I am a market analyst, and I consider myself a power user of both TradingView and TrendSpider. They are both my favorite trading tools, and I have a full-paid subscription to both products. But which one is best for you? I have compared over 70 factors to help you make your decision.

TradingView vs. TrendSpider Ratings

In my head-to-head testing and rating of TradingView and TrendSpider, I judge the result as “too close to call,” with both scoring 4.7/5.0.

TrendSpider shines in AI-powered functionality like pattern recognition, scanning, and backtesting. It also offers auto-trading capabilities and access to launch your own AI models and bots. Meanwhile, TradingView stands out for its 20 million social community covering all assets and exchanges globally.

Both platforms have industry-leading charting, scanning, and backtesting, plus they are both user-friendly.

Here’s a breakdown of their ratings:

| Feature | TrendSpider | TradingView |

|---|---|---|

| Overall Rating | 4.7/5.0 | 4.7/5.0 |

| Pricing | ★★★★★ | ★★★★★ |

| Software | ★★★★★ | ★★★★★ |

| Trading | ★★★★★ | ★★★★★ |

| Scanning | ★★★★★ | ★★★★✩ |

| Pattern Recognition | ★★★★★ | ★★★★✩ |

| News | ★★★★✩ | ★★★★✩ |

| Social | ★★★✩✩ | ★★★★★ |

| Chart Analysis | ★★★★★ | ★★★★★ |

| Backtesting | ★★★★★ | ★★★★✩ |

| Usability | ★★★★★ | ★★★★★ |

TrendSpider scores higher in scanning, pattern recognition, and backtesting. Meanwhile, TradingView leads in social features. Both platforms are top-notch for chart analysis and usability.

My Verdict on TradingView vs. TrendSpider

TradingView and TrendSpider are great trading platforms. TradingView scores 4.7/5.0 for its all-around performance. Meanwhile, TrendSpider rivals it with 4.7/5.0 thanks to its AI innovations and incredibly advanced features.

For me, the choice between TrendSpider and TradingView comes down to this: TradingView is your choice for global community, exchanges, and chart trading. For the innovation leader in AI trading, backtesting, strategy development, and pattern recognition, choose TrendSpider.

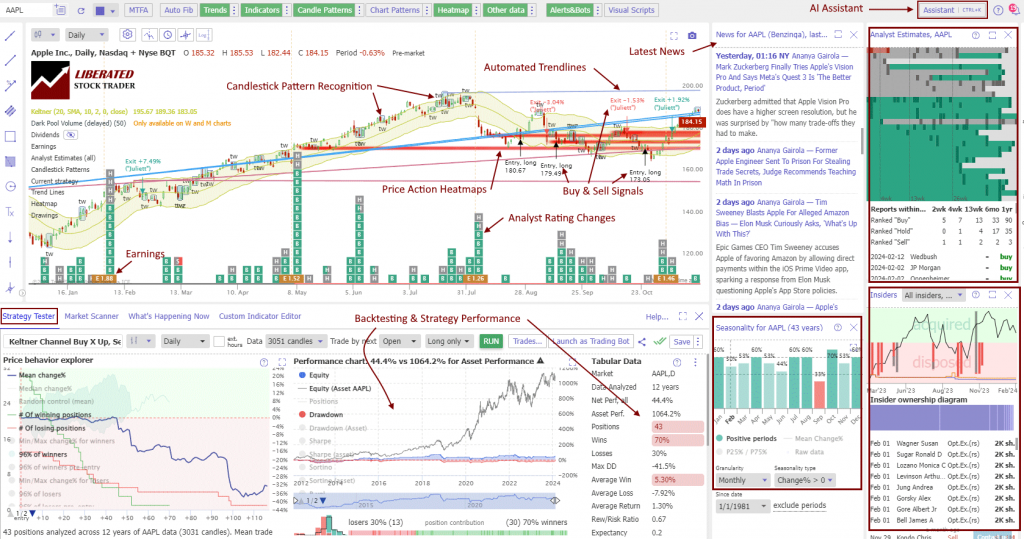

TrendSpider Features Screenshots

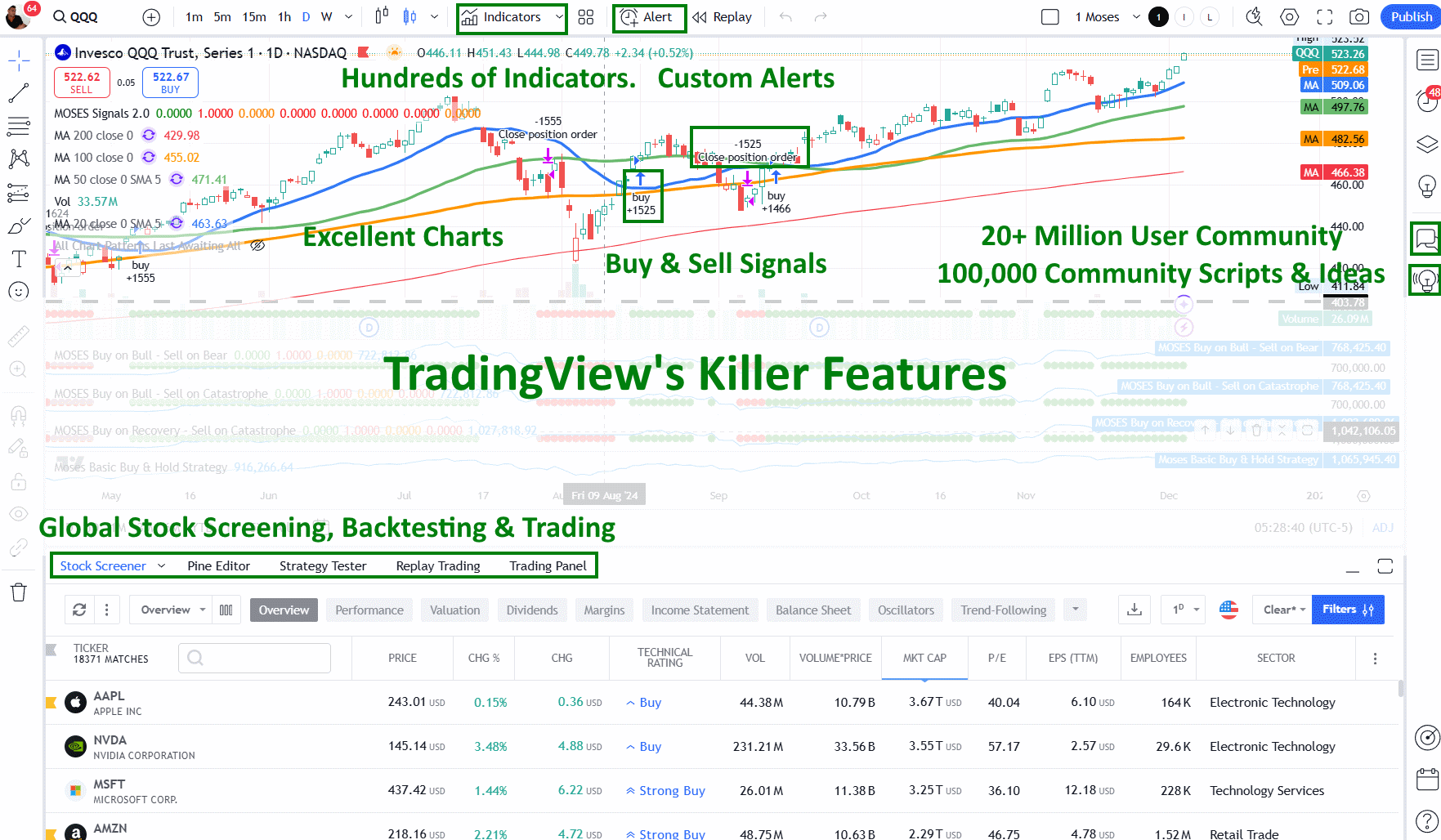

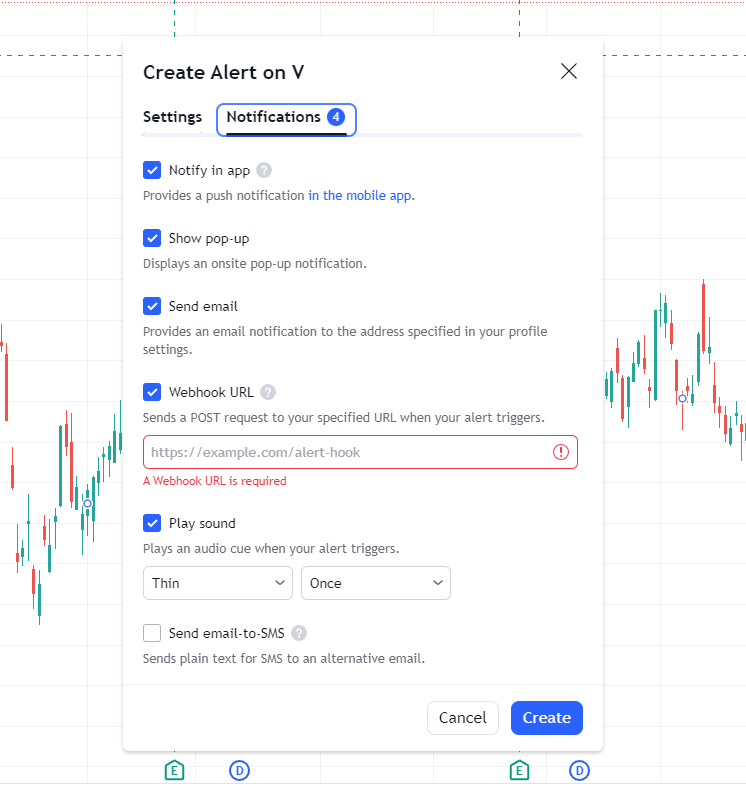

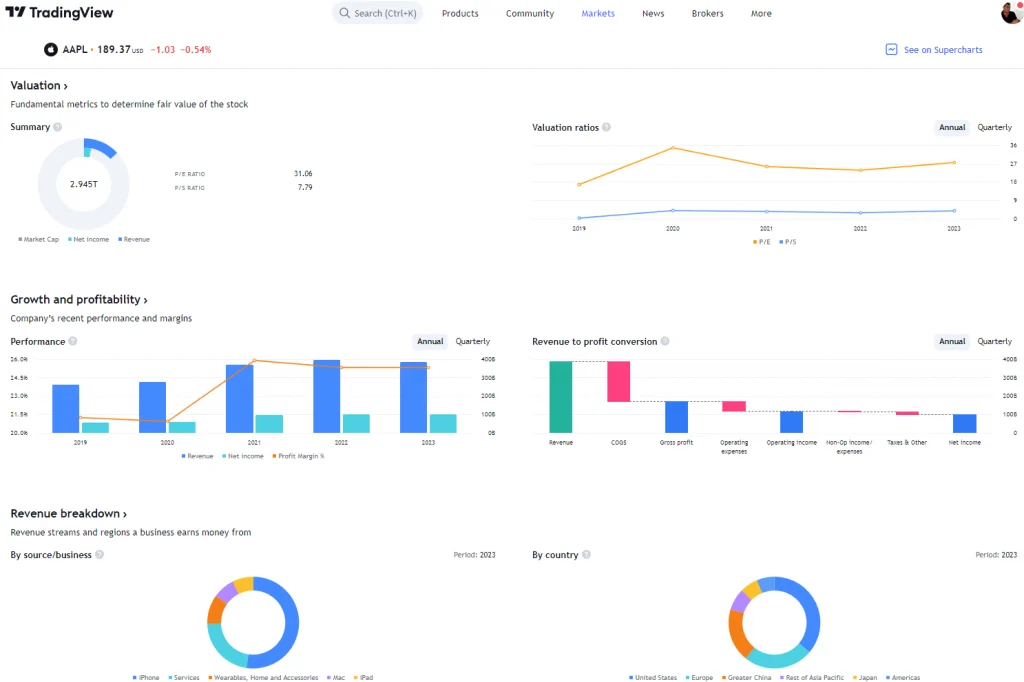

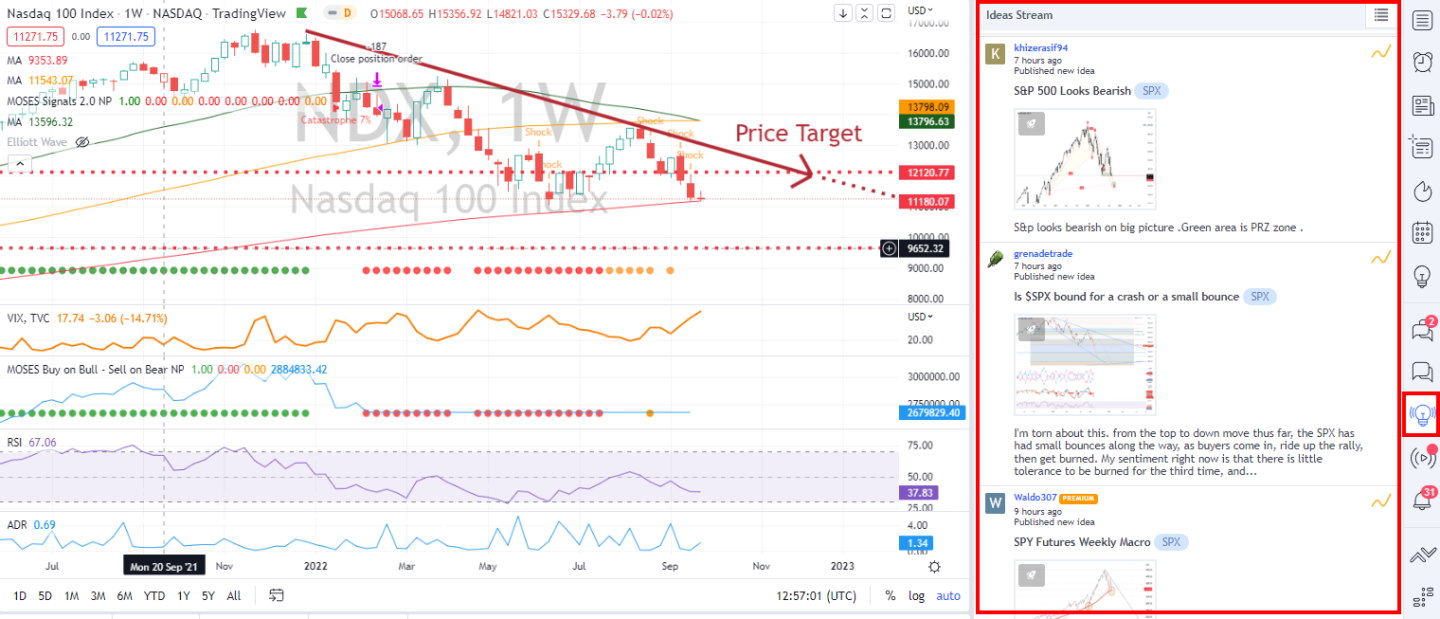

TradingView Features Screenshots

Features Compared

I’ve found that TradingView and TrendSpider are equal in many ways. Both offer powerful tools for traders, but they have some key differences. TradingView boasts a global user base and includes a social aspect, letting me share charts and ideas with millions of other traders. TrendSpider, on the other hand, focuses solely on the US market.

Both platforms provide essential features like charting, watchlists, and screening. TradingView stands out with its trading capabilities, backtesting options, and vibrant community, while TrendSpider shines with its AI pattern recognition technology.

Here’s a quick comparison of their features:

| Feature | TradingView | TrendSpider |

|---|---|---|

| Charts | ✅ | ✅ |

| Watchlists | ✅ | ✅ |

| Screening | ✅ | ✅ |

| Trading | ✅ | ✅ |

| Backtesting | ✅ | ✅ |

| AI Pattern Recognition | ❌ | ✅ |

| Community | ✅ | ❌ |

Both platforms offer monthly and yearly subscriptions, with TradingView starting at $49/month annually and TrendSpider at $48/month annually.

TradingView stands out for its live trading features, vibrant community, and comprehensive global data. Many traders seeking real-time market insights and collaboration consider it a go-to platform.

On the other hand, TrendSpider has impressed me with its AI-powered pattern recognition and robust backtesting capabilities. This platform excels at automating technical analysis, making it easier for traders to spot potential opportunities. Both tools have their strengths, and choosing between them often comes down to individual trading styles and needs.

Pricing & Discounts

TradingView offers better pricing than TrendSpider, with a free basic plan and cheaper premium options. The ad-supported basic plan starts at $0. The Pro plan costs $14.95 monthly, Pro+ is $29.95, and Premium is $59.95. I recommend the Pro or Pro+ plans as they offer a good balance of features and affordability. A yearly subscription to TradingView can save you 16%.

TrendSpider plans cost $48/mo and include real-time data, futures, AI pattern recognition, backtesting, news, options, crypto, and automated bot trading with broker integration. However, you can save 30% with my discount code “LST30“.

| Features | TradingView | TrendSpider |

| Features | Charts, News, Watchlists, Screening | Charts, Watchlists, Screening |

| Unique Features | Trading, Backtesting, Community | AI Pattern Recognition, Trading, Backtesting |

| Best for | Stock, Fx & Crypto Traders | Stock, Fx & Crypto Traders |

| Subscription | Monthly, Yearly | Monthly, Yearly |

| Price | Free or $59/m or $49/m (-16%) annually | $107/m or $48/m annually |

| OS | Web Browser | Web Browser |

| Trial | Free 30-Day | ❌ |

| Region | Global | USA |

| Discount | $15 Discount Available + 30-Day Premium Trial | Use Code “LST30” for -30% on monthly or -63% off annual plans |

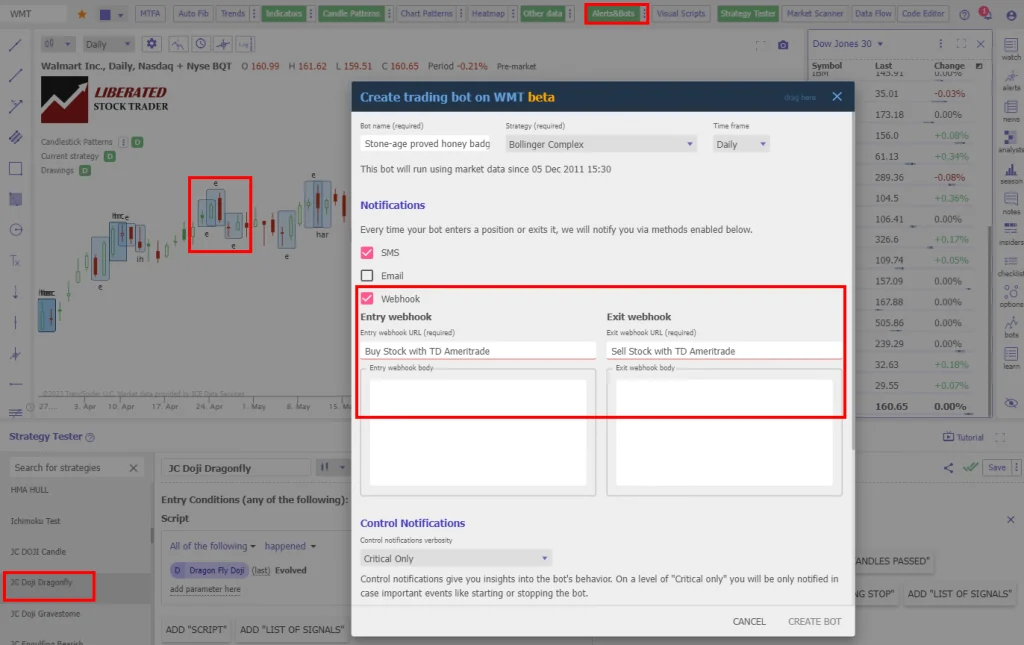

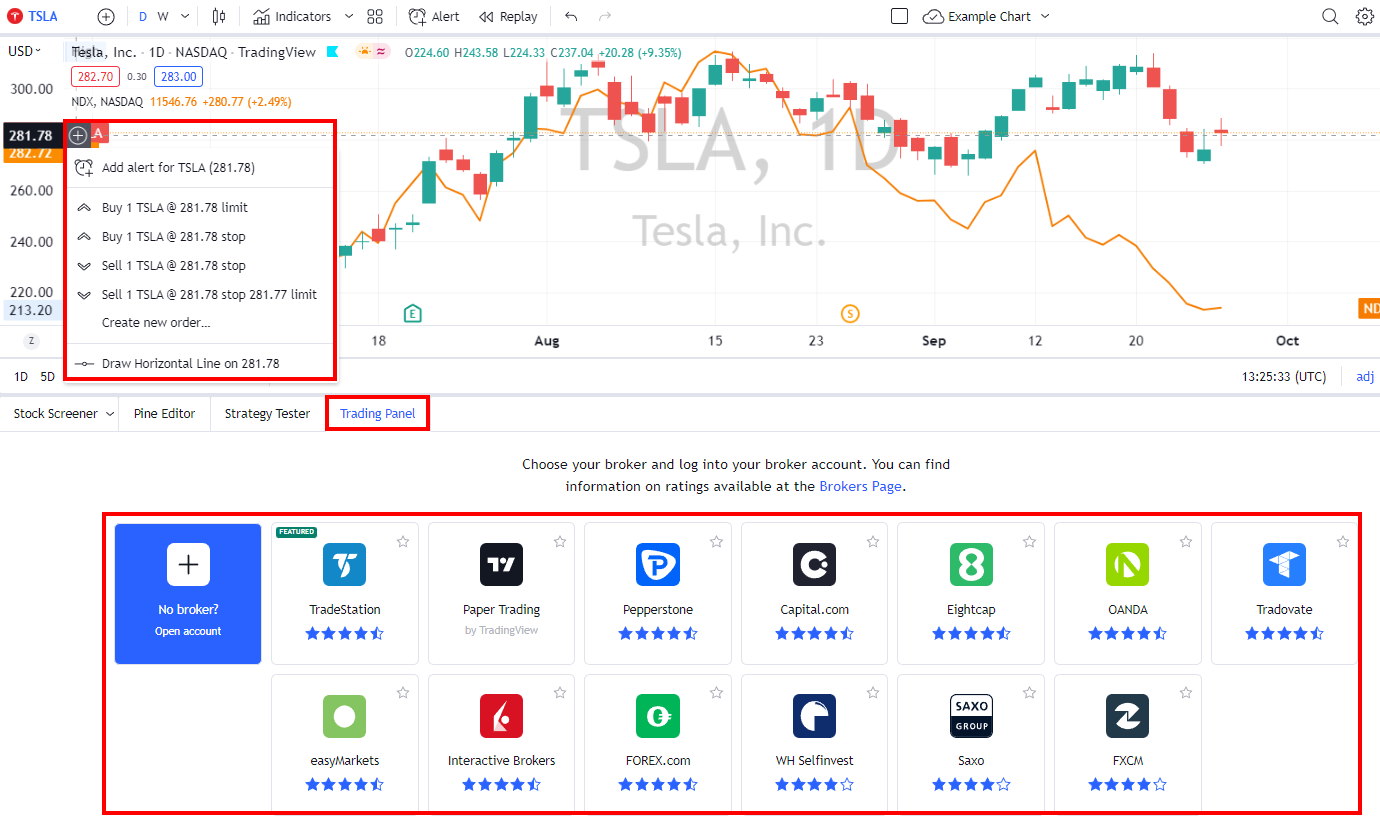

Trading

For broker integration and trading, TradingView wins, but it is close. TradingView offers tight integration with 50 quality brokers across the globe, allowing me to trade directly from charts and track my profits and losses easily. Meanwhile, TrendSpider connects to 25 US brokers and lets me use trading bots to automate my stock, Forex, and crypto trades. Both platforms give me powerful tools for managing my investments across different markets.

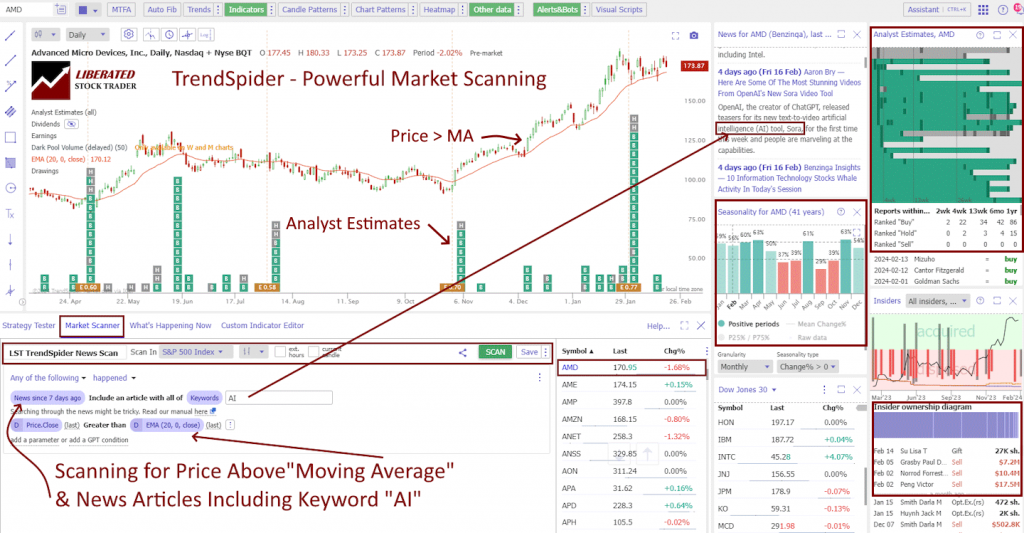

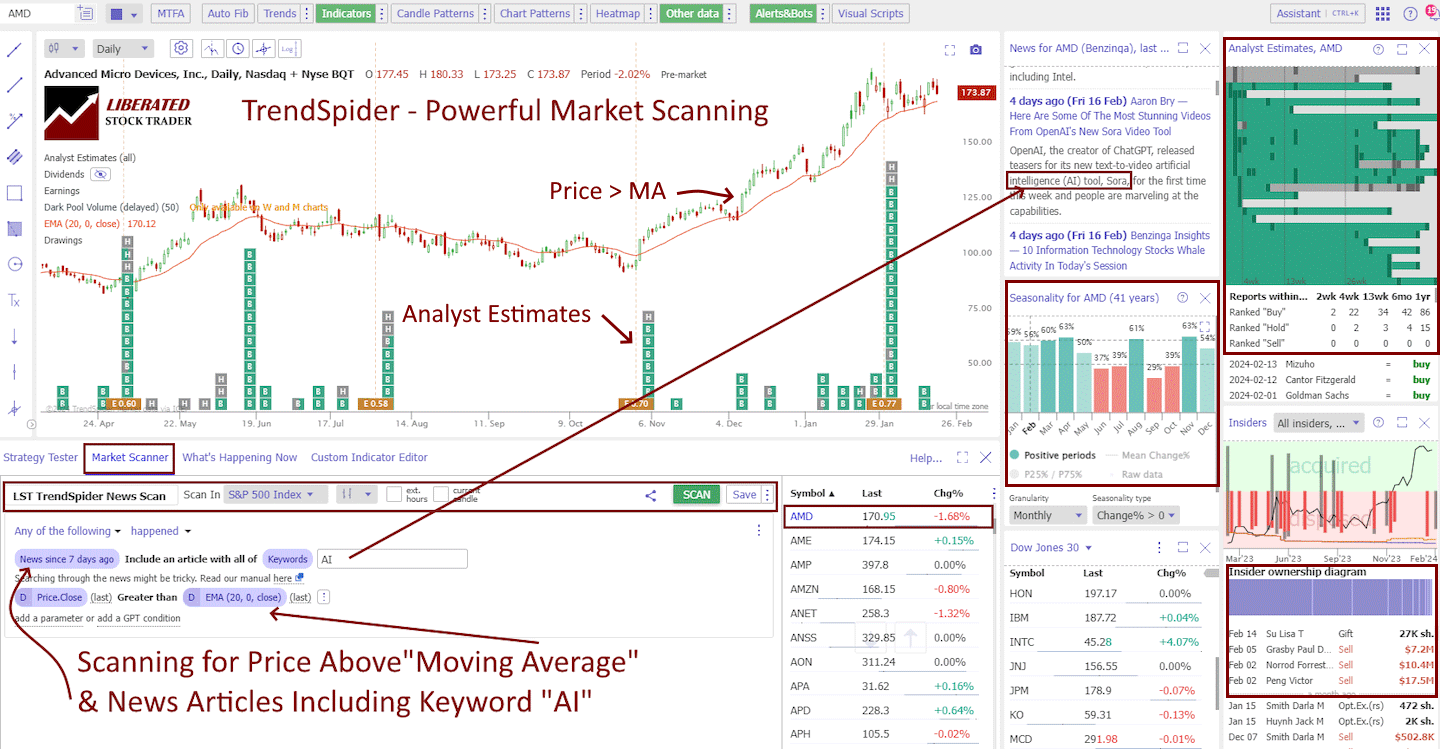

Scanning

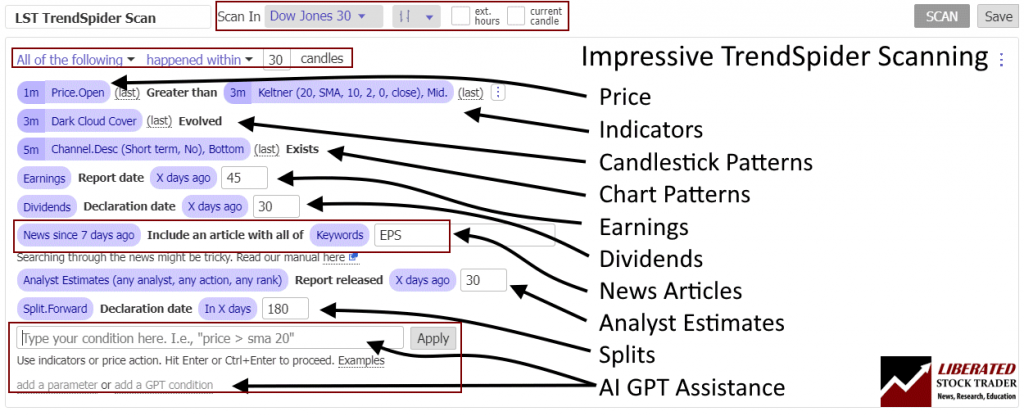

Scanning tools can make a big difference in stock analysis. TrendSpider’s scanner is the winner and stands out with its power and flexibility. It lets me screen for many criteria, such as price, indicators, patterns, earnings, and more. You can even search for news articles with specific keywords.

Here’s a cool example: I can look for companies with upcoming earnings, expected positive surprises, and AI mentions in the news. This multi-layered approach is really useful.

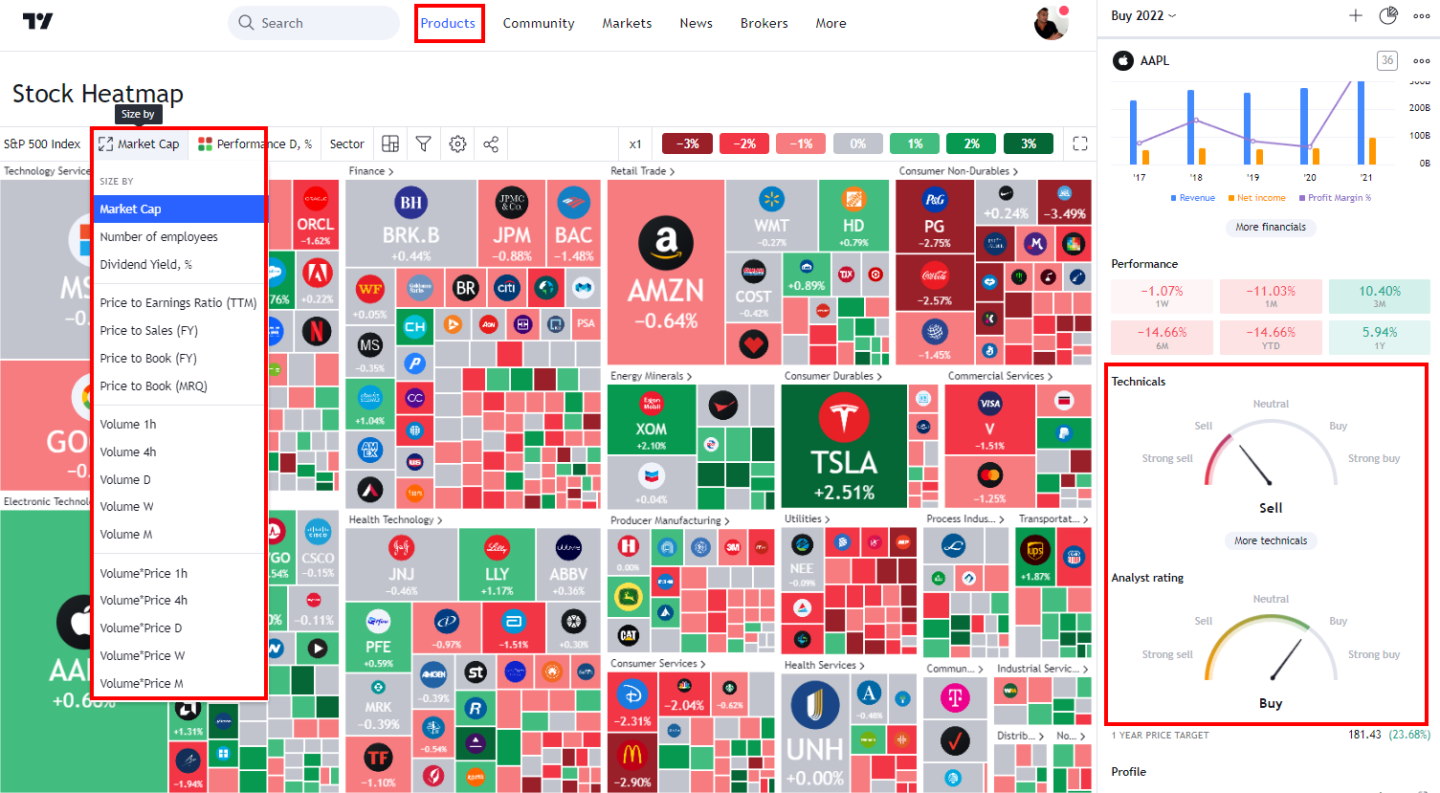

TradingView’s screener is also good. It has 160 criteria, covering basics like EPS and PE ratio, plus some less common ones like employee count and goodwill.

I like how TrendSpider’s Market Scanner can check one stock or the whole market for my technical criteria. It uses AI to spot trends, which is pretty neat when combined with full market scanning.

These tools make it easier for me to find stocks that fit my strategy. They save time and help me spot opportunities I might miss otherwise.

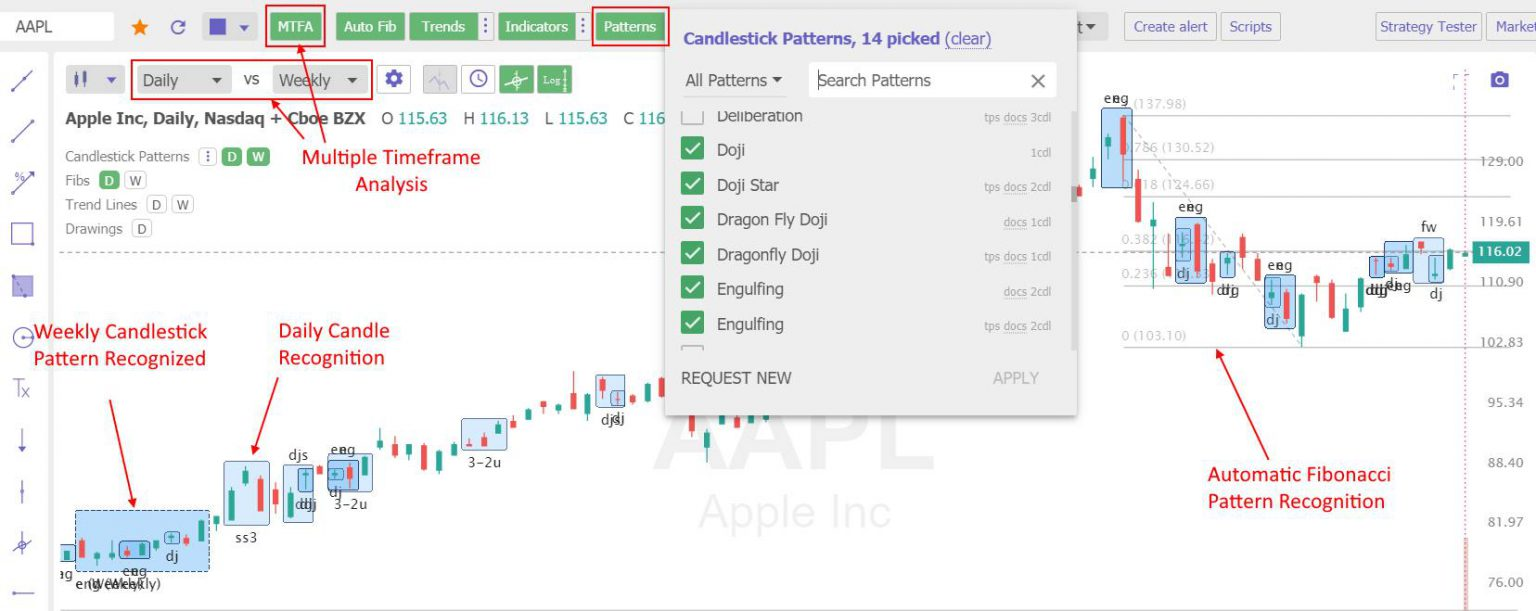

Pattern Recognition

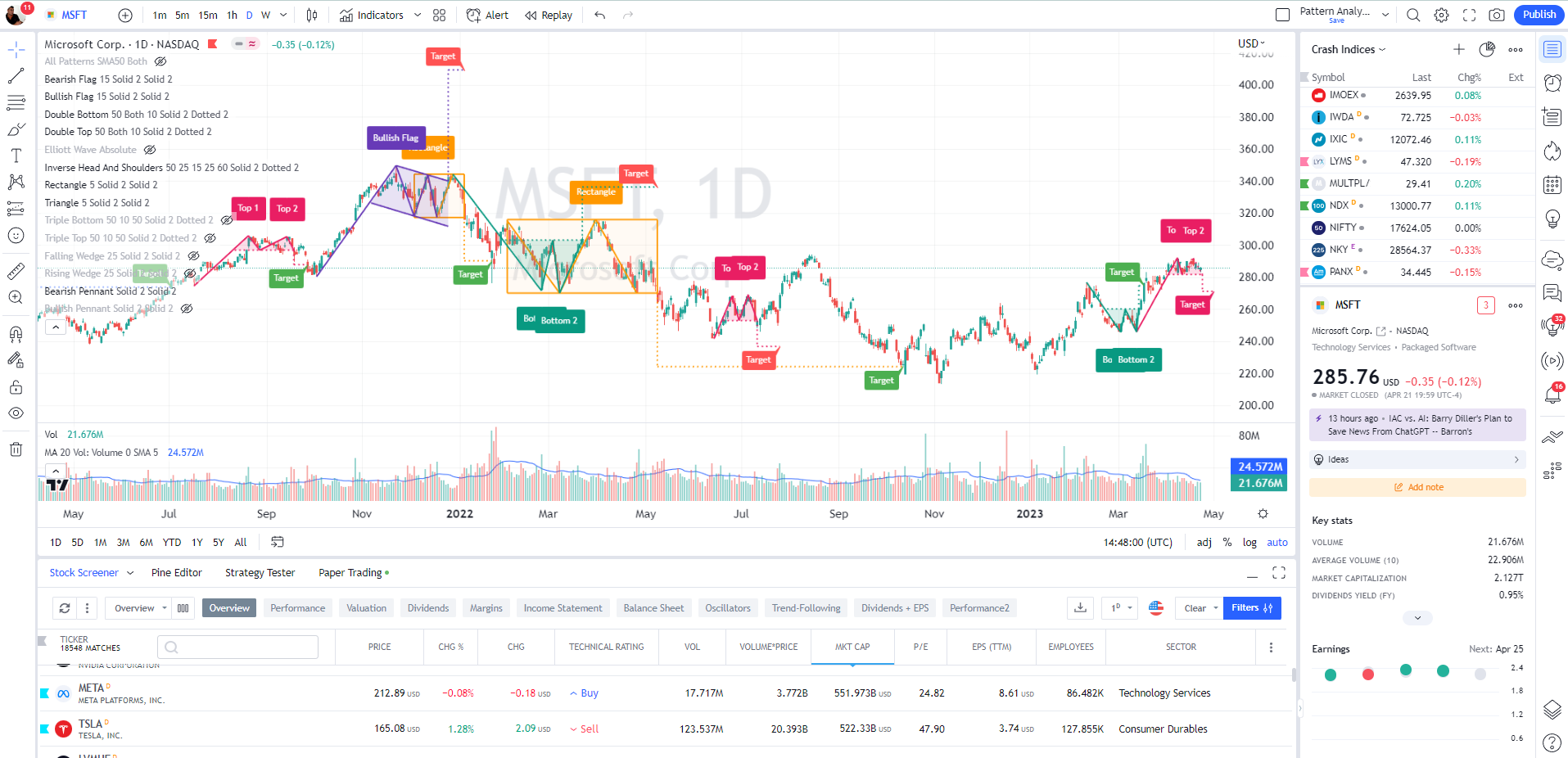

Automated technical analysis tools have revolutionized chart pattern recognition. TrendSpider and TradingView are leading platforms in this field, offering powerful features for traders.

For me, TrendSpider’s AI-powered pattern recognition is the winner; it analyzes vast amounts of data across multiple timeframes, giving traders an edge. Its automated trendline detection is a game-changer, saving time and improving accuracy in morning trade reviews.

TrendSpider’s algorithms can spot thousands of trendlines and highlight the most promising ones based on backtested data. This level of analysis often surpasses human capabilities.

TradingView also shines with its automated candlestick recognition and community-developed indicators. Its pattern recognition tool is user-friendly and effective.

I’m impressed by TrendSpider’s multi-time frame analysis, which allows me to view multiple timeframe charts on a single screen with auto-plotted trendlines. The platform also offers advanced support and resistance line plotting, creating a subtle chart heatmap. This multi-timeframe analysis extends to 42 stock chart indicators, ensuring a thorough market analysis.

News & Social

TradingView is a powerhouse when it comes to its trading community and financial news. I’ve found it to be the go-to platform for social sharing and learning in the trading world. With over 20 million active users, it’s an incredible place to connect with fellow investors.

The platform’s chat forum and publishing system are top-notch. I can easily share my charts and ideas with others. It’s not just about posting—I also get valuable market insights from the community.

I publish my stock market analysis on TradingView. You can follow me there for regular updates and commentary. It’s free to join, so why not give it a try?

Charting

TrendSpider and TradingView offer impressive chart analysis tools that I find essential for technical traders. TradingView’s 160 indicators and unique charts like LineBreak and Heikin Ashi give me a wide range of options. Meanwhile, TrendSpider’s 200+ indicators and patented Raindrop charts are particularly appealing to me.

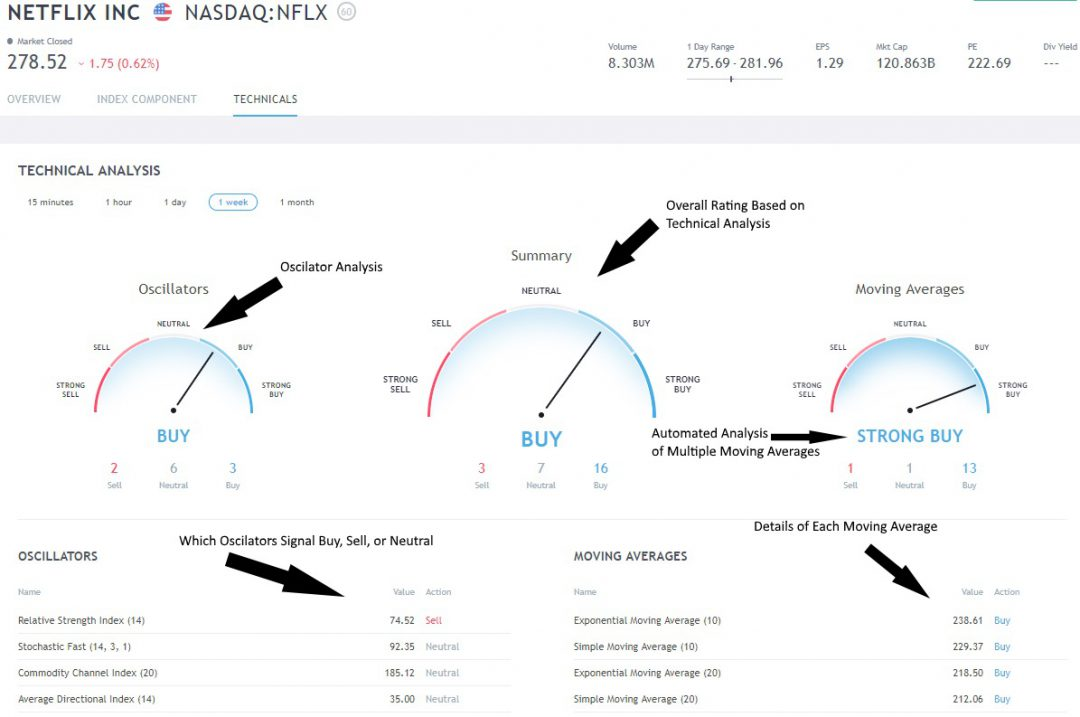

TradingView stands out when it comes to drawing tools. I love using their Gann & Fibonacci tools for trendline analysis. The 65 drawing options and hundreds of icons let me create detailed, informative charts.

TradingView’s Buy and Sell gauges are a time-saver. I can quickly see which stocks are bullish, bearish, or neutral. Their stock indicator ratings are solid, based on moving averages and oscillators. I’ve found these to be a good measure of market sentiment.

I find TradingView’s “Technicals” feature very useful. It shows three gauges: oscillating indicators on the left, a summary in the middle, and moving averages on the right. This setup gives me a quick overview of a stock’s technical status.

Both platforms offer tools for multi-timeframe analysis, which I use to spot trading opportunities. The volume profile and heatmaps help me better understand price action. These features are crucial for making informed decisions in day trading and swing trading.

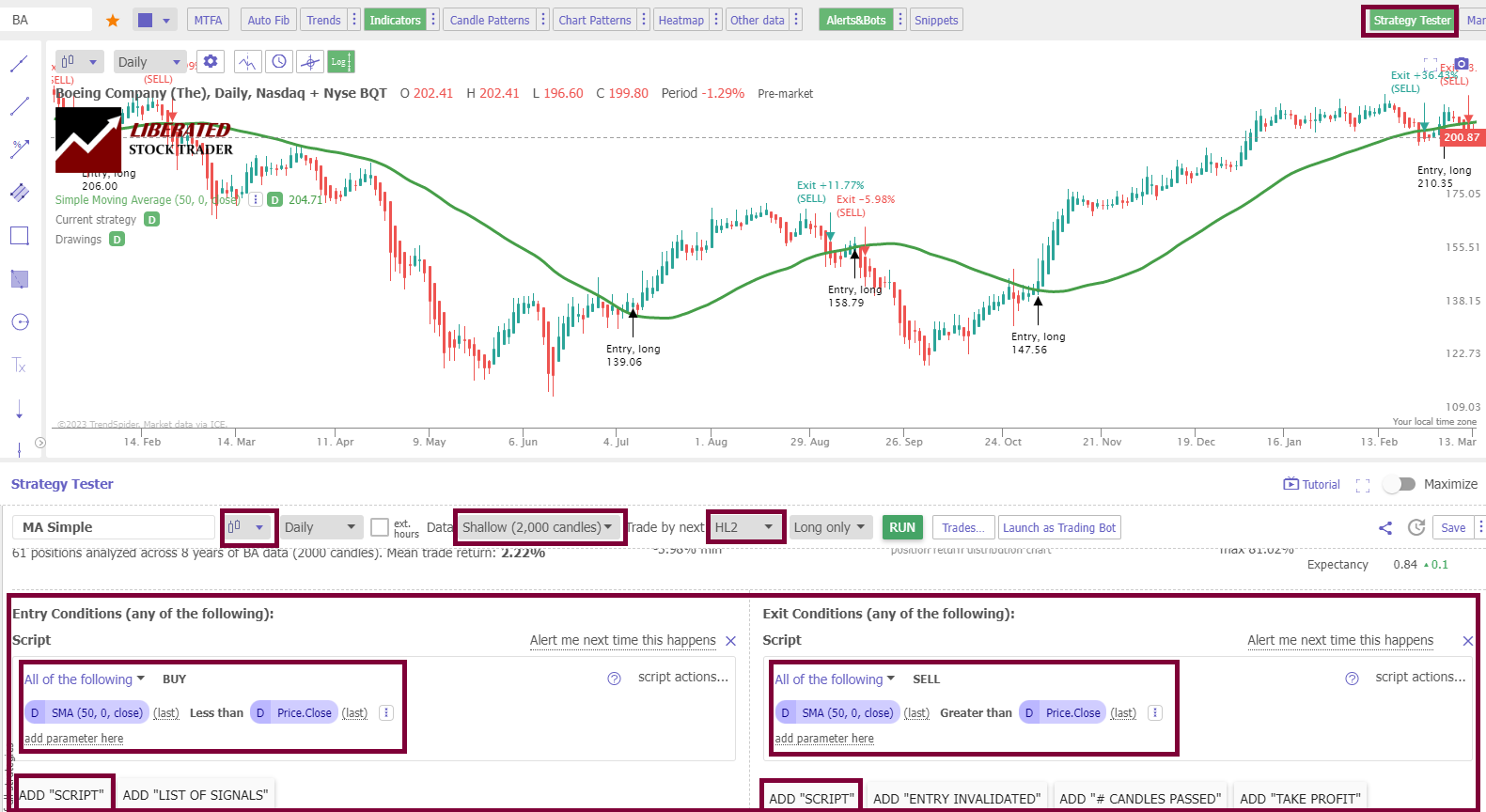

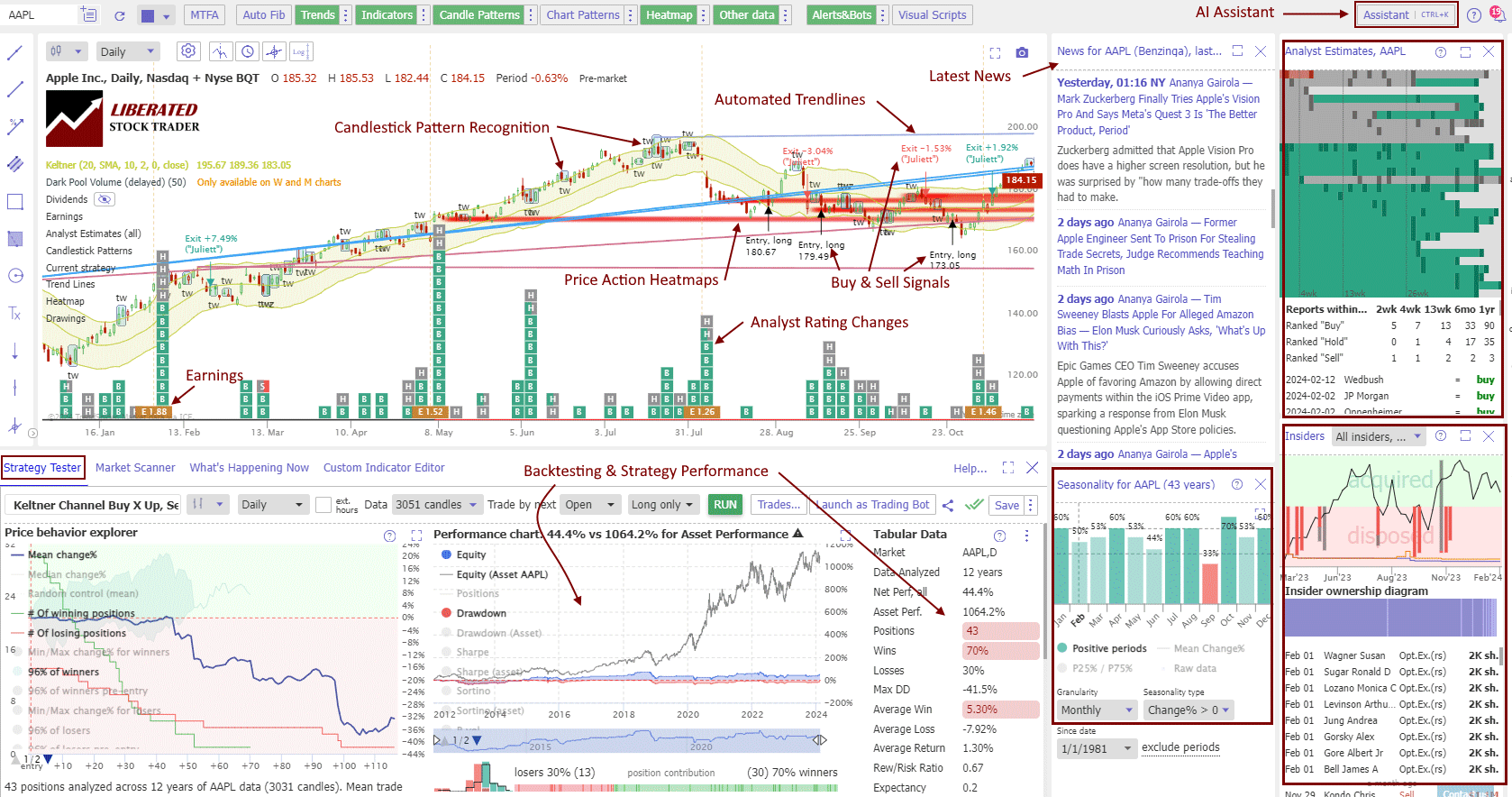

Strategy Backtesting

TrendSpider and TradingView offer top-notch backtesting tools, but TrendSpider is the winner. TradingView’s Strategy Tester requires Pine script knowledge, which can be a hurdle for some. I implemented my MOSES ETF Trading strategy in TradingView, proving that even non-developers can use it with some effort.

TrendSpider, on the other hand, makes backtesting a breeze with its point-and-click system. I was impressed by how quickly I could develop and test strategies without any coding. The platform even allows you to type what you want to test, and it handles the coding for you. This feature lets me create a strategy in just minutes.

Both platforms provide detailed backtesting reports. These show trades, profits, losses, and capital drawdowns. This data is crucial for evaluating strategy performance.

For my trading research, I rely on TrendSpider’s AI automation. As a certified market analyst, I use it to spot and test chart patterns and indicators, helping me gauge their reliability and profit potential.

TrendSpider offers AI-powered automated chart analysis, turning data into useful insights. Its point-and-click backtesting tests any indicator, pattern, or strategy in seconds. You can even turn backtested strategies into auto-trading bots, ensuring you never miss an opportunity.

Right now, TrendSpider is running its biggest sale of the year. They’re offering 75% off both yearly and monthly plans. This Black Friday deal is a great chance to try out their powerful backtesting tools.

Usability & Support

I find TradingView and TrendSpider very user-friendly. They need no setup, making them great for beginners. TrendSpider goes the extra mile by offering free one-on-one training with their staff. This personal touch really helps new users get started quickly and easily.

Final Thoughts

I’ve found that TrendSpider edges out TradingView in my comparison, but it’s a close race. TrendSpider shines with its AI pattern recognition, no-code backtesting, and bot trading for US markets. TradingView is top-notch for global markets, suiting both new and seasoned traders with its lively community and robust charting tools.

MetaStock is my go-to for real-time news and top-tier backtesting. Stock Rover excels in building long-term portfolios focused on value, income, and growth. If AI-powered day trading is your aim, Trade Ideas takes the lead.

Each platform has strengths. Your choice depends on your specific trading needs and goals. Consider trying out a few to see which best suits you. Remember, the right tools can make a big difference in your trading journey.

Other Head-to-Head Tools Comparisons & Tests

- Finviz vs. Stock Rover: Comparing Top Stock Screening Tools.

- TradingView vs. TC2000: 32 Features Tested & Rated

- Finviz vs TradingView: Which One Makes You a Better Trader?

- TradingView vs StockCharts: My Test Results Will Shock You.

- TradingView vs. TrendSpider: 68 Point Test Decides The Best

- Read the full TradingView Review.

- Read the in-depth TC2000 review.

- Check out the Finviz Review.

- Real-time news and advanced charting: MetaStock

- The Ultimate AI Trading Platform: TrendSpider

- AI-powered day trading: Trade Ideas

FAQ

Is TradingView or TrendSpider better for stock trading?

I find both TradingView and TrendSpider excellent for stock trading, but they have different strengths. TradingView shines in chart-based trading and connects to over 50 brokers worldwide. Meanwhile, TrendSpider, while also offering broker integration, stands out with its automated bot trading feature. Your choice might depend on which aspects you value more in your trading approach.

Is TrendSpider better at pattern recognition than TradingView?

In my experience, TrendSpider has an edge in pattern recognition. It can spot patterns, trendlines, Fibonacci levels, and candlestick formations across multiple timeframes on a single chart. This feature is built into TrendSpider’s core functionality, making it particularly strong in this area.

Which is easier to use, TrendSpider or TradingView?

I find both platforms user-friendly and well-designed. TradingView covers a wider range of assets and markets. Meanwhile, TrendSpider offers free one-on-one training sessions, which I think gives it a slight edge in ease of use, especially for beginners.

What is the big difference between TradingView and TrendSpider?

The main difference I see is in their focus areas. TradingView has a massive user base of 20 million active traders and a lively social trading scene. It covers stocks, currencies, and crypto globally.

Meanwhile, TrendSpider, while more niche, offers top-notch stock chart pattern recognition, simple backtesting tools, and better screening for US markets.

TradingView or TrendSpider, which is better?

I’d say it depends on your needs. TrendSpider excels in pattern recognition and offers user-friendly backtesting for those who don’t code. TradingView, on the other hand, boasts a vibrant social trading community and powerful charting tools. It also provides advanced backtesting options for those comfortable with coding.