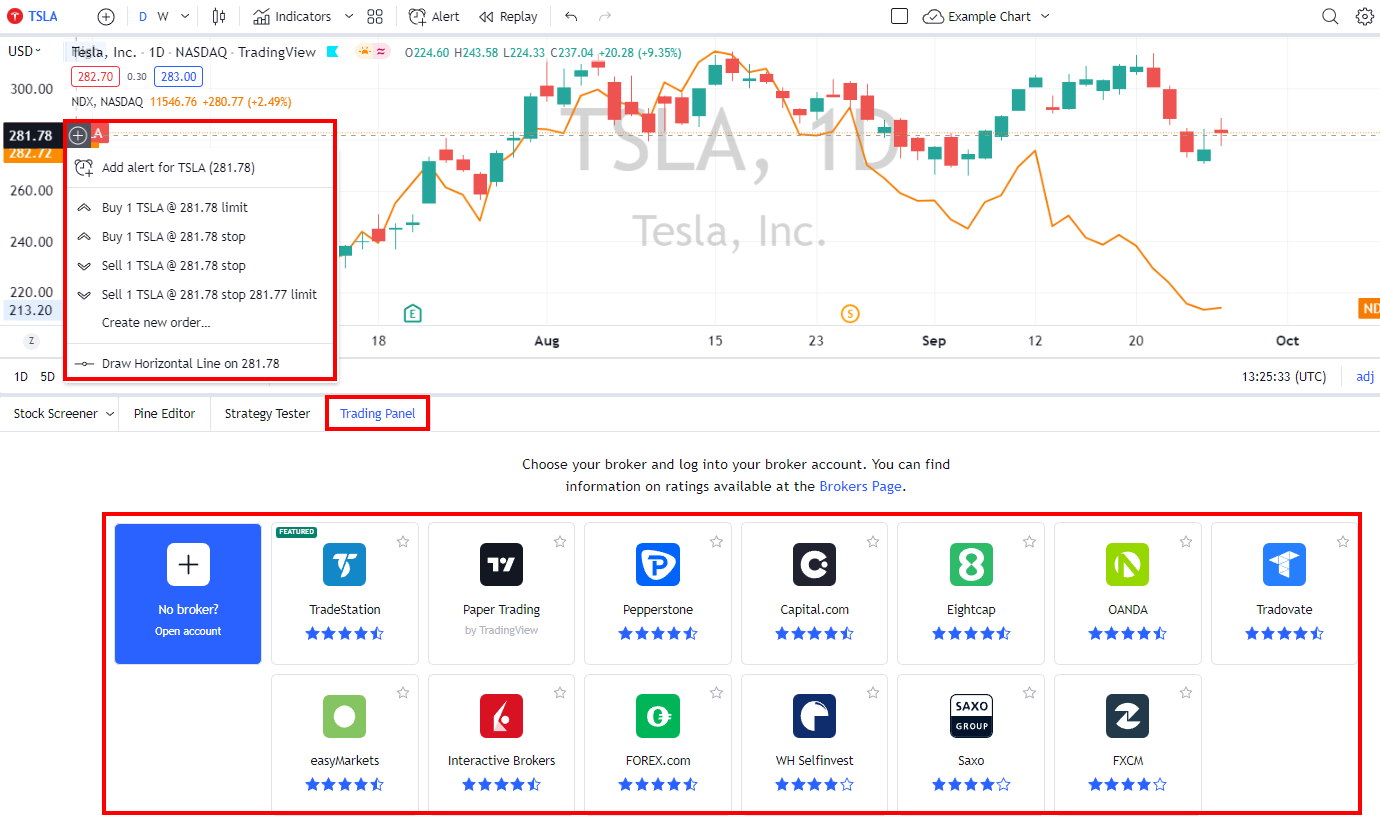

Integrated Brokers & Trading

TradingView’s broker integration is top-notch. I can trade directly from my charts with 43 different brokers. Some standout options include:

- Interactive Brokers

- TradeStation

- Ally Invest

- Tradier

TradeStation even offers commission-free stock trades through TradingView. To start trading, I just click the Trading Panel and choose my broker or paper trading account.

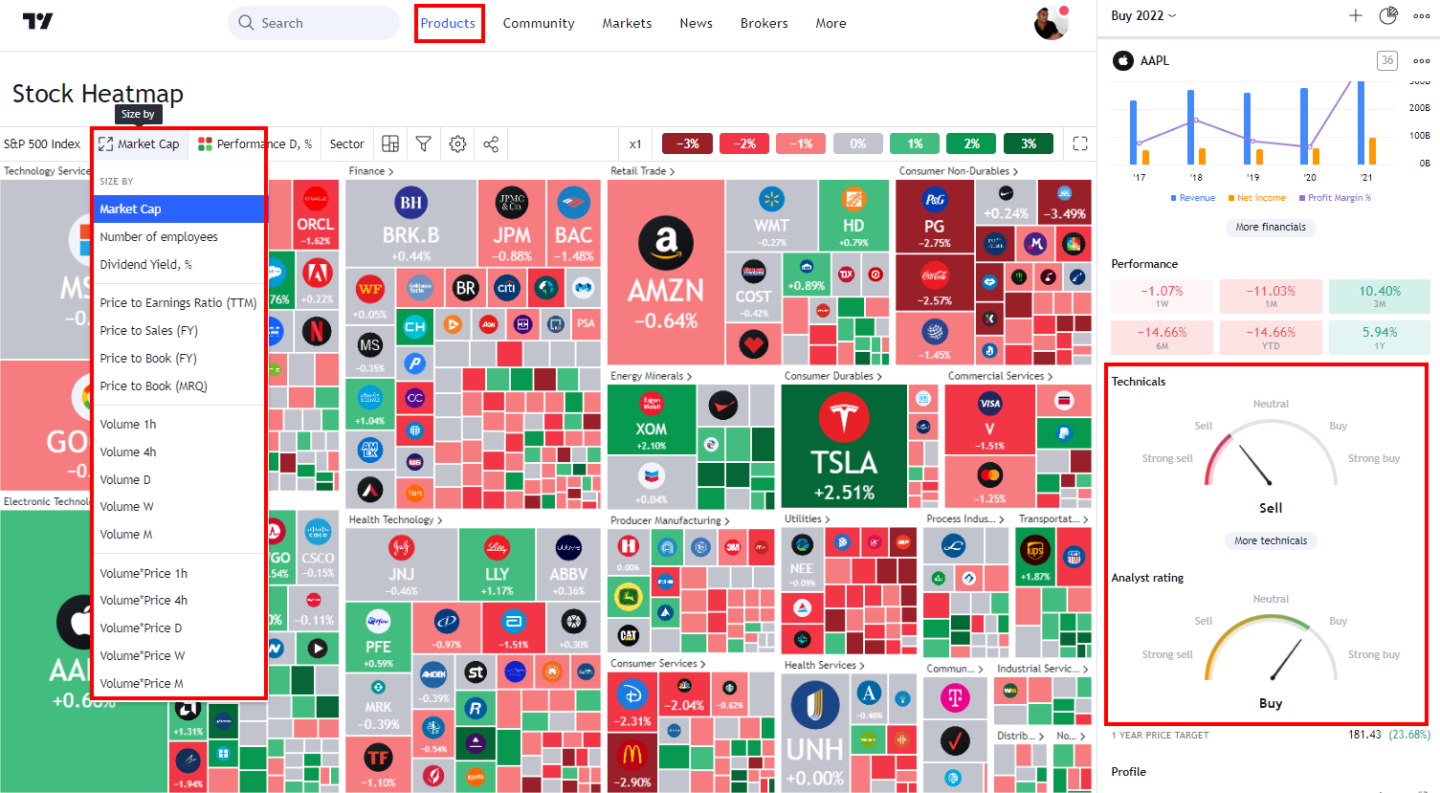

Heatmaps & Stock Ratings

TradingView’s heatmaps are a visual feast for spotting market trends. I can customize them based on:

- Market Cap

- Dividend Yield

- PE Ratio

- Volume

- Volume/Price

Another feature I rely on is the buy/sell gauges. They give me quick technical and analyst ratings for any stock I’m watching.

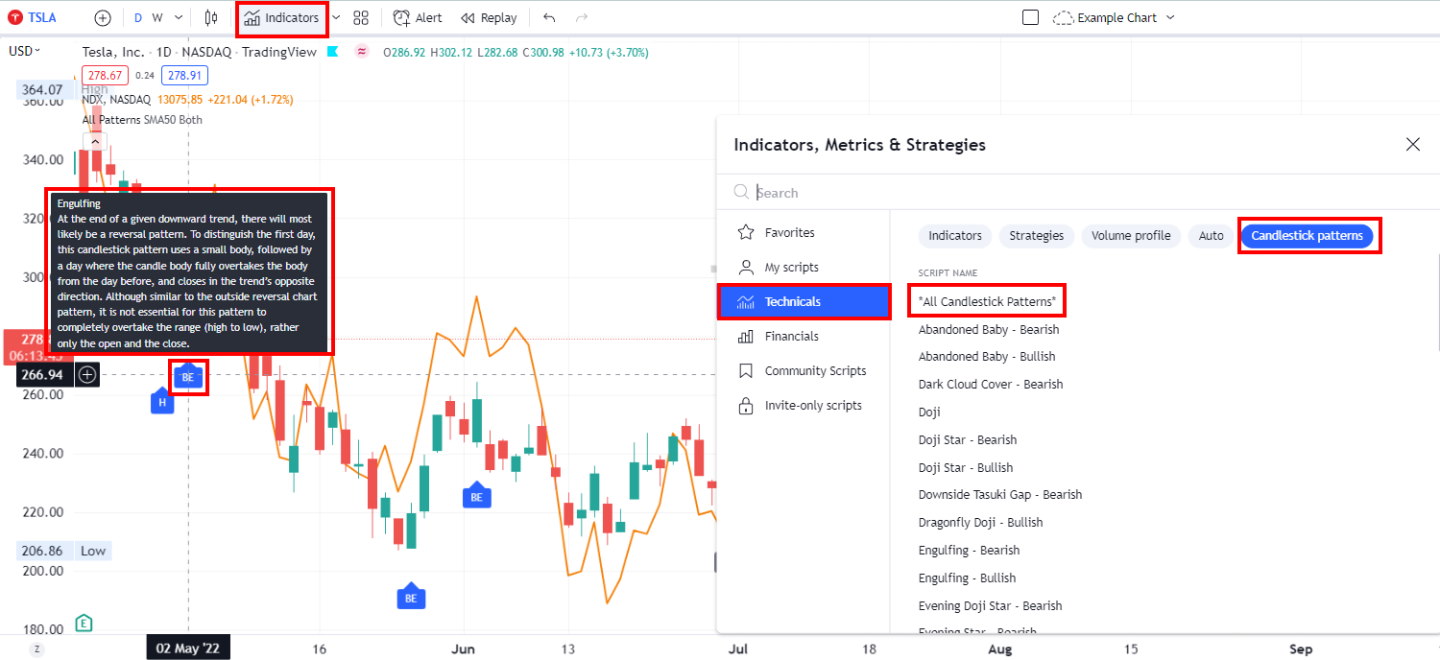

Pattern Recognition

TradingView’s pattern recognition tools are a lifesaver. They automatically identify over 40 candlestick patterns on my charts. I don’t need to memorize them all – the platform does it for me.

To use this feature, I go to Indicators > Technicals > Candlestick Patterns> All Candlestick Patterns. It’s that simple.

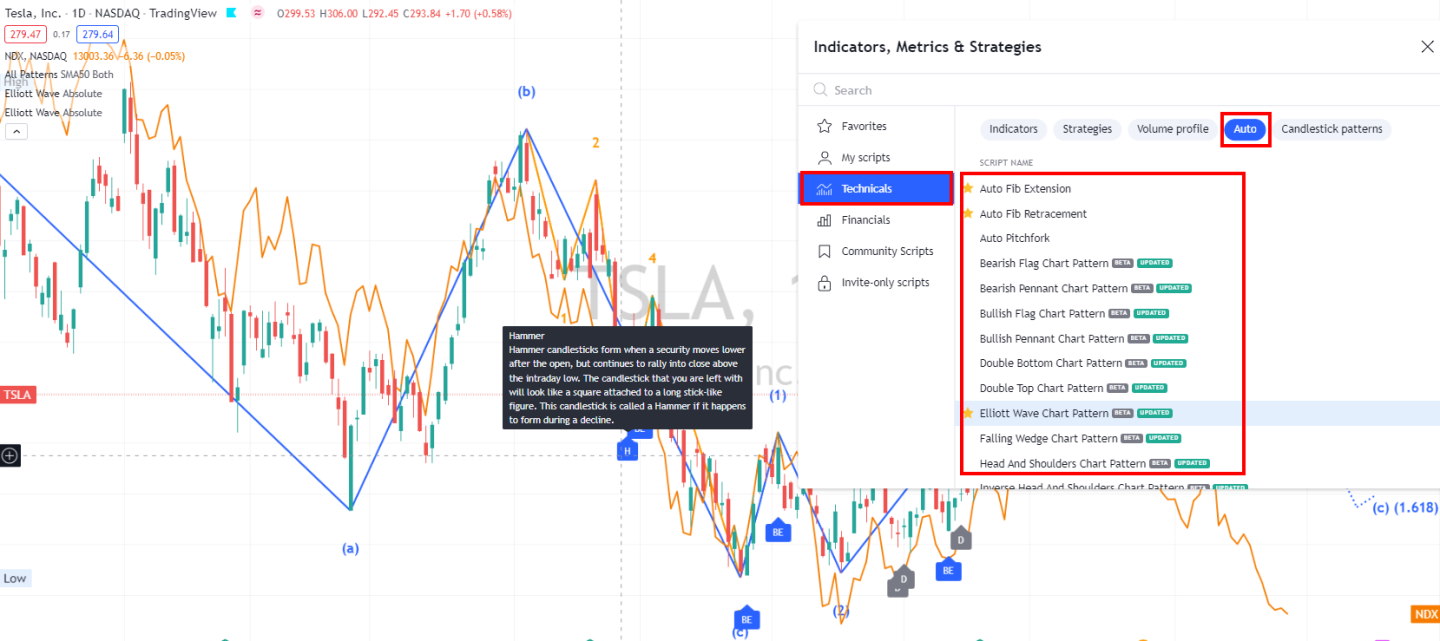

TradingView also recognizes Fibonacci, Elliott Waves, and chart patterns like pennants and flags. I can enable these by clicking Indicators > Technicals > Auto > Choose Your Pattern.

Real-time Stock Scanning

TradingView’s stock scanner is a powerful tool I use daily. It helps me find trading opportunities across multiple markets. I can set custom filters based on the following:

- Price action

- Volume

- Technical indicators

- Fundamentals

The scanner updates in real time, so I never miss a potential trade. I can also save my favorite scans and access them quickly whenever I need them.

I also find the pre-built scans useful. They cover common strategies like breakouts, oversold conditions, and earnings surprises, which are great starting points for my own custom scans.

The scanner also integrates seamlessly with TradingView’s charts. I can click any result to open a detailed chart view, making it easy to do deeper analysis on promising stocks.

Summary

I’ve found that TradingView alternatives offer unique strengths for different trading needs.

TrendSpider caught my eye with its powerful chart pattern recognition and backtesting tools. For traders who rely heavily on technical analysis, this could be a game-changer.

Trade Ideas impressed me with its AI-powered algorithms, which can help spot potential trades I might otherwise miss.

Benzinga Pro stands out for its real-time financial news delivery. Staying on top of market-moving information is crucial, and Benzinga Pro excels here.

For long-term investors, I’d recommend checking out Stock Rover. Its focus on fundamental analysis and portfolio management tools can be invaluable for building a solid investment strategy.

Lastly, don’t underestimate the value of good customer support. Trading can be stressful, and having reliable help when you need it can make a big difference.