You may be trying to decide which of the behemoths of trading analysis tools, TradingView of TC2000, is right for you. I have been a subscriber to TC2000 since 2001 and a pro subscriber to TradingView since 2018. In this comparison, I will highlight the huge differences between these two tools.

TradingView shines with its awesome charting tools, pattern recognition capabilities, and backtesting options. Plus, it has a big community of traders and supports data from all global exchanges. On the flip side, TC2000 is great for broker integration in the US markets and has strong features for options traders. Each platform has its positives, so the best choice depends on what a trader needs and prefers.

TC2000 vs. TradingView Ratings

I’ve tested both TC2000 and TradingView, and I can confidently say they’re top-notch trading platforms. TradingView scores an impressive 4.7/5.0, while TC2000 comes in at a solid 4.3/5.0. If you are a US options trader, then choose TC2000. If you trade stocks, ETFs, futures, or currencies in the US or internationally, then TradinView is the better choice.

| Feature | TradingView | TC2000 |

|---|---|---|

| Rating | 4.7/5.0 | 4.3/5.0 |

| Pricing | ★★★★★ | ★★★★★ |

| Software | ★★★★★ | ★★★★★ |

| Trading | ★★★★★ | ★★★★★ |

| Scanning | ★★★★✩ | ★★★★✩ |

| Pattern Recognition | ★★★★✩ | ★✩✩✩✩ |

| Newsfeed | ★★★★✩ | ★★★✩✩ |

| Social | ★★★★★ | ★✩✩✩✩ |

| Chart Analysis | ★★★★★ | ★★★★★ |

| Backtesting | ★★★★✩ | ★✩✩✩✩ |

| Usability | ★★★★★ | ★★★★★ |

| Customer Support | ★★★✩✩ | ★★★★★ |

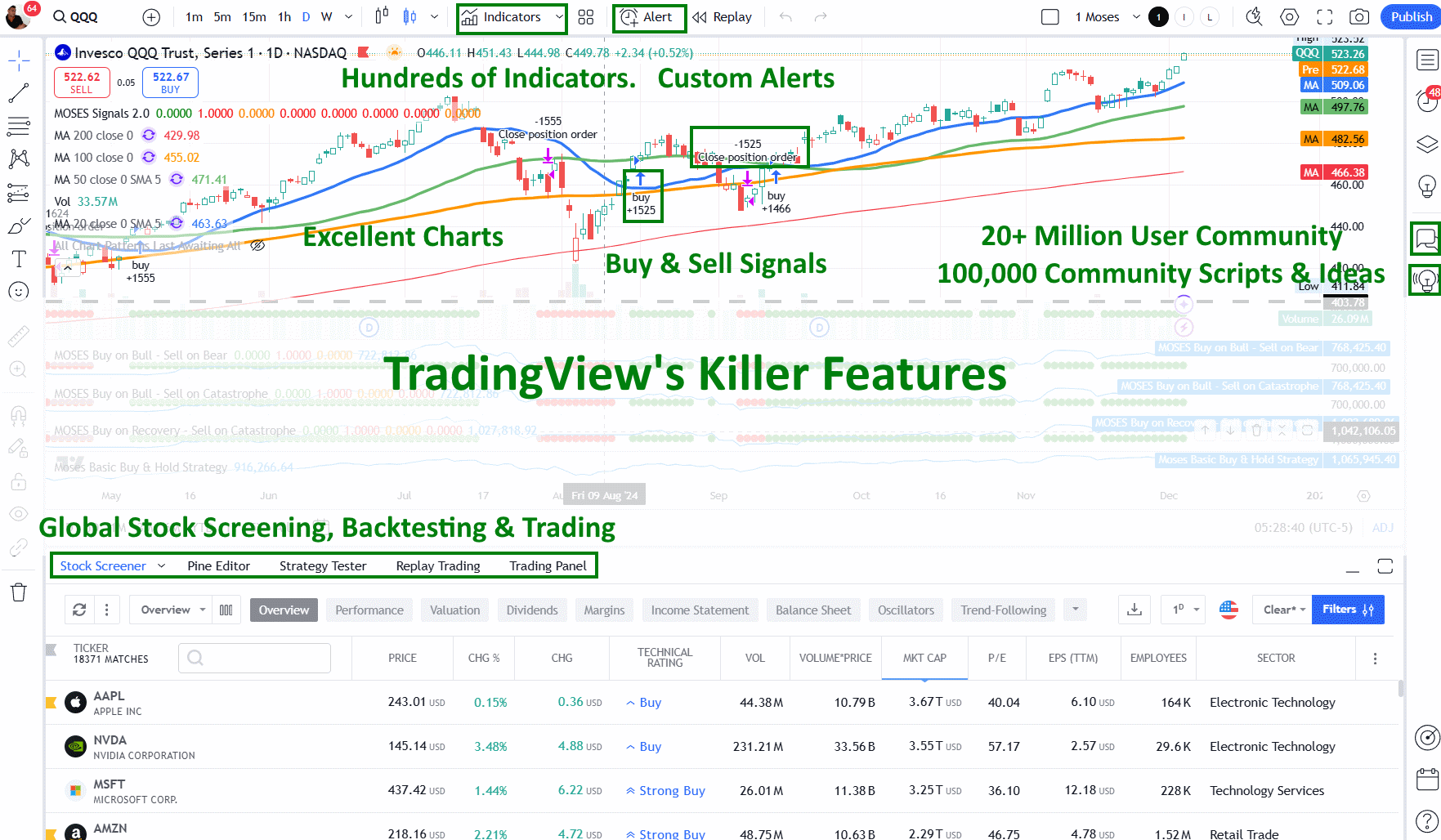

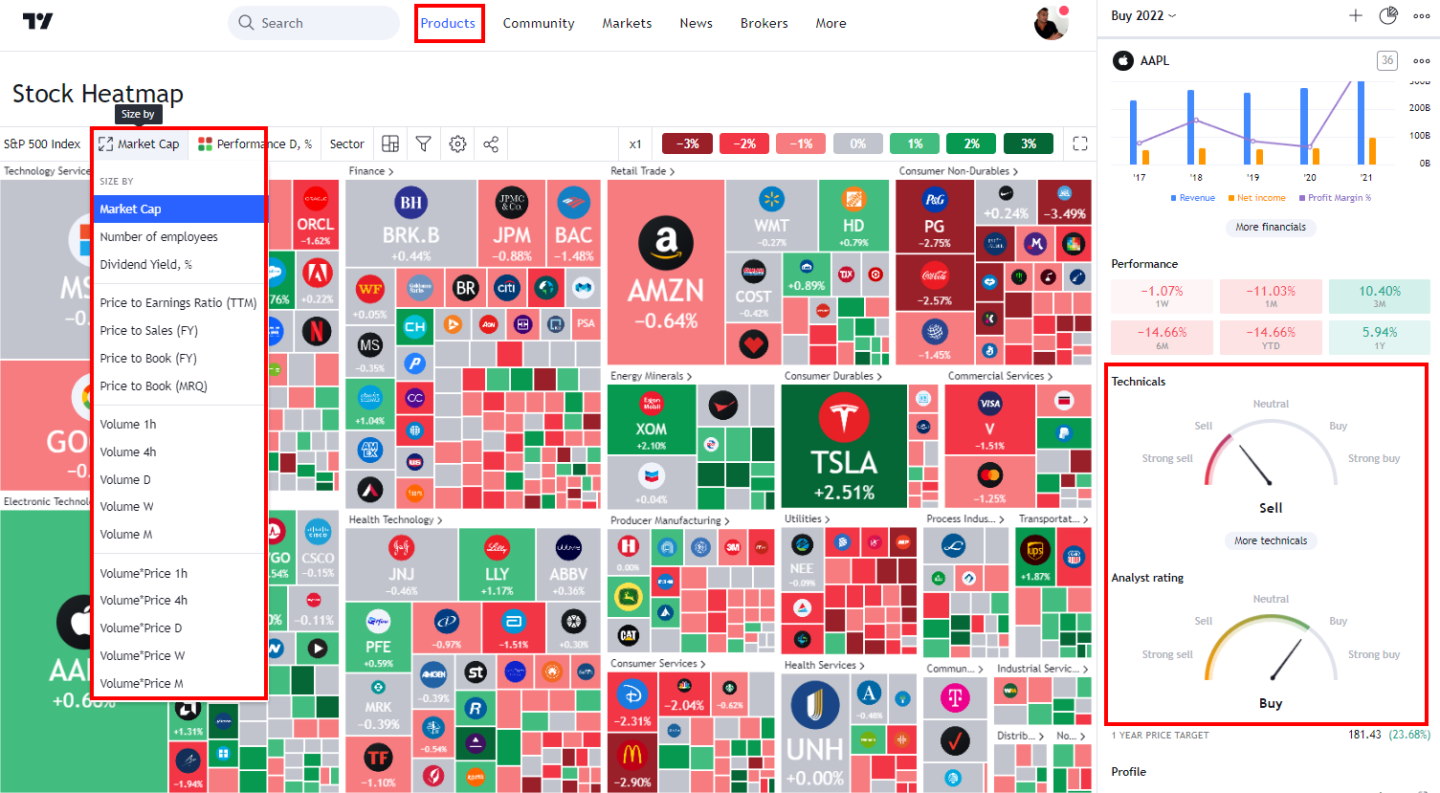

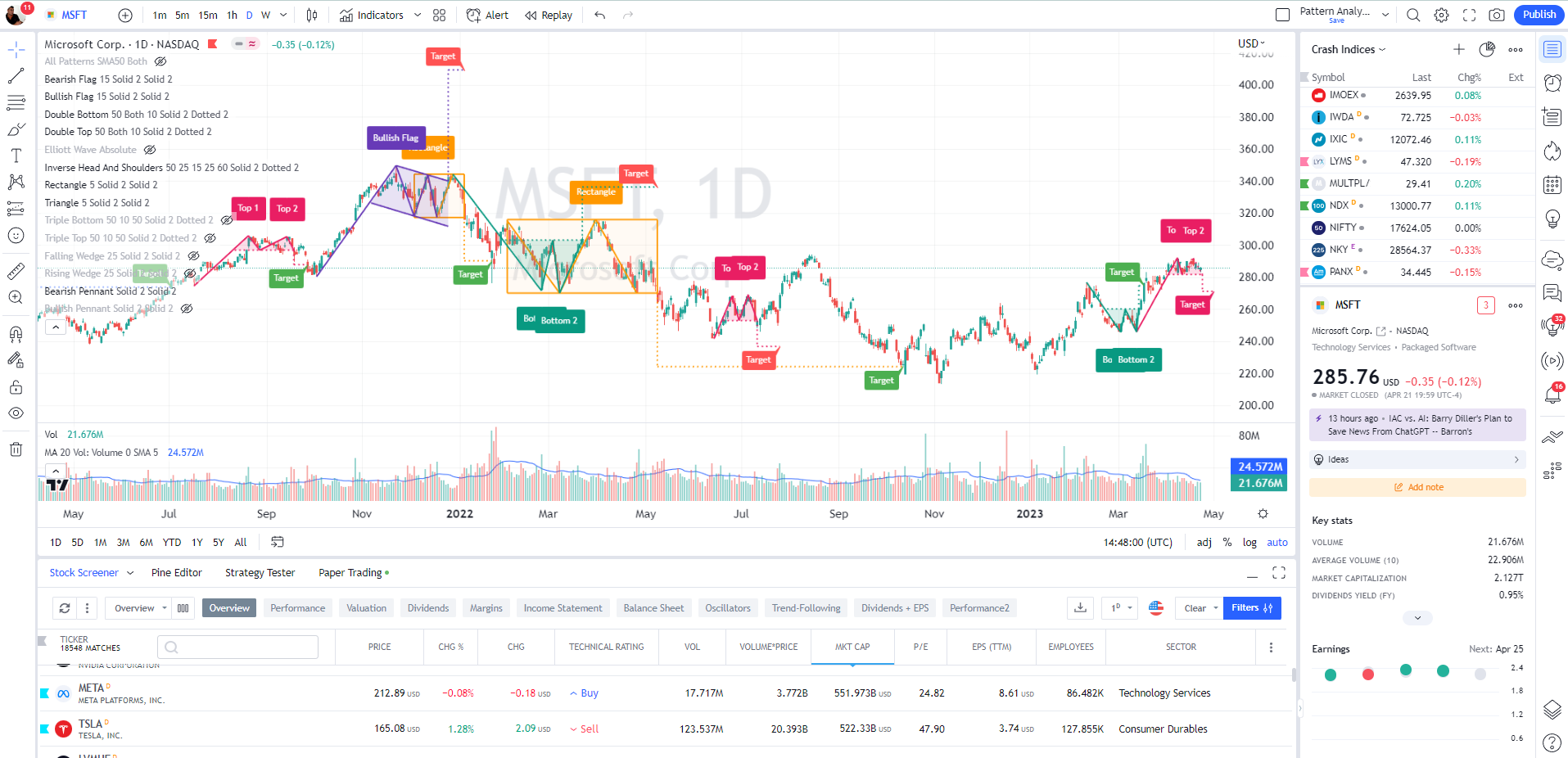

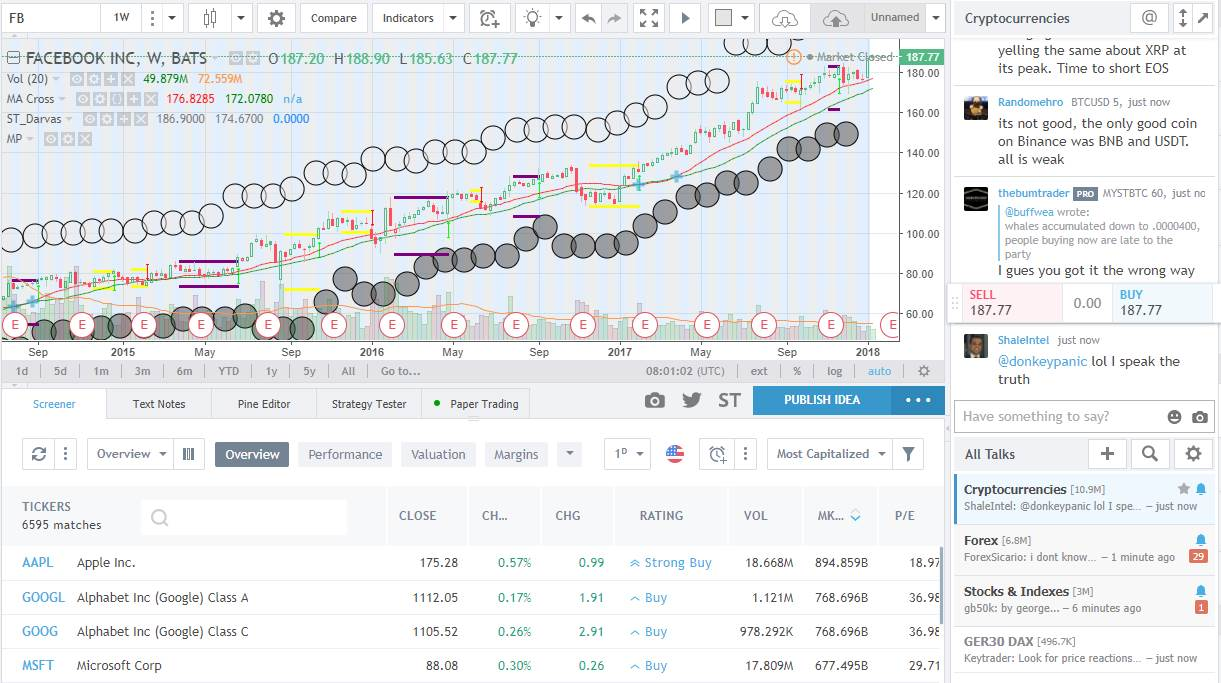

TradingView Features Screenshots

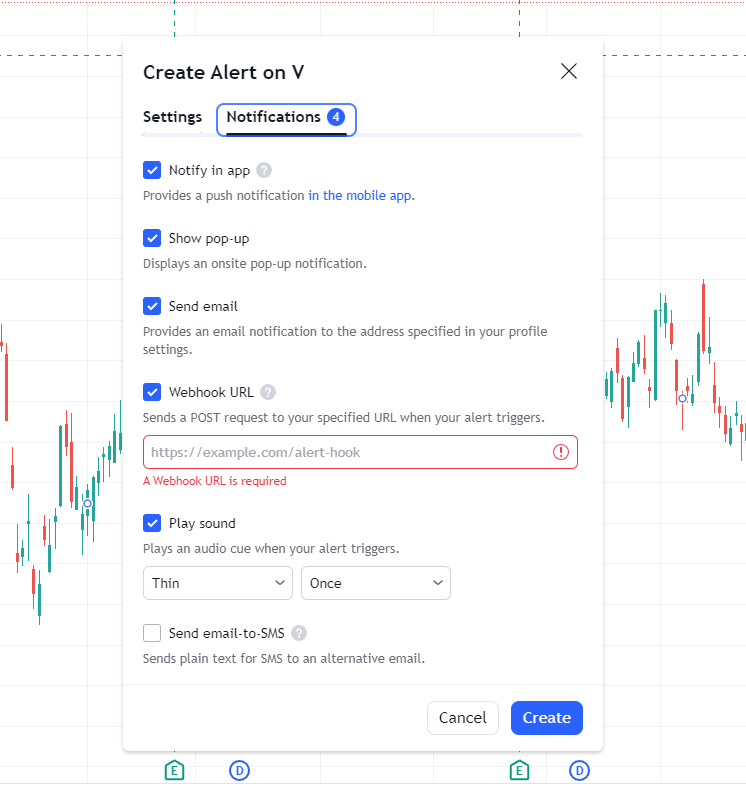

- Global Community: With 50 million users sharing ideas, it’s fantastic for traders.

- Charting: The charts are crisp, clear, and highly customizable.

- Backtesting: You can easily test your strategies on historical data.

- Pattern Recognition: It spots trends and patterns like a pro.

TC2000 Features Screenshots

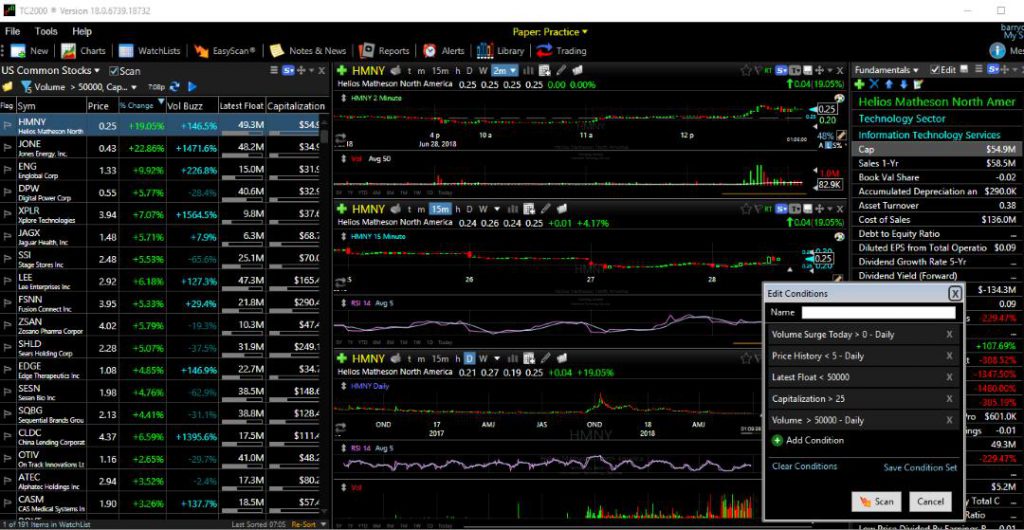

- Scanning: It’s a powerhouse for finding stocks that match your criteria.

- Options Trading: If you’re into options, TC2000 is hard to beat.

Both platforms are user-friendly, but they cater to different needs. I find TradingView better for international trading and strategy development. Its community is a huge plus, with talented chartists constantly sharing ideas.

While TC2000 lacks social features and backtesting, it excels in scanning and options trading. TradingView has an edge price-wise. It offers more features at a lower cost, making it an attractive option for budget-conscious traders.

In terms of chart analysis, both platforms are great. They offer a wide range of indicators and drawing tools to help you make sense of market movements.

Customer support is where TC2000 pulls ahead. They offer more personalized US-based assistance, which can be crucial when you’re dealing with complex trading issues.

Features Comparison

TradingView and TC2000 offer different strengths for traders. TradingView covers a wider range of markets, including stocks, indexes, cryptocurrencies, forex, and commodities globally. TC2000, on the other hand, focuses solely on US markets.

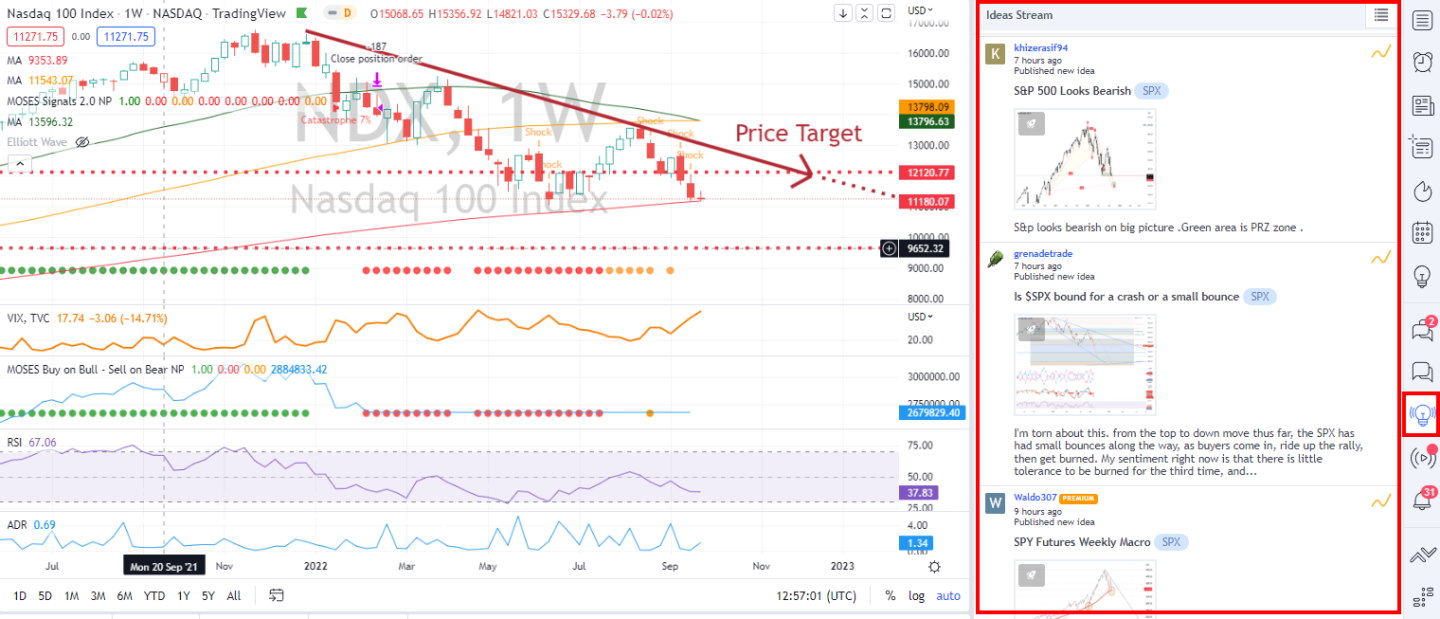

TradingView stands out with its news stream and large social community. With 10 million users sharing charts and ideas, it’s a great place to learn and interact. Meanwhile, TC2000 doesn’t have these social features.

Both platforms provide essential tools like charts, watchlists, and screening. TradingView adds trading and backtesting capabilities, while TC2000 excels in options scanning and trading.

Here’s a quick comparison:

| Feature | TradingView | TC2000 |

|---|---|---|

| Charts | ✔️ | ✔️ |

| Watchlists | ✔️ | ✔️ |

| Screening | ✔️ | ✔️ |

| News | ✔️ | Costs Extra |

| Social Community | ✔️ | ❌ |

| Options Tools | ❌ | ✔️ |

| Global Markets | ✔️ | ❌ |

They’re similar price-wise. Both offer free plans and paid subscriptions around $10-60 per month. TradingView works in web browsers, while TC2000 has PC and Mac software.

Feature Differences

TradingView offers much more than TC2000. I can access global markets, including stocks, forex, futures, and crypto, on TradingView. It has advanced charts, screening tools, and backtesting options. A big plus is the social community where I can share ideas. Meanwhile, TC2000 focuses mainly on US stocks with solid charts and scanning.

Pricing & Discounts

TradingView and TC2000 both offer free plans, but TradingView’s free option packs more features. I can use scanning, backtesting, and watchlists for free on TradingView. TC2000’s free plan is much more limited, allowing only basic charting functionality.

For paid plans, TradingView starts at $14.95 monthly for Pro, $29.95 for Pro+, and $59.95 for Premium. I can save 16% by choosing a yearly subscription. Real-time data costs an extra $2 per exchange. In my experience, Pro or Pro+ plans offer the best value.

TC2000’s paid options begin at $9.99 monthly for Silver, which includes basic charting and watchlists. I’d need the Gold plan for more advanced tools like custom indicators, market scanning, and intraday data. TC2000 also requires a separate $9.99 monthly data subscription and another subscription for news.

✂ TradingView Discounts

TradingView offers a 16% discount on yearly Pro and Premium plans and a $15 rebate for the first month.

✂ TC2000 Discounts

I have a $25 off coupon for your first TC2000 purchase. Combining this with a bi-annual subscription saves an extra 25%. To claim these offers, you can visit the TC2000 Bonuses page.

Here’s a quick comparison of the pricing plans:

| Platform | Basic Plan | Mid-Tier Plan | Premium Plan |

|---|---|---|---|

| TradingView | Free | Pro: $14.95/mo | Premium: $59.95/mo |

| TC2000 | Free (limited) | Silver: $9.99/mo | Gold: $59.95/mo |

Both platforms offer good value, but the best choice depends on my specific trading needs and budget.

Software & Apps

Both TradingView and TC2000 offer stable, easy-to-use platforms for traders. TradingView stands out with its wider range of features at a lower cost. It covers global markets, including stocks, futures, forex, and crypto. TradingView also has a social community, news, backtesting, and screening tools.

TC2000 focuses mainly on US stocks and options trading. While it lacks some of TradingView’s broader features, it still provides powerful charting tools and stock screeners.

Here’s a quick comparison:

| Feature | TradingView | TC2000 |

|---|---|---|

| Global Markets | ✔️ | ❌ |

| Stocks | ✔️ | ✔️ |

| Futures/Forex/Crypto | ✔️ | ❌ |

| Social Community | ✔️ | ❌ |

| Screeners | ✔️ | ✔️ |

| Backtesting | ✔️ | ❌ |

| Options Trading | ❌ | ✔️ |

Both platforms are reliable, but your choice may depend on your specific trading needs and focus.

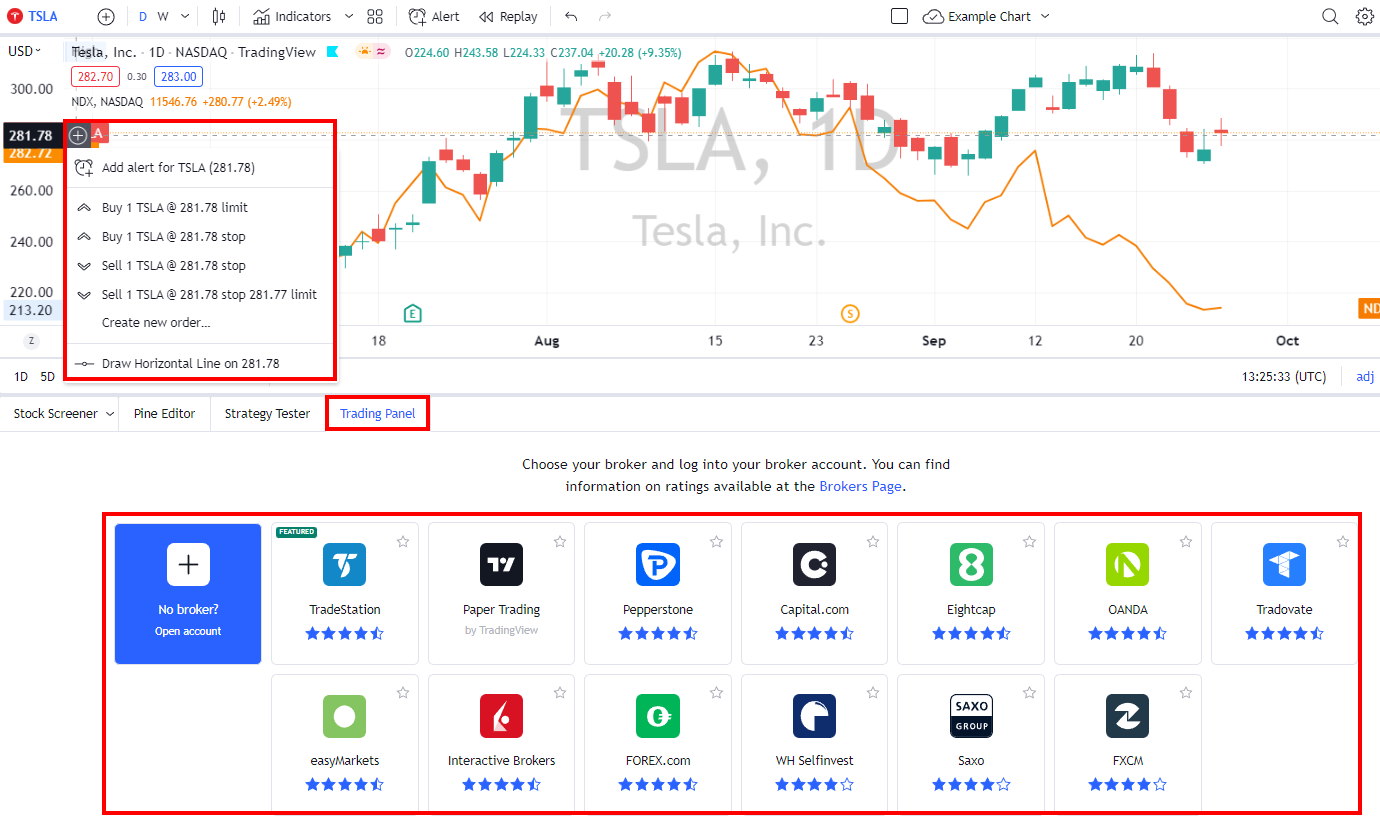

Trading

TradingView offers traders a wide range of broker options. Over 40 high-quality brokers integrate seamlessly with the platform, allowing me to trade directly from charts and track my profits and losses in real time.

TC2000 has more limited broker integration, working only with TC2000 Brokerage. They offer $1 stock trades and $1 + 65¢ per options contract.

TradingView’s integration with TradeStation is noteworthy. I can trade stocks commission-free and access futures, forex, and crypto markets. This flexibility is great for exploring different assets.

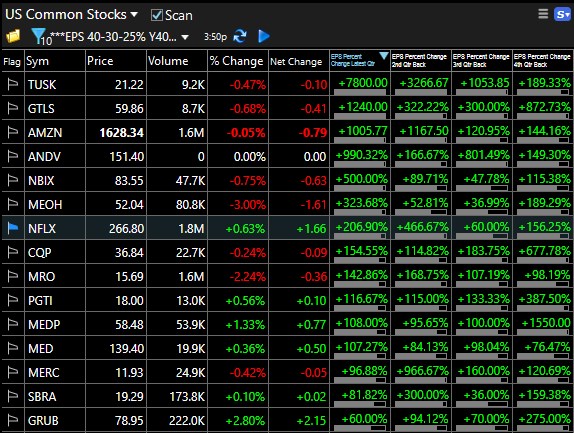

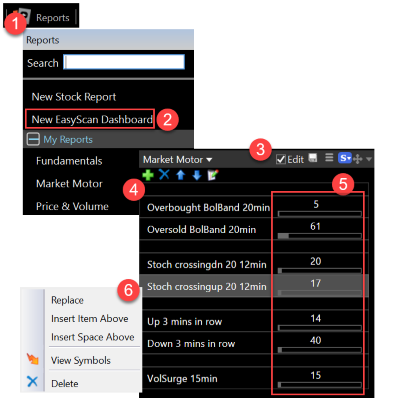

Screening

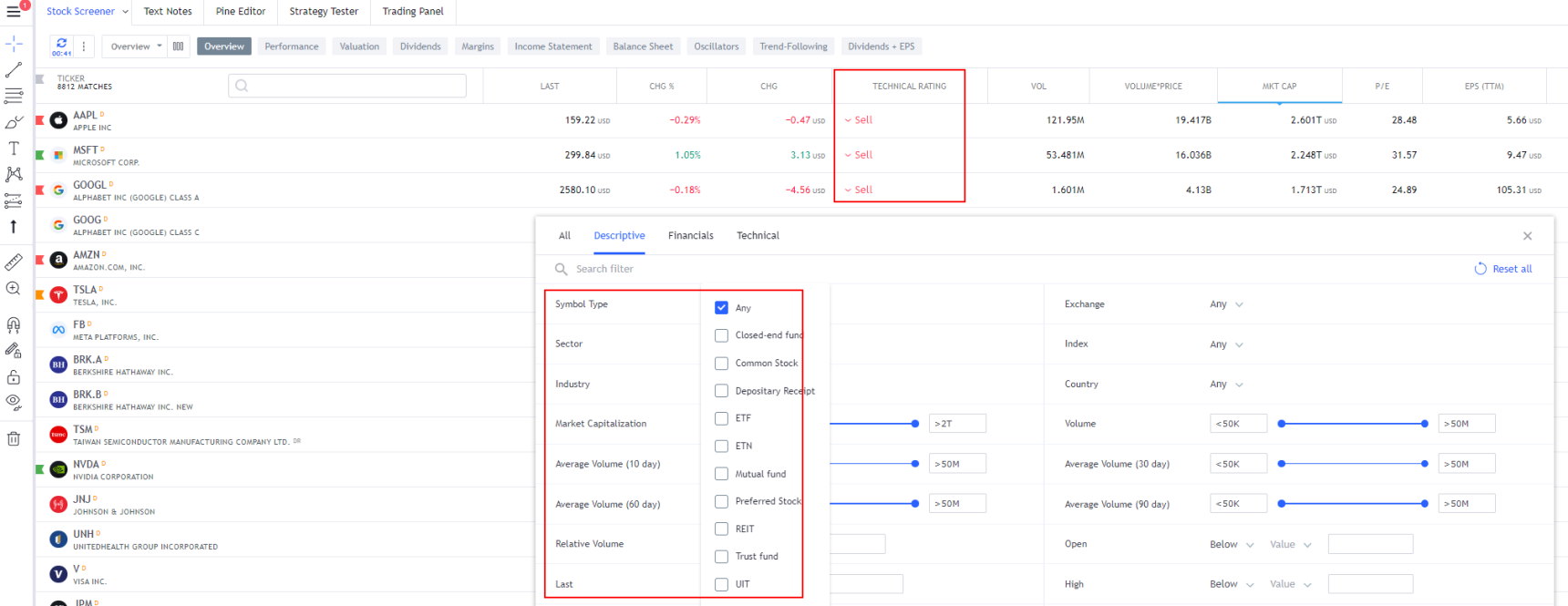

TradingView and TC2000 offer powerful scanning and screening tools but with some key differences. TradingView’s stock screener is quite comprehensive, featuring 160 criteria covering both fundamental and technical aspects. It lets me filter stocks based on common metrics like EPS and PE ratio, as well as more specific factors like employee count and enterprise value.

TC2000’s EasyScan module focuses more on technical analysis, with 108 technical indicators available. While it’s great for price and volume-based screening, it lacks the fundamental analysis capabilities of TradingView.

TradingView has a clear edge in pattern recognition. In its free version, it can spot 28 candlestick patterns, Elliott waves, and 16 chart patterns automatically. TC2000 allows custom indicator creation for gold subscribers, but it’s not as flexible as TradingView’s Pine script engine.

TradingView also impresses me with its vast library of community-created indicators and systems, adding even more screening options. This makes it a solid choice for traders who want a mix of pre-built and custom scanning tools.

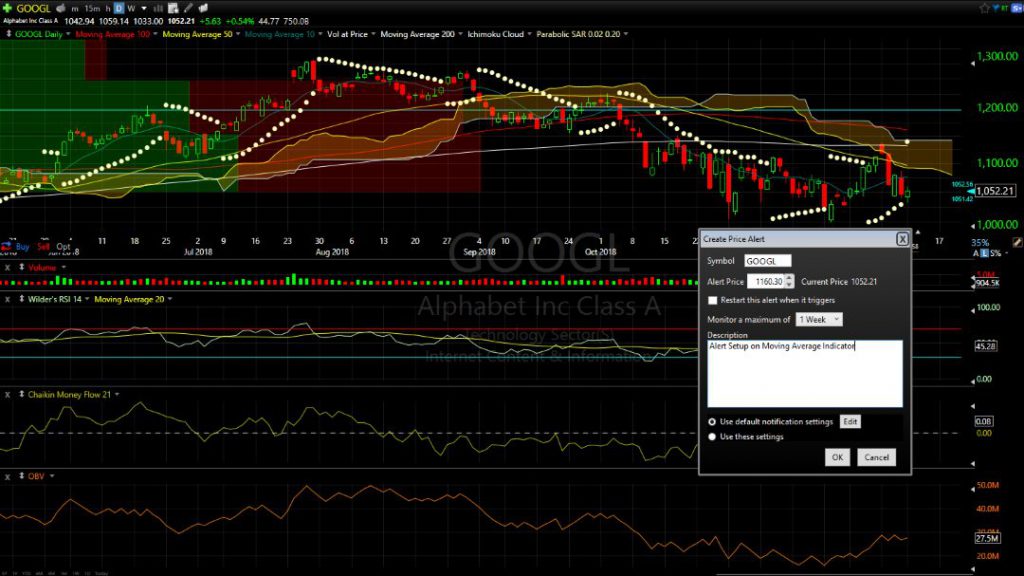

News & Social

TradingView is my top choice for social sharing and learning in the trading world. It beats platforms like StockTwits, hands down. I love how TradingView’s chat forum and publishing system are fully integrated, making it easy to share charts and ideas with other traders.

I’m part of a community of 20 million traders on TradingView. It’s free to join, and I’d love for you to connect with me there. We can chart, scan, trade, and chat together. It’s a great place to meet other investors and share insights.

Chart Technical Analysis

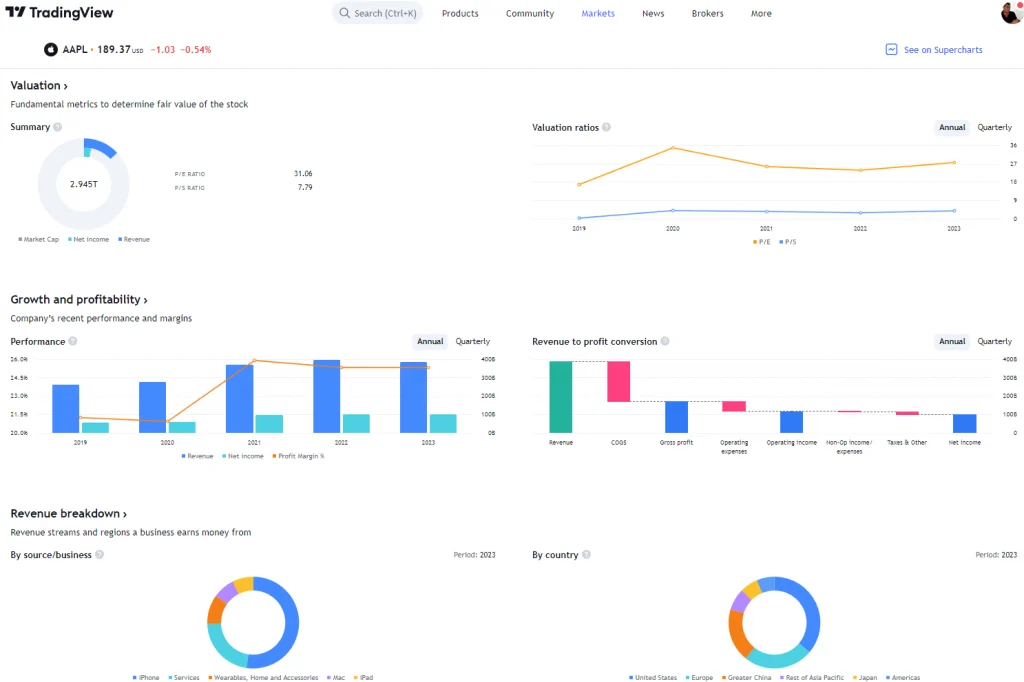

TradingView and TC2000 are both powerful platforms for chart analysis. I find TradingView’s offering particularly impressive. It has 160 indicators compared to TC2000’s 108, giving traders more options to fine-tune their analysis.

TradingView shines in chart variety, too. It offers 12 types, including some unique ones like LineBreak and Kagi. TC2000 has seven types, which cover the basics well but don’t offer as much variety.

For chart annotations, TradingView leads with 65 tools. I’m especially impressed by its Gann & Fibonacci tools and icon library. Meanwhile, TC2000 offers 28 tools, which is solid but not as extensive.

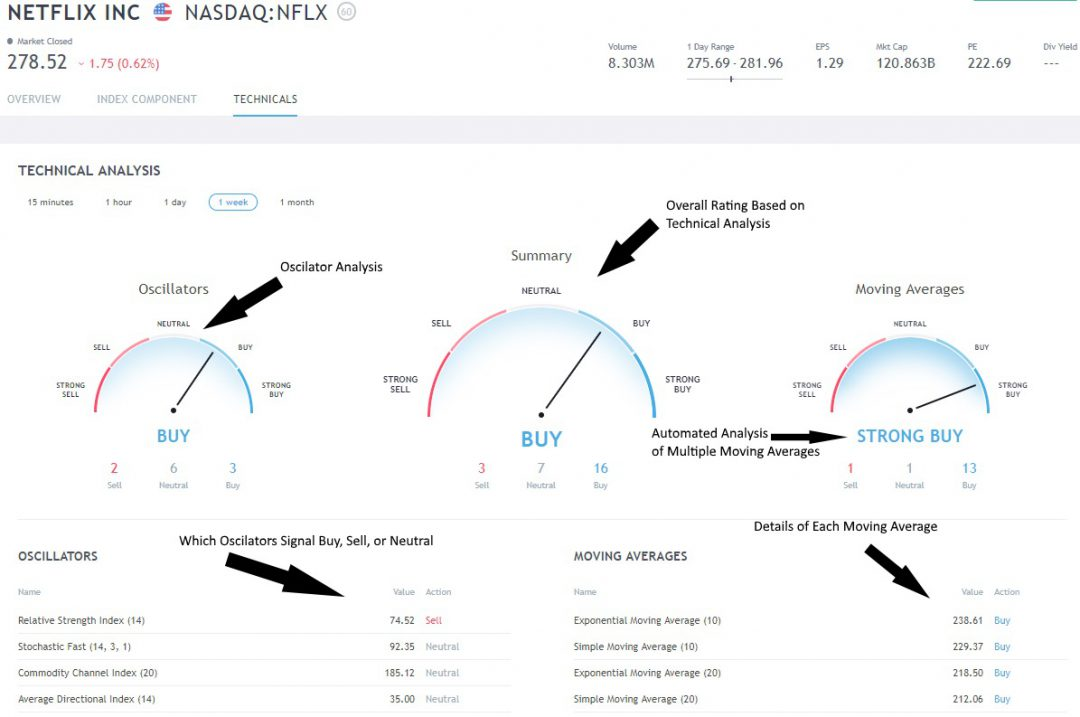

TradingView’s Buy and Sell gauges are a standout feature. They give quick insights into stock sentiment, something TC2000 doesn’t offer. I’ve found these gauges to be quite useful in my analysis.

The stock indicator ratings on TradingView are well-designed. They look at two key areas:

- Moving averages based on price

- Oscillators based on price and volume

The left gauge shows oscillating indicators like relative strength and stochastics. Meanwhile, the right gauge displays various moving averages, including the Ichimoku Cloud.

While TradingView edges out in features, TC2000 ACP is still a strong platform with room to grow.

Strategy Backtesting

I’ve found TradingView to be a game-changer for backtesting trading strategies. Its Strategy Tester is a powerful tool that lets me analyze how my strategies would have performed in the past. I can see detailed reports on trades, profits, losses, and drawdowns.

What I love about TradingView is its Pine Script language. It’s so user-friendly that even I, without a coding background, can create custom backtesting systems. I’ve successfully implemented my MOSES ETF Trading strategy using Pine Script.

Here’s an example of how it looks:

For my market analysis, I rely on TrendSpider. Its AI-powered tools help me spot and test chart patterns and indicators quickly. Try out these powerful backtesting tools.

🏁 Final Thoughts

In my experience, TradingView is the top choice for stock analysis and trading software. It’s a great fit for both new and seasoned traders. I love its lively community and top-notch charting tools. The global screening and backtesting features are also impressive. When I compare it to TC2000, TradingView matches or beats it in most areas. That said, TC2000 has a leg up when it comes to options trading and advanced strategies.

Other Head-to-Head Tools Comparisons & Tests

- Finviz vs. Stock Rover: Comparing Top Stock Screening Tools.

- TradingView vs. TC2000: 32 Features Tested & Rated

- Finviz vs TradingView: Which One Makes You a Better Trader?

- TradingView vs StockCharts: My Test Results Will Shock You.

- TradingView vs. TrendSpider: 68 Point Test Decides The Best

- Read the full TradingView Review.

- Read the in-depth TC2000 review.

- Check out the Finviz Review.

- Real-time news and advanced charting: MetaStock

- The Ultimate AI Trading Platform: TrendSpider

- AI-powered day trading: Trade Ideas

🙋 FAQ

Which is better, TC2000 trading or TradingView?

From what I’ve seen, both platforms let you trade right from the charts. TC2000 needs its brokerage with $1 per trade. I think TradingView’s approach is smarter. It works with brokers like Interactive Brokers (low costs) and TradeStation (free stock trades).

Is TC2000 better for Options trading than TradingView?

Yes, TC2000 is the clear winner for options trading. It has advanced options charting and lets you plan and carry out complex options trades. TradingView doesn’t offer any options or features.

Does Tradingview have Options charts?

No, TradingView doesn’t have options charts. If you’re into options trading, you’ll need to look elsewhere.

What is a good TC2000 alternative?

I’d say TradingView is a solid alternative to TC2000. While TC2000 is better for options, TradingView wins in areas like social trading, backtesting, charting, and coverage of different markets and assets.

Can you trade futures on TradingView or TC2000?

Yes, you can trade futures on TradingView. It has good coverage of commodities and works with various brokers. TC2000 doesn’t offer futures trading.

Which is best, TC2000 paper trading or TradingView?

Both platforms offer solid paper trading options. I find TC2000 is best for practicing with stocks, options, and ETFs in the US. Meanwhile, TradingView is better if you want to paper trade stocks, ETFs, futures, and crypto globally.